Emissions Standards Driving Algae Aviation Fuel Sourcing…or not

by Debra Fiakas CFA Algae in the River Wate photo via BigStock My post “Algae Takes Flight” featured Algae-Tec (ALGXY: OTC/PK), Lufthansa’s new biofuel partner. Algae-Tec has agreed to operate an algae-based biofuel plant in Europe to supply Lufthansa with jet fuel. Lufthansa is footing the capital costs of the plant, which is to be located in Europe near a carbon source. Algae thrive on carbon so industrial plants and power plants using fossil fuels make the best neighbors. Lufthansa has agreed to purchase a...

Climate Change Will Hurt The Poor Most But the Solutions Don’t Have To

The International Center for Appropriate and Sustainable Technology (iCAST) helps communities use local resources to solve their own problems. I've been a fan of iCAST's approach of teaching people how to fish (or, in this case, how to apply sustainable technologies) rather than giving away fish since I first encountered them at a conference in 2006. Last week, they took advantage of some of their own local resources (namely the fact that the DNC was in Denver) to organize a luncheon with a panel of nationally recognized speakers, any one of whom would have been enough to draw a...

US Presidential Election & Carbon Markets: Is The Climate Exchange Story Overdone?

An interesting piece yesterday in POLITICO on how carbon prices on the Chicago Climate Exchange (CCX) have been trending up in recent months, mostly since it's become clear that all three remaining presidential hopefuls will likely regulate CO2 emissions at the federal level. In fact, as per the chart above, prices for the right to emit a metric ton of CO2 have been on a tear, recovering from a pretty significant slump in the preceding months. Last week, the World Bank Carbon Finance Unit released its annual update on the state of global carbon market (PDF...

Carbon Finance…The Next Bonanza

Few investors outside of Europe have ever heard of the term carbon finance. What some investors might have heard, however, is that Goldman Sachs took, on September 20, 2006, a 10.1% stake in a little outfit known as Climate Exchange plc (LSE:CLE) for approximately $23 million. Admittedly, by Goldman Sachs standards, that’s peanuts. Not to be outdone, Morgan Stanley unveiled a plan on Thursday October 26 to invest a whopping $3 billion in global carbon markets over the next few years…now that’s the kind of money that gets folks talking at the water cooler, especially when it’s in something...

Trading Places: Will America’s Carbon Market Outsize Europe’s?

Charles MorandIn early January, I said the following on the likelihood that the Obama Administration would move on carbon regulations in the near-term: "The next 12 to 18 months are unlikely to produce much in the way of vigorous environmental action on the part of government (barring subsidies for alternative energy related to the stimulus package), especially if it means additional costs on industry." Clearly, I had underestimated the power of another fundamental rule of politics - besides "don't anger the rust belt states that gave you your presidency by burdening their industries with avoidable costs in the midst...

World Energy Solutions (XWES) and Ram Power (RPG.TO) Appear Promising

From Small Fries to Big Shots? Part 1 of 2 by Bill Paul Feel like rolling the dice on some small alternative energy stocks that appear to have big-time potential? Just remember: sometimes you roll snake eyes. First up: World Energy Solutions Inc. (Symbol: XWES), which currently trades on NASDAQ for $3 and change per share. Worcester, MA-based World Energy Solutions operates online exchanges for energy and green commodities, including the one administered by Regional Greenhouse Gas Initiative Inc. (RGGI), the regulatory scheme under which 10 Northeastern and Middle Atlantic states "cap" their power plants' emissions by requiring...

US Exchanges And Environmental Investing

An interesting bit of follow-up on my article last week about exchanges and environmental markets. Both the NYMEX and the Chicago Climate Exchange (CCX) have partnered up, in the past 2 weeks, with specialty cleantech and alt energy index makers to launch derivatives products. On March 14, Chicago Climate Futures Exchange (CCFE), a wholly owned subsidiary of the CCX, and WilderShares LLC, announced (PDF document) a licensing agreement to launch a futures market based on the WilderHill Clean Energy Index . The ECO is also the underlying index for the Powershares WilderHill Clean Energy Portfolio ETF...

Carbon Emissions ETF

Today, while reading an article on cleantech ETFs by The Motley Fool, I found out that XShares Advisors LLC and the Chicago Climate Exchange were working on a carbon emissions-based ETF (PDF document). There is not a lot of info available on what exactly this ETF will track. We reported back in November that UBS had launched an index based on European carbon prices. As noted by Richard Kang at around the same time, this index is well-suited for something like an ETF. If any of our readers have any further insight on this, don't hesitate...

Competition In Environmental Markets Heats Up

Close followers of the environmental finance space have known it for a while; Climate Exchange (CXCHF.PK or CLE.L) is sitting on a potential gold mine. The market for environmental commodities, but especially carbon emissions, is slated to grow significantly over the next 5 to 7 years. It was therefore only a matter of time before competition sprung up, both from small players trying to leverage their technological platforms and from the big guys. The big guys came out swinging this week, with NYMEX announcing a partnership with JP Morgan and Morgan Stanley, among others, to set up a...

Linking Emissions Trading Systems

For those interested in the topic of emissions trading, a new piece was just published by the International Emissions Trading Association on the topic of 'linking' different emissions trading regimes (PDF document). Linking entails allowing emission credits from one scheme to be rendered tradable in another. For example, European credits would be valid and tradable in California, and vice-versa. Beyond allowing the carbon market to become more efficient and liquid, linking could also present a range of arbitrage opportunities. For all of you environmental markets fiends out there, I would definitely recommend this paper. It's short (13...

NYMEX To Get Involved In Emissions Trading

A senior NYMEX official told reporters Wednesday that the exchange was considering getting into the business of carbon emissions trading. Given the actual, but especially the potential, size of this market, it makes sense that established bourses would take a good hard look at it. This will probably not be seen as very good news by the folks at Climate Exchange plc . Of course, until NYMEX actually unveils anything substantial, this will remain nothing but chatter.

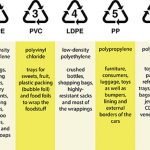

Plastic Recyclers Chasing Arrows

According to Plastics Europe Research Group, over 35 million tons of plastic material was produced globally in 2016, the last year for which full-year data is available. That brought total plastic production to 9 billion tons since 1950. All of those plastic materials remain in existence somewhere - still in use, landfills, junk yards, blowing around the countryside, waterways, oceans, fish stomachs. The post “Plastic Contagion’ on April 13th outline the dangers presented by plastic waste, ranging from respiratory failure from toxic emissions to reproductive interference in aquatic animals.

The building burgeoning volume of plastic waste has sent environmentalists scrambling for solutions to the plastic waste...

Avoiding a Carbon-Price Backlash

by Tom Konrad, Ph.D. Economics and Greenery, a Belated Rapprochement It is truly a triumph of economic ways of thinking that many of environmental activists are championing market-based approaches to tackling climate change. Those people who are not for cap-and-trade on global warming gas emissions promote the even more economically rigorous carbon tax. The most common defense against criticisms of subsidies for renewable energy is to retort that the fossil fuel industry benefits from much large subsidies. Not only do fossil fuels get generous subsidies in direct and indirect payments, but they seldom pay anything like the indirect costs...

Has Shale Gas Reduced Carbon Emissions?

Jim Hansen Last week, I wrote that the U.S. is on course to set a new export record of coal. A few days later the EIA made similar projections and estimate that exports will reach 125 million tons for 2012. One side effect of the success of U.S. coal exports is the degree to which may they have cancelled out the carbon emissions reduction experienced in the U.S. as shale gas displaced coal in the power generation sector. This question of displacement was addressed in a study just released by researchers at the University of...

Climate Change & Corporate Disclosure: Should Investors Care?

Charles Morand On Monday morning, I received an e-copy of a new research note by BofA Merrill Lynch arguing that disclosure by publicly-listed companies on the issue of climate change was becoming increasingly "important". The note claimed: "e believe smart investors and companies will recognize the edge they can gain by understanding low carbon trends." I couldn't agree more with that statement. It was no coincidence that on that same day the Carbon Disclosure Project (CDP), a non-profit UK-based organization that surveys public companies each year on the state of their climate change awareness, was...

Biochar’s Likely Market Impacts

Biochar is still mostly a research and cottage industry, yet it has the potential to impact returns for a broad range of investors. Tom Konrad, Ph.D., CFA Biochar, or amending soil with biomass-derived carbon, shows great potential to improve the productivity of soils, as well as to increase the utilization of fertilizers by plants, while sequestering carbon to reduce the drivers of climate change. On August 10, I went to the 2009 North American Biochar Conference to look at the potential for investors. Before I went, I took a look at the publicly traded companies...