Impossible Foods Launches Impossible Pork

by Helena Tavares Kennedy

It began with beef without the cow, even leather without the cow, and now we wave goodbye to pork from the pig with the news that Impossible Foods has launched pork made from plants.

Not only that, but Impossible Foods is going beyond the Impossible Whopper and expanding their work with Burger King in a new Impossible Croissan’which using Impossible Sausage made from plants as well. That will be available in only some Burger King locations starting in late January.

What’s in it?

Impossible Foods says their new pork protein is mostly made with soy protein, coconut oil, sunflower oil....

Three Renewables Companies: No Pain, No Gain

Jim Lane In California and Canada this week, BioAmber (BIOA), Pacific Ethanol (PEIX) and the former Solazyme (SZYM) reported their Q4 and year-end results, providing between them a fascinating look at the evolution in the fuels, renewable chemicals, specialty products and nutrition that make up the advanced bioeconomy. In advanced nutrition The most spectacular news of the week belonged to TerraVia (formerly SolaZyme), which landed a 5-year, $200 million “baseload” offtake deal with Unilever, which provides a huge lift for investors and validates the economics and performance of the company’s first commercial plant, which it operates in a...

BioAmber Gets Little Love From Investors on Valentine’s Day

by Debra Fiakas

Management of sustainable chemical developer BioAmber (BIOA: NYSE; BIOA: TSX) have not been feeling much love from the capital markets. The BioAmber team just wants some consideration for its proprietary platform for production of bio-based succinic acid. Historically succinic acid has been produced from fossil fuel and sold as an intermediate input for use in drug compounds, agriculture and food production. BioAmber has fine tuned a fermentation process to transform organic materials such as dextrose sugars into a bio-succinic acid.

BioAmber’s woes began last fall when the New York Stock Exchange sent the company a notice of non-compliance with NYSE...

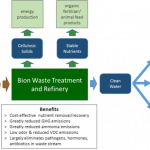

Bion: Waste To Dollars

Earlier this week Bion Environmental Technologies (BNET) received approval of a patent for its proprietary ammonia recovery process. Bion’s technology converts livestock wastes into ammonium bicarbonate. Patent protection in the U.S. paves the way for Bion to deliver an environmentally friendly chemical to the market at attractive profit margins.

Ammonium bicarbonate is used for a variety of purposes from leavening to crop additives. It is the fertilizer market that has caught Bion’s attention. The company intends to ‘close the loop’ for the agricultural sector by helping livestock producers economically dispose of waste and then delivering a fertilizer for food crops that qualifies as organic.

It is an attractive...

Amber Means Caution But BioAmber Means Go

Jim Lane In Canada, BioAmber (BIOA) recorded net income of $4.8M for Q2 2016 and an operating loss of $1.0M on revenues of $2.5M. Revenues were up 73 percent over Q1 and 637 percent compared to Q2 2015. For those less familiar with the company, it produces succinic acid from sugar at a first commercial-scale plant which opened recently in Sarnia, Ontario. Succinic acid has a small existing global market but can be converted into a variety of chemical building blocks used to produce a range of plastics, paints, textiles, food additives and personal care products. If for...

Biofuels & Biobased Earnings Roundup: Novozymes

by Jim Lane

The Top Line. In Denmark, Novozymes (Copenhagen:NZYM-B; OTC:NVZMY) reported 4% organic sales growth for the first half and a 5 percent jump in Q2 with bioenergy reporting a 14% jump. Overall, net profit grew 5% and the company affirmed its 2018 guidance. Sales dipped to DKK 7,018m from DKK 7,278m, and EBITDA was flat at DKK 2,464m, although we primarily attribute that to currency shifts.

The Big Highlights. Growth in Food & Beverages and Agriculture & Feed; Bioenergy particularly strong. Good ramp-up of recent product launches. +7% organic sales growth in emerging markets; Freshness & hygiene platform in Household Care developing according to...

Elevance’s $100M IPO: The 10-Minute Version

Jim Lane Like to quickly understand the surge in renewable chemicals and one of the hottest companies in the hottest sector of the bioconomy? Here’s our 10-minute version of the IPO from Elevance Renewable Sciences. Complete with the risks, translated into English from the original SEC-speak. In Illinois, Elevance Renewable Sciences filed its S-1 registration statement relating to a proposed $100 million initial public offering. The number of shares to be offered and the price range for the offering have not yet been determined. The company indicated that it has apply to list the stock on NASDAQ under the ERSI symbol. The...

Amyris Reaches Positive Cash Flow

Jim Lane In California, Amyris announced positive cash flow of $1.7 million in the first quarter despite negative currency effect of $1.2 million. Overall, Amyris recorded Q1 2015 non-GAAP cash revenue inflows of $30.3 million, compared with $17.9 million for Q1 2014. Total Q1 2015 revenues were $7.9 million, an increase of 30% compared with same quarter last year. Cash, cash equivalents and short-term investments of $44.9 million at March 31, 2015, an increase from $43.4 million at December 31, 2014. “We’re pleased with our continued execution toward diversifying and growing our revenue base through an expanding...

Can Amyris Find The Ingredients Of Success?

In late August 2018, sustainable ingredients developer Amyris (AMRS: Nasdaq) staged a successful secondary offering by a selling stockholders, Foris Ventures and Vivo Capital Fund. In conjunction with the offering the company raised $46.0 million in new capital through the exercise of warrants held by existing shareholders. Last week the shares closed over 40% higher than the $6.25 deal price. The chief executive officer lauded shareholders for their support and apparent endorsement of the company’s game plan to commercialize sustainable alternatives to petroleum-sourced materials used in fragrance, health and beauty products.

Amyris leadership should celebrate its loyal shareholders given how far the company drifted...

Biofuels & Biobased Earnings Roundup: Amyris

by Jim Lane

The Top Line. In California, Amyris (AMRS) reported Q2 GAAP revenue for the second quarter of 2018 of $24.8 million, compared with $25.7 million for the second quarter of 2017. Grants and collaborations revenue was $11.4 million for the second quarter of 2018 compared with $10.3 million for the year-ago period. The company noted that Q2 revenue was $24.8 million compared with the same period in 2017 of $21.7 million when adjusted for the low margin product sales on contracts assigned to DSM (DSM.AS). This reflects 15% growth on an absolute basis. GAAP net loss for the first half was $89.1...

Bioplastics Maker Avantium’s IPO Plans

Jim Lane Here’s our 10-minute version of the filing, slightly re-organized to make sense to Earthlings instead of aliens from the Planet Prospectus. In the Netherlands, bioplastics maker Avantium is planning an initial public offering and listing of all shares on Euronext Amsterdam and Euronext Brussels. The company expects to raise up to €100 million (USD$106 million) and complete the offering by the end of the current quarter. More than half of the offering has already been secured via commitments from cornerstone investors. Avantium’s YXY technology converts plant-based sugar into chemicals and plastics, including 2,5-furandicarboxylic acid, a precursor...

The Return of Advanced Biofuels

by Jim Lane

For several years now we have seen a significant number of players pivoting from biofuels towards smaller but higher-value markets in chemicals, nutrition, nutraceuticals, pharma, materials, flavorings, fragrances, cosmetics and more. We’ve reported on the proliferation of applications both in the Digest and in What’s Nuu? and indeed there’s been so much that’s Nuu, it’s been dizzying at times with all the spinning and twirling.

Capital costs and policy uncertainty have played their part, but the foot on the pedal for many has been oil prices. The scale of operations to compete with oil prices in the 2014-2017 period...

Amyris In The Age Of Rapid Change

by Jim Lane

Last month, Amyris (AMRS) and Chevron (CVX) announced that Novvi and Chevron have entered into an agreement to jointly develop and bring to market novel renewable base oil technologies. Novvi is Amyris’ JV with Cosan (CZZ) to produce targeted hydrocarbon molecules from plant sugar for automotive, industrial, marine, and construction applications at unbeatable economics. Think lubricants for engines and machines.

Since launching its first commercial production in 2014, Novvi has been steadily increasing its base oil production to keep up with robust and growing demand for a variety of automotive, marine and industrial applications. Meanwhile, Chevron has one of...

Save 31% on BioAmber’s IPO

Jim Lane Will BioAmber complete its IPO? As the industry waits, fingers crossed, the biosuccinic developer sweetens the pot with warrants, lower share prices. In Canada, BioAmber has reduced the proposed price range for its IPO to $10-$12 per share, down from a $15-$17 range as it seeks to keep the initial public offering on track. Overall, the company now proposes to raise between $80 million and $110.4 million in the offering, now scheduled for May 13th according to the latest calendar from NASDAQ. At the offering’s midpoint and excluding the sale of up...

Biofuels & Biobased Earnings Roundup: DSM

by Jim Lane

The Top Line. In the Netherlands, Royal DSM (Amsterdam: DSM.AS; US OTC:KDSKF; US ADR:RDSMY) reported a good H1 with organic sales growth in underlying business estimated at 10% and adjusted EBITDA growth of underlying business estimated at 7%, with sales of €4,794 million and adjusted EBITDA of €771 million.

The Big Highlights. Nutrition: an estimated 8% underlying organic sales growth and Adjusted EBITDA growth of underlying business estimated at 6%. Materials: 7% organic sales growth and Adjusted EBITDA growth of 5%. DSM also confirmed its full year outlook 2018, as provided at Q1 2018, and expects an Adjusted EBITDA growth towards...

Investing in Biopolymers

Last month Eastman Chemical Company (EMN: NYSE) announced an expansion of its urethane extrusion line at one of its specialty chemical plants. This one located near Martinsville, Virginia makes paint protection films and window films. Urethane is perfect to protect surfaces in a home or business. It is not brittle like plastic, but has excellent tolerance for grease and oils. When exposed to the elements it does not rot or degrade over time like rubber.

Shareholders likely cheered the development in Virginia for potential addition to market share. Eastman grabbed $9.6 billion in sales from the specialty chemicals market in 2017, earning $1.4 billion in net income or...