Why Energy Storage Investors Must Understand Economies of Scale

John Petersen One of the most seductive and dangerous stock market myths is the immensely popular but demonstrably false notion that the rapid cost reductions and performance gains we enjoyed during the information and communications technology revolution will be repeated in the age of cleantech. The persistence of the mythology is astonishing when you consider that the entire history of alternative energy proves that cost reductions and performance gains are extraordinary events, rather than common occurrences. Investors who buy into economies of scale mythology without carefully considering the fundamental differences are in for a world of disillusionment and...

Exide Technologies: Anatomy of a Mistake

Tom Konrad CFA On June 1st, in the lead up to Exide Technologies’ (NASD:XIDE) first quarter earnings announcement, I made one of my better calls so far this year. I wrote that the Exide stock was in the “bargain basement” and “ready to pop.” That day, XIDE traded in a range of $2.25 to $2.36, within spitting distance of its 52 week low of $2.22. Four months later, the stock is up 45% at $3.25, despite two earnings misses in the meantime. My Mistake Unfortunately, I missed out on a good chunk of that gain. A week...

More Common Sense in Energy Storage Investing

John Petersen Since last week's article, Common Sense in Energy Storage Investing, was well-received by readers who've recently discovered this blog and want to better understand the energy storage sector, I've decided to continue with the theme and drill down deeper into some broad issues. Most of today's material is pretty basic stuff, but when the hype machine starts spinning a firm grasp on economic reality and investment fundamentals can be important to investors that want to avoid a boom and bust bubble like we had in corn ethanol. In the fall of 2008 I confessed to...

Energy Storage, a Tough Year and a Mixed Quarter

John Petersen Quarterly updates are among my least favorite tasks because they focus on where the energy storage sector has been instead of where it's going. I still haven't developed a presentation format I like, but it feels like things are heading in the right direction. Reader comments and suggestions on how I can make these updates more useful are always appreciated. The 12-month performance for the energy storage sector was dismal and the only companies that currently trade above their September 30, 2009 closing prices are Active Power (ACPW) and Enersys (ENS). Most other companies in...

Exide’s Recent Price Collapse Was Unjustified

John Petersen After the market closed on Monday, Exide Technologies (XIDE) released surprisingly poor second quarter results, a $3.6 million loss that included a $5.7 million charge for several years of reporting irregularities at a small Portuguese recycling subsidiary. The market's reaction was absolutely savage as the stock collapsed from Monday's close of $4.48 to Friday's close of $3.01. In my view, the reaction was unjustified and has set up a tremendous buying opportunity for investors who are willing to look beyond the headlines and focus on core business fundamentals. To put things in perspective, Exide's...

Toyota Tests And Rejects Lithium-ion Batteries For The Prius

John Petersen Over the last couple of years, the mainstream media has been awash in reports of how automakers are lining up to build fleets of PHEVs and EVs using lithium-ion batteries as a principal power source. I've consistently argued that investing in objectively expensive lithium-ion battery company shares on the basis of testing decisions was dangerous. The reason for my caution is simple, a decision to test a new concept is very different from a decision to commercialize a proven concept and failures in the preliminary testing stages are far more common than successes. In...

When Will Polypore Payoff?

by Debra Fiakas CFA Diagram of a battery with a polymer separator. Lithium ion batteries make it possible to recharge your smart phone, camera and a multitude of other have-to-have-with-us-every-moment devices. Yet the average person knows very little of the inner workings of something so important to our daily lives. One little item in a battery is a highly specialized membrane that fits neatly between opposing electrodes - the positive and negative poles that make an electrical charge. This membrane manages the charge and discharge process. ...

Stop-Start Realities and EV Fantasies

John Petersen Last week Johnson Controls (JCI) released the results of a nationwide survey that found that 97 percent of Americans are ready for micro-hybrids with stop-start idle elimination, the most sensible automotive innovation in years. A micro-hybrid turns the engine off to save fuel and eliminate exhaust emissions when it's stopped in traffic and automatically restarts the engine when necessary. While the overwhelmingly positive consumer response didn't surprise me, JCI's short-term growth forecast for micro-hybrids did. I've been writing about the rapidly evolving micro-hybrid space since 2008 and during that time the market penetration forecasts have...

Beacon Power Receives Contract from Bechtel Bettis, Inc. to Demonstrate Advanced Flywheel-Based Power System

Beacon Power Corp (BCON) has announced that it has been awarded a contract from Bechtel Bettis, Inc., to design and deliver an advanced flywheel-based power system demonstration unit. Bill Capp, Beacon Power president and CEO says "...Although this contract is not considered material from a revenue standpoint, these types of projects are significant because they extend our technology portfolio, help defray operating expenses, and can lead to other business opportunities."

Beacon Power Announces Award of Phase II SBIR Contract for Advanced Flywheel Energy Storage...

Beacon Power Corp (BCON) announced that it has been awarded a contract through the Air Force Research Laboratory (AFRL), and co-funded by the Defense Advanced Research Projects Agency (DARPA) of the U.S. Department of Defense. The contract, valued at $750,000, is for the preliminary design of a space-based flywheel energy storage system for satellite applications, and is a Phase II award under the Small Business Innovation Research (SBIR) program of the U.S. Small Business Administration's Office of Technology. Beacon announced completion of an associated Phase I project earlier this year. This was welcome news for this company...

Introduction to Electrolyzer Technologies

by Ishaan Goel

Hydrogen has become increasingly prominent as a potential carbon-free fuel, for both automobiles and providing electricity to buildings. It has direct applications in decarbonizing important industries like steel, and can serve as a storage medium for extra renewable energy over seasonal durations too.

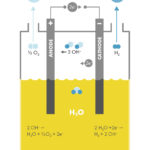

Since hydrogen gas does not occur naturally in our atmosphere, its method of production is an essential component of the hydrogen economy. There are several such methods (discussed in detail here), but the one with least emissions involves using renewable power to run electrolyzers - devices that use electricity to convert water into hydrogen and...

The Graphite Hustle

by Debra Fiakas CFA The Klondike Gold Rush of the 1800s has given way to the Canada Graphite Hustle of the 21st Century. In what may seem to many an interminable series on graphite resources developers we have made note of over a half dozen companies in Canada attempting to bring new supplies of graphite ore out of the earth. The action is not limited to Canada. There are at least a dozen other aspirants with plots in Canada and the rest of North America as well as in Australia and Africa. Piecing together disclosures by the...

Maxwell Technologies: Selling by Growth Funds Looks Done

Tom Konrad CFA Since Maxwell Technologies(NASD:MXWL) lowered guidance in their first quarter conference call at the end of April, the stock has fallen by 58%, and is currently trading at $6.65 compared to $15.80 before the earnings call. This fall has been considerably more dramatic than the lowering of analysts’ price targets. These now stand at an average of $16.40, down about 20% from two months ago. Insiders have been actively buying the stock since it hit $10, and continue to do so. Such active buying reflects conviction that the stock is trading well below fair value. With both analysts and...

A123 Systems, An Object Lesson In Toxic Financing

John Petersen July has been a ghastly month for stockholders of A123 Systems (AONE) who've watched in horror as the stock price collapsed from $1.30 on July 5th to $0.49 at Friday's close. While there was unfavorable news of a director resignation yesterday, all the other news over the last month has been positive, at least at first blush. In my view the market activity was both predictable and directly attributable to recent toxic financing transactions that will have A123 printing stock faster than Ben Bernanke is printing dollars for the foreseeable future. I'd love to be able...

ZAP Displays Advanced Battery Solutions at CeBIT Digital Technology Trade Show in Germany

ZAP (ZAPZ) is currently exhibiting its unique multi-function portable battery to the global marketplace at the CeBIT trade show in Hannover, Germany, March 10-16, 2005. ZAP's Portable Energy division has developed a flexible, multi-use battery for electronic products that deliver up to four times the power of typical batteries, to charge or power a variety of devices, including cell phones and laptops. ZAP is a worldwide technology leader in efficient transportation, offering gas-powered vehicles such as the Smartcar, as well as electric cars and personal transportation products.

Alternative Energy Will Outperform The Market, With Storage Stocks Leading the Way

The public relations firm Waggener Edstrom released a survey of investors and analysts yesterday seeking opinions on what was in store for alternative energy for 2009 (link to the survey at the end of this article). Of the 81 respondents, 47 were institutional investors, 26 were brokerage analysts, five were from independent research firms and three were classified as "Other industry participants". Overall, 58% of respondents were from the buy side, 32% from the sell side and the remainder from "Other". Here are a few tidbits that caught my attention. Storage: The Next Boom? Overall, 50% of respondents expect...