Ten Clean Energy Stocks For 2015: A Fine February

Tom Konrad CFA After a rough start to the year, My Ten Clean Energy Stocks for 2015 posted a strong recovery in February. For the month, the model portfolio rose 7.9% in local currency terms and, 8.3% in dollar terms. For comparison the broad universe of US small cap stocks rose 5.9% (as measured by IWM, the Russell 2000 index ETF), and the most widely held clean energy ETF, PBW, shot up 11.6%. This year I split the model portfolio into two sub-portfolios of six income stocks (NYSE:HASI, NYSE:BGC, TSX:...

A Great Day For Solar Stocks, But Beware The Volatility!

Is it the unprecedented amount of media attention climate change is currently getting? Is it the State of the Union Address? Is it the price of oil? Or is it a combination of factors? In the end, it doesn't really matter; it's this time of year again and the value of the solar sector is heading north. Today was a great day for solar stocks, while the market as a whole was mainly flat. I remember this period last year very well. I was long Suntech Power and Energy Conversion Devices , acquired...

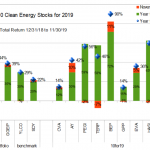

Ten Clean Energy Stocks For 2019: Still Party Time

by Tom Konrad Ph.D., CFA

2019 has become another blockbuster year for the Ten Clean Energy Stocks model portfolio and, to a lesser extent clean energy stocks and the broad stock market as well. I'm frankly surprised to see the party continuing. The continued spiking of the metaphorical punch bowl by the Federal Reserve with interest rate cuts certainly has a lot to do with it. I had expected those cuts to be both fewer and less effective.

Which all goes to show that it's always a good idea to hedge one's bets in the stock market. At least in part...

Ten Clean Energy Stocks for 2013: First Half Review

Tom Konrad CFA I missed my regular monthly update on my Ten Clean Energy Stocks for 2013 model portfolio last month, and a lot has happened to the individual companies since. Because of this, I will split this semiannual update in two parts. This part will look at the performance of the portfolio as a whole, and the reasons it's lagging its benchmarks. The next part will look at the news driving the performance of specific stocks. Since the last update on May 5th, my portfolio has advanced 3.0% for a 10.5% return for the first...

Performance Update: 10 Clean Energy Stocks for 2009

I promised I'd do a performance update on my 10 Clean Energy Stocks for 2009 each quarter. Here is the first (although readers got a mini-update in mid February, because I decided I didn't want to use double-shorts.) Company Ticker Change 12/27/08 to 3/27/09 Dividend & Interest The Algonquin Power Income Trust AGQNF.PK +7.14% 5.36% Cree, Inc. CREE +59.96% First Trust Global Wind Energy ETF FAN -10.73% General Electric GE -32.50% 1.94% Johnson Controls JCI -25.97% 0.77% New Flyer...

In Review: 10 Clean Energy Stocks for 2009

Tom Konrad, CFA 2009 was a banner year for my clean energy stock picks, which are up 57% over 12 months, greatly exceeding their benchmarks. Over the last 12 months, my ten green energy stocks for 2009 are up 57% vs. 29% for the S&P 500, and 12% for my clean energy benchmark, the iShares S&P Global Clean Energy Index (ICLN), the two indexes I specified for benchmarks when I published the list a year ago. Below is a detailed rundown of the results. Company Ticker Change 12/27/08 to 12/27/09 Dividend &...

Shares in Energy Conversion Devices Purchased

Energy Conversion Devices Inc (ENER) opened up trading this morning with a gap down to the $33 level. For the last hour it has been steadily rising up from this point. As I said in my earlier post, I have been looking for a good entry point in this company and feel that the near term support of $33 is an ideal area to place an order. The stock has been on a run for several months and it is always hard to take a new position in a stock that has already seen dramatic increases...

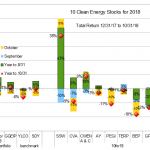

Ten Clean Energy Stocks For 2018: Terraform, Clearway, and Enviva

by Tom Konrad Ph.D., CFA

Last week, I neglected to discuss Terraform Power (NASD: TERP) in the third quarter update on the other ten clean energy stocks for 2018. I did not notice the omission until after the post had been published, so I decided to write a quick follow-up this week after I had a chance to digest the earnings announcements (including TERP's) which were scheduled for later in the week.

Stock discussion

Clearway Energy, Inc (NYSE: CWEN and CWEN/A)

12/31/17 Price: $18.90 / $18.85. Annual Dividend: $1.133(6.0%). Expected 2018 dividend: $1.26(6.7%) Low Target: $14. High Target: $25.

10/31/18 Price: $19.61/$19.42 ...

In a Buying Mood

Several key indicators I follow have put me back into a buying mood. But sadly I will be spending most of my day in meetings and will not have much time to follow through on any purchases. I wanted to post a quick update about the stocks I'm following. I will be averaging down on some of my current holdings this week and also looking to add some new stocks to the portfolio. Here is my short list of new stocks I'm taking a close look at to add to the portfolio: Capstone Turbine Corp (CPTC)...

Portfolio For A GHG-Regulated World

Investment opportunities connected to climate change and greenhouse gas (GHG) regulation are a popular topic of discussion on this blog. Most of the time, however, the companies we discuss are relatively small, often unknown to most investors and overall pretty speculative. Yesterday, I came across an interesting article on Seeking Alpha entitled "Investing In a Greenhouse Gas-Regulated World" - the title says it all. The article looks at the question of investing in a GHG-constrained world from a conventional portfolio management perspective, and therefore argues for a low weighting in pure-play cleantech or carbon finance stocks, and...

Q2 Performance Update: Ten Green Energy Gambles for 2009

Tom Konrad, Ph.D., CFA I never thought 2009 would be a good year for risky stocks, but my readers asked for them anyway. So far, my risk taking readers have not been burnt too badly, and the portfolio as a whole continues to track its benchmarks. In my first quarter update for my green energy gambles for 2009, I noted that the portfolio had lost about 10%, between the benchmark returns (-12% and -5%), but not very impressive. Since then, the portfolio as a whole has gained a little ground, and is almost exactly midway between the benchmarks. The...

Optionetics Story on Alt E Stocks

Fredric Ruffy from Optionetics.com has written a cautionary article about investing in Alternative Energy stocks. If alternative fuel companies made lots of money, there would be no energy crisis today. Unfortunately, most of these companies don't. You will start to see more and more stories about this sector now that gas prices are starting to cross the $3 per gallon mark and head even higher. As I said in a previous article, this sector is currently in a trading market. While he cautions investors that are looking for the long term viability of this investment, he...

Shares in Hoku Scientific Purchased

This morning I purchased shares in Hoku Scientific, Inc. (HOKU) for my personal portfolio and an average price of $9.47. I was unable to purchase shares in this stock for the mutual fund since it is a recent IPO that came to the market in early August. Hoku is a fuel cell membrane manufacture that is based out of Hawaii. They have strategic partnerships created with Sanyo Electric and Nissan. This company also has the honor of being one of the select few companies in this sector that is actually profitable. Another amazing aspect of this company is...

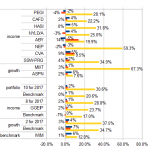

Ten Clean Energy Stocks For 2017: Fall Forward

Tom Konrad Ph.D., CFA

Yieldco Buyouts

A Canadian Yieldco Invasion sent clean energy stocks running up in October and November. My Ten Clean Energy Stocks model portfolio benefited from the purchase of 25% of Yieldco Atlantica Yield (NASD:ABY) by Canadian utility and renewable power generation conglomerate Algonquin Power and Utilities (TSX:AQN or OTC AQUNF), which was one of my Ten Clean Energy Stocks for 2009.

Rumors had circulated that the Atlantica stake would be purchased by Brookfield (NYSE:BAM) and its Yieldco Brookfield Renewable (NYSE:BEP). If there were discussions, Brookfield must have decided that it had enough on its plate with the recently...

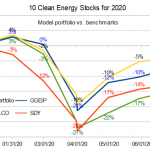

10 Clean Energy Stocks for 2020: June Update

by Tom Konrad, Ph.D., CFA

The coronavirus pandemic no longer has the United States by its financial center throat, the New York City area, but is instead is now gnawing ravenously at its arms and legs. In June, the stock market seems to be just starting to get a clue that this is also a bad thing, leading to a month of volatility and general consolidation.

Europe, in a display of relative competence, has been much more effective than the US at getting the pandemic beast under control, and so investors looking for safe havens might do well to look there. ...

11 Clean Energy Stocks for 2012: Quick Update

Tom Konrad CFA Experimenting with more frequent updates In the past, I genrally only wrote about my annual list of ten clean energy stocks on a quarterly basis, but when I wrote last month to apolgize for inadvertently slipping in an extra stock, and in the process wrote a few notes on a couple of the stocks with news, a couple readers wrote to say they liked the more frequent updates. So let it be written, so let it be done. Leave a comment if you think it's something I should continue doing,...