The post 10 Clean Energy Stocks for 2022-2023: The List appeared first on Alternative Energy Stocks.

]]>By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily fall further, leading to even better opportunities than we see today.

Since I’m not actively buying in the fund, I am now free to share my top picks with the public. Like everything in my hedge fund, these are all companies that, in my judgment, reduce the fossil fuel use, carbon emissions, or other pollution in the overall economy by operating and expanding their businesses.

I probably won’t be able to publish monthly updates to this list as I have in the past. If I am actively buying any one of these stocks, I will not be writing about it, and I will not want to tip my hand by writing about the others while just omitting one or two. But I plan to publish intermittent updates on the whole list when I can, and will do a recap in July 2023 to look at how the list did in the past year and why.

Valuation and Timing

The recent declines of the stock market are finally giving us decent valuations, better than anything we’ve seen since the short-lived market bottom in early 2020. That’s not to say that the market will not fall further, but it’s likely that many individual stocks are currently seeing their lows.

Whenever I see a stock I like trading at a good valuation, I buy some. If it falls further because of a continued general market decline (as opposed to bad news at the company itself), I buy more. These ten stocks have all reached the “buy more” stage. If the market keeps falling, I’ll soon be ready to invest everything I can, and even start using uncovered short puts to take on a bit of leverage.

10 Clean Energy Stocks for 2022-2023: The List

By Tom Konrad, Ph.D., CFA

Ten Green Stocks I expect to do well over the next year (7/1/2022 to 6/30/2023)

Prices are as of the close on 6/30/2022. 1€ = $1.0482, $1 = 7.0972 DKK = C$1.2876

Clean Transportation Stocks

- MiX Telematics (NASD:MIXT – $8.14) – A provider of vehicle tracking and telematics to large international vehicle fleets. The company is green because it both reduces accidents and fuel usage for its customers.

- Valeo, SA (FR.PA – €18.42 or US ADR: VLEEY or US foreign stock ticker: VLEEF) – a provider of electrified drive trains, sensors, and comfort systems for the automotive industry.

- NFI Industries (NFI.TO C$13.39 or US foreign stock ticker: NFYEF) – A leading international bus and motorcoach manufacturer selling a large and growing number of electrified vehicles. N

Green Building Stocks

Rockwool A/S (ROCK-B.CO 1597.50 DKK and ROCK-A.CO or US foreign stock ticker: RKWBF) – a manufacturer of fire and mold resistant building insulation.

Hannon Armstrong Sustainable Infrastructure (NASD:HASI) – A financier of solar, wind, biogas, and energy efficiency installations.

Green Municipal Infrastructure Stock

Veolia (VIE.PA €23.29 or US ADR: VEOEY or US foreign stock ticker: VEOEF) – A large international developer and operator of municipal infrastructure such as water, wastewater, recycling, and environmental remediation.

Biofuel Stock

Enviva, Inc (EVA $57.22) – A vertically integrated wood pellet supplier to European and Japanese markets, where they mostly displace coal in electricity generation.

Recycling Stock

Umicore, SA (UMI.BR €33.32 or US ADR: UMICY or US foreign stock ticker: UMICF) – A vertically integrated recycler of hard-to-recycle and specialty metals used in clean energy industries such as batteries, solar, wind, and catalytic converters.

Green Electricity (Yieldcos)

Avangrid (NYSE: AGR $46.12) – one of the top producers and developers of renewable electricity in the United States.

Atlantica Sustainable Infrastructure (NASD: AY $32.26) – an international owner and developer of renewable energy, efficient natural gas, electric transmission line and water assets.

DISCLOSURE: Long all stocks in the 10 Clean Energy Stocks for 2022/23 portfolio.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The post 10 Clean Energy Stocks for 2022-2023: The List appeared first on Alternative Energy Stocks.

]]>The post Q1 Earnings Roundup: Yieldcos (AGR, BEP, CWEN, GPP) appeared first on Alternative Energy Stocks.

]]>By Tom Konrad, Ph.D., CFA

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. If there is any theme, it’s that low interest rates and increased interest in green investments is lowering Yieldcos’ cost of capital to the benefit of stock investors.

Avangrid Earnings

Avangrid’s (AGR) Q1 earnings report showed solid progress. Key items of note were:

- Increased outlook for full year 2021 Adjusted EPS a little over 5%

- Key environmental approval for 800 MW offshore wind farm Vineyard Wind. Expected to begin construction later this year, with expected completion in 2024. Avangrid is a leader in US offshore wind development, with over 4,000 MW already in the pipeline (including Vineyard) and plans to bid on more.

- The company’s Networks (electricity transmission and distribution) division is also performing strongly, and they are well placed to benefit from Biden’s plans to streamline long range transmission planning and open up existing rights of way to new transmission projects. Transmission upgrades are essential to transitioning to a renewable electricity based grid, and Biden is the first president to take significant action on it. It’s a little recognized clean energy investment theme, so it’s still possible to purchase stakes in key players like AGR at reasonable prices.

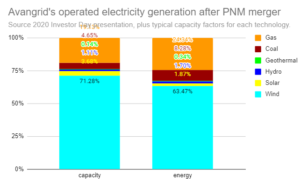

- The purchase of PNM Resources (PNM) looks likely to close near the end of the year. I have mixed feelings about this one because PNM has a fair amount of coal generation, but on balance it’s probably a good thing because Avangrid will close coal plants faster than PNM would have as a stand alone, and the purchase will bolster its Networks business making it much more of a national player.

Although Avangrid’s share price increased significantly after it got shareholder approval for the PNM merger, it remains reasonably priced compared to most Yieldcos.

Brookfield Renewable Partners Earnings Highlights

I originally put Brookfield Renewable Partners (BEP) shares in the 10 Clean Energy Stocks for 2021 portfolio because I thought its ability to raise capital by selling its turbocharged Brookfield Renewable Corp. (BEPC) share class would give the stock a boost if the ongoing clean energy stock bubble continued a few more months.

Two things undermined that thesis- the clean energy stock bubble popped sooner than I expected, and while its parent Brookfield Capital Management (BAM) did take advantage of the huge premium BEPC shares commanded at the time, the company itself did not issue any new BEPC shares so it was not able to get the influx of cheap capital I had hoped for.

Now that the stock is down 15 percent since the start of the year, I’m beginning to get interested again, and am beginning to sell out of the money cash covered puts on BEP to replace the BEPC shares I was selling at the end of last year during the height of the bubble.

To be clear, I don’t think BEP is cheap enough to be a strong buy yet, but it’s an important company to keep in the portfolio as a core long term holding.

A couple of the reasons I think of BEP as a core holding came up in the earnings call:

- They sold some of their older, de-risked assets at a 15% compounded annual return based on their initial cost. This is just one example of Brookfield’s excellent value discipline. Their strong balance sheet and long experience in renewable infrastructure let them stay on the right side of the investment cycle: When capital is flowing into the sector, they have assets to sell. When capital is scarce, they can swoop in and buy assets at big discounts (as they did with Terraform Power in 2019.)

- They made their first investment in offshore wind. Like Avangrid (AGR), they have the scale and financial strength to participate in this up and coming renewable sector where only the largest and strongest financial players will be able to participate, given the gigantic scale of most offshore wind projects.

In short, the first quarter earnings showed the ability to generate profits by operating their extremely stable assets well, selling assets after they have seen great appreciation, and by investing in new sectors like offshore wind where they are one of only a few players with the size and experience to operate successfully. Given the limited number of developers who can compete in offshore wind, I expect the returns for those developers who can participate will be higher than solar and onshore wind where smaller players have a chance of being competitive.

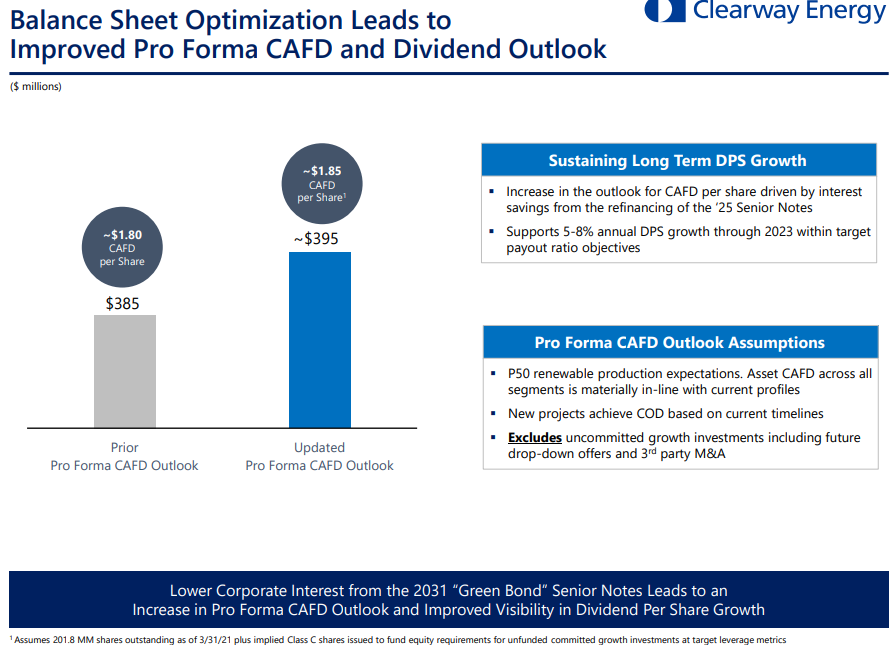

Clearway Gets Green Bond Boost

While it’s not in the 10 Clean Energy Stocks list this year, Clearway Energy (CWEN, CWEN-A) was from 2016 to 2018, when it was NRG Yield, so I suspect it is still in many readers’ portfolios (as it is in mine.)

I thought it was interesting just how significant a boost the company got by refinancing… replacing $600 million of senior notes at 5.75% with a new green bond at 3.75% while extending the maturity from 2025 to 2031. The lower interest payments alone allowed it to boost its outlook for cash available for distribution to shareholders by 5 cents a share annually.

Clearway is not alone; most Yieldcos have been refinancing and raising new debt in the current low interest rate environment, and the newly maturing market for green bonds. The evidence is strong for a “Greenium:” a green premium allowing green bonds to trade at higher prices (and lower interest rates) than conventional bonds that do not support green projects.

This bodes well for hopes for massive new investments in green infrastructure including wind and solar. Since these projects can be financed at lower interest rates due to the greenium, there will be more well financed developers willing to build them.

Green Plains Partners Earnings

Green Plains Partners (GPP) made significant progress reducing its debt burden in the first quarter. In an agreement with lenders reached last year, substantially all its free cash flow beyond the current $0.12 dividend is going to pay down debt until the debt burden is paid off. This quarter, that included cash from the sale of one of the partnership’s ethanol plants.

Without additional asset sales, GPP will be debt free in the second half of 2022, and free to redirect cash flows to paying the dividend and making new investments. Before it cut its dividend last year, it was paying $0.475 a quarter. This was using all of GPP’s free cash flow, so if dividends are increased it will be to some lower level. I would expect a new dividend in the $0.25 to $0.30 range, but with some prospects for dividend growth given the retained capital for investment.

At the current stock price of $12, that would be a substantial yield in the 8 to 10 percent range. This is in line with most MLPs, so I consider GPP to be approaching fair value at this point and am beginning to take profits and trim my holdings so it’s no longer an outsized part of my portfolio.

DISCLOSURE: Long AGR, BEP, BEPC, CWEN-A, GPP

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The post Q1 Earnings Roundup: Yieldcos (AGR, BEP, CWEN, GPP) appeared first on Alternative Energy Stocks.

]]>The post Clean Energy Stock Deflation and Biden’s Infrastructure Plan appeared first on Alternative Energy Stocks.

]]>By Tom Konrad, Ph.D., CFA

Last month saw buying opportunities in some clean energy stocks as the bubble created from the euphoria over Biden’s election vanished as if it never happened.

Clean energy stocks have simply returned to the general upward trendline from the second and third quarter of 2020. Rather than bursting in a market panic, this seems to have been more of a general deflation.

Some clean energy stocks seem reasonably priced, but there are no great values like we often see during the market panics which typically follow bubbles. Without a panic, I’m not ready to buy aggressively. Stocks in general continue to trade at fairly high valuations, and rising interest rates or some other market disruption could still trigger a sell-off.

Biden’s Infrastructure Plan

Biden’s infrastructure plan includes significant funding for clean energy. It would make tax credits refundable and extend them, and includes an offshore wind push. It also includes significant measures to improve the long neglected electric grid, and electric vehicle charging.

Solar and wind manufacturers will benefit from the tax credit extensions, but this may not be that significant for any one company because most sell globally. The US is a large market for solar and wind, but not so large that it’s a dominant player. Renewable energy developers are more likely to see a significant impact.

In the 10 Clean Energy Stocks for 2021 list, Brookfield Renewable (BEP) and Avangrid (AGR) both have significant development arms, so robust support for renewable energy may enable them to increase their growth rates. Of the two, Avangrid is particularly well placed because it also develops offshore wind and electricity transmission and distribution networks. Avangrid’s offshore wind development, Vineyard Wind, had been suffering delays due to roadblocks put up by the Trump administration. Now it seems to be on the fast track.

The best Biden infrastructure pick in the list is Eneti (NETI). As a future owner of offshore wind turbine installation vessels, a booming offshore wind industry and the long lead time for building such vessels should put it in a very good position when its first vessel is delivered in 2023. I expect the company will exercise some of its options to buy more before then so that it will have a robust pipeline of new vessels being delivered in subsequent years.

The ethanol industry and Green Plains Partners (GPP) are also benefiting from the change of administration, with the EPA taking steps to limit Renewable Fuel Standard waivers given to oil refineries. GPP is also benefiting from an investment by an activist hedge fund, which believes the stock is undervalued, as I noted for my Patreon supporters on March 10th.

Conclusion

The changed political climate gives reason to be hopeful about clean energy stocks, especially now that much of the air has been let out of the bubble that began with Biden’s election. However, overall stock market valuations are still high, and rising interest rates are a drag on the income stocks I focus on.

Cautious buying of better clean energy stock values seems warranted, but the emphasis should be on “cautious” not “buying.” Make sure to keep significant cash in reserve.

DISCLOSURE: Long positions all the 10 Clean Energy Stocks for 2021 model portfolio.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The post Clean Energy Stock Deflation and Biden’s Infrastructure Plan appeared first on Alternative Energy Stocks.

]]>The post The Yieldco Virtuous Cycle appeared first on Alternative Energy Stocks.

]]>by Tom Konrad, Ph.D., CFA

Readers who followed my coverage of the Yieldco bubble in 2015 know the Yieldco Virtuous Cycle.

- A Yieldco’s stock price rises

- It issues new shares, and invests the money in renewable energy projects.

- Because the stock price is high, it is able to buy more project cash flow by issuing fewer shares than it has in the past.

- Cash flow available for distribution (CAFD) per share increases, despite the increasing number of shares outstanding.

- Yieldco management sets a target for continued rapid annual distribution growth, which can be met either by further share issuance (if the share price continues to increase), increasing the payout ratio (the percentage of CAFD used to pay dividends) or borrowing.

- The share price rises in response to rising expectations of CAFD per share growth, allowing management to repeat the cycle.

This cycle ran from 2013 to mid-2015, when the public Yieldcos at the time got too greedy, issuing more shares than the market could absorb. Share prices stopped rising rapidly, so Yieldcos turned to increased debt and increased payout ratios in order to meet their lofty dividend per share growth targets. They hoped that share prices would accelerate again while their payout ratios were still below 100% and banks were still willing to finance their debt.

But the writing was on the wall… Yieldco share price growth can continue indefinitely as long as investors believe it will. But, like Tinkerbell, the Yieldco bubble popped as soon as investors stopped believing in it. The virtuous cycle turned viscous.

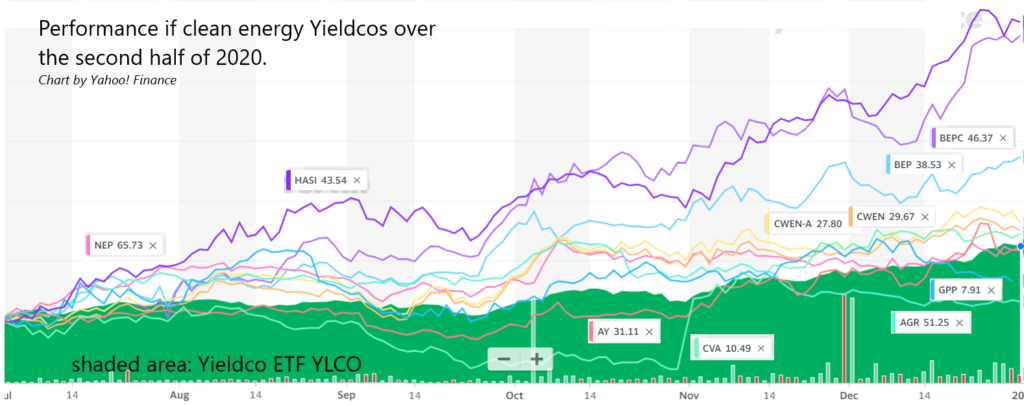

By the end of 2015, many Yeildcos had fallen enough that their stocks were attractive even without assuming any dividend per share growth. That’s not where we are now. Although valuations feel very lofty, the past few years of fiscal discipline has led to lower payout ratios and reduced debt burdens. Combine these with current high share prices, and conditions are right to kick off a new Yieldco virtuous cycle and boom.

A New Yieldco Boom

Most Yieldcos’ share prices have increased rapidly in the second half of 2020. This sets the stage for a new Yieldco boom, with a new virtuous cycle of rising share prices, expectations of dividend per share growth, and new investments beginning to take off. Given the momentum of the divestment movement, a new Yieldco boom seems likely. If a new boom is going to happen, the best Yeildcos to buy today will be the ones with the lowest current dividend yields, because they can raise the cheapest capital in new secondary offerings and they will be able to promise the fastest dividend per share growth.

While a new Yieldco boom is likely, it is not certain. The most likely event to derail the Yieldco growth train would be a US market crash. Given the current high valuations and the worsening pandemic, a crash is impossible to rule out. If this happens, the best Yieldcos to own today are the ones that have the highest yields and/or are retaining the most cash to invest in new projects and pay down debt. These cheaper Yieldcos will also do well if a new Yieldco boom materializes, but not as well as the leaders.

Since I’m more interested in avoiding losses than going for the big win, the Yieldcos in the 10 Clean Energy Stocks for 2021 model portfolio are: Covanta Holding (CVA), Green Plains Partners (GPP), Avangrid (AGR), and Brookfield Renewable Energy Partners (BEP). Covanta, Green Plains Partners, and Avangrid did not appreciate as much as other Yeildcos in the past six months because they are not the pure solar and wind power owners that many investors will be looking to as a replacement for fossil fuel stocks. Covanta is a leader in Energy from Waste, Green Plains Partners is a Master Limited Partnership (MLP) that owns ethanol storage and transportation assets.

Avangrid (AGR) is not completely fossil fuel free, since it owns some natural gas utilities, which is why it has not run up with the purely renewable Yieldcos. Nevertheless, it is a leader among electricity generators in the US, with its CO2 emissions per kWh in 2018 at 15% of the US average. Its utility networks are 77% electric and 23% gas.

That picture is being made somewhat worse by its planned purchase of PNM Resources. After the PNM merger, its electricity generation also includes 22% to 32% fossil fuel (depending on if you measure by electricity capacity or production – see chart), but planned generation investments will be almost entirely renewable, while it phases out coal. While Avangrid’s valuation remains low compared to its more renewables-focused peers, it could benefit if a Yieldco investment boom materializes. Its existing and new renewable generation assets will become more valuable as the increased demand by Yieldcos drives up prices.

It could also take advantage of the boom by selling its fossil fuel assets and becoming a truly fossil fuel free company, although management seems committed to its natural gas utilities, at least for the moment.

Finally, Brookfield Renewable Energy Partners (BEP) is a pure clean energy Yieldco which has seen massive price appreciation over the last six months, and trades at low (2.7%) yield. But compared to other highly priced Yieldcos, BEP has an advantage for raising money in secondary offerings. It has a second type of share in Brookfield Renewable Energy Corporation (BEPC), which is even more highly valued than BEP. While BEP and BEPC pay the same per-share dividend, BEPC shares ended 2020 at $58.27, a 35% premium compared to BEP which closed at $43.15. With this price differential, Brookfield Renewable can issue new BEPC shares and use the funds to invest in clean energy projects which will benefit both share classes equally. Alternatively, the company could sell ten million BEPC shares, buy ten million BEP units, and instantly have an extra $150 million to invest without increasing the total number of shares outstanding. For this reason, I expect the company to issue many new BEPC shares in 2020, with the benefit accruing to both classes of share equally. Over time, this will erode the large premium of BEPC shares over BEP units.

Hedging BEP with BEPC

The safest way to bet that the premium of BEPC over BEP will narrow would be a long-short hedge, buying BEP and selling an equal dollar amount of BEPC short. For every 100 shares of BEP purchased (for $4315), the investor would also sell $4315/$58.27 = 74 shares of BEPC short. This long-short hedge would only change in value if the price premium changed, but the investor would collect approximately $116 in dividend on BEP, while only paying $86 in dividends on the short BEPC shares. Meanwhile, each 10% decrease in the premium would lead to a 10% ($431) gain, while each 10% increase in the premium would lead to a 10% loss.

Unfortunately, there are many hedge funds that follow absolute return strategies like the one I have outlined above, and their demand for BEPC shares to sell short will lead to additional fees for anyone trying to sell BEPC short.

Another option for a partial hedge for BEP shares using BEPC would be to sell call options on BEPC. For this, I would use the longest-dated call options available with a strike price just above the current market price. In this case, that is the call option to buy 100 shares of BEPC at $60 at any time before June 18, 2021, or BEPC 6/18/21 $60 Call. Selling one such contract would be a hedge against small declines of 135 shares of BEP. While I was initially thinking I would include a hedge like this in the model portfolio, the requirement that the BEP position to be at least 135 shares (or $5800) to work means that in order to follow the model portfolio, a reader would have to invest at least $5800 in each of the 10 stocks, or $58,000 total. Since I want this strategy to be accessible to readers with only $10,000 or so to invest, I will include BEP in the portfolio without a hedge.

Conclusion

The end of 2020 looks like it may have set the stage for a new Yieldco boom, with rapidly rising stock prices leading to new investment and rapid dividend per share growth. If this virtuous cycle emerges, the Yieldcos to own will be the ones with the lowest yields and the highest potential for compound dividend growth.

Unfortunately, a Yeildco boom is not certain. Higher yield Yieldcos will also benefit from a boom as investors attracted by the leaders look for diversification in the space, but they offer more safety. If a new Yieldco boom fails to emerge or turns to a bust, more value priced Yieldcos like CVA, GPP, and AGR have less far to fall.

Brookfield Renewable Energy Partners (BEP) is one of the Yieldcos that saw the largest rise (69%) in the second half of 2020. It has the advantage over other Yieldcos that it can raise cash through the sale of shares of the even more highly valued Brookfield Renewable Energy Corp. (BEPC) shares, which are up 126% over six months and now trade at a 35% premium to BEP. BEP shares can not only benefit from a renewed Yieldco boom, but can also benefit from any narrowing of the BEPC/BEP share price premium, which I believe is too large to be sustainable.

DISCLOSURE: Long CVA, GPP, AGR, BEP, BEPC. Short calls on BEPC.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The post The Yieldco Virtuous Cycle appeared first on Alternative Energy Stocks.

]]>The post Ten Clean Energy Stocks for 2021: The List appeared first on Alternative Energy Stocks.

]]>by Tom Konrad, Ph.D., CFA

An annual tradition, here is my Ten Clean Energy Stocks for 2021, which is also the new model portfolio for the year, with equal dollar values of each stock using closing prices on 12/29/2020.

Returning Stocks

- Mix Telematics (MIXT)

- Green Plains Partners (GPP)

- Covanta Holding (CVA)

- Red Electrica (REE.MC, RDEIF, RDEIY)

- Valeo, SA (FR.PA, VLEEF, VLEEY)

- Veolia (VIE.PA, VEOEF, VEOEY)

New Stocks

- Scorpio Bulkers, Inc. (SALT) – Dry bulk shipper converting to offshore wind construction. Thanks to Thad Curtz for bringing my attention to this one.

- Brookfield Renewable Energy Partners (BEP) – A leading clean energy Yieldco with significant hydropower assets.

- Umicore, SA (UMI.BR, UMICF, UMICY) – Leading recycler of batteries and specialty metals.

- Avangrid (AGR) – Owner of renewable generation and utilities.

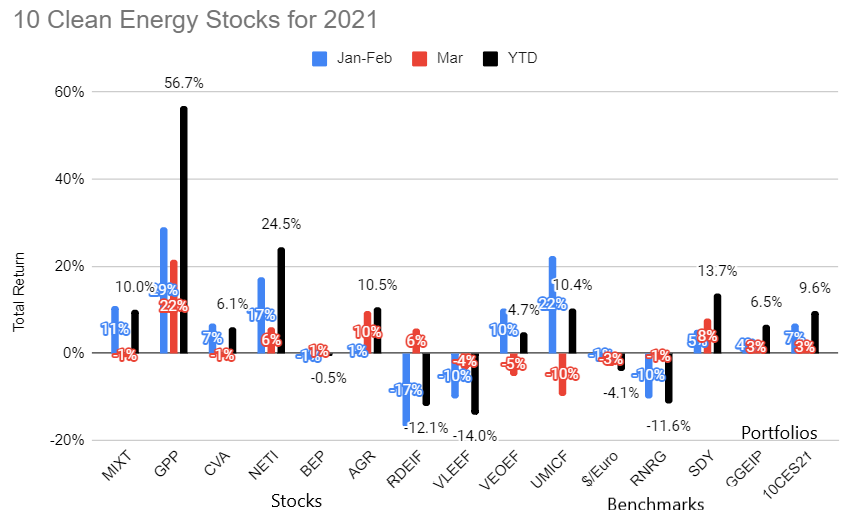

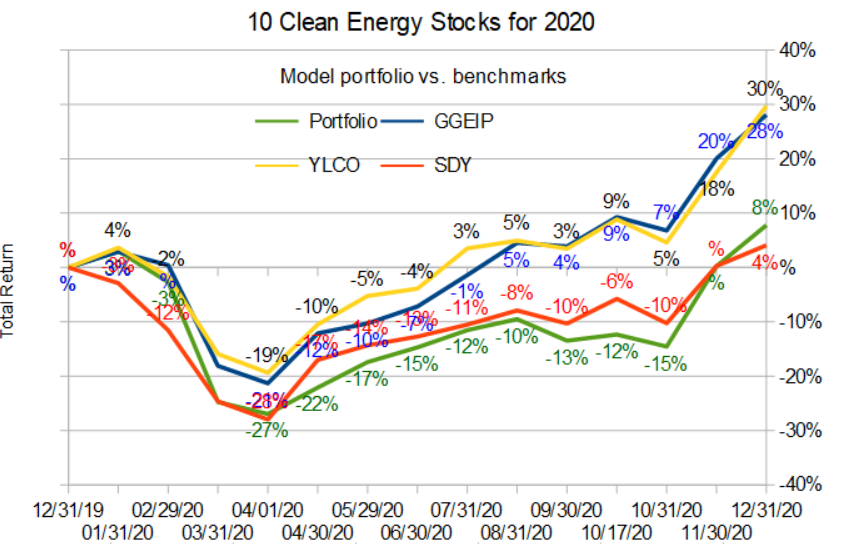

As I track this model portfolio over the year, I will continue using the Global X YieldCo & Renewable Energy Income ETF (YLCO) as a clean energy benchmark and the SPDR S&P Dividend ETF (SDY) as a broad market benchmark, while throwing in the performance of my real money managed portfolio, the Green Global Equity Income Portfolio (GGEIP) for good measure. The chart below shows preliminary numbers for 2020.

As I discussed last week, this was another difficult year to find clean energy stocks that I think are good values. It’s a great thing for the planet that the fossil fuel divestment movement seems to be driving up the prices of clean energy stocks, but it makes life harder for value investors like me.

Given the high valuations, I think it’s important to keep some cash on the sidelines, but my track record on calling market tops is abysmal, so I never get totally out of the market.

I’ll be following up this list with a series of articles looking at the individual holdings in depth over the next week. My Patreon supporters can read drafts of the first two here and here.

Update

You can now read all the articles looking at these stocks in more depth through the links below:

- Valeo, Veolia, Umicore, and Scorpio

- Covanta, Green Plains Partners, Avangrid, and Brookfield Renewable Energy Partners

- MiX Telematics and Red Eléctrica

DISCLOSURE: Long all stocks in the list.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The post Ten Clean Energy Stocks for 2021: The List appeared first on Alternative Energy Stocks.

]]>The post Solar Energy Industry Association (SEIA) Tax Equity Conference Brief appeared first on Alternative Energy Stocks.

]]>I recently attended the Solar Energy Industry Association‘s (SEIA) Finance and Tax Seminar in New York. The subject matter in this event delved into issues related to tax equity finance. Each panel session was moderated by a tax attorney or an accountant, and most of the content of the sessions consisted of technical tax law.

To place the discipline into context, one speaker noted that the tax equity renewables investing deal volume in 2018 was $2-3B for solar and $9B for wind, and the number of tax equity participants is roughly only 25-35 large corporations. So unless there are changes to the tax code that would widen the range of entities that could benefit from tax equity investing, the pool of investors is not likely to broaden parabolically. Total investments in the US for renewables in 2018 was estimated by Bloomberg New Energy Finance at $43B, and globally totaled $300B total for all clean energy investments, including equity raising by companies in smart grid, digital energy, energy storage and electric vehicle. Estimates from numerous NGO’s contend that the rate of investment needed to transition rapidly enough to bend the GHG temperature curves is more like $1-2Tr per year. So the scale of tax equity investment, although substantial and growing, is estimated to be less than 20% of the build rate needed to deliver 80% renewable electricity per various transition targets proposed by various states, the Green New Deal, & others.

The keynote session was moderated by a principal from Novogradac, an accounting firm with a large renewables practice, who prefaced with a very brief overview of the mechanics of the 3 primary partnership structures commonly used in the industry: the partnership “Flip” structure, Sale Leasebacks & Inverted Leases. A second session titled “Solar Finance 101” led by an attorney from Norton, Rose, Fulbright was provided specifically to elaborate on the structures.

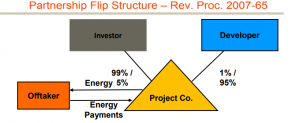

In a Partnership Flip the General Partner (Sponsor/developer) starts by holding 1% of equity, and the Tax Equity Investor (TEI) is the Limited Partner holding 99%. A flip in the ratio to GP 95% / LP 5% is triggered either by reaching a target yield (usually 5-7 yrs), or a date certain (6-8 years). The target ROI for the TEI in a yield-based version is in the range of 6.5%, earned from Investment Tax Credits against prior losses & development costs, and some portion of operating cash flow. The fixed-term version requires different terms for the investors to achieve the desired yield, and usually extends 6-8 years. The fixed flip leaves as much cash as possible for the sponsor, and pays the TEI’s cash as a 2% preferred distribution.

In the 101 session, the main challenge was identified as: how to get a step up in tax basis so that benefits are calculated on Fair Market Value rather than on Cost or DCF (discounted cash flow). She cited 3 court cases that will be adjudicating: a) the allowable standard for this valuation, b) whether developer fees should be limited to 12-18%, and c) whether use of DCF with a low discount rate that artificially raises value should be disallowed as a disguised sale. The test imposed by the IRS would disallow the ITC claim if the DCF is the same after the end of the PPA term, DCF should be different in the merchant period, usually expected to be 7.5% to compensate for the variability risks of merchant pricing.

“Absorption” was the other key element discussed throughout the conference, and is one of the more complex aspects of partnership taxation. The Capital Account for each partner documents what each has contributed and is allowed to take out in tax benefits, and cannot drop below zero. “Tax efficiency” characterizes whether the tax benefits can be fully taken by either party, or remain partially unclaimed. If the TEI capital account is at risk for drawing down too much, such that the tax benefits would re-allocate back to the sponsor who also could not use them, then the remedy is often a Deficit Restoration Obligation (DRO), in which the sponsor indemnifies the TEI.

A 2nd form used for tax equity financing is a Sale Leaseback, which involves an outright sale of 100% of the equity in the project by the Sponsor to the TEI, who then leases it back to the Sponsor & lease payments are a revenue stream from the Sponsor/ Leasee back to the TEI/ Leasor. 100% ownership avoids complicated partnership accounting, while preserving the TEI’s rights to the tax benefits, but still carries a risk of IRS disallowance if the TEI is treated as a lender rather than an owner.

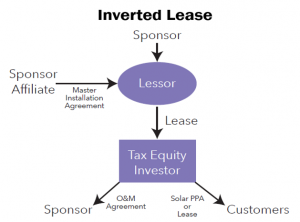

A 3rd form is an Inverted Lease which is used frequently in aggregations of residential rooftop PV systems. The sponsor bundles the customer contracts, assigns them to the TEI, and leases the equipment assets to the TEI, who collects the customer revenue, & pays most of it back to the Sponsor as rent. ITC’s are claimed by the TEI, but depreciation stays with the Sponsor, who then takes back the depreciated assets at the end of the lease term. Distribution of operating cashflow can be convoluted in all these structures, with competing claims from tax equity investors v. lenders, but several panelists seemed to reflect a consensus that this structure tends to leave comparably more of the cashflow for the developer or cash equity investors.

It is more complex conceptually, because there are two partnerships, an Operating entity & an Ownership entity, and both parties, TEI and Sponsor participate in both entities. In the Ownership entity, the Sponsor holds a majority position, and becomes the Leasor, and the Operating entity owned by the TEI becomes the Master Tenant/ Leasee, and transfers rents back to the Leasor. Risks of IRS challenge to the basis used to calculate tax credits can be managed by documentation that transactions have occurred at arms-length, and costs have been clearly segregated, that capital accounts remain positive, and that an appraisal solidly establishes the value. This “basis risk” is usually borne by the developer, but is often capped at the difference between project completed value minus costs. As encapsulated by midsized funder Captona, tax equity financing has an asymmetric contingent liability, a 5% upside but a 50% downside recapture & basis risk, of IRS challenge that can result in disallowance of the tax credits, or decertification of partnership status.

Each structure has pros & cons, but they all seek to optimize and protect the tax benefits for the TEI and the cashflow for the Sponsor, and each varies in dealing with indemnifications, cash sweeps and buybacks. Clearly, there is a fine art in selecting the optimum structure to suit the needs of the participants, and then negotiating each variable element. But surprisingly, when asked if these agreements were prone to litigation to resolve disputes, the answer was no. Bespoke agreements can be designed with bolt-on boilerplate options for contingent indemnifications, cash sweeps, buyback terms, and other assurances & disincentives, to avoid the need for dispute resolution, which would be adjudicated on the contract terms anyhow. For deeper dives into resources that illustrate technical renewable finance modeling, one can go to powerpoints produced by Akin Gump (a conference sponsor), and Finance Energy Institute (Ed Bodmer). An exhibit of a practice that utilizes all three forms of can be seen in Akin Gump’s Global Project Finance brochure.

Panelists in the keynote session, JP Morgan, US Bank, SolSystems, and GAF Solar, were asked about the scope of their transactions in 2018, their preferred structure, and their outlook.

- JPMorgan (JPM) did $3B in tax equity transactions (up from $1.5B in 2017), primarily yield-based flips, on utility scale deals of $150M per deal.

- US Bank, the 5th largest bank in the US, did tax equity fundings of $1.3B in 2018, down from $2B in 2017, which was attributed to the reduction in corporate tax rates from 35% down to 21%, materially affecting their term sheets.

- GAF, a private equity infrastructure fund based in the Bronx with a development side that included a roofing entity with a long history. GAF bundled roofing and solar systems, for both C&I offtakers and residential aggregations, in portfolios sized 50-100MW, and then financed them with tax equity partnerships, usually structured as yield-based flips, all of which he said had been over-subscribed. In some cases they took long duration credit positions on their own. He explained that their terms provided tax equity investors with max of 34% of eligible basis, referencing an economic substance test that allows for 3% IRR if the capital stack is limited to 34% in tax equity. TEI will usually then be able to utilize 99% of the depreciation, and remainder of return comes from 7% of EBITDA as unlevered cash distributed at the same time as distributions to the GP/ builder. He commented that leverage helps utilize the tax basis.

Goldman Sachs (GS), who was also present in another panel, described their activity as “warehousing”, providing lines of credit against PPA’s from residential aggregations for purposes of subsequently assembling asset-backed securities. Credit ratings were a concern, given the need to avoid a repetition of the events of 2008 when credit worthiness of component mortgage contracts in ABS bonds were improperly evaluated by S&P, Moody’s and others. A rep from Kroll Bond Rating Agency detailed their procedures for rating and stress testing ABS’s. Ratings could benefit from insurance “wraps” in order to guarantee revenue, which were offered by carriers including SwissRe, Ares, IGS, ING, New Energy Capital, as described by the CEO of kWh Analytics, which also offers a suite of risk mitigation services marketed as a “Solar Revenue Put”.

In discussing community solar financing, both for tax equity and securitization, panelists were concerned with customer “stickiness” or retention, and replacement. Panelists included two developers Nexamp & Arcadia Power, two private funders Wunder Capital & US Bank, & publicly funded NY Green Bank.

Sol Systems, who was present on several panels, is an employee-owned solar finance and development firm backed by Sempra Energy. It raises development capital, and provides capital management for tax equity asset funds. She noted that their operating level projects were often residential or small C&I aggregations. 80% of their deals were structured as inverted leases, and routinely used leverage in the lower Operating partnership, in order to optimize the depreciation and interest deductions, which in turn helped to manage the capital account and optimize the ITC claim by the Ownership partnership making the tax equity investment.

The CEO of SolSystems, (in absentia) offered an insightful industry overview of the competitive dynamics of capital in this space.

- The market for C&I procurement has evolved from buying voluntary RECs, to compliance RECs, now to VPPAs with supply from specific projects. These transitions are driven by a sustainability sentiment in corporate boards to be able to confirm direct relationship between their procurement efforts & new builds. The instruments for executing these relationships has evolved into a Contract for Difference, with supply hedging that can “shape & firm” pricing, such that end users see a simplified accounting that can be “sleeved” or integrated into utility bills.

- All-in costs have fallen 80% since ’08. Costs per module have dropped to $.30/W, in part because, in part because the equipment supply chain is now so vast, but there is also more excess due to a slowing in procurement by the government of China. Further cost reductions can be forecast due to increasing cell efficiencies, up to 5% from mono-PERC & bifacial cells, & improvements in Balance of System costs, including 2% from trackers at sub-array level & 3-5% from DC optimizers, which in aggregate will result in another 12% reduction in costs. O&M costs will be reduced by 1500V architectures & string inverters built into both new systems & retrofits.

- Utility scale cost will be $.95/watt, & PPA’s under $.03/kwh, based on the Lazard Levelized Cost of Energy report , a gold standard in the industry.

- These savings will enhance yields for large solar portfolio owners like Helios, Brookfield, and Global Infrastructure Partners.

- Scale of Solar Asset Class is 109K MWs installed globally, with a huge pipeline & investor demand, & will be a $10Tr market by 2050. Solar assets are attractive because they are a) real, b) non-correlated to equities markets, c) dollar denominated, & d) inflation insulated. EU & Asian countries have carrot-and-stick policies, imposing specific portfolio requirements for renewable investments while also granting reduced capital set-aside requirements. Many sovereign wealth funds & multinational banks also now have mandates to invest in renewables.

- More new investor entrants drive down cost of capital, by their acceptance of lower returns on investment, because they are viewed as less risky. Lower capital costs as a component of overall costs, drives down LCOE & PPA prices. To offset lower yields, investors are being compelled to take on more operational or project risk, by entering earlier in development.

- Private equity & hedge funds finding it increasingly difficult to compete both in acquiring and holding long term project assets, & are participating in less mature assets, and are being displaced by institutional investors – insurance companies, sovereign wealth funds, pension funds. Institutional investors included AES (AES), John Hancock, NextEra (NEE), Avangrid (AGR), EDF, Orsted (ORSTED.CO) & Equinor (EQNR). SolSystems has built a platform called Helios to help developers sell down their equity to institutional counterparties.

- Independent power producers have a fairly high WACC, in the range of 6.5% – 7.75% unlevered after-tax for those with long-term PPAs. But they can’t compete with institutional capital, and are struggling to support early stage pipeline that is taking longer to “harvest”, and consequently IPPs are being forced to refinance credit lines.

- The biggest problem affecting all aspects of the market right now is the huge back up in interconnection queues. There are 150GW of solar projects waiting for utility interconnection approvals. Many projects may have site control & early stage permits but no offtake or even a strategy for securing a customer. Developers are too aggressive in pursuing these early steps. Some markets remain attractive (NY, IL, VA, PJM), and pending RPS legislation in other states is driving interest, but the development horizons are being stretched beyond 3yrs, which means these projects must be held much longer on balance sheets or in relatively expensive development facilities.

- He recommends developers pull back from taking a buckshot approach, carrying the risks of holding partially developed inventory, and instead focus on the fundamentals of locational marginal pricing, congestion & policy.

The hurdles to accelerating decarbonization of electricity are not availability of capital, or lack of enterprising initiative, but a bottleneck at interconnection. The solutions to that problem must be resolved by reconfiguring structural impediments imposed by utilities and utility commissions. Technological advances are driving LCOE to fall faster than grid adaptations, and even with declining yields, capital markets demand for renewable assets are outpacing WACC for development. But for the drag of a centralized grid, the components are in place to accelerate implementation of a GND-level vision for renewable electricity.

The post Solar Energy Industry Association (SEIA) Tax Equity Conference Brief appeared first on Alternative Energy Stocks.

]]>The post List of Power Production Stocks appeared first on Alternative Energy Stocks.

]]>Alternative energy power production stocks are companies whose main business is the production and sale of electricity from alternative energy installations, such as solar farms, wind farms, hydroelectric generators, geothermal plants, cogeneration facilities, and nuclear plants.

This list was last updated on 9/11/2020.

Acciona, S.A. (ANA.MC, ACXIF)

Atlantica Yield plc (AY)

Algonquin Power & Utilities Corp. (AQN, AQN.TO)

Avangrid, Inc. (AGR)

Bluefield Solar Income Fund Ltd. (BSIF.L)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Partners L.P. (BEP)

Capital Stage AG (CAP.DE)

Edisun Power Europe AG (ESUN.SW)

Elecnor, S.A. (ENO.MI)

Foresight Solar Fund plc (FSFL.L)

Global X YieldCo ETF (YLCO)

Greencoat UK Wind PLC (UKW.L)

Innergex Renewable Energy Inc. (INE.TO,INGXF)

John Laing Environmental Assets Group Limited (JLEN.L)

NextEra Energy Partners, LP (NEP)

Northland Power Inc. (NPI.TO, NPIFF)

Clearway Energy (CWEN, CWEN-A)

Ormat (ORA)

Polaris Infrastructure Inc. (PIF.TO, RAMPF)

Reservoir Capital Corp. (REO.CN. RSERF)

TransAlta Renewables Inc. (RNW.TO, TRSWF)

The Renewables Infrastructure Group Limited (TRIG.L, RWFRF)

US Solar Fund PLC (USF.L)

Veolia Environnement S.A. (VIE.PA, VEOEY, VEOEF)

Global X YieldCo Index ETF (YLCO)

If you know of any alternative energy power producer that is not listed here or any stock that should be removed, please let us know by leaving a comment.

The post List of Power Production Stocks appeared first on Alternative Energy Stocks.

]]>The post List of Wind Farm Owner and Developer Stocks appeared first on Alternative Energy Stocks.

]]>Wind farm owner and developer stocks are publicly traded companies that site, permit, develop, construct, own, or operate wind farms for producing electricity.

This list was last updated on 3/22/2022

Acciona, S.A. (ANA.MC, ACXIF)

Adani Green Energy (ADANIGREEN.NSE)

Algonquin Power and Utilities (AQN, AQN.TO)

Atlantica Yield PLC (AY)

Atlantic Power Corporation (AT)

Avangrid, Inc. (AGR)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Energy Partners (BEP)

China Longyuan Power Group Corporation Limited (0916.HK, CLPXF)

China Ruifeng Renewable Energy Holdings Limited (0527.HK)

Orsted (ORSTED.CO, formerly DENERG.CO)

E.ON AG (EONGY)

Enel SpA (ENEL.MI, ESOCF)

Greencoat UK Wind (UKW.L)

Infigen Energy Limited (IFN.AX, IFGNF)

Innergex Renewable Energy Inc. (INE.TO, INGXF)

Neoen S.A (NEOEN.PA)

NextEra Energy Partners, LP (NEP)

NextEra Energy, Inc. (NEE)

Nordex AG (NRDXF, NDX1.DE)

Northland Power Inc. (NPI.TO, NPIFF)

NRG Yield, Inc. (NYLD, NYLD-A)

Otter Tail Corp (OTTR)

PNE Wind AG (PNE3.DE)

ReNew Energy Global plc (RNW)

The Renewables Infrastructure Group (TRIG.L)

TransAlta Renewables, Inc. (RNW.TO, TRSWF)

Xcel Energy Inc. (XEL)

Wind Works Power Corp. (WWPW)

If you know of any wind farm owner or developer stock that is not listed here, but which should be, please let us know in the comments. Also for stocks in the list that you think should be removed.

The post List of Wind Farm Owner and Developer Stocks appeared first on Alternative Energy Stocks.

]]>The post List of Electric Grid Stocks appeared first on Alternative Energy Stocks.

]]>Electric grid stocks are publicly traded companies whose business involves electric infrastructure, including transmission, distribution, pricing, conversion, and regulation. Includes the list of smart grid stocks.

This article was last updated on 8/12/21.

ABB Ltd (ABB)

Advanced Energy Industries (AEIS)

AMSC (AMSC)

Avangrid, Inc. (AGR)

AZZ Incorporated (AZZ)

China Ruifeng Renewable Energy Holdings Ltd (0527.HK)

Companhia Paranaense de Energia – COPEL (ELP)

Custom Truck One Source, Inc. (CTOS)

Digi International (DGII)

Echelon Corporation (ELON)

EMCORE Group, Inc (EME)

ESCO Technologies, Inc. (ESE)

Fortis, Inc. (FTS, FTS.TO)

General Electric (GE)

Hammond Power Solutions Inc. (HPS-A.TO, HMDPF)

Hubbell, Inc. (HUB-B, HUB-A)

Itron (ITRI)

Landis+Gyr Group AG (LAND.SW)

MasTec Inc. (MTZ)

MYR Group Inc. (MYRG)

National Grid PLC (NGG)

Prysmian S.P.A (PRI.MI, PRYMF)

Quanta Services Inc (PWR)

Red Electrica (RE21.SG, RDEIY)

Schneider Electric (SU.PA, SBGSF, SBGSY)

Siemens AG (SIE.DE, SIEGY)

SMA Solar Technology (S92.DE)

SolarEdge (SEDG)

Stella Jones (STLJF)

Superconducting Technologies, Inc. (SCON)

TE Connectivity, Ltd (TEL)

Terna – Rete Elettrica Nazionale Società per Azioni (TRN.MI, TERRF, TEZNY)

Valmont Industries (VMI)

WESCO International (WCC)

If you know of any electric grid stock that is not listed here and should be, please let us know by leaving a comment. Also for stocks in the list that you think should be removed.

The post List of Electric Grid Stocks appeared first on Alternative Energy Stocks.

]]>The post Can the Geothermal Industry Overcome Challenges to Raising Capital? appeared first on Alternative Energy Stocks.

]]>By Jane Pater Salmon, Navigant Consulting

Geothermal energy presents baseload clean energy at a lower cost than many other renewable energy alternatives. Despite this compelling value proposition, long development horizons and the risks associated with exploration and drilling activities present hurdles to developing the country’s rich geothermal potential. Financing projects that use conventional geothermal technology remains challenging in the uncertain economic environment.

In the past year, geothermal project developers used alternative strategies to overcome three common challenges to geothermal project finance. While the challenges for raising capital at the project level are consistent with those faced in previous years, they have become even more pronounced as investors’ risk-tolerance remains low and capital constraints continue.

Three key challenges to raising capital for geothermal project investment have adversely affected developers in the past year.

- Concerns about creditworthiness of smaller firms. The geothermal industry is a fragmented one, with many smaller companies holding portfolios of just a few projects. With fewer assets against which to secure loans, these smaller firms pose a more significant risk than firms with more diversified portfolios. Even though many of these companies are traded on public exchanges, their capitalization levels are relatively low compared to larger renewable energy technologies companies like Vestas (VWDRY.PK), First Solar (FSLR), and Iberdrola (IBDRY.PK).

- Challenges securing debt with recourse to a single project. When conditions permit, developers prefer to secure project-level debt with no recourse to the company in the event of default. This “non-recourse debt” reduces the developer’s risk in the event of default because the company’s other assets are protected. Non-recourse debt, however, increases risk for lenders who generally have been unwilling to provide this type of loan in the past year. Lenders have sought more collateral to reduce the risk of loss.

- Higher transaction costs at the project level. Geothermal projects that have reached at least the permitting stage in the U.S. are smaller in terms of capacity as compared to other renewable energy projects. With few exceptions, geothermal projects are in the range of 25 to 50 MW, while wind projects are typically at least 100 MW. Similar levels of due diligence and negotiation are required for investments at this scale, resulting in relatively higher transaction costs for geothermal projects.

As a result, companies developing geothermal projects in the United States have deployed a diverse set of strategies fitting each company’s unique circumstance and leveraging the available resources to address these challenges.

Overcoming Concerns about the Creditworthiness of Smaller Firms

Well-known but smaller-cap geothermal firms have partnered with larger, more well-established firms. These partnerships provide smaller firms with the capital needed to move forward on their projects and in some cases, the credibility needed to secure financing. At the same time, larger firms benefit from the financial returns on the project and the strategic benefits of partnership.

Over the past year, both Nevada Geothermal Power and U.S. Geothermal deployed this strategy. Nevada Geothermal Power’s (NGLPF.OB) 30-MW Crump Geyser project in Oregon is a joint venture with geothermal industry giant Ormat (ORA). With a vertically integrated business model and a long history of strong financial performance, Ormat was seen as an ideal partner for the growing Nevada Geothermal Power. By providing the cash needed to complete the project, Ormat gained access to a lower-risk return on a project that was further into the development cycle than others in its own portfolio. The partnership also provided both companies with the potential to consider future collaboration.

U.S. Geothermal (HTM)partnered with Enbridge to raise equity for its 23-MW Neal Hot Springs project in Oregon. This partnership brought Enbridge, a Canadian gas transportation and distribution company, its first geothermal investment. The partnership leveraged Enbridge’s familiarity with the early-stage risk profile of geothermal development, which is closely related to that of oil and gas resources. It also provided Enbridge with the opportunity to experiment with investments in the renewable energy space at a much lower risk.

The creditworthiness of the Neal Hot Springs project was further strengthened by a U.S. Department of Energy Loan Guarantee, which backed a $97 million loan provided by the Federal Financing Bank. The loan represented the balance of capital needed to complete construction on the project. With the loan and the combined equity of U.S. Geothermal and Enbridge, the debt-to-equity ratio on the project was 75 to 25.

Addressing Challenges to Securing Debt with Recourse to a Single Project

Over the past year, geothermal developers have bundled combinations of their assets in order to leverage their equity investments with debt. In many cases, these assets are limited to a portion of those owned by the company but are broader than those assets tied to a specific project. This approach limits the amount of leverage developers have because the debt typically appears on the company’s balance sheet. In exchange, however, developers have secured the capital needed to continue to develop the resources to which they have rights.

Gradient Resources (formerly Vulcan Power) and Ram Power (RPG.TO) have each used corporate assets as collateral to secure credit in order to continue development. Gradient Resources secured a $13 million loan from GB Merchant Partners, LLC, with the firm’s geothermal drilling and cementing equipment. The proceeds from the loan enabled Gradient Resources to continue development of three projects in Nevada. This limited-recourse loan only put select assets at stake, but was unique in that the capital was not tied directly to the projects it will support.

In March 2011, Ram Power closed on a two-year $50 million credit facility providing additional working capital to support its portfolio of projects under development. The credit facility was secured by “unspecified assets” of the company but is not tied to a single project. In addition, the lenders retained rights to exercise warrants based on Ram Power’s reliance on the credit facility. The warrants provide the opportunity for the lender to earn additional returns on its investment if it elects to exercise them.

Reducing Transaction Costs Associated with Project Finance

Bundling projects to reduce transaction costs benefits both the lender and the borrower. The lender benefits from access to a portfolio of assets used to secure the loan. The borrower benefits from lower costs of capital, in t

erms of both fees to lenders and any arranger as well as in terms of staff time committed to closing the deal.

Both Ormat and John Hancock Life Insurance Company took advantage of these benefits in an application to the U.S. Department of Energy (DOE) for a Federal Loan Guarantee. Ormat bundled three projects McGinness Hills, Jersey Valley and Tuscarora that total 121 MW, achieving a scale similar to those achieved by wind projects. Meanwhile, bundling diversified John Hancock’s resource risk and development risk for projects in multiple stages of development. In June 2011, DOE conditionally awarded the bundle a partial guarantee of up to a $350 million loan.

Jane Pater Salmon is an Associate Director with Navigant. Her work focuses on strategic planning, market assessment, the intersection of business and policy, and the diffusion of innovation. Her recent geothermal projects include the development of a project finance guidebook for conventional geothermal projects and the analysis of business models for coproduced and geopressured resources. Ms. Salmon earned a BA in Government from the University of Notre Dame and graduate degrees in energy and business from the University of Colorado.

The post Can the Geothermal Industry Overcome Challenges to Raising Capital? appeared first on Alternative Energy Stocks.

]]>