The post Will McConnell Kill The Bull Market? appeared first on Alternative Energy Stocks.

]]>By Tom Konrad, Ph.D., CFA

The risks of playing politics

The American news media often tries too hard to be “balanced” when talking about politics.

Depending on which news sources you rely on, you may be hearing that “congress” is having trouble passing bills to fund the government and raise the debt ceiling. More partisan sources will be blaming it on the Democrats or the Republicans, depending on their political bent.

I generally consider myself an independent who cares deeply about the environment and competent government. Since the rise of Donald Trump, the Republicans have shifted from being the party of big business (often anti-environment) to the party of big fossil fuels and corruption. Where I used to be mostly aligned with Democrats because of their pro-environmental stance, the recent shift from conservative political positions to the disinformation fueled corruption and pursuit of power for its own sake of Trump and those who follow his lead, I (now) have no choice but to take the opposing position. And because I feel that much of the mainstream media is focused on trying to be “balanced” at the expense of telling it like it is, I’m going to tell it like I believe it is:

Because Republican leaders (especially Mitch McConnell in the Senate) are more interested in scoring political points than making sure that America avoids financial disaster by raising the debt ceiling, the market is starting to look wobbly. Using the filibuster, Senate Republicans are even blocking a simple up or down vote on raising the debt ceiling- one which would need no Republican votes to pass- and are instead trying to force the Democrats to raise the debt ceiling through reconciliation. Even if the Democrats manage to avoid the filibuster by raising the debt ceiling through reconciliation, the delay is already doing damage to investor confidence and the economy.

Not raising the debt ceiling would be like me refusing to make the minimum payment on a credit card balance that I had run up because I suddenly decided I didn’t like credit card debt. It’s fine not to like credit card debt but the way to avoid credit card debt is to pay it off or avoid spending the money in the first place- not by refusing to pay the bill when it comes due. Even if I can pay and eventually do, my credit score and ability to get loans would be damaged for years.

McConnell and other Republicans in the Senate have decided that they want to be able to score political points by blaming Democrats for raising the debt ceiling, rather than voting to do the responsible thing for the country. They certainly did not have any problem adding to the credit card bill by passing giant tax cuts when they controlled the government, while Senate Democrats did the responsible thing by supporting Republican efforts to raise the debt ceiling the last time it came up for a vote. But Republicans would rather score political points than vote to pay the debt that they ran up – or even allow the Democrats to have that vote on the Senate floor.

Stock market consequences

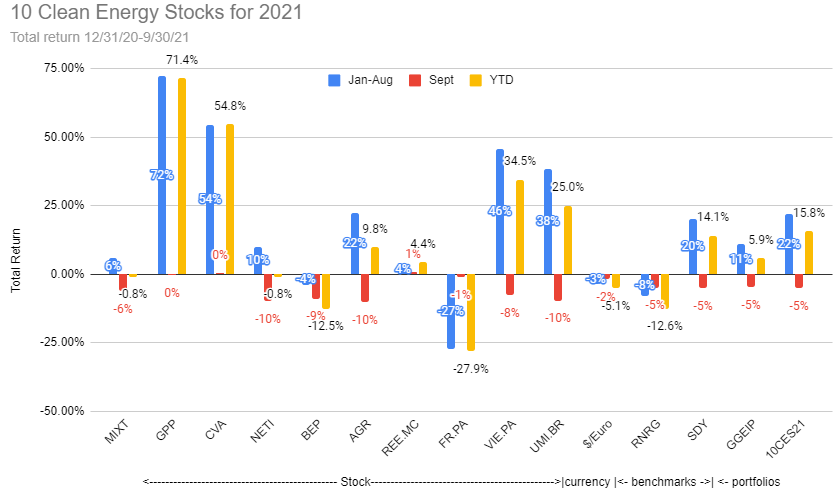

We can see the harm caused so far in the 5% declines of my 10 Clean Energy Stocks model portfolio and its benchmarks in September:

A real bear market will look much worse.

The political standoff over the debt ceiling could easily be the event that ends the current bull market. With the Federal Reserve reducing its stimulus to the economy, and the Delta variant rampant in more rural parts of the country due to low vaccination rates, I find it surprising that the market remains as strong as it does.

The Democrats will almost certainly eventually raise the debt ceiling, but only after considerable economic damage has been done. This is a certainty, since that damage has already started, and barring a reversal by McConnell, it is likely to continue for weeks if not months.

I’ve been cautioning my readers to be prepared for a market downturn for almost a year now, so if we enter a bear market, my readers and I will probably be fine. Those of us who are prepared may even scoop up some stock market bargains at discounted prices.

This potential opportunity to shop a stock market sale and the Republicans scoring a few political points is simply not worth creating a crisis that simply did not need to happen.

If the Democrats are forced to raise the debt limit by reconciliation, I hope they take the process one step further and remove the debt ceiling altogether. These periodic artificial debt ceiling crises are bad for the economy, and one more barrier to the ineffectual congress actually getting something useful done for a change.

DISCLOSURE: Long all stocks in the 10 Clean Energy Stocks for 2021 portfolio.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The post Will McConnell Kill The Bull Market? appeared first on Alternative Energy Stocks.

]]>The post Discom-fort: Barriers to Renewables in India appeared first on Alternative Energy Stocks.

]]>by Ishaan Goel

Energy is crucial to India’s policy agenda. Millions of households are yet to gain reliable access to electricity, hampering their potential for economic growth. Severe pollution issues create widespread health problems. Renewables are prioritized as viable solutions across the political spectrum, with their low costs and ease of installation in remote regions. The current administration has ambitious plans for renewable energy (RE), targeting an almost 4x increase in installed capacity to 450 GW by 2030 and introducing a spate of tax and investment reforms.

At the heart of the Indian power supply chain lie distribution companies (discoms). The discoms purchase power from power generators, and sell it directly to consumers or businesses. Most discoms are public enterprises owned by the central or individual state governments. They are concentrated in specific regions where they hold monopoly over power supply.

Discoms have an important role to play in the integration of RE into the grid. However, they are currently ridden with financial and administrative problems. Due to several issues, a large number of them are running large losses and are in severe debt. They are unable to pay power producers, with outstanding payments summing to over $19 billion in November 2020, and numerous government bailouts have failed to alleviate the situation. These problems pose tough barriers against the adoption of RE in India.

SOURCE OF FINANCIAL PROBLEMS

To make power affordable for the masses, governments regularly provide large waivers in electricity tariffs and unpaid electricity bills owed to discoms. This is usually done for certain demographic groups as part of electoral promises, particularly farmers and low-income households. Governments also seek to promote redistributive welfare through the subsidization of agricultural and rural power using higher revenues from industrial and commercial applications.

All of these provisions are supported by payment guarantees to discoms from state governments, to cover any deficits in revenue. However, governments frequently default from these obligations due to their own financial issues, forcing discoms to operate under loss. Tariffs undergo periodic regulation to ensure that they reflect current costs, but subsidies and other concessions cannot be easily reversed for political and economical reasons.

To make matters worse, a large proportion of discoms are also locked in long-term power purchase agreements with thermal power plants (mostly coal and natural gas). The conditions of these agreements were originally designed to attract private investment into thermal power generation. They usually stipulate that discoms must pay the plant a fixed fee based on its maximum potential output, and a smaller fee for the power actually purchased.

As a result, discoms tend to have high fixed costs because they pay the same amount to producers regardless of how consumption patterns vary. Base tariff rates are generally set low in India for the benefit of low-income households, and change frequently compared to the terms of the agreements. So, discoms must recover their high, fixed costs from variable and uncertain revenue streams.

Technical losses can also contribute significantly to discom problems. Power theft is a big issue in India, with illicit connections to transmission lines drawing out almost a third of power in some regions. Poor maintenance and tampering of electricity meters and lines, especially in rural areas and small towns, leads to wastage of supplied power too. This reduces the already insufficient revenues of the discoms.

EFFECTS ON RE PROVIDERS

When governments default on payments to discoms, the discoms themselves are unable to pay the electricity providers. This creates a chain of debt across the entire power supply chain, which has particularly pronounced effects for RE providers.

Tariffs for RE are usually fixed before or during the development of the project, as an assurance to providers to promote investment in the sector. However, such agreements do not provide the same level of protection as the long-term agreements made with thermal power plants. Providers end up operating on thinner margins that are heavily reliant on projected revenues from discoms.

When discoms do not receive their dues, they cannot pay RE providers whose finances are also placed in precarious conditions. Providers are usually given future payment guarantees, but these cannot help sustain them in the short-term. They also find it more difficult to raise funds from other financial institutions due to their increased risk profile. With such uncertainties and barriers to acquiring capital, firms are dis-incentivized or unable to enter the RE sector.

Discom issues also affect the adoption of captive RE – private generation facilities managed by industrial consumers for their own uses. To avoid wastage of excess power produced during peak times, providers usually ‘bank’ it with discoms. This power can be ‘withdrawn’ during off-peak hours to balance out supply. Discoms usually charge sizable fees for banking to add to their revenues, and also require fees for transporting power from production facilities to industries. All of this raises the cost of RE so that any cost benefits over thermal power are negated, which can discourage switching to RE.

Many governments have established renewable purchase obligations (RPOs) for discoms in their respective states, to promote the integration of RE in the grid. However, adhering to RPOs is cost-inefficient for discoms as they are already paying for capacity from thermal power plants. Discoms also need to spend on upgrading their grid capacity to accept the variable power output of RE. To avoid these issues, many discoms end up curtailing (refusing to accept or pay for) large amounts of electricity from RE generators. This leaves providers with lower revenues than they had planned for when constructing their facilities. This adds yet one more risk to the RE sector.

SOLUTIONS

Discom issues are major deterrents to the adoption of RE. These could be solved by improving the health of discoms, or by developing alternative methods of delivering renewable power.

Of the latter, microgrids are promising and have been implemented with some success in remote regions in India. They attract political goodwill because of their ability to boost electrification of households and commerce in underdeveloped regions. Discoms usually face the greatest difficulties in power supply and tariff collection in such regions, so their burden is eased too.

Private interest in microgrid development is rising. For instance, Tata Power (NSE: TATAPOWER) has partnered with the Rockefeller Foundation to implement 10000 microgrids in India of capacity >2MW by 2026. To promote microgrids, it is important that the government provide greater transparency about grid expansion plans and adequate sources of financing for developers. Awareness also needs to be created amongst target communities to make them more receptive towards the system.

Other alternatives include the promotion of household and community RE projects, particularly in solar energy, which is already underway through numerous government schemes. Captive RE is also gaining ground with several states slashing banking and transmission charges for industrial applications. These measures alone cannot solve discom-related issues, however, as they are mostly applicable in non-urban regions. Larger scale RE projects must be added to the grid and structural issues in discoms must be addressed head-on to boost RE integration in cities and urban industries.

Governments have introduced several relief packages for discoms in the past, but these have not proven very effective due to the underlying structural issues described above. In its most recent budget, the central government allocated almost $42 billion for reforming electricity distribution over the next 5 years. This will be done through breaking the monopolies of discoms in geographic regions to increase efficiency, and funding rural electrification. The benefits of this cash injections are likely to be transmitted to RE providers.

Smart meters are being pushed forward to reduce transmission and collection-related losses in revenue, with the government hoping to install 250 million. Such meters will allow for better maintenance and monitoring of transmission lines to detect possible power theft. They will also digitize the payment of tariffs to reduce defaults.

The government is also experimenting with transitioning to real-time markets, where discoms purchase power on energy exchanges just before supplying it, to ensure supply matches demand. This arrangement reduces average input costs for the discoms, and makes the grid more flexible for the integration of RE.

CONCLUSION

To achieve its targets and foster growth in the RE sector, the government needs to ensure that providers receive guaranteed, regular revenues and operate under low risk to invest and expand further. Despite emerging alternatives to RE provision, creating such an environment is only possible if discoms are streamlined and debt-free. Structural and market-based changes will aid in the recovery process, but it is equally important for state governments to honor payment obligations and minimize defaults across the supply chain.

*****

Ishaan Goel is a high school senior from Mumbai, India and an incoming freshman at the University of Chicago. He likes applied mathematics and statistics, especially in relation to economics and finance. He is very interested in green energy and sustainable technologies, because of their potential and increasing relevance for the future. Ishaan’s hobbies include writing, long-distance running, playing the keyboard and coding.

The post Discom-fort: Barriers to Renewables in India appeared first on Alternative Energy Stocks.

]]>The post Trump Administration Flip-Flops On Oil Refinery Waivers Again, Farm Groups Protest Again appeared first on Alternative Energy Stocks.

]]>by Jim Lane

In Washington, what must have become a weary if vigilant posse of the nation’s biofuel and farm advocates are out on the hustings again this week, over a fresh attack on the US Renewable Fuel Standard, this one led by officials in the Trump Administration, if a story reported by Bloomberg stands up against scrutiny.

What has been described as a “misinformation campaign spearheaded by Senator Ted Cruz” is seeking to overturn a unanimous court decision that would halt the Environmental Protection Agency’s abuse of Small Refinery Exemptions (SREs) under the Renewable Fuel Standard.

The backstory

In a unanimous panel, the Tenth Circuit held that EPA abused its discretion in granting SREs to three small refineries in 2016 because the statute allows the agency only to grant an extension of exemptions that have been continuously extended and in effect since 2011. In the case of these three refineries, there were no previous exemptions to “extend.” The Court also held that EPA exceeded its authority by granting SREs that were based in part on economic hardship unrelated to RFS compliance. Finally, the Court ruled that even if EPA had the authority to grant the SREs, its decision was nonetheless arbitrary and capricious because EPA failed to address its own analysis that refineries recover their RFS compliance costs.

The Whole Darn Story

We covered the controversy and the Tenth Circuit’s actions in Hardship Relief: Tenth Circuit strikes down three small oil refinery waivers in win for renewable fuels.

Statements from the stakeholders

The following joint statement was issued by the National Corn Growers Association, the Renewable Fuels Association, the American Soybean Association, the National Farmers Union, Growth Energy, the American Coalition for Ethanol, the National Biodiesel Board, the Iowa Renewable Fuels Association, and Fuels America.

“The president needs to understand that Ted Cruz doesn’t care about this administration or families across the heartland who are counting on the White House to keep its promises. Just days ago, thousands of farmers rallied behind Secretary Perdue, who expressed his confidence that we had finally reached the end of a long and painful fight against EPA demand destruction. Tearing open that wound, against the advice of rural champions and the president’s own advisors, would be viewed as a stunning betrayal of America’s rural workers and farmers. We cannot stress enough how important this decision is to the future of the rural economy and to President Trump’s relationship with leaders and voters across the heartland. Ted Cruz comes back year after year with the same lies about refinery profits, disproven over and over by economists, the EPA, and even by Big Oil. We urge the president to stand up now against this misguided effort to torpedo the rural recovery.”

BIO VP for Industrial and Environmental section, Stephanie Batchelor, added:

“It’s very unfortunate to hear the administration has chosen to go in this direction,They are doubling down on policies that have already been determined illegal and will be reaffirmed by the courts. This delay will only increase the pain biofuel producers and farmers are already feeling; further undermining innovation and investment in sustainable fuels.”

The Iowa Corn Growers Association chimed in.

“If EPA appeals this case, the EPA is not doing their job or following their mission to protect human and environmental health. Instead the EPA is involved in politics and their decision not to follow the Court’s direction to implement the RFS law as intended and allow oil companies to abuse the use of RFS waivers. The abuse will allow less renewable fuels that are proven to have benefits to human health and our environment,” says ICGA President Jim Greif and farmer from Monticello, Iowa. “Ethanol is a renewable fuel that is clean burning and homegrown. In addition, the RFS provides market access for corn farmers and the ethanol industry to provide just ten and up to fifteen percent of the fuel supply in the U.S. To say we are frustrated and disappointed is an understatement. As we prepare for spring planting and a new growing season, we need market assurances and access rather than the continued fight we are faced with and having to defend the law and Court’s decision to follow the RFS.”

The Bottom Line

The appeal is going to have to be taken up by the US Supreme Court, since this was a 10th Circuit Court of Appeal decision, and 1.1 percent of all cases are granted a writ of certiorati by the Supreme Court. And, these are in cases where there is judicial controversy — such as disagreements between two federal judicial circuits.

It takes four justices to bring the Supreme Court into the picture — to some extent, we might see this as a delaying tactic by the Trump Administration, since the ruling does not appear to be particularly, as the phrase goes, “cert worthy”.

Jim Lane is editor and publisher of Biofuels Digest where this article was originally published. Biofuels Digest is the most widely read Biofuels daily read by 14,000+ organizations. Subscribe here.

The post Trump Administration Flip-Flops On Oil Refinery Waivers Again, Farm Groups Protest Again appeared first on Alternative Energy Stocks.

]]>The post Green swan, Black swan: No matter as long as it reduces stranded spending appeared first on Alternative Energy Stocks.

]]>by Prashant Vaze, The Climate bonds Initiative

In January, authors from several institutions under the aegis of BiS, published The Green Swan[1] Central banking and financial stability in the age of climate change setting out their take on the epistemological foundations for, and obstacles against, central banks acting to mitigate climate change risk.

The book’s early chapters provide a cogent and up-to-date analysis of climate change’s profound and irreversible impacts on ecosystems and society. The authors are critical of overly simplistic solutions such as relying on just carbon taxes. They also recognize the all-too-evident deficits in global policy to respond to the threat.

In short, they accept the need for central banks to act.

The Two Arguments

The paper makes two powerful arguments setting out the challenges central banks face using their usual mode of working.

Firstly, climate change’s impact on financial systems is an unknowable unknown – a segment of ignorance which escaped Donald Rumsfeld’s taxonomy.

The many different modelling endeavors seek to trace a path from emissions of greenhouse gases, to stocks in the atmosphere, to climate impacts through damage functions, to company balance sheets, and finally ending with the impacts on financial institutions’ portfolios.

There are just too many degrees of separation for this ever to be a tractable problem. (An equivalent explosion in possibilities could be mapped for policy mitigation risks also.)

Worse, calibrating models using pre-climate change historical data can never reveal the future where social and economic ramifications of climate risks play out along their non-linear, complex path. Statistical modelling is epistemologically misleading, perhaps useless.

But the authors also challenge the current fad for climate stress tests.

What is a representative stress test?

A £200 carbon tax or a 4m sea-level rise will wreak havoc on any bank’s balance sheet. But in reality, the policy to bring about net-zero emissions will never be just a massive carbon tax.

The second challenge the paper puts forward is that confronting banks and investors with the enormity of their risks, will not reduce the climate risk in and of itself. Also, hedging the risks is not viable – banks cannot insure or diversify their way out of climate hell. Instead, system-wide action has to be taken. But the authors recognise: “A rather weakened multilateral order that is an important barrier to address the multiple trade-offs that a global low-carbon transition will generate”.

Their argument is obverse of the Heisenberg uncertainty principle.

What is true at the quantum level is sadly not true at the macro-economic level. Instead of the act of observation altering the subject, the subject remains immutable to scrutiny. The tragedy of the horizon means that even if we all fully understand the hazard confronting us, rather than acting decisively, we just pray calamity does not fall on our watch.

Reducing climate change’s forward risks means more Paris Agreement aligned assets

This is a great analysis of the nature of the problem and the authors have been champions of central banks’ engagement and vital to the creation of the Network for Greening the Financial System (NGFS).

But when it comes to action, they are cautious about central banks straying outside their mandates to influence prices or demand and supply for green and brown assets to any large scale.

Instead they advocate the role of the central banks on climate policy to be: “five Cs: contribute to coordination to combat climate change” as though stringing together five alliterative words and coining a new acronym constitutes action.

On the issue of the tragedy of the horizon they blow hot and cold about using ESG screening to counter short-termism but finally plumb for inculcating the “values or ideals of sustainable finance” to cajole finance to become more long-term.

The authors are not enthusiastic about using the policy tools at their disposal to counter climate risk. They disagree with the notion; “central banks could now substitute for many (if not all) government interventions”, echoing similar remarks made by Mark Carney late in 2019. But they put up a straw man argument.

Joint action

Critics like Climate Bonds are not arguing for central banks substituting for finance ministers, but for joint action. The central challenge for climate finance is not ensuring the financial stability of banks, but ensuring they redeploy scarce resources from brown assets formation to green and allowing the orderly winding down of losses from stranded assets.

This creation of green assets is necessary so that banks can rebalance their holdings to dampen the instability arising from ‘forward risks’.

This means cutting the cost of credit for green so new renewables and climate proofed structures receive cheap and abundant finance outside of the flawed credit-risk models which the authors acknowledge to be flawed.

Central banks and governments need to take immediate and dramatic action. In our October report[2], Greening the Financial System: Tilting the playing field – The role of central banks, we suggest nine things central banks should do to discourage FIs from continuous financing of assets that give rise to climate risks.

These include green QE, brown penalizing factors and the limited use of green-supporting factors to influence the cost of credit for brown and green activities. The EU is developing a taxonomy to define activities aligned to the EU’s environmental priorities including net-zero emissions.

Our discussions with potential issuers of green bonds to create brand new climate aligned assets, always end with the question: What’s in for us? Can we get cheaper finance?

It’s time for central banks to step up and answer: “Yes!”

What financial actors now need is robust policy measures to incentivize investment in these assets.

Rescuing the green swan

We agree that a brown penalizing factor would reduce the risk on banks’ balance sheets. But even more important, central banks have to act to stimulate the creation of green assets. The stock of green investment-grade assets is still too low.

We note with approval that the Hungarian central bank[3] (MNB) is experimenting with reducing the cost of credit to energy-efficient mortgages. Similar actions have been taken by Bank of Bangladesh, PBOC in China and Bank of Lebanon. MNB reconciled the theoretical risk of this green-supporting factor, causing under-capitalization of the lending bank by restricting the aggregate use of this facility. Too much genuine green is a problem we wouldn’t mind having.

Mark Carney recently protested that it wasn’t the role of central banks to introduce carbon taxes through the back door. But as we see too often, the political process’ imperfections mean government only acts once there’s no longer any need for it to do so: it doesn’t act in anticipation of problems, it reacts to them.

The last word

As I write this blog the coronavirus is devastating Wuhan. China and other countries have imposed travel restrictions to contain the spread. These mitigation measures will have huge impacts on hundreds of millions of Chinse students and tourists, and the businesses that rely on them.

These certain short-term costs now are seen as necessary to prevent uncertain costs and loss of life from the disease. This decisive action to mitigate a disease contrasts vividly with the procrastination in stopping the destabilizing financial flows that are driving us towards climate oblivion.

To misquote Deng Xiaoping: Who cares whether central banks or governments take the lead the important point is to divert financial spending into green assets.

Prashant Vaze Head of Policy and Government at The Climate Bonds Initiative, an “investor-focused” not-for-profit promoting long-term debt models to fund a rapid, global transition to a low-carbon economy.

[1] https://www.bis.org/publ/othp31.pdf authors from Banque de France, Columbia University, Bank for International Settlement and Amundi

The post Green swan, Black swan: No matter as long as it reduces stranded spending appeared first on Alternative Energy Stocks.

]]>The post Biofuel Industry Reacts To EPA New Renewable Fuel Standard appeared first on Alternative Energy Stocks.

]]>Yay or Nay for EPA? RFS Volumes out for 2020, Biodiesel for 2021 – What’s the reaction from industry?

by Jim Lane

What’s the reaction from industry? Coal for Christmas?

Should Santa bring coal for EPA’s stocking this year? Do the biofuels and agriculture industries think the EPA just put coal in their stocking? Is it thumbs up or thumbs down from biofuel industry advocates on last week’s U.S. Environmental Protection Agency renewable fuel volumes? What about the exempted volumes?

The Ruling – Rotten or Respectable?

First, a bit on the EPA ruling that establishes the required renewable volumes under the Renewable Fuel Standard (RFS) program for 2020, and the biomass-based diesel volume for 2021. Here are the numbers from EPA:

| Final Volume Requirements | |||||

| 2019 | 2020 Statutory Volumes |

2020 Proposed Volumes |

2020 Final Volumes |

2021 Final Volumes |

|

| Cellulosic biofuel (billion gallons) | 0.42 | 10.50 | 0.54 | 0.59 | n/a |

| Biomass-based diesel (billion gallons) | 2.1 | ≥1.0 | n/a | 2.43 | 2.43 |

| Advanced biofuel (billion gallons) | 4.92 | 15.00 | 5.04 | 5.09 | n/a |

| Renewable fuel (billion gallons) | 19.92 | 30.00 | 20.04 | 20.09 | n/a |

a All values are ethanol-equivalent on an energy content basis, except for BBD which is biodiesel-equivalent.

The key elements of the EPA action are as follows:

- “Conventional” biofuel volumes, primarily met by corn ethanol, will be maintained at the 15 billion gallon target set by Congress for 2020.

- Cellulosic biofuel volumes for 2020, and thus advanced biofuel volumes, will increase by almost 170 million gallons over the 2019 standard.

- Biomass-based diesel volumes for 2021 will be equivalent to the standard for 2020, still more than double the statutory requirement.

- EPA will closely examine the labeling requirements for E15 fuel and move forward with clarifying regulations as needed.

According to the EPA press release:

Through this rule, EPA has modified the RFS program by projecting small refinery relief to ensure that these final volumes are met, while adjudicating small refinery relief when appropriate. As proposed, we are finalizing a projection methodology based on the 2016-2018 annual average of exempted volumes had EPA strictly followed the Department of Energy (DOE) recommendations of 770 million Renewable Identification Numbers (RINs) in those years, including granting 50 percent relief where DOE recommended 50 percent relief. This is our general approach to adjudicating Small Refinery Exemption (SRE) petitions going forward, beginning with 2019 SRE petitions and including 2020 SRE petitions and beyond, we are committed to following the DOE recommendations. By proposing effectively 15.8 billion gallons for 2020 we will ensure meeting our target of 15 billion gallons.

“Through President Trump’s leadership, this Administration continues to promote domestic ethanol and biodiesel production, supporting our Nation’s farmers and providing greater energy security,” said EPA Administrator Andrew Wheeler. “President Trump committed to our nation’s farmers that biofuel requirements would be expanded in 2020. At the EPA we are delivering on that promise and ensuring a net of 15 billion gallons of conventional biofuel are blended into the nation’s fuel supply.”

EPA has modified the way RFS obligations are determined to better ensure that these volumes are met, while still allowing for relief for small refineries consistent with the direction provided by Congress under the statute. By proposing effectively 15. 8 billion gallons we will net out at 15 billion.

More information can be found on the EPA website here.

Reactions from the Industry

Ok, so now that we know the numbers, what’s the reaction? Sure, there are increases in the volumes but is it enough?

Overall consensus is no, not even close. But it’s not just the volume numbers that have folks up in arms – it’s the small refinery exemptions. The EPA is counting only half of the exempted volumes actually granted over the past three years.

Just a taste of what they are saying:

The EPA is playing games…

They blew it…

They’ve missed the mark…

Disappointed, frustrated, and quite frankly angry…

This is not what we agreed to in that meeting on Sept. 12 or Oct. 4…

Trust has been lost…

EPA has decimated demand for more than 4 billion gallons of renewable fuel…

We’ve gone from promises of a giant package to the reality of a lump of coal…

Stifles investment in green energy breakthroughs…

Leads to more uncertainty for renewable fuels…

We will keep holding EPA’s feet to the fire…

I don’t think the White House truly understands the depth of discontent in farm country…

Here’s more on what key players in the biofuels industry had to say:

Growth Energy asks EPA to take further action

“While the final rule provides an uptick in federal biofuel targets and signals an intent to account for demand lost to oil refinery exemptions, Growth Energy stressed that the agency must enforce those volumes by accounting for exemptions accurately and that EPA Administrator Wheeler must take additional steps to uphold the administration’s October 4th commitments to rural America.”

“President Trump pledged to deliver certainty and stability for America’s farmers and biofuel producers by restoring integrity to the RFS,” said Growth Energy CEO Emily Skor. “While we’re encouraged that EPA is finally taking steps to follow the law and account for biofuel demand lost to secretive oil refinery exemptions, this rule leaves important work unfinished.

“Integrity is restored to the RFS only if the agency accurately accounts for exemptions it will grant. The rule uses an accounting formula based on Department of Energy recommendations, which EPA has a poor track record of following. All eyes will now be on EPA’s next round of refinery exemptions and future targets, which will signal whether Administrator Wheeler is truly committed to ending demand destruction.

“Additionally, Administrator Wheeler must act swiftly to break down remaining market barriers to E15 as promised in the October 4th EPA announcement. When the RFS is working as intended and government has eliminated market access barriers, drivers across the nation will able to take full advantage of the administration’s move to unleash sales of E15 year-round.”

National Biodiesel Board disappointed with lack of growth in 2020 RFS volumes

The NBB said that the EPA rule blocks growth for the biodiesel industry and Kurt Kovarik, NBB’s VP of Federal Affairs, said, “EPA’s final rule for the 2020 RFS volumes is simply out of step with Congressional intent and President Trump’s promises. This week, Congress and the president are extending the biodiesel tax incentive through 2022 and sending an unmistakable signal that they support continued growth of biodiesel and renewable diesel. At the same time, EPA Administrator Wheeler is doing everything he can to block that growth.”

Kovarik continued, “Despite his statement to the press, Administrator Wheeler’s method for estimating future small refinery exemptions does not provide assurance to the biodiesel and renewable diesel market. The best estimate of future exemptions is an average of the 38 billion gallons exempted over the past three years. Even if EPA had included that estimate, though, there is nothing in today’s rule to ensure that the agency will get these exemptions under control.”

BIO says EPA’s rules are leading to more uncertainty, stifles investment in green energy

“Unfortunately, this final rule from EPA does not alleviate concerns we had when the draft rule was published earlier this year,” said Stephanie Batchelor, VP of BIO’s Industrial and Environmental Section. “The lack of growth for advanced and cellulosic biofuels, and the failure to fully reallocate the gallons lost from the drastic expansion of small refinery exemptions, will continue to stifle investment in green energy breakthroughs. This final rule will have a long-lasting negative impact on the country’s renewable fuels industry as we’ve already seen plants close because of the agency’s manipulation of the policy to date.”

Iowa Biodiesel Board says biodiesel flatlined in final rule and future small refinery exemptions underestimated

Grant Kimberley, executive director of the Iowa Biodiesel Board, said, “The EPA rule does not provide positive signals to a market longing for assurance. EPA’s actions have already decimated demand for more than 4 billion gallons of renewable fuel, including biodiesel and renewable diesel. With this final rule, the agency has once again declined to uphold the integrity of a federal law meant to encourage the use of renewable fuels in America, siding with oil company interests at the expense of family farmers. Ten biodiesel producers have closed their doors or drastically cut production due to loss of demand.”

“In addition to our discouragement over lack of growth, the industry does not have confidence in EPA Administrator Andrew Wheeler’s plan for estimating future small refinery exemptions, based on EPA’s past actions. There is no assurance these exemptions will be brought under control or properly accounted for. Meanwhile, we stand ready to meet continued sustainable growth of several hundred million gallons every year.”

Iowa Renewable Fuels Association says EPA rule fails to restore RFS integrity, Trump turns back on previous promises

“President Trump turned his back on certainty for farmers and failed to keep the September 12 deal,” stated Iowa Renewable Fuels Association (IRFA) Executive Director Monte Shaw. “Instead of certainty, we are essentially being told to trust the EPA to uphold the RFS in the future even though for the past three years the EPA has routinely undermined the program. Every farmer and biofuel supporter I have talked to is deeply disappointed, frustrated, and quite frankly angry. I don’t think the White House truly understands the depth of discontent in farm country.”

In order to remove EPA discretion from the process, biofuels supporters united behind a plan to account for SREs using a three-year rolling average of actual refinery exemptions granted. President Trump agreed to this plan in a September 12 Oval Office meeting with Midwestern elected officials, including Iowa’s Governor and Senators. Today, however, President Trump sided with EPA’s alternative plan which relies on using a three-year rolling average of U.S. Department of Energy (DOE) recommendations for SREs, which EPA has routinely ignored and is under no legal obligation to follow.

“IRFA today called upon the EPA to immediately post DOE recommendations – past, present and future – on their SRE website dashboard,” stated Shaw. “Market participants must have faith in the process and must know whether or not EPA is following the DOE recommendations. Further, to prevent any entity from gaming the system, this information should be made public to all market participants at the same time. In just a few months, EPA will begin adjudicating the 2019 compliance year SREs. It will be their first opportunity to demonstrate good faith and we’ll be watching very, very closely.”

Click here to see IRFA’s full letter to the EPA.

American Coalition for Ethanol calls RFS rule a failure to uphold President’s biofuel deal

American Coalition for Ethanol (ACE) CEO Brian Jennings said, “Over the course of the past few months, we’ve gone from promises of a ‘giant package’ to the reality of a lump of coal. To say we are disappointed is an understatement. While it was well understood this rulemaking would not make farmers and the ethanol industry ‘whole’ for the damage EPA has done by abusing the small refinery exemption provision of the RFS, we were led to believe the rule would represent a step in the right direction, an opportunity to account in a meaningful way for refinery waivers.

“We are forced yet again to continue defending the RFS and fighting EPA’s mismanagement of the program in the third branch of government, but this is another painful reminder our industry needs to go on offense with a new plan to increase demand on ethanol’s low carbon and high octane advantages.”

National Corn Growers Association’s President, Kevin Ross, said, “The Administration has chosen to move forward with a final rule that corn farmers believe falls short of adequately addressing the demand destruction caused by EPA’s abuse of RFS refinery waivers. While using the DOE recommendations to account for waivers is an improvement over the status quo, it is now on corn farmers to hold the Administration to their commitment of a minimum of 15 billion gallon volume, as the law requires. We will use future rulemakings and other opportunities to hold the EPA accountable.”

Renewable Fuels Association’s President and CEO, Geoff Cooper, “After EPA’s overwrought abuse of the SRE program in recent years, agency officials had a chance to finally make things right with this final rule—but they blew it. EPA’s rule fails to deliver on President Trump’s commitment to restore integrity to the RFS, and it fails to provide the market certainty desperately needed by ethanol producers, farmers, and consumers looking for lower-cost, cleaner fuel options. While the final rule is an improvement over the original proposal, it still does not guarantee that the law’s 15-billion-gallon conventional biofuel blending requirement will be fully enforced by EPA in 2020.”

POET’s Senior Vice President of External Affairs and Communications, Kyle Gilley, said “Today was a missed opportunity to finally restore clarity to the ethanol and grain markets, but more opportunities lie ahead in 2020. With these 2020 RVO levels now finalized, our near-term focus shifts to implementation of the remainder of the President’s critical biofuels package: ensuring 15 billion gallons means 15 billion blended, deploying an infrastructure package, changing the pump label, and reforming the fuel survey.”

Iowa Senator Chuck Grassley said, “Once again, EPA is playing games and not helping President Trump with farmers. An agreement was reached on September 12 in an Oval Office meeting between several Midwest leaders, President Trump and other members of his Administration. This does not reflect what we agreed to in that meeting.”

“The magic words from the Oval Office meeting were three-year rolling average based on hard data and actual waived gallons. Abiding by this would have solved all the problem’s EPA has created.”

Iowa Senator Joni Ernst said, “Throughout this process, I, along with Senator Grassley and Governor Reynolds have made it crystal clear that Iowa’s farmers and biofuel producers need certainty that EPA will follow the law. After shaking hands in the Oval Office this fall, EPA had an opportunity to restore the broken trust of farmers and to follow through on the president’s commitment, but it appears they’ve missed the mark…again. We were guaranteed a deal in September, and we were assured of that same deal in October, yet EPA rolled out, and has now finalized, a different proposal. It’s no wonder trust has been lost.

“We will keep holding EPA’s feet to the fire to ensure they truly uphold the RFS, the law, as intended and fully implement the other critical aspects of this rule.”

U.S. Rep. Collin Peterson (D-MN), Chairman of the House Agriculture Committee, said, “At a time when our agriculture economy is struggling, the EPA has ripped 4 billion gallons of ethanol out of the market and impacted corn prices and rural communities. We also have yet to see the other things that were promised to the biofuels industry and corn farmers to get more ethanol into the market via infrastructure incentives and policies related to higher ethanol blends.”

RNG Coalition welcomes EPA’s biofuel targets

On the other hand, the Coalition for Renewable Natural Gas (RNG Coalition) said they welcomed the EPA cellulosic biofuel targets for 2020, but they are certainly not in the majority among the biofuel and agriculture industries.

“The RFS has helped spur the remarkable growth of America’s RNG industry. We welcome today’s final rule providing for a 41% percent increase in the program’s cellulosic biofuel target, and we appreciate the Administration’s willingness to promote the expanded production and use of cellulosic biofuels,” stated Escudero.

Jim Lane is editor and publisher of Biofuels Digest where this article was originally published. Biofuels Digest is the most widely read Biofuels daily read by 14,000+ organizations. Subscribe here.

The post Biofuel Industry Reacts To EPA New Renewable Fuel Standard appeared first on Alternative Energy Stocks.

]]>The post EPA Reneges on Trump’s Biofuels Deal appeared first on Alternative Energy Stocks.

]]>by Jim Lane

“EPA Reneges on Trump’s Biofuels Deal”, said the Iowa Renewable Fuels Association in reacting to the US Environmental Protection Agency’s new plans for fulfilling federal renewable fuel requirements. EPA released a proposed supplemental rule for the Renewable Fuel Standard today, and the bioeconomy is up in arms, and the outrage is centered in farm country, once a Trump bastion of support.

“IRFA members continue to stand by President Trump’s strong biofuels deal announced on Oct. 4, which was worked out with our elected champions and provided the necessary certainty that 15 billion gallons would mean 15 billion gallons, even after accounting for SREs. Unfortunately, only 11 days after President Trump’s landmark announcement, the EPA proposal reneges on the core principal of the deal.

“Instead of standing by President Trump’s transparent and accountable deal, EPA is proposing to use heretofore secret DOE recommendations that EPA doesn’t have to follow. That means there is no guarantee that RFS exemptions will be accounted for in the RFS.”

Is the EPA’s action an outright about face from the Trump deal announced recently?

As we mentioned at the time of the deal, the operative meme for the Trump Administration’s rural policy is, “sort of”. The deal a couple of weeks ago sorted out the bioeconomy’s problems with small refinery waivers, sort of. The EPA’s actions run counter to the announced Grand Bargain, sort of.

As IRFA explains, “the proposal today essentially asks Iowa farmers and biofuels producers to trust that EPA will do the right thing on SREs in 2021 when they have spent the last two years weaponizing SREs to unfairly undermine the RFS. It is unreasonable and counterproductive to expect Iowans to put their faith in EPA to fix the SRE problem when they were the ones who created the crisis in the first place.

“As this proposal goes against the core of President Trump’s deal that we continue to support, we will work with our elected champions and the President to get the deal he proposed, and we all celebrated, back on track. There must be certainty that 15 billion gallons will mean 15 billion gallons to restore integrity to the RFS.”

The Big Switcheroo: Those pesky DOE recommendations

As IRFA noted, “prior to supporting President Trump’s October 4th deal, biofuels producers and farmers were briefed by the White House and EPA that EPA would account for SREs using a three-year rolling average of actual refinery exemptions granted. Today’s draft rule proposes using a three-year rolling average of U.S. Department of Energy (DOE) recommendations for SREs,

Why all the heated reaction to that proviso?

Bottom line, EPA has ignored DOE recommendations in the past, as we reported here, and is under no legal obligation to follow them. Which undermines the “15 billion means 15 billion” thesis of the October 4th deal.

How did EPA put it?

The EPA painted a far rosier picture.

The agency said in an official statement: “Today’s notice does not change the proposed volumes for 2020 and 2021. Instead, it proposes and seeks comment on adjustments to the way that annual renewable fuel percentages are calculated. Annual renewable fuel percentage standards are used to calculate the number of gallons each obligated party is required to blend into their fuel or to otherwise obtain renewable identification numbers (RINs) to demonstrate compliance.

Specifically, the agency is seeking comment on projecting the volume of gasoline and diesel that will be exempt in 2020 due to small refinery exemptions based on a three-year average of the relief recommended by the Department of Energy (DOE), including where DOE had recommended partial exemptions. The agency intends to grant partial exemptions in appropriate circumstances when adjudicating 2020 exemption petitions. The agency proposes to use this value to adjust the way we calculate renewable fuel percentages.”

Biodiesel “skeptical” over “never-before-discussed” proviso that “lack transparency” and “can’t be trusted”.

In biodiesel country, the National Biodiesel Board said it is skeptical the Environmental Protection Agency’s proposed supplemental rule will ensure that 2020 and future biomass-based diesel volume obligations are fully met. The supplemental notice contains a never-before-discussed proposal to estimate small refinery exemptions for 2020, with no assurance that the estimate will come close to actual future exemptions. The biodiesel industry does not believe the proposal meets President Donald Trump’s October 4 promise to American farmers and biodiesel producers.

Kurt Kovarik, NBB Vice President of Federal Affairs, added, “The notice that EPA issued today is significantly different from the agreement that biofuel industry champions negotiated with President Trump just two weeks ago, which was to estimate future exempted RFS volumes based on the average of actual volumes exempted over the past three years. EPA is proposing a brand-new method for making the estimate – one that was never previously proposed or discussed and significantly undercounts past exemptions. Once again, EPA is sending a signal to the biofuel industry that the volumes it sets in annual rules can’t be trusted.”

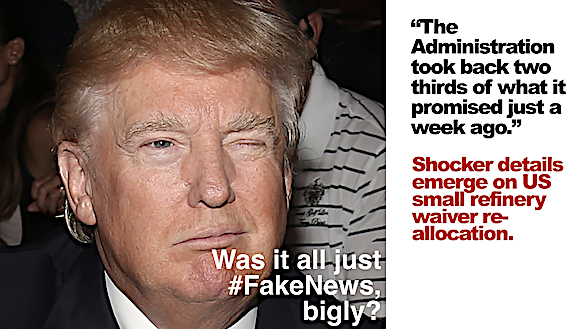

Advanced biofuels: “the Administration took back two thirds of what it promised just a week ago”

Over at the Advanced Biofuels Association, there were fighting words.

“Today, the Administration took back two thirds of what it promised just a week ago, and the irony is rich,” said ABFA president Mike McAdams. “In this rule, EPA has based SRE reallocation on DOE recommendations when the Agency ignored those recommendations in its August 9 decision to grant 31 exemptions for compliance year 2018. Furthermore, EPA has proposed to reallocate only 580-770 million gallons when 1.4 billion were ultimately displaced by those SREs. We doubt the legality of this action, and the Administration’s good faith in proposing this ‘deal.’

“ABFA will argue its case later this month before the D.C. Appellate Court challenging the SREs granted over the last several compliance years. We look forward to the Court’s judgment on the Administration’s efforts to undercut the congressional intent of the RFS program.”

Ethanol: “unconscionable” proposal “betrays President Trump’s promise to rural America”

Growth Energy CEO Emily Skor blasted the EPA proposal in no uncertain terms. “It is unconscionable that EPA’s proposal betrays President Trump’s promise to rural America” she said. “A week ago, Administrator Wheeler personally took to the airwaves and promised Iowa farmers that he would accurately account for lost gallons moving forward based on the ‘last three years of the waivers.’ Administration officials repeatedly said that 15 billion gallons will mean 15 billion gallons and this proposal fails to ensure that farm families and biofuel producers have the certainty they need to reinvest and rebuild after three years of massive demand destruction at the hands of EPA.

From Iowa: “Apprehension” over “dramatic departure” proposal that “appears to run contrary to a previously agreed-upon deal with President Trump”

In Iowa, the Iowa Biodiesel Board expressed apprehension over the Trump Administration’s new plans for fulfilling federal renewable fuel requirements, saying it appears to run contrary to a previously agreed-upon deal with President Trump. The group will join other renewable fuel and farm advocates in examining the Environmental Protection Agency’s proposed supplemental rule for the Renewable Fuel Standard, released today.

“We are deeply concerned by EPA’s new proposal to address renewable fuel gallons lost through refinery exemptions to the RFS, said Iowa Biodiesel Board executive director Grant Kimberley. “The solution President Trump previously promised us would have estimated future exempted RFS volumes based on the average of actual volumes exempted over the past three years. That is the remedy we need to steady the renewable fuels market, help plants re-open their doors, and infuse rural economies still in crisis.

“This new plan from EPA appears to be a dramatic departure from the agreement struck with the President, and we expect markets to react accordingly. This is likely to inflict further damage on the already struggling biodiesel industry and farm economy. We will join our Iowa political champions, the National Biodiesel Board and other groups in scrutinizing this new proposal, and in ensuring the final rule fulfills the deal President Trump agreed to earlier this very month.”

The Bottom Line

One of the classic Trumpisms is “you’ll find out”.

11 days ago, we cautioned industry against excessive celebration over the October 4th biofuels deal while we awaited the hard details. Then, we wrote,”This is a plan with an awful lot of ‘EPA will take comments‘ in it, so there are good reasons to wait and see how this deal plays out.”

So, now, we found out. On the other hand, did we? This Administration likes a cliffhanger more than any before it, and we’ll have to wait for next week’s episode to find out what comes of all the frothing and frustration roiling the industry now.

The stakes are Yuge. Tremendous. This story has zero finished.

Jim Lane is editor and publisher of Biofuels Digest where this article was originally published. Biofuels Digest is the most widely read Biofuels daily read by 14,000+ organizations. Subscribe here.

The post EPA Reneges on Trump’s Biofuels Deal appeared first on Alternative Energy Stocks.

]]>The post AltEnergyStocks Endorses Elizabeth Warren For President appeared first on Alternative Energy Stocks.

]]>by Tom Konrad, Ph.D., CFA, Editor

Past Endorsements

AltEnergyStocks.com has endorsed a candidate in all the US Presidential races since 2008 (Obama, followed by Obama in 2012, Clinton in 2016, and a generic endorsement of congressional Democrats in 2018.

Despite the long string of Democratic endorsements, AltEnergyStocks this site does not automatically endorse Democratic or liberal candidates. We are issue driven, and all our endorsements to date have been purely based on the policy positions of the candidates.

It is simply a sad fact about the Republican party that they have not fielded a conservative who actually cares about conservation of the environment since John McCain in 2008. Since then, the Republican nominee’s stance on the environment has descended from McCain’s serious consideration to the outright attack on the environment currently being waged by the presumptive Republican nominee, Donald Trump.

How We Make Our Decisions

On the Democratic side, the platform has shifted from generally good policies but not nearly enough of a priority under Obama, to now, when nearly all the Democratic nominees having serious plans to address climate change. If it were a choice between nearly any of the candidates for the 2020 Democratic nomination and the platforms of President Obama or Secretary Clinton in the past three presidential elections, AltEnergyStocks would have selected one of the current candidates. Andrew Yang is the only candidate mentioned in this article whose climate plan we cannot endorse (although we love his advocacy of Universal Basic Income.)

The wealth of strong climate plans arose at least in part thanks to the short lived candidacy of Jay Inslee. Governor Inslee not only brought the climate issue to the fore, but left behind his detailed and practical blueprint for tackling climate change. When he left the race, he made sure to note that his plan was open source, and urged the other candidates to draw from it. Many did, even to the point of consulting directly with Governor Inslee or his staff when crafting their climate plans.

2020: A Wealth of Choice

The current bounty of choice and detail in Democratic environmental platforms could easily lead an environmentally oriented political analyst down the rabbit hole of analysis paralysis. AltEnergyStocks is not a website for political analysis, however, we do stock market analysis. That means we are accustomed to handling an endless stream of seemingly relevant information and focusing on only that information which will make a real world difference in a company’s financial performance.

Back in the realm of politics, the important questions about the Democratic nominee’s environmental performance are:

- Can the candidate beat Trump in 2020

- What policies will they be able to deliver, especially if the Senate remains in Republican hands?

Who Can Beat Trump?

There are three broad arguments about what type of candidate has the best chance of beating Trump in

2020.

First, there are those who believe that after three and a half years of Trump’s continual affronts to our nation’s constitution, the law, and basic human decency, swing voters will swing back to any Democrat now that they are familiar with the alternative. The example of 2016 shows the folly of this sort of complacency. Throughout the 2016 presidential campaign, not to mention his entire public life before that, Trump repeatedly showed himself to be liar, a generally abhorrent human being, and a bad businessman. Yet he still won the Presidency (if not the popular vote) over a highly competent if not particularly inspiring Democratic candidate, Hillary Clinton.

This time around, Trump is clearly using every power of the Presidency and his influence in foreign affairs to rig the election in his favor. In the face of this, Democrats need an inspiring candidate who can beat Donald Trump in enough of a landslide so that Trump and Trump’s allies attempts to sway public opinion and rig the election will insufficient to effect the final outcome.

The second broad argument focuses on traditional working class swing voters in the Midwestern states that tipped the election to Trump in 2016. Supporters of Joe Biden and other relatively moderate Democratic candidates like Pete Buttigieg and Amy Klobuchar believe they will be more effective in these states than the more progressive candidates.

As with the first argument, we find this argument unconvincing. Relatively moderate candidates are less likely to inspire the Democratic base and may depress voter turnout. A low turnout election will be more vulnerable to manipulation.

The third broad argument is that an inspirational candidate is best equipped to beat Donald Trump is. Such a candidate can motivate the large numbers of infrequent voters in the Democratic base to turn out and vote. A high turnout election is also likely to be key to flipping control of the Senate into Democratic hands. Without Democratic control of the Senate, it will be difficult for the new President to fix the damage to our institutions and the environment done by the four years of the Trump administration, let alone making forward progress.

What Will a New Democratic President Be Able to Deliver?

Helmuth von Moltke the Elder is popularly quoted as saying that no battle plan survives contact with the enemy. Likewise, no political platform will survive contact with the realities of the presidency and the need to work with Congress (even if both the House and Senate are controlled by the Democrats.)

In order to deliver on an environmental agenda, our candidate will need to have experience working with Congress, a strong electoral mandate, and (we hope) a Democratic controlled House and Senate. A strong mandate and Democratic control in the Senate both point to the need for high turnout and very energized Democratic voters. In terms of experience, former and current National office holders like Joe Biden, Elizabeth Warren, Bernie Sanders, Kamala Harris, and Cory Booker are likely to have an advantage in delivering on their promises than relatively inexperienced hands like Pete Buttigieg, Tom Steyer, and Andrew Yang.

Also in terms of getting things done, not being beholden to special interests by relying only on small donors like Bernie Sanders and Elizabeth Warren will be an advantage, but this might also be a disadvantage in terms of elect-ability if they cannot match the funds raised by Trump from his fossil fuel and corporate donors. Not being beholden to big donors may help a candidate by exciting the Democratic base and even voters who voted for Trump in 2016 in a protest against politics-as-usual. Since refusing corporate donations has both pros and cons, this is not a factor we used to decide which candidate to endorse.

Putting it All Together

In sum, AltEnergyStocks is choosing to endorse a candidate that who will excite the Democratic base rather than a moderate candidate. We also want one with previous experience in the Federal Government. Based on the polls and personal conversations with voters, the candidates who are able to excite supporters are Buttigreg, Harris, Sanders, and Warren. Andrew Yang is notable for a small but extremely devoted following, but does not seem to be able to expand his appeal to the broader swath of Democratic voters. While still the front runner, Joe Biden seems to hold that place mainly because people think he can beat Trump, not because they are excited about him.

Those candidates which both have some level of excitement behind them and experience in Washington are Kamala Harris, Bernie Sanders, and Elizabeth Warren. All three combine experience in Washington with a willingness to take a principled stand against corruption. Despite being political insiders, they can all can claim to be ready and able to confront Washington’s vested interests. Harris does not yet seem to have the broad support of Warren and Sanders, but has enough that she could still gain momentum. As a black woman, her candidacy would be more likely to inspire high turnout among black voters who will be crucial for a high turnout election.

Our Choice

Looking beyond the environment, elect-ability, and likely effectiveness in Washington, Elizabeth Warren has an appeal to AltEnergyStocks that neither Harris nor Sanders can match.

The purpose of this website is to help educate the investing public about clean and alternative energy stocks with the goal of increasing investment in those stocks and helping the companies we are writing about and investing in solve the climate crisis. Underlying this goal is the belief that the stock market and capitalism in general, though flawed, can be a powerful tool for solving the world’s problems. We believe that capital markets need reform, but with proper regulation, capital markets can be a powerful force for good.

Like Warren, AltEnergyStocks.com is a capitalist website. Like her, we also believe that capital markets need rules so that they will better work for everyone.

We hope you will join us in donating to the Warren campaign. If we are going to reform capitalism and turn financial markets back into a force for good and the environment, the support will come from small investors like us who support market reform, not from the people currently profiting from the many flaws in the system.

If you have been following our stock picks, you should have some decent capital gains to share. You should also know that right now is a particularly risky time to keep your money invested in the stock market. So invest Elizabeth Warren’s campaign and better capital markets instead!

The post AltEnergyStocks Endorses Elizabeth Warren For President appeared first on Alternative Energy Stocks.

]]>The post New York State Pension $ 22 Billion Poorer By Not Divesting 10 Years Ago appeared first on Alternative Energy Stocks.

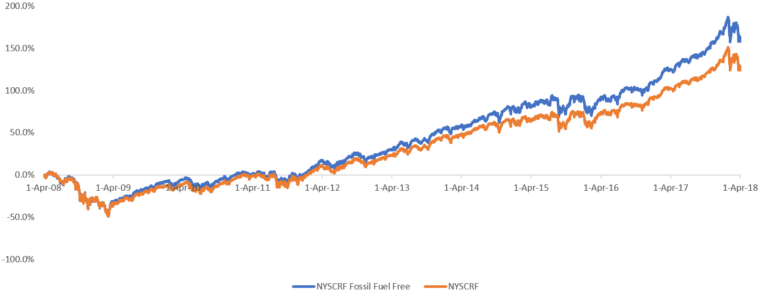

]]>Research firm Corporate Knights revealed that the pension fund would be $22 billion richer had it divested from fossil fuel stocks in 2008. That’s almost $20,000 for of each of the pension fund’s 1.1 million members & retirees.

A new in-depth analysis by the research firm Corporate Knights, shows that New York State pension fund would be $22 billion richer had it divested from fossil fuel stocks 10 years ago. That works out to almost $20,000 for of each of the pension fund’s 1.1 million members and retirees. To perform their analysis, Corporate Knights looked at the stock holdings of the pension fund in every year between 2008 and 2018.

These shocking numbers come on the heels of recent WNYC which revealed that the top pension official, Chief Investment Officer Vicki Fuller, took a $275,000+ job with the Williams (NYSE:WMB) pipeline company just one day after she quit working for the state. She did this after advocating against divestment by the state pension fund for years and while doubling the fund’s investments in the Williams pipeline company to $160 million. Williams is trying to get two fracked gas pipelines built in New York State. More than 30 organizations have asked the New York State Ethics watchdog to investigate this conflict of interest.

It’s abundantly clear we need to get fossil fuels out of politics in New York and also out of the state pension fund.

By refusing to divest from fossil fuels, the New York state comptroller Thomas DiNapoli, who has ultimate authority over the pension fund, has chosen to be on the wrong side of history, and it’s costing New Yorkers billions in foregone profits. The money the state could have earned by divesting a decade ago would have covered more than 25 percent of the costs from 2012’s climate change fueled Superstorm Sandy.

Fossil fuel companies are driving the climate crisis. And investing public funds in them is not only morally wrong, it doesn’t make financial sense. For years, experts have been ringing the alarm bell on the growing financial risks of coal, oil and gas companies.

While Comptroller DiNapoli has chosen to spend his time ‘talking’ to fossil fuel companies like Exxon, other jurisdictions, recognizing the risks and their fiduciary duties, are moving forward with real climate actions like divesting. New York City, for example, announced in January, its commitment to divest its $200 billion pension funds from fossil fuels and more recently promised to invest $4 billion in climate solutions like renewables. That’s real, financially sound, climate action and much better than talking to and investing in Big Oil companies.

If New York City can do it, New York State can too.

As we face down the next storm and as sea levels rise, our state needs to do more to protect the futures of New Yorkers. It’s important that the state take action on climate at all levels, including getting fossil fuels out of the state pension fund.

This article was first published on the Fossil Free NY Blog.

The post New York State Pension $ 22 Billion Poorer By Not Divesting 10 Years Ago appeared first on Alternative Energy Stocks.

]]>The post Creating a Climate Resilient America: A Green Investment Adviser Testifies To Congress appeared first on Alternative Energy Stocks.

]]>The prepared remarks of Garvin Jabusch, Chief Investment Officer of Green Alpha Advisors before the House Select Committee on the Climate Crisis in Washington, DC, July 25th, 2019.

Chairwoman Castor, Ranking Member Graves, committee members, thank you for the opportunity to testify and contribute to this important conversation.

Climate disruption and resource degradation present significant threats to and opportunities for American business. Every sector and industry are affected, and my industry of asset management, in its role deploying capital across the economy, is directly exposed to it all, risks and opportunities inclusive.

First, risks. The purpose of investing is to preserve and grow one’s purchasing power. Whatever amount I am investing, I want to be able to buy as much or more with its value in the future than I could have with its cash value today. There are volumes of portfolio theory about how to achieve this, and, overall, those theories have worked well for decades. But many theories of the world work great, until the world changes. Now, the change is climate disruption, and in the full exercise of fiduciary responsibility as an asset manager, I have to think hard about the effects that climate disruption will have on every business I consider placing my clients’ assets into, and inversely, the effect each business may have upon the climate. It is in doing this analysis, no longer optional for the prudent risk manager, that I can minimize investment risk and grow my clients’ purchasing power into the future.

What is the practical application of this? It begins with the realization that even within asset management, it is science that is our path to knowing things. Science tells us that many of our present economic activities, such as fossil fuel development, internal combustion engine manufacture, fossil powered electricity generation, and use of topsoil depleting chemicals, have to decline dramatically, and soon. Thus, the prudent fiduciary knows that holding the securities of companies pursuing these activities is likely to put his or her client assets at risk, particularly in the medium and long terms.

According to experts such as the Federal Reserve of the U.S., former Bank of England governor Mark Carney and noted investor Jeremy Grantham, climate has emerged as “bar none” the most important risk in asset management, and the main threat to investments today is in holding the causes of the climate crisis. To de-risk a portfolio, it is necessary to not own the primary threats undermining economic stability.

Those are the risks within my industry. The main risk to the climate coming from my industry is that the predominant way of investing today completely ignores the climate crisis. A recent CNBC article explains that “80% of the stock market is now on autopilot…Passive investments control about 60% of the equity assets, while quantitative funds — using trend-following models instead of fundamental research — account for 20% of market share.” This means that today, the main reason a stock is bought is because it is in an index, and not because of what the company makes or what services it provides. This is dangerous because the major indices are riddled with the causes of our largest environmental and therefore economic risks. The S&P 500 includes approximately 60 fossil fuels related companies and any number of other risks to water, topsoil and economic equality, to mention a few.

Let me be clear: if you own the S&P 500 today, you may believe you are investing passively, but you are not. You are making an active bet on the causes of system-level collapse. By your actions, if not your intent, you are signaling that you hope to benefit from causing climate disruption and resource degradation. Climate is the most important risk to capital preservation, yet the main overall risk coming from the investment industry is that the vast majority of professionals and their clients are flat ignoring it.

There are those in investment management working to change this, my firm Green Alpha Advisors, among them. It sounds simple to invest for a more sustainable economy, but the problem has been that investment managers don’t have good principles to guide them. Green Alpha’s approach to de-risking portfolios has been to select stocks not because of their presence in a benchmark index, but because of what the company actually does. We believe the best way to begin, and the clearest line of sight, is to look at sources of revenues. Is a company being paid to de-risk the global economy, or is it being paid to help drive it towards the edge? Are the majority of revenues coming from business activities that will help society mitigate or adapt to the climate crisis, or from causing it?

Rather than blindly indexing, investment professionals have to get back to judging individual cases on their merits; and we can use disinterested, objective principles to make better choices. If a company’s net activities do not lower the risk profile of the economy on an ongoing basis, we should wonder why we own it. You get the economy you invest in, and as long as most investors still own the S&P 500, we are going to be living in the fossil fuels economy that it represents.

Those are the risks in and from my industry, and how to avoid them. What about the opportunities? This is the good news, and I think it is generally underappreciated.

Human innovation is increasing in an unprecedented way, and the rate of that increase itself is accelerating. Faster and faster, we’re coming into possession of the means to both mitigate climate disruption, and to adapt to what we have already committed ourselves to. Why? Because innovation means doing things better. It means, as it always has meant, making economic production more efficient: getting more output out of ever fewer inputs. As biologist Edward O. Wilson, who testified here on the Hill just a couple days ago, has noted, the digitalization of the economy is key to achieving environmental sustainability, because the associated expanding efficiency of production can shrink our ecological footprint. But of course indefinite sustainability isn’t emerging only from digitalization, we are also today seeing great strides in advanced materials, biotech, renewable energy and storage, zero emissions transportation, water management, and in key adaptations like indoor agriculture. Investing in these efficiency solutions will lead to competitive performance returns as these innovators continue to gain market share from their legacy economy predecessors, and thus grow faster.

Economic production can be much greater than it is today while consuming far fewer inputs, be those inputs natural resources, person hours or dollars, and can do so with far fewer externalities like greenhouse gasses and other pollution. This will lead to enormous wealth creation opportunities for investors, and will also put us on the path to indefinite sustainability, meaning we can realize a good standard of living for everyone – the 100% – without overtopping earth’s tolerances. The greatest wealth preservation and growth opportunities for my firm come from that; from keeping our eye on, and investing for, that endgame: namely, for a zero-risk economy.

Garvin Jabusch is co-founder and chief investment officer of Green Alpha Advisors. For more information, please visit https://greenalphaadvisors.com/about-us/legal-disclaimers/.

The post Creating a Climate Resilient America: A Green Investment Adviser Testifies To Congress appeared first on Alternative Energy Stocks.

]]>The post Another Biodiesel Plant Gets The Axe. Here’s Why. appeared first on Alternative Energy Stocks.

]]>by Jim Lane

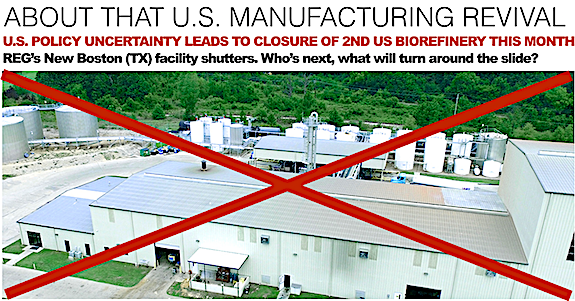

In another small but sharp blow to the Trump Administration’s strategy for American manufacturing revival, news arrives from Texas of a second smaller biodiesel shuttering owing to “ challenging business conditions and continued federal policy uncertainty,” as Renewable Energy Group (REGI) phrased it in announcing the closure of its15 million gallons per year New Boston, Texas biorefinery. The company is currently working with plant employees on relocation opportunities within the production network.

In another small but sharp blow to the Trump Administration’s strategy for American manufacturing revival, news arrives from Texas of a second smaller biodiesel shuttering owing to “ challenging business conditions and continued federal policy uncertainty,” as Renewable Energy Group (REGI) phrased it in announcing the closure of its15 million gallons per year New Boston, Texas biorefinery. The company is currently working with plant employees on relocation opportunities within the production network.

The tax credit issue

The forces impacting the US biodiesel industry at present are complex, but REG in this case is pointing the blame at the biodiesel tax credit, the renewal of this tax credit has been stalled for more than 18 months in Congress — the credits expired at the end of 2017 — and there has been no definitive progress on renewal (or clear progress on new directions) from Congress, which has stymied the US biodiesel industry in terms of its long-term capital and operating strategy formation and execution.