The post How New Battery Applications Will Disrupt the Home Generator Market appeared first on Alternative Energy Stocks.

]]>By Tom Konrad Ph.D., CFA

The market for reliable back-up power in homes and businesses is booming.

With more people working from home and increasing news coverage of power outages due to severe weather events and public safety power shutoffs in California (not to mention domestic terrorism), power reliability seems like it’s destined for a long term boom.

New Competition

A decade ago, if you wanted backup power, a generator was the only option. Now, there are an increasing number of battery-based alternatives beginning to compete with generators to provide back-up power. While most battery-based solutions are better than gas or propane generators when it comes to carbon emissions, none of them can yet beat traditional generators in every way most homeowners and businesses consider important. It’s more of a “horses for courses” type scenario with the best solution depending on price, the amount of power needed, the length of power outage the buyer is preparing for, and convenience.

Here is a list of options a homeowner might consider and how they stack up.

Natural Gas Generators

Traditional gas generators which run off the utility gas network are a relatively inexpensive solution for a homeowner looking to power their entire home for extended power outages lasting days or weeks. The main downside for such gas generators is that they won’t work if the weather events or other factors cause a gas outage at the same time as an electrical outage. For example, during the 2021 Texas Power Crisis, one of the major causes was a cascading problem of cold temperatures shutting down both gas supplies and electric generation. The resulting lack of electricity caused further problems with gas supply leading to further electric shortfalls, and so on. All in all, gas supply dropped by approximately 56 percent (and production in Texas dropped by approximately 40 percent) during the crisis. This means that even people who had home gas generators may not have been able to use them when the power went out.

Liquid Propane Generators

Generac and competitors’ propane generators share the low cost and most of the convenience of gas generators but cost more to run because they rely on propane stored in a tank on the premises, and delivered propane fuel costs far more than pipeline gas. On the other hand, local storage of the fuel makes them more reliable in an electrical outage that lasts a few days even if the crisis also affects the natural gas supply. On the downside, the generator will eventually use all the fuel in the tank, and a prolonged crisis may interfere with propane deliveries.

Gasoline and Diesel Generators

Gasoline and Diesel generators are typically smaller than the natural gas and propane generators. They typically do not have the capacity to power a whole home and deliver their power through outlets on the generator itself. Although they are not a solution for whole home power backup, they can be used to power critical loads like the refrigerator to prevent food from spoiling and charging electronics.

They are also commonly used by building contractors to work on sites that are not yet connected to the grid. Their relatively low price point (hundreds as opposed to thousands of dollars) appeals to people who want some backup power but find that a whole home generator is too much for their budget.

Home Battery Backup

There are now a number of home energy battery brands in addition to the best known Tesla (TSLA) Powerwall. These include the PWRcell offering from home generator leader Generac (GNR), as well as offerings from Panasonic (Tokyo:6752 or US ADR:PCRFY), microinverter maker Enphase (ENPH), and solar manufacturer SunPower (SPWR).

Until the recent passage of the Inflation Reduction Act (IRA), the only way to get 24% the US federal Investment Tax Credit (ITC) for a home battery system was to install it with a solar system in such a way that it charged primarily from the solar. The IRA both extended and raised the ITC to 30%, and made it applicable to stand-alone battery systems.

Now that home battery systems can be installed independently from solar and still qualify for the ITC, we can expect demand to increase as homes and businesses that are not good candidates for solar suddenly see effective prices fall by 30%.

Batteries vs Generators

Even with the tax credit, however, home battery storage is likely to remain relatively expensive compared with generators for the purpose of maintaining power during an outage.

If a generator has enough power to supply the electricity need, it can continue to supply that need as long as it is connected to a large enough storage tank or to the gas network. Because of this, increasing the duration that a generator can protect against a power outage costs very little. In contrast, doubling the duration that a battery system can protect against a power outage requires doubling the size of the battery, which will nearly double the cost.

Because of this, generators have a significant economic advantage compared to stand-alone batteries when it comes to ensuring long term power supply. But while secure power supply may be the main attraction for consumers of home battery storage and generators, batteries are far more attractive to grid operators and utilities because of many services they can provide that generators cannot:

- No direct greenhouse gas (GHG) emissions: Electricity from batteries is as clean as the power used to charge them. Small generators, which rely almost exclusively on fossil fuels produce GHG emissions usually far in excess of other electricity on a utility’s grid. Any reliance on generators makes it harder for a utility to meet its targets for GHG emissions reduction. While some utilities have voluntary GHG targets, many also are subject to legally binding targets imposed by their regulators and state governments.

- Load shifting and renewable energy integration: Increasing solar and wind penetration on the grid is rapidly changing net usage patterns for electricity. This trend is particularly pronounced in states that have been early adopters of solar, like California and Hawaii. Both have now adopted compensation schemes for solar that give homeowners strong incentives to pair solar with battery systems. Since these battery systems also give the homeowners some protection against power outages, this eats into the market for home generators.

- Utility grid upgrade deferral: Batteries can also be used to delay or replace expensive grid upgrades. Utility power lines and transformers need to be sized to the peak power usage that passes through them, even if this peak only occurs for a few hours per year. If controlled by the utility, batteries in homes can help with this: by charging when the local line or transformer is operating well below its peak capacity, and supplying that power to meet local demand when it otherwise would be operating at or above peak.

Green Mountain Power has an interesting pilot program where it leases home battery systems to customers at a subsidized rate in return for the right to use that battery for both utility upgrade deferral and load shifting so long as it keeps enough charge in the battery to assure the customer that they will have protection from a power outage. Battery system owners can also enroll in the program in exchange for an upfront payment of up to $9,500. A payment that large could easily influence a homeowner to prefer a battery backup system over a generator.

I expect similar programs to proliferate around the country as utilities and their regulators become more familiar with the benefits batteries can deliver to the grid.

…And It Also Provides Backup Power

An even larger potential disruptor for the generator market is devices that consumers buy for other reasons, but which can also provide power in a blackout. A prime example of this is the Ford (F) F-150 Lightning: an all-electric pickup truck which can also power your home with the right electrical upgrades. Electric cars from Nissan and VW are expected to have similar capabilities soon.

The F-150 is only the most prominent example of battery powered vehicles, devices, and appliances that can also deliver backup power. Many other electric and plug-in hybrid electric vehicles come equipped with standard 120V outlets, while the Kia EV6 has an adapter which turns the charging port into a functional 120V outlet. Even if an electric or hybrid vehicle does not come with a 120V outlet, an inverter costing $300 or less plugged into the cigarette lighter or attached to the car’s traditional 12 volt battery can serve much the same purpose. This ability of an electric or hybrid vehicle to power one or more standard outlets is referred to as “Vehicle to Load” while the F-150 Lightning’s ability to replace a home generator is often called “Vehicle to Home.”

While Vehicle to Load cannot replace the utility of a whole home generator, it can easily replace the functionality of smaller gas and diesel generators. Homeowners who already have electric cars that can power their refrigerator and charge their electronics will also be less likely to spend thousands of dollars on a generator to power their whole home during infrequent outages.

Energy Storage Equipped (ESE) Appliances

Nor are cars the only devices that can provide incidental power backup. Owners of Ego battery lawnmowers, snowblowers, and other devices can buy the Ego Nexus Power Station which uses the batteries from those devices to provide all the functionality of a gasoline or diesel generator that can be used indoors.

Photo: The author and other members of the Marbletown Environmental Conservation Commission and Rondout Valley High School Environmental Club with their all electric entry in a holiday parade. The trailer is being towed by a 2012 Toyota RAV4 EV and the lights and music on the trailer are powered by a Ego Nexus Power station. Other entries trailers in the parade have lights powered by gas or diesel generators.

Another potential development is the including of batteries in home appliances that have not previously had them. These Energy Storage Equipped (ESE or “Easy”) Appliances also provide incidental power backup. The main purpose of the batteries is to enable efficient electric appliances like induction stoves and heat pump water heaters to replace their gas counterparts without expensive electrical upgrades. The batteries allow them to deliver high power performance (like an induction stove’s unmatched ability to boil a large pot of water in minutes) while plugging in to a typical low-power electric outlet. The extra cost of the battery is offset by lower installation cost and the new investment tax credit for battery storage, effectively delivering a device that not only delivers high performance cooking at no extra cost, but also provides an external outlet which can power your fridge and other critical loads during a power outage.

While neither the Nexus Power Station nor an ESE appliance can deliver the full performance of a home generator, if someone gets one because they need a new stove or snowblower, they will probably be less willing to pay thousands of dollars for a home generator.

Conclusion

While the market for reliable home power is expanding, companies that sell home generators seem likely to benefit only in the short term. Longer term, increasingly ubiquitous electric and hybrid electric vehicles with Vehicle to Home and Vehicle to Load capability, along with Energy Storage Equipped (ESE) appliances and utility programs that subsidize (or give away) home battery storage will disrupt the market for generators in a way with which they cannot compete.

How will a home generator installer persuade a customer to spend many thousands of dollars on a home generator when they already have most of the resiliency benefits it can supply for much lower cost, or even for free as an extra feature of an appliance they would have bought anyway?

A few people still buy high-end digital cameras for the capabilities that a cell phone can’t yet emulate, but those people (and those capabilities) are becoming fewer and fewer. Ten years from now, we’ll be saying the same things about home generators’ capabilities and home generator buyers..

DISCLOSURE: No positions in companies mentioned in this article.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The post How New Battery Applications Will Disrupt the Home Generator Market appeared first on Alternative Energy Stocks.

]]>The post Surprisingly Affordable Electric Vehicles appeared first on Alternative Energy Stocks.

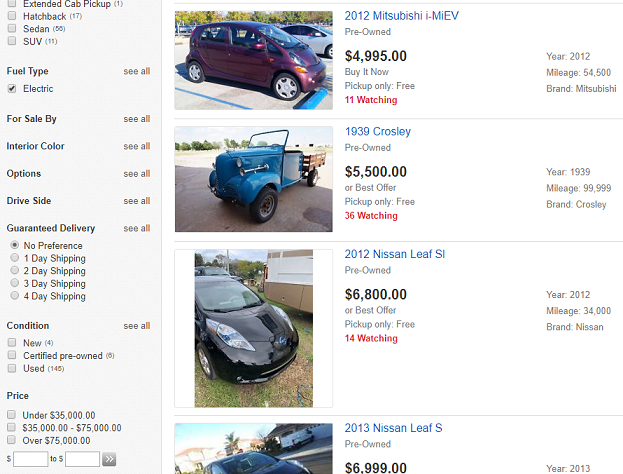

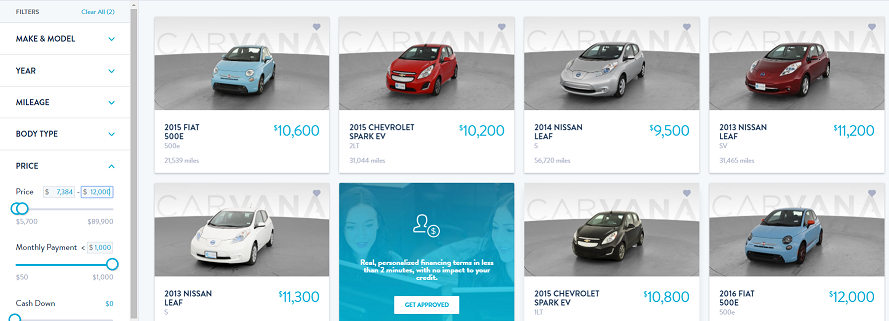

]]>When will electric vehicles cost the same or less than gas cars? If you are buying a used vehicle, the answer is “Today.”

If you are considering buying a used car, cost is clearly important to you. That’s why you should seriously consider a used electric vehicle (EVs). Lists of cars that lose their value fastest (a good thing if you are a used car buyer) are full of electric vehicles and luxury vehicles. The first generation of electric vehicles including GM’s (GM) Chevy Volt and the Nissan (NSANY) Leaf regularly appear on lists of cars that depreciate quickly. Less well known early EV like the 2012-2014 Toyota (TM) RAV4 EV and the Ford (F) Fusion Energi can also be had for a fraction of their new vehicle price.

Low prices for used EVs come despite the fact that they are much less expensive to own than used gas vehicles. Not only does electricity cost approximately half as much as gasoline per mile driven, but EVs don’t require oil changes, need less frequent brake pad replacement (because much braking is done with the electric motor) and don’t require emission testing (or repairs if they fail), and there is no transmission.

The flip side of buying a first generation EV is limited driving range, and a used EV will have less range even than they had when new. You can expect your used EV to have between 5 percent and 20 percent less range than it did when new. The early Nissan Leaf is one that can see significant battery degradation, especially if it was driven a lot in hot climates. The Leaf lacks a battery temperature management system, which does a lot to protect the batteries in most other EVs.

How to Choose

If have a one car household and live rural or frequently take long trips, the limited range of pure EVs means that you will probably want a Plug-In Hybrid EV (PHEV) like the Volt. These cars have limited electric-only range (38 miles in the case of the Volt), after which a gas engine kicks in.

If you have access to another car for longer trips, a low cost EV with limited range will allow you to do most of your driving for pennies per mile. Choosing one is relatively easy because there are only a few common models. A Smart EV can often be found for as little as $5000, but had only 58 miles of electric range when new (expect 50 to 55 miles depending on how old the one you find is.) The ubiquitous Leaf can be had for as little as $9000 and will give you about 70 miles of range. People who need more range should consider a used Volt plug-in hybrid. A used Volt can be had for about $15,000, and gives the opportunity to drive on electric power for something like 35 miles after battery degradation, but also has a gas generator for longer trips.

A number of other, more obscure EVs were built in limited quantities from 2011 to 2016, such as the 2012-14 RAV4 electric. I highly recommend Facebook groups and other online groups dedicated to particular models both for learning the ins and outs of a car you might be interested in, and for finding used EVs without the dealer mark-up.

Inexpensive Home Charging

All EVs and PHEVs come with a “Level 1” charger that plugs into an ordinary 120V outlet and will add about 5 miles of range per hour of charging. With this, a Volt will be fully charged in 7 hours, a Smart in 11, and a Leaf in 15. The level 1 charger that comes with the Volt is also capable of Level 2 charging at double this rate if it is plugged in to 240V outlet like one for a dryer using an adapter costing $20 to $50.

For owners of EVs other than the Volt, inexpensive ($200 to $300), portable level 2 chargers that plug into various types of 240 volt outlets are available online. If you have such an outlet near your parking space already (perhaps for a clothes dryer in a garage) you can find one by searching for “Level 2 EV charger NEMA 6-20” if your outlet is a NEMA 6-20R. You can identify your receptacle by comparing to a NEMA configuration chart. Only if you do have to add a 240 volt outlet in your garage or next to your driveway does preparing for Level 2 charging have to be expensive.

If you only plan to drive your EV 50 miles or less a day, you can probably make do with Level 1.

How to buy

If you are buying one of the less common first generation EVs, you probably will not find it close by. Fortunately, having a car shipped to you is a lot simpler and less expensive than it sounds. While the buyer is usually responsible for the cost of delivery, if you buy from a dealer, they can arrange for the car to be shipped to you. Ebay Motors has links to third party shippers that will give you quotes for delivery along with its listings, and Carvana has its own delivery service. While you can expect to pay $500 to $1,500 for delivery, you will usually save more than that on the purchase price by buying online, and delivery charges are not subject to sales tax.

Conclusion

Buyers of new EVs can make the argument that the money they save on gas and maintenance pays for the extra up-front cost quickly. Electricity will cost 3 to 5 cents per mile driven, or even less if you can take advantage of free charging at work or at public charging stations. Buyers of used EVs get these same savings, without the extra up-front cost. If you’re looking for an affordable car, look no farther than a used EV.

The post Surprisingly Affordable Electric Vehicles appeared first on Alternative Energy Stocks.

]]>The post EV Fast Charging Disincentives appeared first on Alternative Energy Stocks.

]]>by Daryl Roberts

DC Fast Chargers (DCFCs) and Tesla superchargers are a key element in electric vehicle (EV) charging infrastructure that could facilitate wider adoption of EVs by enabling recharging that comes to resemble the time currently taken for gas station stops, and thereby reducing “range anxiety” for drivers.

However, the pricing structure for electrical costs incurred at commercial DC fast chargers is currently prohibitive, because it includes a special fee called a “demand charge”. Rate design in a number of states includes this additional charge, based on the “peak rate” on electric power consumed in kW. In New York, demand charges are determined from max instantaneous demand, the amount used in any 15-30min segment in a monthly billing cycle (not from coincident peak demand which is user demand that coincides with peak system demand). This is a separate factor, distinct from the volume of electricity actually consumed, which as priced in kWhs and referred to as the “volumetric charges”.

Demand charges were originally conceived to apply to small to medium commercial enterprises with high utilization, to incentivize reduction of demand during periods of demand congestion. As long as such businesses have peak instantaneous demand that coincides with periods of demand congestion, then these businesses can be said to be paying a fair rate for their cost of service.

DCFCs by contrast are “low utilization” enterprises, with low monthly load factor at current low levels of EV penetration, despite high capacity factors. DCFC load profiles are intermittent and random, as compared to the load profile for typical commercial entities driving demand. Consequently, peak instantaneous demand only rarely coincides with periods of demand congestion. Demand charges for DCFCs not only fail to align with the cost of delivering power, they are so disproportionate as a percentage of costs that even the NY Power Authority recognizes that the business proposition is rendered infeasible, precluding a viable case for DCFC investments.

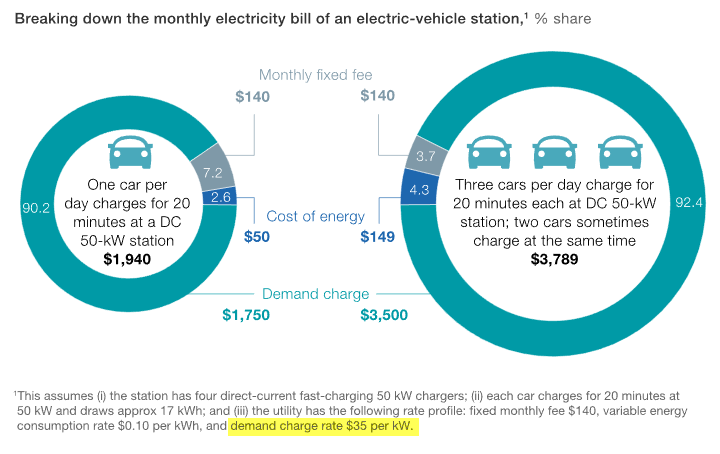

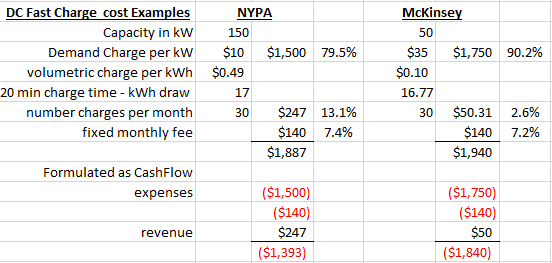

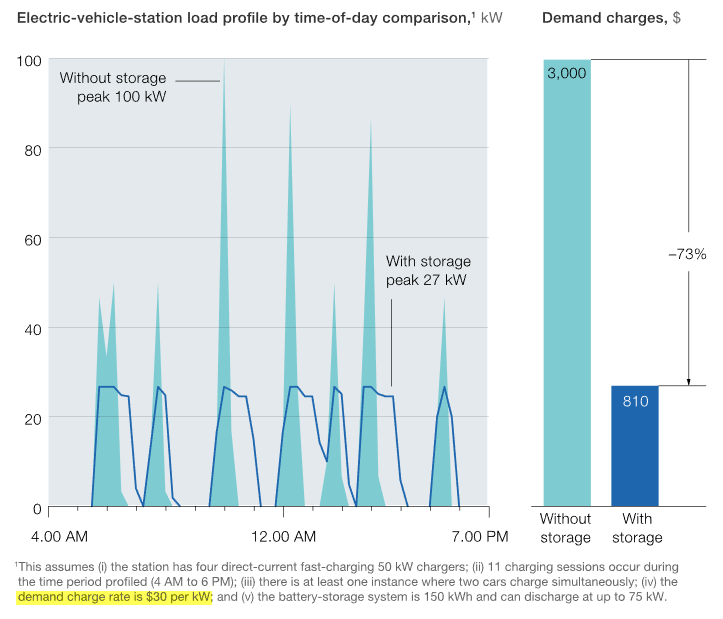

Two examples of the calculations demonstrate the problem – one included in a recent NY Power Authority petition to the Public Service Commission, the other in a Mckinsey consulting analysis (How battery storage can help charge the EV market) as shown in the graphic below.

Comparing the two examples in the table below, the NYPA version shows that demand charges constitute almost 80% of costs, which are roughly confirmed by the 90% shown in the McKinsey version. The ratio is not improved by 3x scaling as shown in the graphic, because the increased utilization also raises the total instantaneous demand.

As currently structured, in NY as well as in other states facing similar considerations, it is increasingly recognized that demand charges applied to low utilization, intermittent DCFC stations do little to mitigate impacts to peak load, but rather result in disincentives to development that are inconsistent with other state goals. In New York, a goal of 800,000 electric vehicles by 2025 was set under the Multi-State Memo of Understanding, and since there are less than 30,000 on the road in 2108, in order to add 110,000 EVs per year for the next 7 years, some dramatic incentives will be needed to accelerate infrastructure penetration and EV adoption.

A Rocky Mountain Institute study from Oct ‘17 contended that eliminating demand charges for DCFCs is consistent with societal objectives of vehicle electrification. Creating a business opportunity for companies that provide public EV charging is a societal objective and hence these companies should be able to earn a reasonable profit providing a valuable service & maintaining publically available charging equipment. Even if volumetric tariffs for public DCFCs does not recover all system costs incurred, some costs could be justifiably recovered from general customer base, because DCFC’s provide a public benefit in air pollution reduction & other local economic benefits.

Rather than designing a tariff by building up from cost basis of the utilities, RMI proposes instead to work down from a cost that would be attractive to EV drivers. Find a consumer cost target, deduct a reasonable profit margin, & set that as the rate ceiling for public DCFC owners. Any shortfall in utility revenue for actual costs of service could be recovered from the general customer base on a cost basis only, which would also recognize numerous EV-grid value streams, including benefits to the grid from “smart charging” EVSE’s and the value of enabling greater renewable energy penetration. As emerging EV telematics technologies evolve, a more precise quantification of the value streams in the EV-grid interaction can result in a more sophisticated & granular tariff design. NYSERDA offered a 2015 report with similar contentions Electricity Rate Tariff Options for Minimizing DCFC Demand Charges

In New York, the issue is before the Public Service Commission, NYPA Joint Petition of New York Power Authority, New York State … – NY.gov filed 4/13/18 by five agencies NY Power Authority, NYS Dept of Environmental Conservation (DEC), NYS DOT, and NYS Thruway Authority, to request immediate and long-term rate relief to encourage statewide deployment of DCFC facilities. The Petition argues that:

- Demand charges render DCFC business case infeasible, are not cost-based

- Shifting to non-demand metered rate is fully justified, would spur deployment

- Other states have taken similar action on demand charges for DCFCs, and offer various strategies for immediate elimination followed by incrementally adding them back in as utilization rates increase, such that incentives are structured to synergize with Time of Use rates to encourage charging at off peak periods.

- Immediate elimination of demand charges would reconcile the tariff to be consistent with other policy initiatives:

- Multi-state MOU for 800K vehicles by 2025

- GHG 40% reduction targets for 2030 in State Energy Plan, & exec Order 166

- Renewable Energy Vision goals (REV)

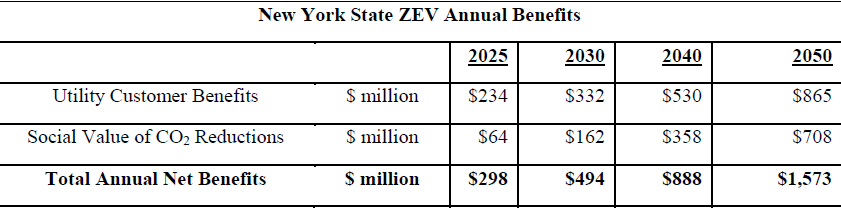

- 1500 DCFCs are calculated to be necessary to me the ZEV mandate, which if achieved would result in utility revenue arising from EV use of $234 million (net the loss of avoided delivery charges $58.8 million to $124.6 million), yielding net positive value to utility ratepayers at approximately $175 million to $109 million due to the increased EV adoption, made possible by increased penetration of DCFC, and increased throughput from EV charging by 2025

- CO2 reductions due to EV adoption would be valued at $64 million by 2025.

Supporting comments were filed 7/23/18 by the Sierra Club and Natural Resources Defense Counsel. Readers can view other comments that have been filed under the case number 18-E-0138 by numerous other industry participants, including by companies producing charging equipment, vehicles and charging networks [Tesla (TSLA), Greenlots, ChargePoint, EVgo, Siemens (SIE.DE, SIEGY), BYD (BYDDY, a Chinese electric bus manufacturer)], non-profit public interest organizations [RMI, NY Battery & Energy storage Tech Consortium, Advanced Energy Economy Institute, City of NY], and utilities [Orange & Rockland, PSEG (PEG), Niagara Mohawk, National Grid (NGG)] and others.

If this regulatory shift can be achieved, an accelerated transition to electrification of transportation is being envisioned in some interesting media. NYPA offers a vision for DCFC corridors that can provide 200 miles of range in 10 minutes of charge. Tesla has the most evolved vision for DCFC infrastructure, with over 1200 supercharger stations and 10,000 superchargers globally, and is promoting 3rd party development of charging convenience stops.

Other extensive DCFC charging networks are being developed with similar visions for providing sufficient charging services to accommodate massive adoption, including:

- Electrify America is administering, in collaboration with Greenlots, the VW (VOW.DE) settlement fund which is mandated to distribute $2B in infrastructure development as part of the fine in its emissions fraud case;

- Ionity, the European charging network [Porsche (PAH3.DE), Audi (NSU.DE), VW, Daimler (DAI.DE), BMW (BMW.DE) and Ford (F)],

- Fastned in the Netherlands

- ChargePoint & EVgo are the next largest charging network and EVSE providers in the US

- Projects linking remote renewable supply to DCFCs are also emerging. One such example was the remote net metering proposal from an independent renewable generator (small hydro) providing dedicated supply to an independent gas station chain in NY (Stewarts).

For charging station developers, the battle is being waged on two fronts: 1) to change the Demand Charge regulatory environment and 2) to develop charging facilities that integrate battery storage to benefit from time of use charging, and peak shaving discharge to smooth the load profiles and thereby avoid or reduce Demand Charge pricing, supplemented by PV generation on solar carports. Peak smoothing has the potential to significantly reduce the burden of demand charges, even if there is no regulatory relief, as shown in the calculations below, in this estimate by 73%.

Perhaps the most forward looking is the vision of tech firm ZapGo, which is developing carbon ion supercapacitors that will be integrated with batteries to enable very short charging times, both for end user vehicles and for supply trucks envisioned be able to deliver fast recharging of bulk storage in filling station environments.

Both technology and regulatory solutions need to be aggressively pursued in order to achieve the goals being set forth, for reduction of GHG’s and dramatically increased electrification of transportation.

Bio

Daryl Roberts has been following renewable energy technology & policy for 20 years, recently most interested in EV charging infrastructure, community solar development and net metering policy, utility scale solar development, project financing, and renewable energy asset management. He has participated in Sierra Club electric vehicle policy initiatives, and offered consulting for grant applications to install municipal EV charging stations. He has been involved with business plan development for commercial projects in diverse technologies, municipal solid waste gasification, PV fabrication on architectural glass, and LENR research. Previously he worked for almost 20 years in litigated medical malpractice claims.

The post EV Fast Charging Disincentives appeared first on Alternative Energy Stocks.

]]>The post New Biodiesel Vehicles and Emissions Reduction Estimates appeared first on Alternative Energy Stocks.

]]>

The makers of the world’s favorite advanced biofuel — a/k/a the biodiesel industry — descended upon Texas to mingle, make and renew ties at the 2018 National Biodiesel Conference. And, to champion new ideas and find new supply chain and distribution partners.

Bummer that there wasn’t a biodiesel tax credit extension on offer. (UPDATE: The new budget includes the biodiesel tax credit.) Bummer that diesel’s getting a bad rap in the press. Bummer that Tom Petty isn’t with us any more to sing:

“I’ll Stand My Ground, I Won’t Back Down,

I know what’s right, got just one life

in a world’s that keeps on pushing me around, I Stand My Ground”.

Because he might as well be singing to biodiesel’s makers, distributors and legion of customers and fans. In a world of coal cars running electric drivetrains, biodiesel still brings the power, the thrill, and the real thing on emissions.

A Ford Flivver in a Fuel Economy First — and B20 ready

Several automakers’ new 2018 diesel models were featured and a highlight was Ford’s (F) first first-ever Ford F-150 diesel with a targeted EPA-estimated 30 mpg highway rating and full B20 support. B20 is a fuel blend of 20 percent low-carbon biodiesel with petroleum diesel.

Ford F-150 is delivering another first – its all-new 3.0-liter Power Stroke diesel engine targeted to return an EPA-estimated rating of 30 mpg highway, and B20 support.

The Ford F-150 joins the F-250/350/450 Super Duty and F-650/750 medium duty trucks as well as the Transit van to round out Ford’s strong line-up of diesel models supporting the use of B20 biodiesel blends. In mid-January, Ford dealers begin taking orders for the 2018 F-150 with all-new 3.0-liter PowerStroke diesel engine, and deliveries begin this spring.

But let’s not overlook General Motors (GM), which is also bringing a strong lineup of 20 different diesel vehicle options to market in the 2018 model year, spanning the car, truck, van and compact SUV categories. General Motors supports B20 in all 20 of its diesel models. One of GM’s flagship models, the 2018 Chevrolet Silverado HD pickup with a 6.6L Duramax turbo diesel engine, as well as the new 2018 Chevy Equinox SUV with 1.6L turbo diesel engine, will be featured at the National Biodiesel Conference this week compliments of The Thompson Group Classic Chevrolet in Grapevine, TX.

The important off-road equipment market was highlighted by John Deere’s (DE) 5075E with a B20-supported PowerTech turbocharged diesel engine. John Deere was one of the first original equipment manufacturers to get involved with biodiesel, and this year the company is celebrating an important anniversary of its own – the 100th year since the first John Deere tractor was built.

And equipment giant Caterpillar (CAT) was showcasing a CAT 938M Small Wheel Loader with a high torque, low speed C7.1 ACERT engine in the Biodiesel Vehicle Technology Showcase.

Going for B100? In the after-market, there was Optimus Technologies, whose technology enables B100 use even in the coldest climates. With its controller and second heated B100 tank system, Optimus is providing fleets an easy and cost-effective way to use pure B100 biodiesel in their existing vehicles and reduce carbon by 80 percent at a fraction of the cost of conversion to other fuel alternatives being considered that don’t provide as much carbon reduction, like compressed natural gas.

Today over 80 percent of the diesel vehicles coming off production lines fully support the use of B20, and OEMs are beginning to look into higher blends as well.

Emissions reductions

Highlight from the week was a new study from the United States’ Argonne National Laboratory on biodiesel’s lifecycle energy and greenhouse gas emission effects found biodiesel compared to petroleum diesel reduces GHG emissions by 72 percent and fossil fuel use by 80 percent.

This study represents the first time Argonne National Laboratory has published a lifecycle assessment of biodiesel including indirect land use change. ILUC has been included in analyses by the U.S. Environmental Protection Agency and the California Air Resources Board that independently conclude biodiesel’s GHG advantage exceeds 50 percent reduction over diesel fuel.

“The improvements to ILUC modeling in this study were not possible just a few years ago, because we did not have as much data as we do today,” said Farzad Taheripour, one of the authors of this paper from Purdue University’s Department of Agricultural Economics. “Data available today shows that farmers all around the world are increasing productivity on existing farm land. Calibrating the model to these real-world trends improves the accuracy and reduces the predicted emissions of biofuel expansion.”

The improved model reduces ILUC emissions by more than 30 percent relative to the score adopted by CARB in 2015.

Roughly half of the biodiesel used in the US is made from soybean oil. The other half is produced from sources like used cooking oil, animal fats, and other fats and oils. The authors of this study began by collecting the latest data on the energy and emissions from farming soybeans. Soybeans are grown primarily to produce protein meal for livestock feed. So, the first processing step after soybeans leave the farm is to a soybean crush facility where 80 percent of every soybean is used to produce livestock feed. The volume of oil that remains after protein extraction exceeds demand for feed or food, (i.e. salad dressing, frying and baking, etc.), so a portion of that oil that we cannot eat or export is used to produce biodiesel.

“This study includes the largest ever survey of biodiesel production facilities to capture the energy used in the form of natural gas and electricity to convert fats, oils, and grease into biodiesel fuel,” said Jeongwoo Han, who maintains the GREET model for Argonne National Lab.

All these emissions were also combined with the emissions of transporting raw ingredients and finished fuel to market. By including all the emissions in the entire fuel lifecycle, this report presents a comprehensive comparison with the emissions of producing and using diesel fuel. This study includes more data but yields consistent results with other studies published over the last two decades.

The Bottom Line

To heck with the mess in DC, there’s cheerful new data on emissions reduction, a new B20 compliant vehicle from Ford and some NBB recognition of R&D and deployment pioneers were there to greet them all in Texas, and in DC the fight goes on. Biodiesel stands its mighty ground.

Jim Lane is editor and publisher of Biofuels Digest where this article was originally published. Biofuels Digest is the most widely read Biofuels daily read by 14,000+ organizations. Subscribe here.

The post New Biodiesel Vehicles and Emissions Reduction Estimates appeared first on Alternative Energy Stocks.

]]>