Ten Insights into Carbon Policy and Its Implications

On November 27, I attended the National Renewable Energy Laboratory's (NREL) Fifth Energy Analysis Forum, hosted by NREL's Strategic Energy Analysis & Applications Center. The forum focused on carbon policy design, the implications for Renewable Energy and Energy Efficiency. As a stock analyst focused on that sector, I am extremely lucky to have NREL as a local resource: the quality and the level of the experts at NREL and the ones they bring in is probably not matched anywhere in the country, and conferences like these provide priceless insights into what these Energy Analysts are thinking. Why should investors...

BioNitrogen: Valuable Technology, Management Questions

by Debra Fiakas CFA My last post outlined how Bion Environmental Technologies, Inc. (BNET: OTC/QB) is transforming livestock waste into organic fertilizer. Bion is not the only aspiring fertilizer producer. BioNitrogen Holdings Corp. (BION: OTC/PK) was recently patent protection for a process to produce urea from stranded natural gas. Instead of burning off the unwanted gases, oil and gas operators can turn it into an economically viable by-product. There is more than just cash flow at stake for oil and gas producers. Burning off stranded gas increases harmful emission that can lead to penalties in the...

Tetra Tech: Energy Engineer

by Debra Fiakas CFA In the coming years power generators will be under pressure to meet new standards for lower carbon emissions embedded in the EPA’s Clean Power Plan. Each state has to meet a set of standards set by the EPA based that state’s particular circumstances in electrical generation. The carbon pollution limits begin in 2022 and ramp to full effect by 2030. Power generators could meet standards by reducing harmful emissions from existing fossil fuel-fire plants. Unfortunately, that may prove too costly at some of the older plants. It is logical that power generators...

OriginClear: Metals out of the Muck

After the worst of the wind and rain had died down from Hurricanes Harvey and Irma, and people began making their way back home, it became apparent that citizens of Texas and Florida would have more worries. The U.S. Environmental Protection Agency disclosed that at least thirteen toxic waste sites in Texas were flooded and damaged by Hurricane Harvey and another forty-one Superfund sites were negatively affected. Legacy contamination includes lead, arsenic, polychlorinated biphenyls, benzene and other carcinogenic compounds from historic industrial processes. After Hurricane Irma over six million gallons of wastewater reportedly flowed out to the coast and...

Mantra’s Promise of Innovation

by Debra Fiakas CFA How often do we see the crowd rooting for the underdog? You could hear the cheers for Mantra Energy (MVTG: OTC) last week at the Marcum Microcap Conference in New York City. Mantra is a developmental stage company pursuing technologies to harness carbon dioxide for energy. Of course, the company has no revenue and therefore no earnings. Indeed, its technologies are so unique and as yet at such an early stage some might find them almost fanciful. Yet for some investors, a fanciful underdog is even better than another. Mantra sees itself...

FuelTech: Pushing on a String of New Orders

by Debra Fiakas CFA Earlier this month Fuel Tech, Inc. (FTEK: Nasdaq) announced the receipt of order for air pollution control systems totaling $2.0 million. The customers are strung out across the U.S., Europe and China, but they all have dirty combustion systems and need to reduce toxic nitrogen oxide (NOx) and carbon dioxide (CO2) emissions or risk running afoul of government clean air standards. These shipments are just the most recent in a string of orders Fuel Tech has won in recent months. In late August 2015, the company received similar air pollution contracts from...

Earnings Roundup: Metals Prices Boost Covanta and Umicore

By Tom Konrad, Ph.D., CFA

You don’t have to own mining companies to benefit from rising metals prices.

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. Waste to energy operator Covanta and specialty metals recycler Umicore are both benefiting from skyrocketing metals prices.

Just as renewable energy and energy efficiency stocks have long shown that investors don’t have to own fossil fuel companies to benefit from rising prices of fossil fuels, recyclers like Covanta and Umicore are showing that you don’t have to own environmentally damaging mining companies to benefit from rising...

OriginOil Renames Product – Will It Help The Business?

by Debra Fiakas CFA Mid-March 2014, OriginOil, Inc. (OOIL: OTC/QB) relaunched its waste water treatment process for shale gas producers. The company’s CLEAN-FRAC and CLEAN-FRAC PRIME products are now called OriginClear Petro. OriginOil is expanding into the industrial and agricultural waste water treatment markets using the product name OriginClear Waste. The company has been toiling away since 2007 perfecting its “Electro Water Separation” process that uses electrical impulses in a series of steps to disinfect and separate organic contaminants in waste water. In June 2014, OriginOil management declared its development stage completed and start of full...

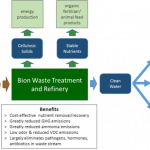

Bion: Waste To Dollars

Earlier this week Bion Environmental Technologies (BNET) received approval of a patent for its proprietary ammonia recovery process. Bion’s technology converts livestock wastes into ammonium bicarbonate. Patent protection in the U.S. paves the way for Bion to deliver an environmentally friendly chemical to the market at attractive profit margins.

Ammonium bicarbonate is used for a variety of purposes from leavening to crop additives. It is the fertilizer market that has caught Bion’s attention. The company intends to ‘close the loop’ for the agricultural sector by helping livestock producers economically dispose of waste and then delivering a fertilizer for food crops that qualifies as organic.

It is an attractive...

Phycal Captures CO2 Funding for Biofuel

by Debra Fiakas CFA As part of its program to promote beneficial reuse of carbon dioxide, the Department of Energy awarded a total of $27.2 million ($3.0 million in the first phase and $24.2 million in a second phase) to a consortium led by alternative energy developer Phycal, Inc. (private). According to the DOE website, Phycal is to develop an integrated system to produce biofuel from microalgae cultivated with captured carbon dioxide (CO2). The biofuel is to be blended with other fuels for power generation or as drop-in diesel or jet fuel. It is a bit of...

The Low Cow-bon e-Cow-nomy

Jim Lane This month in Finland, a team of intrepid researchers herded one thousand European cows one-by-one into a glass “metabolic chamber” to measure their methane emissions, digestion, production characteristics, energy-efficiency, metabolism, and the microbial make-up of their rumens. The Project is known as RuminOmics, but if it had been titled The Truman Show II: When the Cows Come Home, we wouldn’t have been a bit surprised. The Cow Emission Crisis. No Kidding Around. The ultimate aim of the study was to find an optimal, low-emission, high-yield cow, and the team noted in its premise that of all greenhouse...

Plasma Arcs For Pig Waste

This week MagneGas (MNGA: NASDAQ) announced new work completed toward plans to enter the commercial pork sector with a proprietary manure processing and disposal solution. Management held a meeting with the North Carolina Department of Environmental Quality and the U.S. Army Corps of Engineers to discuss MagneGas technology to treat agriculture waste and the state’s required environmental permit protocols. MagneGas aims to sell to pig farmers equipment based on its innovations.

The company wants to help pig farmers address environmental problems cause by manure accumulation with its proprietary waste sterilization process. Handling pig waste using conventional methods can be costly, but failure to...

A Coal Stock…Almost

This morning, I read an article in this week's Economist that summarized well what I've been hearing over the past few weeks: coal is back in fashion with power utilities. As pointed out in the article, on a BTU basis, coal remains the cheapest fuel for thermal generation, an the prospect of high carbon prices is not deterring even European power generators from investing in coal-fired assets. A few months ago, Tom discussed his peak coal portfolio. The long-term perspective is of course critical to keep in mind, and that piece helps putting recent news around...

Greenhouse Gas Management Stocks: Key To A Real Climate Change Portfolio?

There has been a lot written lately about how to turn climate change into an investment opportunity, including on this site. Not all of it is, however, especially useful or relevant. In the worst cases, commentators have ascribed the 'climate change investment opportunity' label to just about any industry out there, indiscriminate of whether or not there really is a strong and direct connection. If you are seriously interested in playing the climate story, you should stay focused on near and medium term opportunities with real and tangible links to what is currently going on with the climate...

Three Water Recycling Stocks

by Debra Fiakas CFA The water series continues as we attempt to get arms around the very large market to package, deliver, purify, treat, and recycle water. As the need for water increases with population and economic activity, the use of waste waters has become an imperative. In this post we look at three companies helping to clean up, reclaim and otherwise recycle waste water. Ecosphere Technologies, Inc. (ESPH: PK) has introduced several water solutions that can be used in agriculture, mining, industry, or municipal applications. The company’s flagship Ozonix Technology is a chemical-free system to recycle...

Tetra Tech’s Two-Penny Disappointment

by Debra Fiakas, CFA

Tetra Tech’s (TTEK: NASDAQ) quarter earnings report last week was met with high drama as traders reacted with surprisingly vehement disappointment over the recent financial performance of the engineering and technology business. The company’s stock price gapped down in the first day of trading following the announcement, falling through a significant line of price support. The shares continued to fall and finished the week at a price not seen since mid-April 2017 before the stock began its recent drive higher.

The drama unfolded after Tetra Tech reported net earnings of $0.52 per share on $498 million in total...