11 Clean Energy Stocks for 2012: August Update

Tom Konrad CFA July Overview July was a good month for my Clean Energy model portfolio. Since the last update, these 11 stocks are up an average of 3.3%, with a year to date return total return a tiny loss of -0.5%. While it's never pleasant to be down for the year, it's helpful to compare this performance to that of the most widely held clean energy ETF, the Powershares Wilderhill Clean Energy ETF (PBW), which was down 8.7% for the month, and down 21% year to date. All in all, it has been a miserable year...

Correction, or Bear Market?

by Tom Konrad, Ph.D., CFA

On February 21st, I was helping an investment advisor I consult with pick stocks for a new client's portfolio. He lamented that there were not enough stocks at good valuations. This is one of the hardest parts of being an investment advisor: a client expects the advisor to build a portfolio of stocks which should do well, but sometimes, especially in late stage bull markets, most stocks are overvalued. I reminded him, "The Constitution does not guarantee anyone the right to good stock picks." He agreed, but he still had to tell his client that...

Trading Alert: CPTC.OB

In my article about electrical transmission, I mentioned that I liked Composite Technology Corp. (CPTC.OB). I became increasingly bullish on this stock as a result of my changing understanding while I was researching the article. The article then initiated an email conversation with a long-time investor, where I learned more about the company's business. As a result, I just purchased more of the stock (at $1.33, using a limit order), quadrupling my initial position (acquired in February at $.91. My current average cost basis is $1.23.) Several of my clients also own...

Give the Gift of a Future This Christmas: Five Sustainable Companies For Your Kids...

A Carbon Conundrum for Christmas Do we have to choose between happy kids this Christmas, and a happy future for those kids? Practically everything we buy has a negative environmental impact. If green consumption is an oxymoron, so is green giving. Are we left with only greener giving? It often seems that the only way to be truly green is to be like the Grinch (before his heart-enlargement) and not give anyone anything. And skip the tree while you're at it. It's a hard decision, and while there are many Green Shopping Advisories telling us that we can buy...

Two Clean Energy Speculations For 2014: Wrap-Up

Tom Konrad CFA I included two "Clean Energy Speculations" along with my annual model portfolio of ten clean energy stocks this year. It's been a tough year for clean energy stocks in general, with my industry benchmark (Powershares Wilderhill Clean Energy ETF (PBW)) down about 15% since I initiated the portfolios on December 27th 2013. Despite this, both the main portfolio and the speculations look likely to end the year with small gains. The two speculations were Ram Power Corp (TSX:RPG, OTC:RAMPF) and Finavera Wind Energy (TSX-V:FVR, OTC:FNVRF). Both are clean energy project...

Growth Stocks Shrivel; Income Stocks Grow

Ten Clean Energy Stocks For 2014: June Update Tom Konrad CFA While the major market indexes were hitting new highs in May, small capitalization stocks and clean energy stocks (most of which are small cap) continued to lag. The broad market benchmark IWM gained just 0.2% and is down 2.3% for the year, while my clean energy benchmark PBW fell 3.2% cutting its gains for the year to a slim 1.2%. Meanwhile my 10 Clean Energy Stocks for 2014 model portfolio managed to eke out a 0.3% gain. ...

Ten Clean Energy Stocks for 2010: Q2 Update

Tom Konrad CFA In the six months since I published my annual clean energy mini-portfolio, it has far outperformed my industry benchmark, the Powershares Wilderhill Clean Energy Index (PBW). The dismal performance of renewable energy stocks so far this year is likely to lead to great buying opportunities in the rest of the year. 2010 is the third year in a row that I've published a list of ten renewable and energy efficiency stocks that I expect to perform well over the coming year. The details on the list for 2010 are here; this article is...

Shares in Hoku Scientific Purchased

This morning I purchased shares in Hoku Scientific, Inc. (HOKU) for my personal portfolio and an average price of $9.47. I was unable to purchase shares in this stock for the mutual fund since it is a recent IPO that came to the market in early August. Hoku is a fuel cell membrane manufacture that is based out of Hawaii. They have strategic partnerships created with Sanyo Electric and Nissan. This company also has the honor of being one of the select few companies in this sector that is actually profitable. Another amazing aspect of this company is...

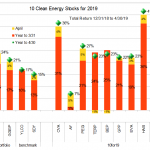

Ten Clean Energy Stocks For 2019: April Ascent

In April, my 10 clean energy stocks model portfolio continued to power ahead, despite the concerns about market valuation I expressed last month. As I said at the time "me being nervous about the market is not much of an indicator that stocks are going to fall" at least in the short term. So I continue to trim winning positions and increase my allocation to cash as stocks advance.

Both the model portfolio and the Green Global Equity Income Portfolio (GGEIP) were up 4.5% and 3.6% respectively in April. This was solidly ahead of their clean energy income benchmark YLCO...

Ten Clean Energy Stocks for 2013: February Update

Tom Konrad CFA Clip Art by Phillip Martin February was a month of consolidation after blistering January returns in clean energy stocks, and the market in general. My clean energy benchmark, the Powershares Wilderhill Clean Energy Index (PBW), declined 2.2%, while the broad universe of small cap stocks which I benchmark with the iShares Russell 2000 Index ETF (IWM) eked out a 0.6% gain. My ten clean energy picks for 2013 (introduced ...

Q3 Performance Update: Ten Green Energy Gambles for 2009

Tom Konrad, CFA I never thought 2009 would be a good year for risky stocks, but my readers asked for them anyway. The market's strong third quarter have paid off for risk-takers who gambled on my 10 Green Energy Gambles for 2009. I started out the year by providing readers with a portfolio of ten relatively conservative plays on green energy. That portfolio was representative of how I planned to approach the market this year, and has produced stronger returns and less volatility when compared to both green energy stocks and the market as a whole. Many of my...

The Peak Coal Portfolio

Last week, we alerted you to a report from Germany's Energy Watch Group called “Coal: Resources and Future Production,��? which predicts peak coal by 2025. Readers of AltEnergyStocks are doubtless familiar with peak oil, the inevitable fact that as we consume a finite resource (oil reserves) at some point the rate of that consumption must peak, and taper off. Serious arguments about peak oil center around "when" oil production (and consumption) will peak, not "if." The same it true for other finite natural resources, such as natural gas, uranium, and even coal. The difference with coal is the received...

Shares in Capstone Purchased

This morning I purchased shares of Capstone Turbine Corp (CPTC) in both my personal portfolio and the mutual fund. I have been waiting for the stock to show some strength after its recent declines. The stock appears to have some nice support at the $2.25 level as a bottom. They will be announcing quarterly earnings on November 10th. Capstone Turbine developments and manufactures microturbine generators. The company’s microturbines can also be used as generators for hybrid electric vehicle applications. It also offers Model C60 integrated combined heat and power systems (CHP). A one third stake have been purchased...

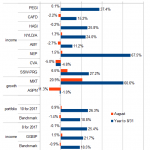

Ten Clean Energy Stocks For 2017: Sunny August Skies

by Tom Konrad Ph.D., CFA

After a strong performance all year, the stock market stumbled in August, along with clean energy stocks in general, although the sector continues to outperform the broad market. My Ten Clean Energy Stocks model portfolio again came out on top, buoyed by two winners (Seaspan Preferred (SSW-PRG) and MiX Telematics (MIXT). Both were catalyzed by strong earnings reports at the start of August, which I summarized last month.

For the month of August, the model portfolio was up 0.9%, for a 26.3% total gain for the year to the end of August. It's clean energy benchmark...

In Review: 10 Clean Energy Stocks for 2009

Tom Konrad, CFA 2009 was a banner year for my clean energy stock picks, which are up 57% over 12 months, greatly exceeding their benchmarks. Over the last 12 months, my ten green energy stocks for 2009 are up 57% vs. 29% for the S&P 500, and 12% for my clean energy benchmark, the iShares S&P Global Clean Energy Index (ICLN), the two indexes I specified for benchmarks when I published the list a year ago. Below is a detailed rundown of the results. Company Ticker Change 12/27/08 to 12/27/09 Dividend &...

What’s Going On With Beacon Power and RailPower Tech?

Two diametrically-opposed stories for this post: Beacon Power and RailPower Tech . The latter is up 134% on its week-ago closing price, while the former is down nearly 22% over the same period. Beacon Power Corp I wrote about Beacon Power a little while ago. The recent drop in share price is due in large part to the fact that Beacon announced, last Friday (Dec. 29), a glitch at one of its testing facilities in Massachusetts. This was followed by an analyst at Merriman Curhan Ford downgrading the company from Buy to Hold. Almost immediately, the...