BioAmber Gets Little Love From Investors on Valentine’s Day

by Debra Fiakas

Management of sustainable chemical developer BioAmber (BIOA: NYSE; BIOA: TSX) have not been feeling much love from the capital markets. The BioAmber team just wants some consideration for its proprietary platform for production of bio-based succinic acid. Historically succinic acid has been produced from fossil fuel and sold as an intermediate input for use in drug compounds, agriculture and food production. BioAmber has fine tuned a fermentation process to transform organic materials such as dextrose sugars into a bio-succinic acid.

BioAmber’s woes began last fall when the New York Stock Exchange sent the company a notice of non-compliance with NYSE...

BioAmber Goes Ballistic

Jim Lane Word arrived from Minnesota that BioAmber has signed a 210,000 ton per year take-or-pay contract for bio-based succinic acid with Vinmar International. Explaining why BioAmber (BIOA) stock shot up nearly 17% in today’s trading despite a global equities pullback that affected almost everyone else in industrial biotech. Under the terms of the 15-year agreement, Vinmar has committed to purchase and BioAmber Sarnia has committed to sell 10,000 tons of succinic acid per year from the 30,000 ton per year capacity plant that is currently under construction in Sarnia, Canada. Bottom line, BioAmber continues to roll and roll....

Countdown To Codexis’ Day Of Reckoning

It is earnings season and bio-catalyst developer Codexis (CDXS: Nasdaq) is expected to report fourth quarter and year-end 2017 financial results in the coming weeks. The three analysts who regularly publish estimates for the company expect a nickel profit in the quarter on $23 million in total sales of the company’s custom protein catalysts. Codexis is still perfecting its proprietary platform technology called CodeEvolver, but has already delivered an array of unique enzymes that help drive critical biological processes for its customers.

Codexis does not have a good track record in terms of meeting the consensus estimate. The company has only cleared the...

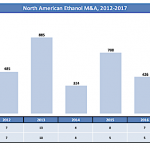

Biofuels M&A: 2017 Review and Outlook

by Bruce Comer, Ocean Park Advisors

More industry players chose to develop and build new capacity rather than buy plants

The North American biofuels industry experienced the fewest merger and acquisition transactions in recent history in 2017. There were only six M&A transactions, with a total estimated value of more than $100 million. They involved eight plants with 297 million gallons per year (MGPY) of production capacity. Half of these deals were for non-operating plants. A fourth deal was for a sub-scale demonstration plant. Contributing to the limited deal flow, two historically active acquirers, Green Plains and REG, did not close...

Solazyme Shares Soar On Sasol Deal

Jim Lane Bioenergy’s #1 company surges on the exchanges after big Sasol, AkzoNobel partnership announcements. In California, Solazyme (SZYM) announced a Q2 loss of $25.8M, compared to a Q2 2012 loss of $19.2M, on revenues of $11.2M, down from $13.2M for Q2 2012, as government funded revenues declined as expected. Excluding the government sector, sales jumped 28% year on year despite the lack of the big capacity that Moema and Clinton will represent when completed. Product gross margins were a very healthy 70%, in line with guidance. Solazyme shares were up 12.95 percent today at market close....

Impossible Foods Launches Impossible Pork

by Helena Tavares Kennedy

It began with beef without the cow, even leather without the cow, and now we wave goodbye to pork from the pig with the news that Impossible Foods has launched pork made from plants.

Not only that, but Impossible Foods is going beyond the Impossible Whopper and expanding their work with Burger King in a new Impossible Croissan’which using Impossible Sausage made from plants as well. That will be available in only some Burger King locations starting in late January.

What’s in it?

Impossible Foods says their new pork protein is mostly made with soy protein, coconut oil, sunflower oil....

Amyris’ Date With Destiny: Better Late Than Never

Jim Lane Amyris was dismissed by the critics some time ago, but is ately continuing a big comeback. We have become so accustomed to receiving obituaries of Amyris (AMRS) that recently I was inspired to re-read the Devotions of John Donne to discover if, in fact, he wrote, “Send not to know for Whom the Bell Tolls, it Tolls for Amyris.” Amyris, we were recently assured by short-sellers, was as dead as a doornail, just as Jacob Marley was reputed to be in the opening stave of A Christmas Carol and it is therefore...

Amber Means Caution But BioAmber Means Go

Jim Lane In Canada, BioAmber (BIOA) recorded net income of $4.8M for Q2 2016 and an operating loss of $1.0M on revenues of $2.5M. Revenues were up 73 percent over Q1 and 637 percent compared to Q2 2015. For those less familiar with the company, it produces succinic acid from sugar at a first commercial-scale plant which opened recently in Sarnia, Ontario. Succinic acid has a small existing global market but can be converted into a variety of chemical building blocks used to produce a range of plastics, paints, textiles, food additives and personal care products. If for...

BioAmber Completes IPO

Jim Lane Raises $80M at $10 per share; becomes first new industrial biotech company to complete IPO in more than a year. What went right and how? Is the IPO window re-opening? In Minnesota, BioAmber announced the pricing of its initial public offering of 8 million units consisting of one share of common stock and one warrant to purchase half of one share of common stock at $10 per unit, before underwriting discounts and commissions. All units are being sold. BioAmber has granted the underwriters an option for 30 days to purchase up to an additional 1.2 million...

The “Jesus” Molecule: Paraxylene

Jim Lane The Coca-Cola Company invests in Gevo, Virent and Avantium partnerships, in the race to develop renewable plastic bottling entirely from renewables. There’s been an awful lot of press this week about progress in the search for the God particle. That’s the subatomic Higgs Boson a key, but as yet undetected, anchor in the standard model of the universe. Then there’s the Jesus molecule. As in, “Kind lord Jesus in Heaven, grant me an affordable way to make one of those.” It’s renewable PX, also known as your friend, paraxylene a key, but as...

BioAmber: Fingers Crossed

by Debra Fiakas CFA Plastic is everywhere - our homes and offices, the cars we drive, our personal items, food containers and even our dental fillings. Plastic is also toxic. Dioxins, BPA (bisphenol A) and PCBs (polychlorinated biphenyl), both of which are critical chemicals in plastics, have been identified as endocrine disruptors, upsetting hormonal balance, triggering the growth of tumors and interfering with sexual development in fetuses. Even people who deliberately avoid plastics are exposed to the toxicity. For example, we ingest BPA when eating fish that lived in waters contaminated with plastics. Remember that ‘island’...

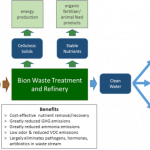

Bion: Waste To Dollars

Earlier this week Bion Environmental Technologies (BNET) received approval of a patent for its proprietary ammonia recovery process. Bion’s technology converts livestock wastes into ammonium bicarbonate. Patent protection in the U.S. paves the way for Bion to deliver an environmentally friendly chemical to the market at attractive profit margins.

Ammonium bicarbonate is used for a variety of purposes from leavening to crop additives. It is the fertilizer market that has caught Bion’s attention. The company intends to ‘close the loop’ for the agricultural sector by helping livestock producers economically dispose of waste and then delivering a fertilizer for food crops that qualifies as organic.

It is an attractive...

Interview With Dan Oh, CEO Of Renewable Energy Group

Jim Lane Leading a series this week, “The Strategics Speak", in which we’ll look at what a number of major strategic investors see in the landscape relating to industrial, energy and agricultural investment, Biofuels Digest visited with Dan Oh, CEO of Renewable Energy Group (REGI), which has long been the US’s leading independent biodiesel producer but in recent years has steadily diversified and expanded operations. In many ways, REG is the entire industrial biotech business in a nutshelll. They’re fermentation (through REG Life Sciences), and thermocatalytic (through REG Geismar and their extensive biodiesel business). They use both...

Biofuels & Biobased Earnings Roundup: Amyris

by Jim Lane

The Top Line. In California, Amyris (AMRS) reported Q2 GAAP revenue for the second quarter of 2018 of $24.8 million, compared with $25.7 million for the second quarter of 2017. Grants and collaborations revenue was $11.4 million for the second quarter of 2018 compared with $10.3 million for the year-ago period. The company noted that Q2 revenue was $24.8 million compared with the same period in 2017 of $21.7 million when adjusted for the low margin product sales on contracts assigned to DSM (DSM.AS). This reflects 15% growth on an absolute basis. GAAP net loss for the first half was $89.1...

Amyris Reaches Positive Cash Flow

Jim Lane In California, Amyris announced positive cash flow of $1.7 million in the first quarter despite negative currency effect of $1.2 million. Overall, Amyris recorded Q1 2015 non-GAAP cash revenue inflows of $30.3 million, compared with $17.9 million for Q1 2014. Total Q1 2015 revenues were $7.9 million, an increase of 30% compared with same quarter last year. Cash, cash equivalents and short-term investments of $44.9 million at March 31, 2015, an increase from $43.4 million at December 31, 2014. “We’re pleased with our continued execution toward diversifying and growing our revenue base through an expanding...

Ramp-Up Delay Sends Solazyme Stock Into Free-Fall

Jim Lane Revenue and customer numbers are up at Solazyme (SZYM), 60% YOY growth from Q3 2013 to Q3 2014. But a slowdown in the rollout at Moema capacity leads to a spectacular 58% one-day drop in the stock price. What happened? Solazyme has been on a relatively steady downward trajectory for the past few quarters, dropping from the $11-$13 range and down into the $6-$8 range. And then plunged a stunning 58 percent to $3.14 yesterday – amidst downgrades by Cowen & Company, Pacific Crest and Baird generally to Market Perform or Neutral, and remains...