by Susan Kraemer

As unrealistic expectations of dividend growth are scaled back, yieldcos are now on a more sustainable path.

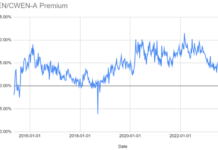

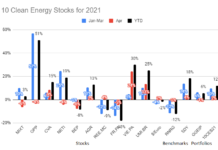

Weaknesses in the US yieldco model came into sharp relief this summer as share prices fell along with oil and gas stocks. This was in part due to investor confusion about energy stocks but also in response to a flaw in US yieldco expectations.

Manager of the Green Global Equity Income Portfolio and AltEnergyStocks.com editor Tom Konrad Ph.D., CFA had warned of the looming potential for exactly this kind of market correction in a conversation a year ago. He was worried that investors imagined that yieldcos could keep raising their dividends “forever.”

In July of 2014, Konrad voiced this concern: “I think investors think that the party will never end, but at some point we’re going to reach this place where yieldcos can’t raise their dividends. They have sowed the seeds of their own demise. I think most investors do not understand exactly what’s going on.”

Now, he said: “There has been a kind of an emperor-is-wearing-no-clothes moment. Investors were assuming that dividend growth would continue forever but that was predicated upon infinite stock price rises. I think it will certainly make people more cautious about investing in yieldcos.”

“What yieldcos need to be is boring”

Until recently, yieldcos were benefiting from a virtuous cycle of rising stocks, share issuance at high prices, rapid dividend growth and more share-price rises.

“People are greedy and the people who were setting up yieldcos were catering to that,” Konrad said. “The stocks were overpriced. That has corrected.”

The fall happened when too many yieldcos issued too much stock at once and the market was not able to absorb it. This led to falling expectations for dividend growth, leading to stock-price falls.

To fix the yieldco model, both investors and management just need to stop focusing on dividend growth, according to Konrad.

“What yieldcos need to be is boring,” he said. “You don’t want a stock price that goes up and down crazily, you don’t want a dividend getting raised really quickly because they are selling lots of stock.”

“A more rational growth rate for dividends would be 2% to 5%”

Konrad believes yieldcos could do worse than imitate certificates of deposit (CDs) at US banks, which offer interest rates well under 1%. Investing in a yieldco would offer a better return than simply leaving money in a CD, and be a little riskier as bank deposits are government guaranteed.

But even yieldco dividend rates of 3% to 7% are much more attractive than CD interest rates at a fraction of a percent, and it is unrealistic to expect yieldcos to grow at 10% or more annually. “A more rational growth rate for dividends would be 2% to 5%, or even 0%,” said Konrad.

“You basically just want a stock that you can buy like buying a piece of a community solar farm.”

Konrad does not think a lot of changes have to be made to the yieldco model, because they are already happening now with the market correction. Now that investors have a more rational expectation of lower dividend growth, share prices for yieldcos are falling.

But that doesn’t mean the dividends themselves are going down. The value of a yieldco doesn’t change because its stock price has changed. The value of a yieldco is simply its ability to pay dividends, and what that dividend rate is.

Dividends are not affected by the stock prices, and are still expected to rise, just more gradually, assuming that more stable solar assets with power-purchase agreements continue to be added, which is a reasonable assumption.

It seems that in their haste to leverage these very solid assets, solar firms overreached.

Currently the dividend yield, or dividend as a percentage of the share of stock, is increasing, because the more the share price falls, the higher the dividend yield goes.

The fundamentals are sound. And solar farms with guaranteed 25-year power contracts in place have been likened to toll roads in terms of the stability and security of the income they generate.

Since a yieldco holds only these already-generating assets, with guaranteed revenue streams, a yieldco is arguably a more secure and safe investment than the companies that built the assets. After all, there are no 25-year contracts that guarantee the income of project development companies.

It seems that in their haste to leverage these very solid assets, solar firms overreached. For the solar industry, a high share price in a yieldco provided cheap capital. Yieldcos set dividends to start low so that they could raise them, making it appear that dividend increases would continue long term.

Konrad is not pessimistic about the long term after the correction of the bubble, and believes yieldcos serve a real need that has been overlooked in the recent bad news.

“I do think that there will be more people buying solar farms once they understand the characteristics,” he said. “They are simple vehicles to allow you and me to buy solar and wind farms.”

This article was written for YieldCon, the Renewable Energy Yieldco Conference to be held in NYC on December 3rd. Tom Konrad Ph.D. CFA will speak at the conference.