10 Clean Energy Stocks for 2021: November. Notes on MIXT, GPP, EVA

By Tom Konrad, Ph.D., CFA

Monthly Performance

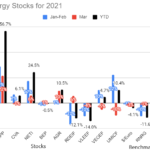

Returns for the Ten Clean Energy Stocks for 2021 model portfolio are shown below. It was a good month for clean energy stocks as well as the broader stock market, with the portfolio up 4% for a 20% total return through the end of October. Its clean energy benchmark (RNRG) was up more (8%) but is still down 6% for the year. Its broad market benchmark (SDY) rose 5% and has caught up with the model portfolio at a 20% return year to date.

Earnings

Third quarter earnings season has started. Below are some notes I’ve...

Calpine Gets Hammered

Shares of Calpine Corp. (CPN) suffered a greater than 20% loss yesterday and is now down almost another 13% today. All of this was caused by a court ruling stating that they will be unable to use the $395 million in cash they received from the sale of oil and gas fields earlier this year for the purpose of buying natural gas to run its power plants. The dispute stems from the Bank of New York's decision in September when, acting as trustee for Calpine bondholders, it withheld proceeds from Calpine's sale in July of North...

The Quick Guide To A Green Stock Portfolio

Tom Konrad, CFA I recently published a quick guide to a green or fossil fuel free stock portfolio aimed at the small investor. For most people, the best options will be to use mutual funds or an investment advisor. Some of us like to do things ourselves, and build a portfolio from scratch, using individual stocks. Doing so could rapidly become a full-time job, but it does not have to be. Instead, you can use information which mutual funds disclose to piggy-back on their research. Garvin Jabusch, Co-Founder and CIO of Green Alpha Advisors in...

Ten Clean Energy Stocks For 2016 Spring Forward

Tom Konrad CFA March and April were months of recovery for the broad market and for clean energy income stocks, but most clean energy stocks failed to participate in the rally. By design, my Ten Clean Energy Stocks for 2016 model portfolio is heavily weighted towards income, recovering 9% in March and 6% in April so that it is now back in the black, up 0.8% year to date. This puts it ahead of its benchmark, which is down 0.8% through the end of April. I want to thank Aurelien Windenberger...

Ten Clean Energy Stocks for 2011: Buying Opportunities

Tom Konrad, CFA The geothermal and demand response stocks in my annual portfolio of ten clean energy stocks for 2011 have fallen significantly since the start of the year, making this an excellent time to buy. Every year since 2007 I've been publishing a list of ten renewable energy and energy efficiency stocks that I think will do well over the coming year. For 2008-10, my list outperformed my clean energy benchmark. This year so far looks like it is going to break my streak, but there is a very bright silver lining: I now think four...

Veolia Cleaning Up Balance Sheet

Tom Konrad CFA On Thursday, Veolia Environnement (NYSE:VE) closed a deal to sell its solid waste business for $1.9 billion. This is part of its ongoing effort to reduce debt and cost of operations by selling assets worth $6.14 billion, which the company expects to complete by the end of 2013. Last year, Veolia took the first step in this program by selling its UK water business, also for $1.9 billion. I’ve long been attracted to Veolia for its green credentials and high dividend yield. The company paid a euro 0.70 ($0.85) dividend in 2012,...

Ten Clean Energy Stocks For 2017: Summer Harvest

Tom Konrad Ph.D., CFA

Colossal Fossil Failure

With a president actively hostile towards renewable energy and focused on promoting fossil fuels, it would be easy to think that clean energy stocks would underperform their fossil cousins. The exact opposite has been true. Despite the administrations' efforts and tweets bragging about new highs for the Dow, energy funds are down over 10% for the year. For example, the Energy Select Sector SPDR (XLE), largely composed of oil and gas companies, is down 13% for the year. The tiny coal sector did better, with the VanEck Vectors Coal ETF up 18%.

Even so, Trump's...

Valeo February Update (Ten Clean Energy Stocks)

I'm trying something different and doing quick updates on individual stocks in my 10 Clean Energy Stocks model portfolio as I have time to write. The portfolio as a whole has been accelerating with the instant torque of an electric vehicle this year (details here.) I thought I'd start with the company that's newest to my readers,

Valeo SA (FR.PA, VLEEF)

12/31/18 Price: €25.21/$28.20. Annual Dividend: €1.25. Expected 2019 dividend: €1.25. 03/4/19 price: €29.13/$33.00. YTD gain: 15.5% Euro/ 12.8% USD.

I added this stock to the portfolio because it has great technology and and improving market share, but weak industry growth and overoptimistic management projections in 2018...

Q1 Earnings Roundup: Yieldcos (AGR, BEP, CWEN, GPP)

By Tom Konrad, Ph.D., CFA

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. If there is any theme, it’s that low interest rates and increased interest in green investments is lowering Yieldcos’ cost of capital to the benefit of stock investors.

Avangrid Earnings

Avangrid's (AGR) Q1 earnings report showed solid progress. Key items of note were:

Increased outlook for full year 2021 Adjusted EPS a little over 5%

Key environmental approval for 800 MW offshore wind farm Vineyard Wind. Expected to begin construction later this year, with expected completion in 2024. Avangrid...

Clean Energy Stock Deflation and Biden’s Infrastructure Plan

By Tom Konrad, Ph.D., CFA

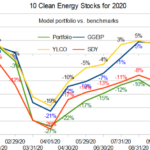

Last month saw buying opportunities in some clean energy stocks as the bubble created from the euphoria over Biden’s election vanished as if it never happened.

Clean energy stocks have simply returned to the general upward trendline from the second and third quarter of 2020. Rather than bursting in a market panic, this seems to have been more of a general deflation.

Some clean energy stocks seem reasonably priced, but there are no great values like we often see during the market panics which typically follow bubbles. Without a panic, I’m not ready to buy aggressively. Stocks...

Restarting 10 Clean Energy Stocks Series

By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily...

Where To Next For Solar PV Stocks?

Charles Morand There was an interesting post in Barron's tech trader daily on Monday discussing how solar PV stocks are coming under pressure, in part because product prices are falling further than expected. About a month ago, I discussed the potential return effect for households in given states of removing the $2,000 ITC cap. Such measures, it seems, are failing to kickstart demand, and solar recovery might end up being significantly slower than many had been expecting. Case in point, since hitting a high of $11.49 on June 11, the TAN ETF is down about 12%. KWT, for...

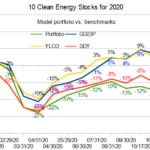

10 Clean Energy Stocks for 2020: Spooked in October, but Trading Anyway

by Tom Konrad, Ph.D., CFA

Two of the cash covered puts in the 10 Clean Energy Stocks for 2020 model portfolio have now expired, and I am left with a difficult decision as to what to replace them with.

As I discussed last month, I feel the market is overvalued given the economic impact of the pandemic and little prospect of fiscal stimulus before January. Yes, the market is not the whole economy, and large tech firms and high income workers and the wealthy are doing great while people on the bottom half of the income ladder are being crushed. With...

10 Clean Energy Stocks for 2020: Rose Colored Covid

by Tom Konrad, Ph.D., CFA

The stock market took off in November, fueled by very positive covid-19 vaccine news, and possibly also the prospect of a little competence and sanity in the White House. While both of these are unambiguously positive for the economy, I think investors are seeing the future through rose colored glasses.

Rose colored covid-19.

What a Biden Victory Means for the Economy

A Biden victory is good news in that we will finally have someone in the White House who will work to reduce the infection rate in the pandemic, rather than vacillating between wishful thinking and actively spurring...

Ten Clean Energy Stocks For 2014: September Swoon

Tom Konrad CFA Worries including the conflict with ISIL, Ebola, and economic slow-down in Europe, sent the stock market down in the month to October 3rd, with small cap stocks and clean energy stocks falling even farther than the large cap S&P 500. My 10 Clean Energy Stocks for 2014 model portfolio weathered the storm relatively well because of its emphasis on defensive and income stocks. Since the last update, the model portfolio was down 4.8%,...

Year In Review: 11 Clean Energy Stocks for 2012

Tom Konrad CFA Year In Review For the fourth year in a row, my model portfolio of clean energy stocks has beaten the clean energy sector as a whole, this year by 23.8%. Unfortunately, this was mostly due to another year of poor performance by my industry benchmark, the widely held Powershares Clean Energy (PBW) ETF, which lost 16.4% for the year. My model portfolio, composed of eleven clean energy stocks listed in this article published on January 2nd, gained 7.4%, still short of the performance of the broad market, which gained 16.6%. The general market...