By Tom Konrad, Ph.D., CFA

On Friday February 2nd, Brookfield Renewable (BEP and BEPC) reported earnings. Judging by the immediate stock market reaction, many investors did not like the results. Quarterly earnings actually beat expectations, but for Yieldcos like Brookfield, cash flow numbers and revenue (which can be more indicative of the company’s ability to pay and raise dividends) can be more important. These fell short.

The company attributes the cash flow shortfall to its own clients delaying payments at the end of December, in order to make their own financial statements look better, and it expects the shortfall to reverse in the first quarter.

Beyond cash flow, I found the earnings report to be all good (if not particularly unexpected) news. As one of the preeminent renewable energy infrastructure investors in the world, Brookfield’s access to capital is allowing the company to go on something of a spending spree, buying up cheap assets and companies as many of its rivals have to pull back.

Overall, I feel the pullback after the earnings call is a buying opportunity, and sold some short puts on BEPC this morning (February 5th.)

Why buy BEPC rather than BEP?

Unlike the nearly equivalent share classes of Clearway Energy (CWEN-A and CWEN, discussed here.), rival Yieldco Brookfield Renewable Energy has two share classes with significant differences: Brookfield Renewable Energy Partners (BEP) and Brookfield Renewable Energy Corporation (BEPC).

The company was originally organized as a limited partnership with all equity issued as partnership units (BEP). In 2020, the company created Brookfield Renewable Energy Corporation (BEPC) through a combination of legal and financial wizardry in order to appeal to investors who prefer to get all their investment income from a brokerage’s 1099 form rather than the individual K-1s received by BEP limited partners.

This makes BEPC more appealing than BEP to many investors, so it is unsurprising the BEPC tends to trade at a larger premium to BEP than CWEN trades relative to CWEN-A.

As I write on Feb 5th, BEPC is trading at $26.10, compared to $24.55 for BEP, or a 6.3% premium. I generally buy BEPC when the premium is under 10%, and BEP if the premium is higher than that.

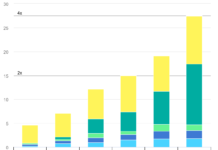

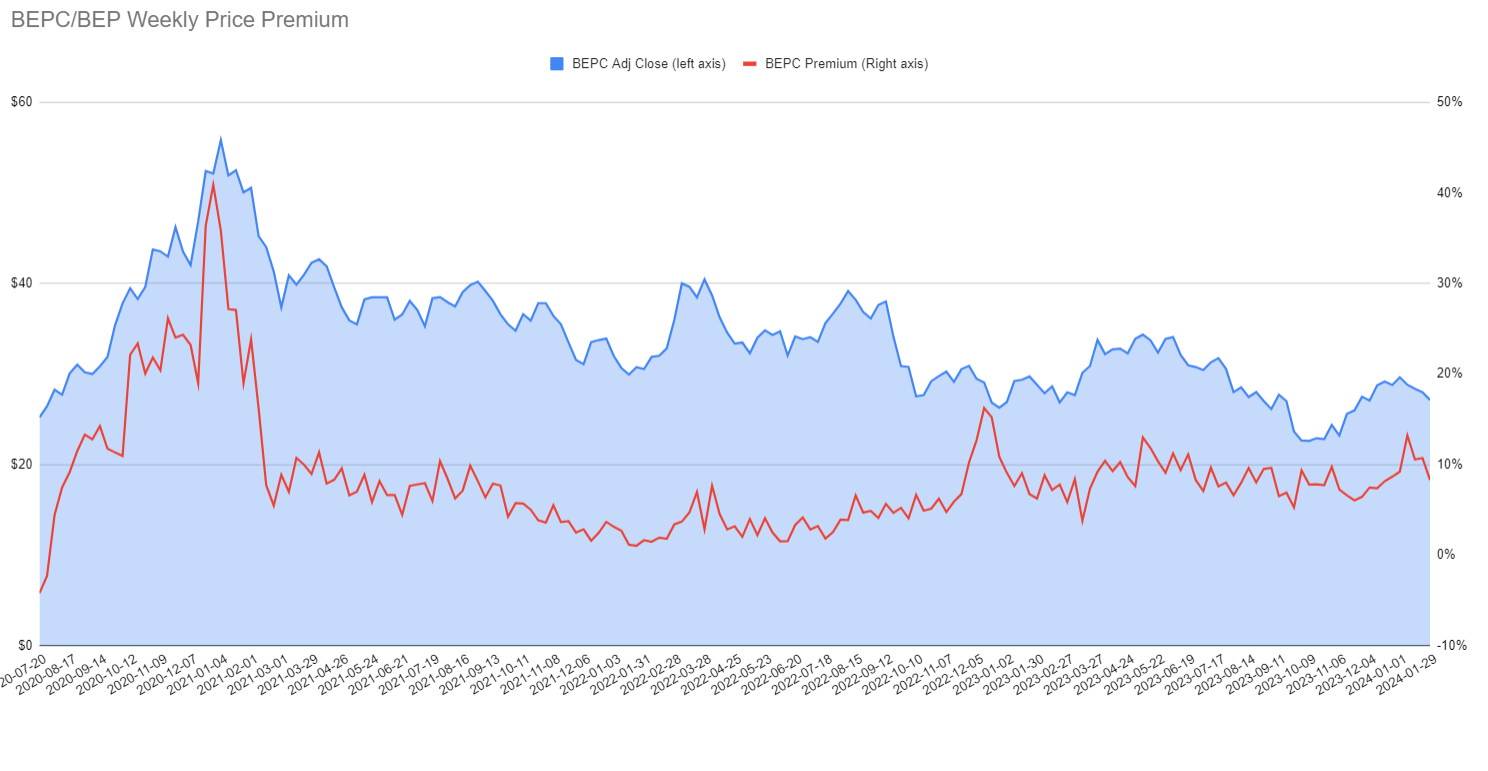

Here’s a chart of the prices of the two shares and the BEPC price premium over time. The data is from Yahoo! Finance on 2/5/2024.

You’ll note that when BEPC was first launched in 2020, the C-shares temporarily traded at a slight discount (negative premium) to BEPC, and shot up to a bubbly 30%+ at the end of 2020 into early 2021. The premium hit 25% in November 2020, and later got as high as 40%. At 25%, I thought BEPC’s premium was too high. That was the only other time I’ve written about the premium publicly. I thought it was far too low when it was below 5% for most of 2022, but I didn’t get around to writing about it.

Now that BEPC shares are a little more seasoned and we’re mostly done with the stock market disruptions of the covid pandemic, I doubt future swings in the premium will be nearly as dramatic, but it still make sense to pay attention to the price premium when you are deciding to trade BEP or BEPC.

DISCLOSURE: As of 2/5/24, Tom Konrad and accounts he manages own the following securities mentioned in this article: CWEN-A, BEP, BEPC. He does not expect to sell any of them in the next three weeks, and may buy more of CWEN-A or BEPC. He might buy BEP if the BEPC premium over BEP increases to over 10%.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. All investments contain risk and may lose value. Past performance is not an indication of future performance. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

ABOUT THE AUTHOR: Tom Konrad, Ph.D., CFA is the Editor of AltEnergyStocks.com (where this article first appeared) and a portfolio manager at Investment Research Partners.