Amber Means Caution But BioAmber Means Go

Jim Lane In Canada, BioAmber (BIOA) recorded net income of $4.8M for Q2 2016 and an operating loss of $1.0M on revenues of $2.5M. Revenues were up 73 percent over Q1 and 637 percent compared to Q2 2015. For those less familiar with the company, it produces succinic acid from sugar at a first commercial-scale plant which opened recently in Sarnia, Ontario. Succinic acid has a small existing global market but can be converted into a variety of chemical building blocks used to produce a range of plastics, paints, textiles, food additives and personal care products. If for...

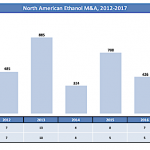

Biofuels M&A: 2017 Review and Outlook

by Bruce Comer, Ocean Park Advisors

More industry players chose to develop and build new capacity rather than buy plants

The North American biofuels industry experienced the fewest merger and acquisition transactions in recent history in 2017. There were only six M&A transactions, with a total estimated value of more than $100 million. They involved eight plants with 297 million gallons per year (MGPY) of production capacity. Half of these deals were for non-operating plants. A fourth deal was for a sub-scale demonstration plant. Contributing to the limited deal flow, two historically active acquirers, Green Plains and REG, did not close...

BioAmber’s $150 Million IPO: The 10-Minute Version

Jim Lane A first-to-market leader in bio-succinic acid comes to the public markets with its IPO. Can BioAmber translate a lead in succinic acid’s smallish market into leadership in a vast array of high-priced renewable chemicals? Here’s our 10-minute version of the BioAmber IPO, with a translation of the risks into English. In Minnesota, BioAmber has filed an S-1 registration statement for a proposed $150 million initial public offering. The number of shares to be offered in the proposed offering and the price range for the offering have not yet been determined. The lead book-running managers for...

BioAmber’s Sarnia Plant Operating At Commercial Scale

Jim Lane Ultra-secret yeast tech also exceeding expectations in yield, productivity and quality, BioAmber reports. Baby Sarnia checks in at 60 million pounds, no ounces, doing fine. In Canada, BioAmber’s (BIOA) Sarnia joint venture with Mitsui & Co. Ltd. has begun shipping bio-succinic acid to customers and is operating its manufacturing process at commercial scale, meeting a significant company milestone, the company said. Yeast biotechnology exceeds performance targets BioAmber has confirmed the performance of its proprietary yeast in the production fermenters in Sarnia. The fermentation performance achieved is significantly above the initial targets set for...

BioAmber Goes Ballistic

Jim Lane Word arrived from Minnesota that BioAmber has signed a 210,000 ton per year take-or-pay contract for bio-based succinic acid with Vinmar International. Explaining why BioAmber (BIOA) stock shot up nearly 17% in today’s trading despite a global equities pullback that affected almost everyone else in industrial biotech. Under the terms of the 15-year agreement, Vinmar has committed to purchase and BioAmber Sarnia has committed to sell 10,000 tons of succinic acid per year from the 30,000 ton per year capacity plant that is currently under construction in Sarnia, Canada. Bottom line, BioAmber continues to roll and roll....

New Bio-Based Tacky Resins Launched With Amyris Technology

Jim Lane In France, Cray Valley has launched new tackifying resins produced with Amyris’ (AMRS) biologically derived Biofene branded farnesene. Tack is the measure of stickiness vital to everything from adhesives that need to hold things in place to inks that need to stay on the printed page. According to independent market research firm, MarketsandMarkets.com, the global tackifier market is projected to reach USD 3.56 billion by 2020. This poses a large opportunity for renewable farnesene-based tackifiers and Amyris believes it can access a large market share as its product applications within the space achieve commercial scale. Cray...

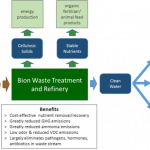

Bion: Waste To Dollars

Earlier this week Bion Environmental Technologies (BNET) received approval of a patent for its proprietary ammonia recovery process. Bion’s technology converts livestock wastes into ammonium bicarbonate. Patent protection in the U.S. paves the way for Bion to deliver an environmentally friendly chemical to the market at attractive profit margins.

Ammonium bicarbonate is used for a variety of purposes from leavening to crop additives. It is the fertilizer market that has caught Bion’s attention. The company intends to ‘close the loop’ for the agricultural sector by helping livestock producers economically dispose of waste and then delivering a fertilizer for food crops that qualifies as organic.

It is an attractive...

Elevance’s $100M IPO: The 10-Minute Version

Jim Lane Like to quickly understand the surge in renewable chemicals and one of the hottest companies in the hottest sector of the bioconomy? Here’s our 10-minute version of the IPO from Elevance Renewable Sciences. Complete with the risks, translated into English from the original SEC-speak. In Illinois, Elevance Renewable Sciences filed its S-1 registration statement relating to a proposed $100 million initial public offering. The number of shares to be offered and the price range for the offering have not yet been determined. The company indicated that it has apply to list the stock on NASDAQ under the ERSI symbol. The...

Lower Revenues at Solazyme, But Also Lower Losses and New Customers

Jim Lane In California, Solazyme (SZYM) reported Q2 revenues of $11.7M compared with $15.9M in Q22014. GAAP net loss was $37.2 million for Q2 2015, compared to net loss of $42.9M in the prior year period. The company said that “year over year decline in revenues was due to expected decreases in funded program revenue as well as in product revenue due to the timing of certain Algenist sales activities and slower than anticipated adoption rates for Encapso.” The market responded to the results by slashing the stock price 20 percent in Friday trading. Analyst reaction was more positive,...

Three Renewables Companies: No Pain, No Gain

Jim Lane In California and Canada this week, BioAmber (BIOA), Pacific Ethanol (PEIX) and the former Solazyme (SZYM) reported their Q4 and year-end results, providing between them a fascinating look at the evolution in the fuels, renewable chemicals, specialty products and nutrition that make up the advanced bioeconomy. In advanced nutrition The most spectacular news of the week belonged to TerraVia (formerly SolaZyme), which landed a 5-year, $200 million “baseload” offtake deal with Unilever, which provides a huge lift for investors and validates the economics and performance of the company’s first commercial plant, which it operates in a...

Beets to Gas

by Debra Fiakas, CFA

In recent weeks management from Global Bioenergies (ALGBE: EURONEXT)made the rounds among New York City investors. The French specialty chemical developer is trying to win new friends in the U.S. for its bio-isobutene made through the fermentation of organic materials. Isobutene, also called isobutylene, is a four-molecule hydrocarbon that is a foundational chemical in a wide range of common products from gasoline additives to cosmetics. Until recently, isobutene was made exclusively in the crude oil refinement process. It is one of the many by-products of crude oil refining that helps pad the profit margins of big oil...

Living Endangeredly- Q2 Biobased Earnings Roundup

by Jim Lane

In hand we now have the latest earnings reports from what you might call the 8 Pathfinders – eight publicly traded stocks whose second quarter results offer insights into the health and performance of the advanced bioeconomy as 2019 heads towards its closing crescendos.

Our 8 Pathfinders – In the world of global renewable diesel at scale, Neste (Neste.HE); pure-play enzymes, Novozymes (NVMB); In pharma and synbio, Codexis (CDXS); as a hybrid play in advanced fuels, Aemetis (AMTX); in advanced marine and jet fuels, Gevo (GEVO); for biodiesel and hydrocarbons, Renewable Energy Group (REGI); in advanced began foods,...

Biofuels & Biobased Earnings Roundup: Amyris

by Jim Lane

The Top Line. In California, Amyris (AMRS) reported Q2 GAAP revenue for the second quarter of 2018 of $24.8 million, compared with $25.7 million for the second quarter of 2017. Grants and collaborations revenue was $11.4 million for the second quarter of 2018 compared with $10.3 million for the year-ago period. The company noted that Q2 revenue was $24.8 million compared with the same period in 2017 of $21.7 million when adjusted for the low margin product sales on contracts assigned to DSM (DSM.AS). This reflects 15% growth on an absolute basis. GAAP net loss for the first half was $89.1...