Biodiesel Tax Credit Back In US Budget Deal

by Jim Lane

In Washington, the US Congress passed its budget deal, and among the items in the deal was a retroactive restoration of the $1 per gallon biodiesel tax credit for 2017. The bill did not include a provision for 2018 and future years.

The budget compromise had run into headwinds in the Senate, in the form of a voting delay imposed by Rand Paul of Kentucky, while opposition in the House from a group of Democrats and hardline conservatives had put the bill into some degree of jeopardy.Renewable Energy Group CEO Randy Howard said “We are pleased that Congress recognized...

FutureFuel, Present Buying Opportunity

Tom Konrad CFA FutureFuel Corp. (NYSE:FF) manufactures chemicals, biofuels (mostly biodiesel), and other biobased products. About 60% of revenues have historically come from the Chemicals unit, with the balance of 40% coming from the Biodiesel unit. Both units saw sharp declines in revenues over the last two quarters for reasons that seem likely to be temporary (at least in part.) The stock has sold off sharply as a result, falling from the $18-$21 range this spring to its $12 recent price Biodiesel The entire biodiesel industry has been suffering from the expiration of the biodiesel blender's tax...

Renewable Energy Group’s New CEO: C.J. Warner

by Jim Lane

In Iowa, white smoke has emerged from the Renewable Energy Group (REGI) conclave: Tesoro EVP and former Sapphire Energy CEO C.J. Warner has been named chief exec of Renewable Energy Group, at a pivotal moment for biodiesel in Washington and around the world and amidst a boom for renewable diesel like the world has never seen.

REG has been making good progress with Wall Street under interim CEO Randy Howard and its share price has been on the rise, and the plants have been humming along nicely churning out hundreds of millions of gallons of biodiesel and the liquid gold...

REG Buys Imperium Renewables

Jim Lane The biggest US biodiesel, renewable diesel producer Renewable Energy Group (REGI), or "REG" buys the biggest US facility in asset deal. The fully-operational 100-million gallon nameplate capacity biorefinery will be renamed REG Grays Harbor. The facility includes 18 million gallons of storage capacity and a terminal that can accommodate feedstock intake and fuel delivery on deep-water PANAMAX class vessels as well as possessing significant rail and truck transport capability. REG will pay Imperium $15M in cash and issue 1.5 million shares of REG common stock in exchange for substantially all of Imperium’s assets. In addition to...

Renewable Energy Group Profits Exceed Subsidies

by Debra Fiakas CFA Earlier this month biodiesel producer Renewable Energy Group, Inc. (REGI: Nasdaq) reported a tidy profit of $22.3 million on record $1.0 billion in total sales. Reported net income was $43.5 million, including accounting treatments for corporate recapitalization undertaken in the year. Results from 2012 were noteworthy on a couple of counts. It was the first time in the company’s ten-year history (including years of operation among predecessor firms) that sales exceeded $1.0 billion. REGI produced 188 million gallons of biodiesel from a variety of feedstock, including non-edible corn oil, used...

FutureFuel Profits Preview

by Debra Fiakas CFA Biodiesel and biochemical producer FutureFuel Corporation (FF: NYSE) will report fourth quarter 2015 financial results after the market close today. No conference call will be held due to low attendance on recent calls. The single published estimate for FutureFuel is for $0.28 in earnings per share on $122.5 million in total sales. Despite an increase in this estimate in the last week, the number still represents a significant decrease in earnings compared to the prior-year period. The Company has missed the consensus estimate in both of the last two quarters and we do not...

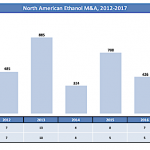

Biofuels M&A: 2017 Review and Outlook

by Bruce Comer, Ocean Park Advisors

More industry players chose to develop and build new capacity rather than buy plants

The North American biofuels industry experienced the fewest merger and acquisition transactions in recent history in 2017. There were only six M&A transactions, with a total estimated value of more than $100 million. They involved eight plants with 297 million gallons per year (MGPY) of production capacity. Half of these deals were for non-operating plants. A fourth deal was for a sub-scale demonstration plant. Contributing to the limited deal flow, two historically active acquirers, Green Plains and REG, did not close...

Future Fuel’s Enticing Earnings

by Debra Fiakas CFA Who doesn’t like a bargain? FutureFuel Corporation (FF: NYSE) is trading near $13.15 per share, below nine times net earnings. Yet, the enticing earnings multiple might be only part of the story. The stock has gapped down in price twice in the last six months, trailing off after each leg down. The stock now appears oversold. Based in Missouri, FutureFuel produces biodiesel and biobased speciality chemical products. In the twelve months ending June 2014, the company reported $396.9 million in sales, providing $53.5 million in net income or $1.52 per share. ...

Renewable Fuels’ Dunkirk

by Jim Lane

It’s been a very busy week in Washington DC, the high point being a letter to seven senators sent late Thursday by EPA Administrator Scott Pruitt, who took significant (and as of a few days ago, unexpected) steps toward strengthening the foundation for ethanol and renewable fuels.

The truth? It’s a Trump Administration back-down. EPA overreached on de-clawing the Renewable Fuel Standard on behalf on some grumpy oilpatch donors (known as GODs), and the Trump Administration managed to revive a Grand Alliance around renewable fuels — one that now includes almost 40 members of the United States Senate,...

Fretting Over FutureFuel

by Debra Fiakas CFA Earlier this week FutureFuel Corporation (FF: NYSE) reported financial results for the second quarter ending June 2015. Sales of the company’s biodiesel and specialty chemical products increased 53.7% to $104.6 million compared to the prior-year quarter when reported revenue was $68.0 million. The company delivered a profit as usual, but traders appeared unimpressed. The stock gapped lower on the news and two days later set a new 52-week low price. Granted net income was lower year-over-year by 30.9%, coming in at $3.8 million or $0.09 per share. A closer look...

A Decade Of Unexpected Curves In The Bioeconomy

By Jim Lane

Over the years we’ve all seen a lot of curveballs in the advanced bioeconomy. You see companies like Valero, which lobby the United States Congress with unbridled intensity to get rid of the Renewable Fuel Standard, on the verge of becoming the single-biggest producer of RINs in the United States (with news that they might take capacity at Diamond Green Diesel up to 540 million gallons).

You see companies like Solazyme which love the Renewable Fuel Standard and drive up to nearly a billion-dollar post-IPO valuation based on delivering fuels at volume, then announcing that there are even...

REG Buying European Biodiesel From Used Cooking Oil Producer

Jim Lane US biodiesel leader heads for the EU – what’s up with used cooking oil, and what is REG’s path forward with the German-based biodiesel producer? In Iowa, Renewable Energy Group and IC Green Energy announced that REG will acquire ICG’s majority equity ownership position in German biodiesel producer Petrotec AG (XETRA: PT8). Closing of the transaction is expected before year end. REG CEO Dan Oh Last month, REG CEO Dan Oh told The Digest, “We’re not done growing, that’s for sure! We’ve done something of...

Green Star Products Unveils Advanced Biodiesel Reactor

Green Star Products Inc (GSPI) announced that they have developed and successfully commercially tested their advanced biodiesel reactor. GSPI reactors require an amazing two minutes to complete the biodiesel conversion reaction versus over one hour for the rest of the industry. This means that GSPI's processing rate through the reactor is at least 30 times faster than the rest of the biodiesel industry.

List of Biodiesel Stocks

Biodiesel stocks are publicly traded companies whose business involves producing biodiesel made from oils and fats for use as a fuel diesel engines, either alone or blended with petroleum derived diesel. Common feedstocks include soybean oil, palm oil, and waste oils from the food industry. Biodiesel is the most widely produced and used advanced biofuel, and all biodiesel stocks are also biofuel stocks.

This list was last updated on 7/20/2022.

China Clean Energy Inc. (CCGY)

FutureFuel Corp. (FF)

Green Star Products, Inc. (GSPI)

Greenshift Corporation (GERS)

Methes Energies International (MEIL)

Neste Oil (NEF.F)

PetroSun, Inc. (PSUD)

RDX Technologies, Inc. (RDX.V)

If you know of any biodiesel stock that is...

EPA’s 2018 Renewable Fuel Targets Disappoint Producers

In Washington, the Environmental Protection Agency released its final Renewable Fuel Standard renewable volume obligations for 2018. The agency finalized a total renewable fuel volume of 19.29 billion gallons , of which 4.29 BG is advanced biofuel, including 288 million gallons of cellulosic biofuel.

As the Renewable Fuels Association explained: “That leaves a 15 BG requirement for conventional renewable fuels like corn ethanol, consistent with the levels envisioned by Congress in the 2007 Energy Independence and Security Act. The 2018 total RFS volume finalized today represents a minor increase (10 million gallons) over the 2017 standards, and a modest increase...

Neste’s Growing Circular Economies

by Jim Lane

In California, waste feedstock from the city of Oakland is now being converted to Neste (NEF.F, NESTE.HE, NTOIF, NTOIY) MY Renewable Diesel and fuels the city’s fleet.

The city, Neste, fuel distributor Western States Oil and local collectors for used cooking oil joined forces to gather waste cooking oils from restaurants and other businesses in the Oakland metropolitan area and convert it to fuel the city’s fleet. By making waste more valuable and supporting jobs that collect and treat it, this concept helps the local economy in the city while the cleaner-burning Neste MY Renewable Diesel improves the lives of its...