Tom Konrad CFA

Geothermal power generation has several advantages over higher profile alternative energy such as wind and solar, but gets much less attention.

Part of the lack of recognition for Geothermal power arises from a confusion with the technology variously called Geoexchange, Ground Source Heat Pump, or Geothermal Heat Pumps. Geoexchange uses the near constant temperature of the soil a few feet to a few hundred feet below the ground to heat and cool a building. According to the Environmental Protection Agency, Geoexchange is the most efficient way to heat and cool a building, and is a very interesting energy efficiency technology (and investment opportunity) in its own right, but it has little in common with Geothermal power.

In contrast, Geothermal power involves using much higher temperature heat from hot springs or wells much deeper into the earth to generate electric power. Unlike Geoexchange, current Geothermal power technology requires an existing geothermal resource where natural geologic forces have brought an unusual amount of hot liquids into permeable formations relatively near the Earth’s crust. There is currently a great deal of research going into Enhanced Geothermal Systems (EGS) which use modern drilling and fracking technology to recreate the natural conditions that make Geothermal power generation possible, but EGS technology needs more development to become commercially competitive.

In contrast, Geothermal Power with a good resource can produce electricity for pennies per kWh. Electricity from one of the world’s best geothermal resources, The Geysers in Northern California, is sold for 3 to 3.5 cents per kWh, although many the lower grade resources being exploited today need prices between six and twelve cents, depending on who you ask. These prices are comparable to natural gas fired generation and wind, and are considerably less expensive than solar photovoltaic. Unlike natural gas, the operating costs of running geothermal plants are very low, and they produce minimal emissions of any kind. Unlike wind, geothermal power is available in all weather conditions, and geothermal plants generally run more than 95% of the time, which makes them more reliable even than coal power plants, which typically only produce power 80-90% of the time.

Geothermal Power also has a small footprint, requiring only 7.5 km2 per TW*hr/year, less than Coal (9.7 km2 per TW*hr/year), Natural Gas (18.6 km2 per TW*hr/year) and all other Renewable Electricity generation technologies. This small footprint and lack of emissions mean that geothermal power plants can even be located inside cities without disturbing the neighbors… if there is a geothermal resource available.

All these factors mean that a good Geothermal resource located near transmission can be very valuable to a company that can tap it. Unlike wind and sun, such geothermal resources are as rare as they are valuable, since they only occur in areas with tectonic or volcanic activity. This rarity is one of the factors keeping geothermal a relatively undiscovered technology among investors interested in renewable energy, but it also means that the rights to develop these resources are valuable, in much the same way as a good mineral deposit is valuable to a mining company.

Perhaps most importantly, Geothermal power enjoys support from both Republican and Democrats, with the recently proposed Geothermal Investment Act of 2010 receiving bipartisan support. Perhaps one factor in this support is that relatively small size of the industry means that government incentives can make a large difference for the industry with only a tiny budgetary impact.

Here is a previous article where I take a deeper look at the business of geothermal power.

Geothermal Stocks

Geothermal stocks fall neatly into two categories: Large cap companies and junior exploration and development companies. The large-cap companies are:

- Ormat (NYSE: ORA): Ormat is the leading vertically integrated geothermal power giant, involved in exploration, development, power production and maintenance both for themselves and as a contractor almost everywhere geothermal resources are found in the world. Ormat is as close as you can get to a one-stop shop for exposure to the geothermal power sector.

- Calpine (NYSE:CPN): Calpine is the largest independent power producer (IPP), owning 19 of 21 generation stations in the world-class Geysers geothermal field near Santa Rosa, CA. Despite producing one-fourth of the non-hydro renewable power produced in California, Calpine should not be analyzed as a renewable energy IPP, since renewable generation accounts for less than 3% of total generation capacity. The vast majority of Calpine’s capacity comes from natural gas fired units, so investors in Calpine are really getting a natural gas IPP with some expertise in geothermal power production. In the context of this article, Calpine is most interesting as a possible acquirer of the small geothermal exploration and production companies, as it acquired its interest The Geysers in 1999 and 2000.

- United Technologies (NYSE:UTX): Like Calpine, United Technologies is a diversified industrial giant included here because of the modular PureCycle geothermal and heat recovery engine from its Pratt&Whitney unit. While not a significant contributor to the results of a giant corporation like United Technologies, PureCycle might open up low temperature geothermal resources that cannot produce enough power to justify the cost of a custom Ormat Power Converter, but may be productive enough for an off-the-shelf generator such as PureCycle.

Junior Geothermal Exploration and Development Companies

None of these companies are currently profitable, but all own geothermal resources in various stages of development, including producing plants. With substantially all the cost of geothermal development coming up-front, investors in these companies need to consider the availability of funding for development as well as the riskiness and time line for developing each company’s geothermal assets. There has been a recent trend of consolidation in the industry which is likely to continue in the current difficult financing environment, despite growing government support for geothermal.

These small micro cap companies in

clude:

- Magma Energy Corp. (Toronto: MXY.TO/Pink Sheets: MGMXF). Magma Energy has three operating geothermal plants in Nevada and Iceland, and is also developing several prospects.

- Nevada Geothermal Power (Toronto Venture:NGP.V/OTC BB: NGLPF.OB). Nevada Geothermal is developing five projects totaling over 200MW in the Western United States, and brought on-line its 49.5MW Faulkner-1 plant in late 2009.

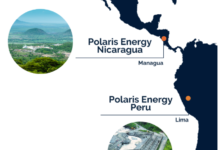

- Ram Power Corp. (Toronto:RPG.TO/ RAMPF.PK). Ram Power was formed by buying up several smaller geothermal developers (Polaris Geothermal, Western GeoPower Corp, GTO Resources, and the recently acquired Sierra Geothermal Power.) Ram currently owns an operating 10MW plant and hundreds of MW of development prospects.

- Raser Technologies (OTC:RZTI). Raser Technologies owns one of the largest portfolios of low-temperature geothermal development projects which it intends to develop using the PureCycle energy converters mentioned above. However, power production at Raser’s first 10MW Hatch power plant initially fell short of expectations, and Raser needs significant additional funding to execute on its business plan.

- US Geothermal (AMEX:HTM). US Geothermal currently has about 11 MW of operating capacity at two power plants, with plans to quickly develop several times that in the next few years to take advantage of current US federal incentives.

If you know of any other geothermal stocks missing from this list, please let me know in the comments. I plan to take a closer look at each of the exploration and development companies in coming weeks, and I’ll add your suggestions to the list.

DISCLOSURE: Long HTM, NGLPF.OB.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

I really like the Norwegian company RockEnergy, I don’t think they are public though. Their technology of using North Sea drilling techniques to create an underground heat exchanger instead of fracking is really cool. http://rockenergy.no/

“Cool” and “great investment” seldom go together, but that’s a moot point for a private company. And you are right, it is cool.