Green New Deal Roadmap – Accelerating Renewable Energy Infrastructure Development

Investment in renewable energy is rising, but clearly needs to grow faster to meet the goals for an expedited transition away from carbon infrastructure if we are to avoid dangerous climate change, given that now even the Trump administration forecasts a 7°C increase by 2100, which would be catastrophic.

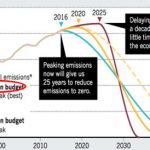

The Paris Agreement determined that in order to keep warming below 2°C, the global economy would need to be restricted to a 600 gigaton carbon “budget”, and completely decarbonize by 2040.

Emissions must be cut by 70% in the Paris-congruent Remap case, and 90% of those cuts in energy-related CO2 emissions can...

The Brookfield Renewable Energy Corporation Premium

By Tom Konrad, Ph.D., CFA

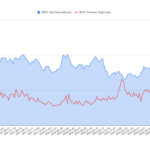

On Friday February 2nd, Brookfield Renewable (BEP and BEPC) reported earnings. Judging by the immediate stock market reaction, many investors did not like the results. Quarterly earnings actually beat expectations, but for Yieldcos like Brookfield, cash flow numbers and revenue (which can be more indicative of the company’s ability to pay and raise dividends) can be more important. These fell short.

The company attributes the cash flow shortfall to its own clients delaying payments at the end of December, in order to make their own financial statements look better, and it expects the shortfall to reverse...

The Case of Divestment From Fossil Fuels (Powerpoint presentation)

This is a presentation from the Third Annual Climate Solution Summit by Katelyn Kriesel, Board President of the Sustainable Economies Alliance on the case for divesting from Fossil Fuels.

_Divestment Presentation - New Paltz

Katelyn Kriesel is an expert in the field of sustainable finance. She is a Financial Advisor with Hansen’s Advisory Services, located in Fayetteville, NY, a firm that has specialized in Socially Responsible Investing for over 30 years. She is also Board President and founder of the Sustainable Economies Alliance (SEA), a not-for-profit organization that is raising community awareness regarding economic sustainability and empowerment. She uses this expertise...

The Energy Balance of Snake Oil

It's no secret that money is flooding into the alternative energy sector, but not all of this money comes from sophisticated, investors. Unsophisticated investment is a lighting rod for the scam artists. Because there is both an urgent need to deal with the the problems posed by global warming, energy security, and resource depletion, and the new money is rapidly accelerating the advance of technology in renewable energy, new innovations are very plausible. There are many ways to lose money in alternative energy, even without being taken by a scam. The current emotional...

Presentation: A Permaculture Portfolio

Unfortunately, my attempt to record my presentation last Monday failed... still learning to use Screencastify. There was a lot that was not in the text of the presentation itself- I use slides more as a reminder of what I want to talk about than a script.

On the other hand, it would have been a 2 hour recording, so flipping through the slides will be at least save you time. The link to the PDF version is below:

A Permaculture Portfolio

Richard Rhodes, “Energy: A Human History”

Richard Rhodes has written an amazing book. He aspired to tell the tales of energy transitions over the past 400 years. His Energy: A Human History accomplishes that task.

The book is daunting in size for non-required reading. It is filled with brief stories of this or that device or discovery or development, and almost overwhelming in both scope and detail. I wondered, at times, when the payoff would come.

My advice: If you are at all interested in the topic, stick with it.

To my economics-trained mind the book lacks analytical structure. One story after another, linked together by fuel source or technology, layer...

ESG5 Summit brief

A conference hosted in NYC in early April, 2019 ESG5 SUMMIT showcased the issues of current concern to institutional asset managers. ESG as a term is a rebranding of SRI (socially responsible investing) and CSR (corporate social responsibility) now under broad headings of Environment Social & Governance, to reflect that it is more than just an investing style, but is concerned with risk management and value creation. ESG strategies are being pursued by a range of participants, including public and private pension funds, mutual funds and ETFs, family offices and sovereign wealth funds, and advisors and advocacy groups.

The goals are...

Stock Picking For Green Investors (Presentation)

Here is a short presentation on stock picking for green investors by AltEnergyStocks Editor Tom Konrad CFA, Ph.D., with a couple stock picks. I gave this presentation as part of a workshop on divestment from fossil fuels and investment in green stocks at the third annual Climate Solutions Summit. The Divestment part is here.

Climate Change & Corporate Disclosure: Should Investors Care?

Charles Morand On Monday morning, I received an e-copy of a new research note by BofA Merrill Lynch arguing that disclosure by publicly-listed companies on the issue of climate change was becoming increasingly "important". The note claimed: "e believe smart investors and companies will recognize the edge they can gain by understanding low carbon trends." I couldn't agree more with that statement. It was no coincidence that on that same day the Carbon Disclosure Project (CDP), a non-profit UK-based organization that surveys public companies each year on the state of their climate change awareness, was...

Are the Declines in Solar and Wind Stocks Structural, or Cyclical?

Tom Konrad, CFA Last week, I asked three green money managers if they thought cleantech stocks, especially solar and wind sectors were near a bottom. While they did tell me about eight cleantech value stocks, they were not ready to call the bottom. Commoditization in Clean Energy In response to my questions, Rafael Coven, the manager of the Cleantech Index (^CTIUS), which is the index behind the Powershares Cleantech Portfolio ETF (PZD,) ...

EnviroStar: A Clean Laundry Stock For Your Portfolio

Saj Karsan EnviroStar (EVI) is a distributor of laundry equipment that has developed a proprietary dry-wet-cleaning machine that avoids the use of perchloroethylene (Perc), a harmful chemical that the International Agency for Research on Cancer has deemed a carcinogen. Perc is also classified as a hazardous air contaminant by the US Environment Protection Agency, and its use will become illegal in the state of California in the year 2023. EnviroStar's patented Green-Jet process uses an environmentally-friendly, water-based solution that is both non-toxic and requires less energy consumption than traditional dry-cleaning methods. This is currently a tiny company, with...

Book Review: Investment Opportunities for a Low Carbon World (Wind + Solar)

Charles Morand Tom and I recently received complimentary copies of a new book called "Investment Opportunities for a Low Carbon World", edited FTSE Group's Director of Responsible Investment Will Oulton*. The book is a compendium of articles by 31 different authors broken down into three main categories: (1) environmental and low-carbon technologies; (2) investment approaches, products and markets; and (3) regulation, incentives, investor and company case studies. While Tom will provide a comprehensive review of the book once he's finished reading it in its entirety, I will instead review a few selected chapters over...

Sustainable Investment Opportunity In 2017

by Garvin Jabusch Lord Nicholas Stern recently said, “Strong investment in sustainable infrastructurethat’s the growth story of the future. This will set off innovation, discovery, much more creative ways of doing things. This is the story of growth, which is the only one available because any attempt at high-carbon growth would self-destruct .” More pointedly, the Investment Bank division at Morgan Stanley in 2016 advised clients that long-term investment in fossil fuels may be a bad financial decision, writing, “Investors cannot assume economic growth will continue to rely heavily on an energy sector powered predominantly by fossil fuels." What...

60 Minutes Reply: Cleantech Rocks

On Sunday, January 5, 60 Minutes aired a piece on the cleantech space. In the days that followed, I have had interesting conversations with clients about what was broadcast to 7.4 million viewers. Those discussions reinforced my belief that 60 minutes missed the mark and inspired me to write this blog on why cleantech is essential, massive, vibrant, and desired. Cleantech is essential. We recently took fifteen clients to China on our annual tour, and the Beijing Air Quality index (AQI) of PM2.5 read above 200 on multiple days. The average AQI in Los Angeles, California, through 2009...

What Does Clean Energy Cost?

Renewable Electricity cost estimates from a California transmission study and the investment implications. Tom Konrad, Ph.D., CFA The seemingly simple question, "How much does wind/solar/geothermal/etc. cost per kWh?" can be surprisingly difficult to answer. Advocates often cite particularly low figures, but they are often based on particularly favorable conditions, or analyses that don't include all the costs (for instance, costs of permitting.) Opponents do the opposite, often assuming particularly unfavorable conditions, or adding in costs which they would never consider adding in for their favored technology. Adding to the confusion, levelized cost of generation calculations are very sensitive to...

Clean Energy Stocks to Fill the Nuclear Gap

Tom Konrad, CFA If the Japanese use less nuclear power, what will take its place? I'm astounded by the resilience and discipline of the Japanese people in response to the three-pronged earthquake, tsunami, and nuclear disaster, perhaps in large part by my cultural roots in the egocentric United States, where we seem to have forgotten the virtue of self-sacrifice for the greater good. Yet while Japanese society has shown itself to be particularly resilient, the Japanese electric grid is much less resilient. According to International Energy Agency statistics, Japan produced 258 TWh of electricity from...