The post Yieldco Valuations Look Attractive appeared first on Alternative Energy Stocks.

]]>By Tom Konrad Ph.D., CFA

Despite a run-up in the fourth quarter of 2023, it has been a long time since valuations of clean energy stocks have been this cheap. Perhaps it is worries about hostility towards clean energy under a new Trump administration, or disappointment at the slow implementation of the Inflation Reduction Act. Whatever the cause, prices are low, and many clean energy stocks are likely to produce good returns even if the political climate turns further against them.

This is especially true for companies that are less dependent on favorable policy or subsidies. For instance, Yieldcos, high yield companies that own and develop clean energy assets like solar and wind farms get most of their profits from things which are already built. New subsidies, like those included in the Inflation Reduction Act, almost exclusively target new facilities. Because of this, changes in subsidies and interest rates will affect a Yieldco’s growth prospects, but will have limited effect on its short term earning potential.

Yieldcos such as Brookfield Renewable Energy (BEP and BEPC), Atlantica Yield (AY), Clearway (CWEN and CWEN-A), and Nextera Energy Partners (NEP) fell as much as 50% in 2023. At current prices, I love them all. Collectively, these four names account for a fifth of the portfolio. My current favorite is Nextera Energy Partners, which I have historically felt was consistently relatively overvalued because investors have had faith in its strong sponsor, Nexterea (NEE). That valuation did not survive the effects when persistently high interest rates led NEP to sharply cut its dividend growth targets last September.

Among the Yieldcos, NEP got the least benefit of the strong rally in the fourth quarter, and it is still trading at a price that gives it an 11% dividend yield. That high a yield would normally signal that investors are expecting a dividend cut. I think such a cut is unlikely. First, NEP’s liquidity and cash flow ratios are in line with other Yieldcos, and if management felt that a dividend cut might be necessary in the near future, they would have done it when they were already disappointing investors by slashing their dividend growth plans. Instead, I expect NEP’s dividend growth to stall for several years. But at 11%, who needs growth?

Among the Yieldcos, NEP got the least benefit of the strong rally in the fourth quarter, and it is still trading at a price that gives it an 11% dividend yield. That high a yield would normally signal that investors are expecting a dividend cut. I think such a cut is unlikely. First, NEP’s liquidity and cash flow ratios are in line with other Yieldcos, and if management felt that a dividend cut might be necessary in the near future, they would have done it when they were already disappointing investors by slashing their dividend growth plans. Instead, I expect NEP’s dividend growth to stall for several years. But at 11%, who needs growth?

Another likely scenario would be for NEE to buy back the outstanding shares of NEP to improve its own cash flow ratios. This is far from unprecedented – Transalta (TA) did exactly that last year by buying back the outstanding shares of TransAlta Renewables (Toronto: RNW). NEE, like TA, would buy NEP at a 10-20% premium to current prices. NEP has significant convertible debt financing, much of which will need to be refinanced in 2026. If NEP has trouble refinancing this convertible debt, I expect the most likely scenario will be a buyback by it parent, NEP. I’d prefer to collect an 11% dividend for several years to come, but a small short term gain is not something to scoff at.

DISCLOSURE: As of 1/15/2024, Tom Konrad and funds he manages own the following securities mentioned in this article: Brookfield Renewable Energy, Atlantica Yield, Clearway, Nextera Energy Partners. He expects to add to (but not sell) some of these positions in January 2024. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. All investments contain risk and may lose value. Past performance is not an indication of future performance. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

ABOUT THE AUTHOR: Tom Konrad, Ph.D., CFA is the Editor of AltEnergyStocks.com (where this article first appeared) and a portfolio manager at Investment Research Partners.

The post Yieldco Valuations Look Attractive appeared first on Alternative Energy Stocks.

]]>The post Solar Energy Industry Association (SEIA) Tax Equity Conference Brief appeared first on Alternative Energy Stocks.

]]>I recently attended the Solar Energy Industry Association‘s (SEIA) Finance and Tax Seminar in New York. The subject matter in this event delved into issues related to tax equity finance. Each panel session was moderated by a tax attorney or an accountant, and most of the content of the sessions consisted of technical tax law.

To place the discipline into context, one speaker noted that the tax equity renewables investing deal volume in 2018 was $2-3B for solar and $9B for wind, and the number of tax equity participants is roughly only 25-35 large corporations. So unless there are changes to the tax code that would widen the range of entities that could benefit from tax equity investing, the pool of investors is not likely to broaden parabolically. Total investments in the US for renewables in 2018 was estimated by Bloomberg New Energy Finance at $43B, and globally totaled $300B total for all clean energy investments, including equity raising by companies in smart grid, digital energy, energy storage and electric vehicle. Estimates from numerous NGO’s contend that the rate of investment needed to transition rapidly enough to bend the GHG temperature curves is more like $1-2Tr per year. So the scale of tax equity investment, although substantial and growing, is estimated to be less than 20% of the build rate needed to deliver 80% renewable electricity per various transition targets proposed by various states, the Green New Deal, & others.

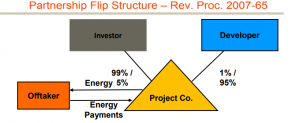

The keynote session was moderated by a principal from Novogradac, an accounting firm with a large renewables practice, who prefaced with a very brief overview of the mechanics of the 3 primary partnership structures commonly used in the industry: the partnership “Flip” structure, Sale Leasebacks & Inverted Leases. A second session titled “Solar Finance 101” led by an attorney from Norton, Rose, Fulbright was provided specifically to elaborate on the structures.

In a Partnership Flip the General Partner (Sponsor/developer) starts by holding 1% of equity, and the Tax Equity Investor (TEI) is the Limited Partner holding 99%. A flip in the ratio to GP 95% / LP 5% is triggered either by reaching a target yield (usually 5-7 yrs), or a date certain (6-8 years). The target ROI for the TEI in a yield-based version is in the range of 6.5%, earned from Investment Tax Credits against prior losses & development costs, and some portion of operating cash flow. The fixed-term version requires different terms for the investors to achieve the desired yield, and usually extends 6-8 years. The fixed flip leaves as much cash as possible for the sponsor, and pays the TEI’s cash as a 2% preferred distribution.

In the 101 session, the main challenge was identified as: how to get a step up in tax basis so that benefits are calculated on Fair Market Value rather than on Cost or DCF (discounted cash flow). She cited 3 court cases that will be adjudicating: a) the allowable standard for this valuation, b) whether developer fees should be limited to 12-18%, and c) whether use of DCF with a low discount rate that artificially raises value should be disallowed as a disguised sale. The test imposed by the IRS would disallow the ITC claim if the DCF is the same after the end of the PPA term, DCF should be different in the merchant period, usually expected to be 7.5% to compensate for the variability risks of merchant pricing.

“Absorption” was the other key element discussed throughout the conference, and is one of the more complex aspects of partnership taxation. The Capital Account for each partner documents what each has contributed and is allowed to take out in tax benefits, and cannot drop below zero. “Tax efficiency” characterizes whether the tax benefits can be fully taken by either party, or remain partially unclaimed. If the TEI capital account is at risk for drawing down too much, such that the tax benefits would re-allocate back to the sponsor who also could not use them, then the remedy is often a Deficit Restoration Obligation (DRO), in which the sponsor indemnifies the TEI.

A 2nd form used for tax equity financing is a Sale Leaseback, which involves an outright sale of 100% of the equity in the project by the Sponsor to the TEI, who then leases it back to the Sponsor & lease payments are a revenue stream from the Sponsor/ Leasee back to the TEI/ Leasor. 100% ownership avoids complicated partnership accounting, while preserving the TEI’s rights to the tax benefits, but still carries a risk of IRS disallowance if the TEI is treated as a lender rather than an owner.

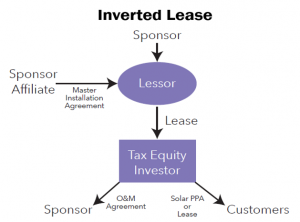

A 3rd form is an Inverted Lease which is used frequently in aggregations of residential rooftop PV systems. The sponsor bundles the customer contracts, assigns them to the TEI, and leases the equipment assets to the TEI, who collects the customer revenue, & pays most of it back to the Sponsor as rent. ITC’s are claimed by the TEI, but depreciation stays with the Sponsor, who then takes back the depreciated assets at the end of the lease term. Distribution of operating cashflow can be convoluted in all these structures, with competing claims from tax equity investors v. lenders, but several panelists seemed to reflect a consensus that this structure tends to leave comparably more of the cashflow for the developer or cash equity investors.

It is more complex conceptually, because there are two partnerships, an Operating entity & an Ownership entity, and both parties, TEI and Sponsor participate in both entities. In the Ownership entity, the Sponsor holds a majority position, and becomes the Leasor, and the Operating entity owned by the TEI becomes the Master Tenant/ Leasee, and transfers rents back to the Leasor. Risks of IRS challenge to the basis used to calculate tax credits can be managed by documentation that transactions have occurred at arms-length, and costs have been clearly segregated, that capital accounts remain positive, and that an appraisal solidly establishes the value. This “basis risk” is usually borne by the developer, but is often capped at the difference between project completed value minus costs. As encapsulated by midsized funder Captona, tax equity financing has an asymmetric contingent liability, a 5% upside but a 50% downside recapture & basis risk, of IRS challenge that can result in disallowance of the tax credits, or decertification of partnership status.

Each structure has pros & cons, but they all seek to optimize and protect the tax benefits for the TEI and the cashflow for the Sponsor, and each varies in dealing with indemnifications, cash sweeps and buybacks. Clearly, there is a fine art in selecting the optimum structure to suit the needs of the participants, and then negotiating each variable element. But surprisingly, when asked if these agreements were prone to litigation to resolve disputes, the answer was no. Bespoke agreements can be designed with bolt-on boilerplate options for contingent indemnifications, cash sweeps, buyback terms, and other assurances & disincentives, to avoid the need for dispute resolution, which would be adjudicated on the contract terms anyhow. For deeper dives into resources that illustrate technical renewable finance modeling, one can go to powerpoints produced by Akin Gump (a conference sponsor), and Finance Energy Institute (Ed Bodmer). An exhibit of a practice that utilizes all three forms of can be seen in Akin Gump’s Global Project Finance brochure.

Panelists in the keynote session, JP Morgan, US Bank, SolSystems, and GAF Solar, were asked about the scope of their transactions in 2018, their preferred structure, and their outlook.

- JPMorgan (JPM) did $3B in tax equity transactions (up from $1.5B in 2017), primarily yield-based flips, on utility scale deals of $150M per deal.

- US Bank, the 5th largest bank in the US, did tax equity fundings of $1.3B in 2018, down from $2B in 2017, which was attributed to the reduction in corporate tax rates from 35% down to 21%, materially affecting their term sheets.

- GAF, a private equity infrastructure fund based in the Bronx with a development side that included a roofing entity with a long history. GAF bundled roofing and solar systems, for both C&I offtakers and residential aggregations, in portfolios sized 50-100MW, and then financed them with tax equity partnerships, usually structured as yield-based flips, all of which he said had been over-subscribed. In some cases they took long duration credit positions on their own. He explained that their terms provided tax equity investors with max of 34% of eligible basis, referencing an economic substance test that allows for 3% IRR if the capital stack is limited to 34% in tax equity. TEI will usually then be able to utilize 99% of the depreciation, and remainder of return comes from 7% of EBITDA as unlevered cash distributed at the same time as distributions to the GP/ builder. He commented that leverage helps utilize the tax basis.

Goldman Sachs (GS), who was also present in another panel, described their activity as “warehousing”, providing lines of credit against PPA’s from residential aggregations for purposes of subsequently assembling asset-backed securities. Credit ratings were a concern, given the need to avoid a repetition of the events of 2008 when credit worthiness of component mortgage contracts in ABS bonds were improperly evaluated by S&P, Moody’s and others. A rep from Kroll Bond Rating Agency detailed their procedures for rating and stress testing ABS’s. Ratings could benefit from insurance “wraps” in order to guarantee revenue, which were offered by carriers including SwissRe, Ares, IGS, ING, New Energy Capital, as described by the CEO of kWh Analytics, which also offers a suite of risk mitigation services marketed as a “Solar Revenue Put”.

In discussing community solar financing, both for tax equity and securitization, panelists were concerned with customer “stickiness” or retention, and replacement. Panelists included two developers Nexamp & Arcadia Power, two private funders Wunder Capital & US Bank, & publicly funded NY Green Bank.

Sol Systems, who was present on several panels, is an employee-owned solar finance and development firm backed by Sempra Energy. It raises development capital, and provides capital management for tax equity asset funds. She noted that their operating level projects were often residential or small C&I aggregations. 80% of their deals were structured as inverted leases, and routinely used leverage in the lower Operating partnership, in order to optimize the depreciation and interest deductions, which in turn helped to manage the capital account and optimize the ITC claim by the Ownership partnership making the tax equity investment.

The CEO of SolSystems, (in absentia) offered an insightful industry overview of the competitive dynamics of capital in this space.

- The market for C&I procurement has evolved from buying voluntary RECs, to compliance RECs, now to VPPAs with supply from specific projects. These transitions are driven by a sustainability sentiment in corporate boards to be able to confirm direct relationship between their procurement efforts & new builds. The instruments for executing these relationships has evolved into a Contract for Difference, with supply hedging that can “shape & firm” pricing, such that end users see a simplified accounting that can be “sleeved” or integrated into utility bills.

- All-in costs have fallen 80% since ’08. Costs per module have dropped to $.30/W, in part because, in part because the equipment supply chain is now so vast, but there is also more excess due to a slowing in procurement by the government of China. Further cost reductions can be forecast due to increasing cell efficiencies, up to 5% from mono-PERC & bifacial cells, & improvements in Balance of System costs, including 2% from trackers at sub-array level & 3-5% from DC optimizers, which in aggregate will result in another 12% reduction in costs. O&M costs will be reduced by 1500V architectures & string inverters built into both new systems & retrofits.

- Utility scale cost will be $.95/watt, & PPA’s under $.03/kwh, based on the Lazard Levelized Cost of Energy report , a gold standard in the industry.

- These savings will enhance yields for large solar portfolio owners like Helios, Brookfield, and Global Infrastructure Partners.

- Scale of Solar Asset Class is 109K MWs installed globally, with a huge pipeline & investor demand, & will be a $10Tr market by 2050. Solar assets are attractive because they are a) real, b) non-correlated to equities markets, c) dollar denominated, & d) inflation insulated. EU & Asian countries have carrot-and-stick policies, imposing specific portfolio requirements for renewable investments while also granting reduced capital set-aside requirements. Many sovereign wealth funds & multinational banks also now have mandates to invest in renewables.

- More new investor entrants drive down cost of capital, by their acceptance of lower returns on investment, because they are viewed as less risky. Lower capital costs as a component of overall costs, drives down LCOE & PPA prices. To offset lower yields, investors are being compelled to take on more operational or project risk, by entering earlier in development.

- Private equity & hedge funds finding it increasingly difficult to compete both in acquiring and holding long term project assets, & are participating in less mature assets, and are being displaced by institutional investors – insurance companies, sovereign wealth funds, pension funds. Institutional investors included AES (AES), John Hancock, NextEra (NEE), Avangrid (AGR), EDF, Orsted (ORSTED.CO) & Equinor (EQNR). SolSystems has built a platform called Helios to help developers sell down their equity to institutional counterparties.

- Independent power producers have a fairly high WACC, in the range of 6.5% – 7.75% unlevered after-tax for those with long-term PPAs. But they can’t compete with institutional capital, and are struggling to support early stage pipeline that is taking longer to “harvest”, and consequently IPPs are being forced to refinance credit lines.

- The biggest problem affecting all aspects of the market right now is the huge back up in interconnection queues. There are 150GW of solar projects waiting for utility interconnection approvals. Many projects may have site control & early stage permits but no offtake or even a strategy for securing a customer. Developers are too aggressive in pursuing these early steps. Some markets remain attractive (NY, IL, VA, PJM), and pending RPS legislation in other states is driving interest, but the development horizons are being stretched beyond 3yrs, which means these projects must be held much longer on balance sheets or in relatively expensive development facilities.

- He recommends developers pull back from taking a buckshot approach, carrying the risks of holding partially developed inventory, and instead focus on the fundamentals of locational marginal pricing, congestion & policy.

The hurdles to accelerating decarbonization of electricity are not availability of capital, or lack of enterprising initiative, but a bottleneck at interconnection. The solutions to that problem must be resolved by reconfiguring structural impediments imposed by utilities and utility commissions. Technological advances are driving LCOE to fall faster than grid adaptations, and even with declining yields, capital markets demand for renewable assets are outpacing WACC for development. But for the drag of a centralized grid, the components are in place to accelerate implementation of a GND-level vision for renewable electricity.

The post Solar Energy Industry Association (SEIA) Tax Equity Conference Brief appeared first on Alternative Energy Stocks.

]]>The post Crowded Playground of Solar Panel Makers appeared first on Alternative Energy Stocks.

]]>The last post discussed the proposition of solar panel manufacturer SunPower Corporation (SPWR: Nasdaq). The company is looking for a partner to help build out and operate SunPower’s production facility in Hillsboro, Oregon. SunPower plans to manufacturer its innovative P-Series panels in Hillsboro to fulfill U.S. orders.

The Hillsboro plant was acquired in early 2018, from SolarWorld AG after the Trump administration slapped 30% tariffs on solar panels imported to the U.S. Domestic production, even at higher local costs, could make sense when compared to such prohibitive import tariffs.

SunPower is widely regarded as the go-to source for the highest quality solar cells available with efficiency ratings as high as 22.2%. The company’s products also have the reputation of being the most expensive brand on the market. The P-Series has been regarded as a breakthrough product not just for its technology, but for its potential to capture market share among price-conscious customers.

Notably, SunPower was not the only solar panel manufacturer that gave the appearance of responding to the Trump Administration tariffs with investment in U.S. manufacturing capacity. In March 2018, JinkoSolar (NYSE:JKS) invested an initial $50 million in a Florida factory that is ultimately expected to cost $410 million and have capacity to produce one million panels or 400 megawatts of solar modules per year. Trump may have taken credit for the move, but in fact JinkoSolar had been working on the plans for months before Trump’s tariffs were put in place.

Production is expected to begin yet in 2019 at Jinko’s new plant.

NextEra Energy Resources (NEE: NYSE), the parent of Florida Power & Light, has pledge to purchase over seven million solar panels over the next four years from JinkoSolar.

LG Electronics (KSE:066570) followed directly on JinkoSolar’s heels in June 2018 with a $28 million investment in a factory located in Huntsville, Alabama. Production is expected to begin in early 2019, and ramp to 500 megawatts of solar modules per year. It is noteworthy that LG has also adopted a technique for hiding circuitry and solders, moving the clutter to the back of the panel from the front to create efficiency. The technique is featured in LG’s Neo R Black product.

Construction started in late 2018, on Hanwha Q Cells new manufacturing site in Whitfield County, Georgia to produce PERC-cells. Hanwha’s version of the solar cell technology could give SunPower some strong competition. There have been reports of efficiency in the high teen’s in the Hanhwa product. Like SunPower’s P-Series, Hanhwa’s cells increase efficiency with an added layer in the back that reflects unabsorbed light back to the solar cell for a second absorption attempt.

The trade dispute between the U.S. and China has fostered some interesting new bedfellows. In September 2018, three solar panel manufacturers – Neo Solar Power, Gintech Energy Corporation and Solartech Energy Corporation – merged to form United Renewable Energy (UREC). From a legal perspective Neo Solar acquired the other two, but the point is the tie-up created a new entity that has sufficient strength to deal with the tariff situation head on. In the run-up to the deal closing, UREC management alluded to the possibility of a move into the U.S. However, after a US$90 million investment by the Taiwanese government, the new tie-up may keep its collective eye on Taiwan

The tariffs will decline over a four-year period, but in the near-term could have a lasting effect on the competitiveness of imported solar panels, even those granted an exemption like SunPower are affected. That does not mean U.S.-China trade talks no longer matter. If the discrepancies are finally worked out and both sides drop prohibitive tariffs, it could mean another significant shift in competitive dynamic.

At a time when the company is poised to capture market share, it is an interesting proposition to invest in SunPower, either as a joint venture partner or as a minority investor. In the next post we look at SunPower’s financial condition.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 2/26/19 as “Crowded Playground of Solar Panel Makers.”

The post Crowded Playground of Solar Panel Makers appeared first on Alternative Energy Stocks.

]]>The post Investing in in Prairie Winds appeared first on Alternative Energy Stocks.

]]>Last week NextEra Energy, Inc. (NEE: NYSE) broke ground on its newest wind power project. The company plans to build 71 wind towers in Wayne County, northeastern Nebraska, outfitting each with General Electric (GE: NYSE)turbines. Called the Sholes Wind Energy Center, the wind farm will have a collective generating capacity near 160 megawatts and require $200 million in to build. Construction is expected to begin in March 2019, to meet a December 2019 planned operational start.

The Omaha Public Power District (OPPD) has already signed a twenty-year power purchase agreement with NextEra, making return on the Sholes project close to guaranteed. OPPD is the twelfth largest public power utility in the U.S., serving over 374,000 customers across thirteen counties in Nebraska.

Nebraska Winds

OPPD is not new to wind power. The public utility already sources electricity from the Grande Prairie Wind Farm in Holt County, Nebraska. Grande Prairie is comprised of 200 turbines with a total capacity of 400 megawatts. The wind farm is owned by Berkshire Hathaway Energy Renewables, a privately held renewable energy developer based in Des Moines, Iowa. In 2017, wind power represented 29.5% of OPPD retail electricity sales.

Nebraska’s prairie landscape is ideal for wind power generation. The state ranks fourth in wind energy among U.S. states, generating over four billion kilowatts hours annually. According to the State of Nebraska Energy Office, the state has 786 operating wind turbines with total capacity of 1.4 million kilowatts. In addition to the 71 wind turbines slated for the Sholes Wind Farm, three other projects are underway in Nebraska totaling 150 turbines with a collective generating capacity of 431.5 megawatts. All have power purchase agreements in place.

Grousing over Prairie Grouse

Not all in Nebraska are enamored with wind power. Legislation was introduced in the 2018 state legislative session to strip the ‘renewable’ designation from wind power, pulling wind power projects into the purview of the Nebraska Power Review Board and requiring public hearings on wind power projects. Supporters of the legislation cited risks to wildlife and the environment that go challenged without public scrutiny.

True enough Nebraska’s iconic Sandhills do have a fragile ecology of mixed-grass prairie and sand dunes that do not hold up well under construction activities. Wind farm operations could potentially interrupt the delicate mating dances of the greater prairie chicken or grouse. There is also a building body of evidence on the mortality of birds and bats due to wind towers and blades. The American Wind Wildlife Institute has been building a knowledge base and recently made available a compilation of studies that suggest bird and bat mortality in a range of 3 to 6 birds per megawatt per year. While populations of smaller birds are apparently not at risk, large raptors and bats may be in peril given their smaller populations that could be trimmed to endangered levels by unfortunate encounters with turbine blades.

Jobs, Taxes and Cash

Nonetheless, economic growth appears to be just too rich an incentive to forestall interest in wind power. NextEra’s Sholes Wind Farm in Nebraska is expected to create 200 construction jobs over the next year and then another 10 permanent jobs for ongoing operations. Wayne County and the adjacent Stanton Counties expect to receive $1 million in incremental annual property taxes over the Sholes planned thirty years of operation. The icing on the cake and possibly the reason wind power is given little check in Nebraska is an estimated $1.3 million in annual payments to landowners from the Sholes.

The Nebraska project will help keep NextEra with its NextEra Energy Resources (NEER) subsidiary in its leadership position as the one of the largest operators of wind and solar power projects in the world. NEER has over 19,000 megawatts of renewable energy generation capacity spread out across the U.S., Canada and Spain. Wind power represented 69% of NEER net generating capacity in 2017.

NextEra Profits

NEER earns revenue from the sale of electricity and as well as renewable energy credits (REC). However, that is not the only source of revenue for NextEra. The company also operates the utility Florida Power and Light (FPL), which serve customers along the eastern coast of Florida as well as the western coast of the Florida peninsula.

NextEra reported $17.1 billion in total sales in the twelve months ending March 2018, providing $8.2 billion in net income or $17.34 per share. In the same period, the company converted 37.7% of sales to operating cash flow or $6.5 billion.

The hefty cash generation figure helps support quarterly dividends that are expected total $4.44 per share in 2018. The current price the dividend represents a yield of 2.7%. The attractive yield helps explain why the stock is priced at 20.4 times forward earnings. Then again the broader utility industry is trading at a forward price earnings ratio near 20.2 times.

Debt Play in Public Utility

For those investors who are not interested in a position in a large capitalization company like NextEra – the market cap is $80.4 billion – the prairie winds have blown up an investment alternative. The Omaha Public Power District is not a public company, but it uses leverage to pay for infrastructure build-out. Its most recent bond issue in December 2017, was composed of $220.2 million in revenue bonds that received an Aa2 rating from Moody’s and AA from Standard and Poor’s. The bonds offered a coupon rate of 5.0% and were sold at yields to call in a range of 2.46% to 2.78%.

While OPPD does not make quarterly or annual filings with the SEC, its financial reports are made available to the public. The district reported $1.1 billion in total revenue in 2017, providing $77.2 million in net income. Operations generated $367.9 million in cash flow. We estimate free cash flow after capital investment was $120.5 million.

Generation of free cash flow is important given the debt load of $3.8 billion on OPPD’s balance sheet. Total debt has declined in recent years as OPPD engaged in debt refunding over the past four years. The debt-to-equity ratio was 3.45 at the end of 2017, which may seem like a significant amount of leverage. Importantly, OPPD had enough cash earnings before taxes to cover interest expense 3.19 times.

Wind Alernatives

OPPD debt may not be any more suited for a broad audience than NEE as a large cap utility is appealing to investors seeking strong growth. The debt of OPPD is privately placed by large underwriters, and not all investors will get a taste. Nonetheless, the two companies give investors alternatives to participate in the value that blows on prairie winds.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries. Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

The post Investing in in Prairie Winds appeared first on Alternative Energy Stocks.

]]>The post The US Solar Module Capacity Bandwagon appeared first on Alternative Energy Stocks.

]]>by Paula Mints

South Korea’s Hanwha Q Cells (HQCL) jumped on the US solar module capacity building bandwagon by announcing that it planned to add 1.6-GWp of module assembly in the US with the goal of taking advantage of the 2.5-GWp of cells that can be imported without the tariff.

Comment: The US has about 1-GWp of module assembly for which cells must be imported. Jinko is expected to add 600-MWp of module assembly capacity in Florida.

SunPower (SPWR) is expected to add capacity in Oregon if and when (when or if) the SolarWorld US acquisition is approved. Meanwhile new module assembly is being announced on almost a weekly basis (read below about LG’s (066570.KS) US capacity announcement. The untariffed limit for imported cells is 2.5-GWp, and if all announcements come to pass new module assembly capacity will exceed 2.5-GWp. Surely, the manufacturers announcing capacity building can add, or, perhaps all the cells will come from India. More likely however, there will be some scaling back or, walking back, from the planned capacity building.

Lesson: The original Jinko (JKS) announcement was in the gigawatt range and has now dropped to 600-MWp and may only, in the end, be 100-MWp or so. Announcements are not facts. Finally, all those who assume the involvement of NextEra (NEE) means that the announcement is 100% to be believed should remember that the 201 tariffs are temporary, meaning they expire.

In other words, look to the facts around the announcement – always – for clarity.

Lastly, concerning announcements … companies (and celebrities and politicians) make announcements for a variety of reasons:

• To call attention to themselves much the same way a small child leaps up and down shouting ‘I’m here! I’m here,’

• To deflect attention from something else much the way a politician will answer a question with ‘what about them,’

• Or, to actually announce something worthy.

Paula Mints is founder of SPV Market Research, a classic solar market research practice focused on gathering data through primary research and providing analyses of the global solar industry. You can find her on Twitter @PaulaMints1 and read her blog here.

This article was originally published in SPV Reaserch’s monthly newsletter, the Solar Flare, and is republished with permission.

The post The US Solar Module Capacity Bandwagon appeared first on Alternative Energy Stocks.

]]>The post List of Solar Farm Owner and Developer Stocks appeared first on Alternative Energy Stocks.

]]>Solar farm owner and developer stocks are publicly traded companies who develop or manufacture equipment that converts sunlight into other types of useful energy. Includes manufacturers and developers of both solar photovoltaic and solar thermal equipment, as well as their supply chain.

This list was last updated on 3/21/2022.

See also the list of Solar Manufacturing Stocks, the list of Residential Solar Stocks, and solar and wind inverter stocks.

7C Solarparken AG (HRPK.DE)

Abengoa SA (ABG.MC, ABGOY, ABGOF)

Acciona, S.A. (ANA.MC, ACXIF)

Adani Green Energy (ADANIGREEN.NSE)

Algonquin Power and Utilities (AQN, AQN.TO)

Atlantica Yield PLC (AY)

Azure Power Global Ltd. (AZRE)

Bluefield Solar Income Fund (BSIF.L)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Energy Partners (BEP)

Canadian Solar (CSIQ)

Capital Stage AG (CAP.DE)

Clearway Energy, Inc. (CWEN, CWEN-A)

Edisun Power Europe AG (ESUN.SW)

Etrion Corp. (ETX.TO, ETRXF)

Canadian Solar (CSIQ)

First Solar Inc (FSLR)

GCL-Poly Energy Holdings Ltd. (3800.HK)

Iberdrola, S.A. (IBE.MC, IBDSF, IBDRY)

Infigen Energy Limited (IFN.AX, IFGNF)

Infraestructura Energética Nova, S.A.B. de C.V. (IENOVA.MX)

Innergex Renewable Energy Inc. (INE.TO, INGXF)

JinkoSolar Holding Co. (JKS)

Greenbriar Capital Corp. (GRB.V)

Guggenheim Global Solar ETF (TAN)

Neoen S.A (NEOEN.PA)

New Energy Exchange Limited (EBODF)

NextEra Energy Partners, LP (NEP)

NextEra Energy, Inc. (NEE)

Northland Power Inc. (NPI.TO, NPIFF)

Panda Green Energy Group Limited (0686.HK)

Premier Power Renewable Energy (PPRW)

Principal Solar (PSWW)

Renesola Ltd. (SOL)

ReNew Energy Global plc (RNW)

RGS Energy (RGSE)

Scatec Solar ASA (SSO.OL)

Shunfeng International Clean Energy Limited (1165.HK)

Sky Solar Holdings Ltd. (SKYS)

Solar Wind Energy Tower (SWET)

Solaria Energía y Medio Ambiente, S.A. (SLR.MC, SEYMF)

Sunpower (SPWR)

Sunvalley Solar, Inc. (SSOL)

Sunworks, Inc. (SUNW)

Terraform Power, Inc. (TERP)

The Renewables Infrastructure Group (TRIG.L)

US Solar Fund PLC (USF.L)

UGE International (UGE.V)

Vivint Solar (VSLR)

Yingli Green Energy Holding Company (YGEHY)

If you know of any solar farm developer or owner stock that is not listed here and should be, please let us know by leaving a comment. Also for stocks in the list that you think should be removed.

The post List of Solar Farm Owner and Developer Stocks appeared first on Alternative Energy Stocks.

]]>The post List of Wind Farm Owner and Developer Stocks appeared first on Alternative Energy Stocks.

]]>Wind farm owner and developer stocks are publicly traded companies that site, permit, develop, construct, own, or operate wind farms for producing electricity.

This list was last updated on 3/22/2022

Acciona, S.A. (ANA.MC, ACXIF)

Adani Green Energy (ADANIGREEN.NSE)

Algonquin Power and Utilities (AQN, AQN.TO)

Atlantica Yield PLC (AY)

Atlantic Power Corporation (AT)

Avangrid, Inc. (AGR)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Energy Partners (BEP)

China Longyuan Power Group Corporation Limited (0916.HK, CLPXF)

China Ruifeng Renewable Energy Holdings Limited (0527.HK)

Orsted (ORSTED.CO, formerly DENERG.CO)

E.ON AG (EONGY)

Enel SpA (ENEL.MI, ESOCF)

Greencoat UK Wind (UKW.L)

Infigen Energy Limited (IFN.AX, IFGNF)

Innergex Renewable Energy Inc. (INE.TO, INGXF)

Neoen S.A (NEOEN.PA)

NextEra Energy Partners, LP (NEP)

NextEra Energy, Inc. (NEE)

Nordex AG (NRDXF, NDX1.DE)

Northland Power Inc. (NPI.TO, NPIFF)

NRG Yield, Inc. (NYLD, NYLD-A)

Otter Tail Corp (OTTR)

PNE Wind AG (PNE3.DE)

ReNew Energy Global plc (RNW)

The Renewables Infrastructure Group (TRIG.L)

TransAlta Renewables, Inc. (RNW.TO, TRSWF)

Xcel Energy Inc. (XEL)

Wind Works Power Corp. (WWPW)

If you know of any wind farm owner or developer stock that is not listed here, but which should be, please let us know in the comments. Also for stocks in the list that you think should be removed.

The post List of Wind Farm Owner and Developer Stocks appeared first on Alternative Energy Stocks.

]]>The post Investors Awaken to NextEra YieldCo appeared first on Alternative Energy Stocks.

]]>by Debra Fiakas CFA

Last week NextEra Energy Partners, LP (NEP: NYSE) reported financial results for the third quarter ending September 2015. The numbers were released in along with quarter results from its parent, Florida-based utility NextEra Energy, Inc. (NEE: NYSE). The partnership is the operating arm of clean energy projects originated by the NextEra parent. The ‘yieldco’ as these operating entities have been kindly dubbed by shareholders, delivered $1.0 million in reported net income, but operating cash flow was a whopping $36 million in the quarter.

The consensus estimate had been for $0.24 in earnings per share, but NEP delivered only a nickel. The shortfall should not have been such a surprise. The company has missed the consensus estimate in each of the last four quarters. This might be due in part to the fact that NEP has only been public for just over a year. Analysts may still be having trouble rationalizing NEP’s business prospects after the Company’s well publicized initial public offering last year.

Over the previous two and a half years NEP had converted 53.3% of sales to operating cash flow. True enough the sales-to-cash conversion rate did slip slightly to 35% in the recently reported quarter. However, some seasonal variability is expected in the wind and solar energy sources that comprise NEP’s revenue sources. The company ended the September quarter with $696 million in cash and equivalents derived in part from operating activities.

Cash is a critical element in NEP’s growth strategy. The company is expected to continue acquiring renewable and alternative energy assets, some of which could come from the stream of energy projects under development by its parent or sponsor NextEra Energy. NEP recently acquired natural gas pipelines in Texas and a wind project in Canada.

The company also raised $319 million in new capital from the sale of new common units during the first nine months of 2015. Going forward NEP has announced a new $150 million ‘dribble program’ whereby the company could issue new common units from time to time. This program will allow the parent NextEra Energy to purchase units in periods of undervalued.

NEP management has suggested that acquisition plans to grow its portfolio of energy assets could eventually support distributions in excess of $1.20 per unit over the next five years. This compares to the current distribution rate at $1.08 per unit. The current distribution rate represents a current yield of 4.0%.

The yield might appear attractive, but the stock appears to be priced at a premium with a price-to-earnings multiple of 92.2 times trailing earnings. Importantly, the price-to-cash flow multiple on a trailing basis is 5.2 times. Since cash generation is NextEra’s forte, it seems appropriate to price the the basis of cash flows rather than reported earnings that include considerable noise from non-cash charges.

The stock hit 52-week low of $19.34 in late September as traders had seemed to remain stubbornly focused on each successive quarter earnings miss. There appears to have been an awakening among traders to the value in NEP. The stock has been attempting a comeback in recent weeks. Money flows into the stock turned positive in late October just as the company was preparing to release third quarter results. In my view, NEP is at an interesting point and is worth a serious look for yield-hungry investors.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

The post Investors Awaken to NextEra YieldCo appeared first on Alternative Energy Stocks.

]]>The post NextEra Energy: the Real Attraction appeared first on Alternative Energy Stocks.

]]>by Debra Fiakas CFA

One member of the NuStart Energy consortium of nuclear power developers is Florida Power & Light or FPL Group, a subsidiary of NextEra Energy (NEE: NYSE). The group had its sights on getting a nuclear power plant construction and operating license from the Nuclear Regulatory Commission (NRC). The company operates the third largest nuclear power generation fleet in the U.S. composed of eight nuclear reactors at five plant sites. The fleet is far flung, ranging from Florida to New Hampshire and Wisconsin and West to Iowa.

FPL is working on an expansion of its Turkey Point facility in Florida. The plan is to construct two additional nuclear reactors – Units 6 and 7 – using Westinghouse’s pressurized-water design called the Applied Passive 1000. A combined construction and operation license application (COL) is pending before the NRC. FPL took public comments at meetings held in July this year as one step toward certification of the project.

Together the company claims these the two added units would have the capacity to produce 2,200 megawatts – enough to serve 750,000 homes. Furthermore at least $78 billion in fuel costs could be saved by sourcing this power requirement from nuclear instead of fossil fuel.

|

| Turkey Point Nuclear Facility |

In early August 2013, Duke Energy (DUK: NYSE) announced the indefinite postponement of two planned reactors at its facility in Levy County, Florida. Duke knuckled under after its license application was delayed. A more pressing issue is economic. Construction costs keep mounting and cost recovery schemes may not get approval from Florida regulators. Duke’s action does not bode well for FPL, which submitted its application for the Turkey Point expansion back in 2009, when economic circumstances are entirely different than today.

The issue before regulators and the public is whether plans and designs made over five years ago should be altered or scrapped outright because substitute power sources have experience a favorable change in economy. Hydraulic fracturing or ‘fracking’ has rendered natural gas newly competitive for electricity generation. It is not entirely certain that these favorable economics will continue unchanged in the future. The practice of fracking has been brought into question by environmentalists and land owners. Regulatory action to restrict the use of fracking would lead to a change in economic circumstances for the natural gas industry. This would cast nuclear reactor plans in an entirely different light – even with unanticipated cost increases.

Investors do not appear much troubled by the nuclear worries of FPL or its parent company NextEra Energy. The stock is trading at 19.7 times trailing earnings, well near the company’s five-year high price/earnings ratio. Of course, diversified utilities as a group are trading near the five-year high average P/E. This could be in part due to shrinking profits as costs continue to mount even as sales have been weakened by the slow economic recovery. Earnings fall, P/E measures rise.

NEE is trading at 15.2 times the 2014 consensus earnings estimate, suggesting investors are not taking little away from the stock. However, two dozen or so analysts who follow NEE have projected only 6% growth over the next five years. The comparison of multiple with growth rates suggests traders are paying way too much for NEE. A forward dividend yield of 3.2% may the real attraction to NEE.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein. SUNE is included in the Solar Group of Crystal Equity Research’s The Atomics Index, composed of companies using the atom to create alternative energy sources.

The post NextEra Energy: the Real Attraction appeared first on Alternative Energy Stocks.

]]>