The post OriginClear Gambles on Marketing Program appeared first on Alternative Energy Stocks.

]]>by Debra Fiakas, CFA

Last week waste water treatment developer OriginClear (OCLN: OTC/QB) announced pilot projects for rental of its commercial water systems for pool cleaning. The company has several patents to its credit, protecting its innovations. OriginClear has developed a proprietary catalytic process to clean up solids from waste water as well as an oxidation technology to eliminate microtoxins in water. Unfortunately, the company has struggled to extract value from its efforts. OriginClear has yet to report profits. Indeed in the most recently reported fiscal year ending December 2019, revenue of $3.588 million only barely covered cost of goods of $3.217 million, let alone operating expenses that totted up to $4.279 million.

The rental gambit was first discussed by OriginClear in Marcy 2020, when the company introduced Investor Water for ‘investor-financed water systems. As the program has unfolded it sets up an opportunity for local service providers to enter or expand mobile pool water recycling services. OriginClear’s commercial water system makes it possible to clean or repair a pool without draining. The method is particularly attractive for markets where water is a premium such as Arizona. No surprise then that one of the first participants in the rental problem is a Phoenix, Arizona-based pool cleaning service.

Until third-party financing is secured OriginClear is financing the rental problem internally. At the end of December 2019, the company had $490,614 in cash on its balance sheet and working capital of negative $7.0 million, excluding $31.6 million in derivative liability. Eliminating current liabilities associated with the near-term commitments related to the company’s preferred stock and convertible promissory notes, brings negative working capital down to $2.4 million. Besides current liabilities OriginClear has $3.9 million in additional long-term liabilities composed of the long-term obligations of convertible preferred stock and convertible promissory notes.

A balance sheet heavily laden with debt and short of working capital suggests OriginClear is not in a strong position to support a rental program of any proportion. Third-party financing seems to be critical to allow this rental program to expand. Unfortunately, that might eliminate some potential participants that cannot meet credit standards set down by traditional lenders. OriginClear may still need to underwrite some potential relationships to capture all opportunities.

At the end of December 2019, the company had an accumulated deficit of $107.3 million built up in over a decade of operating losses. It may require several decades to reverse this deficit and create positive shareholder equity. As promising as the rental program may sound based on management’s introduction, it is not entirely clear how it can deliver adequate profits to bring OriginClear back out of a dangerous debt-laden situation. Granted the company has large-scale water treatment systems targeted at municipal and industrial customers. However, penetration of those markets has been at a snail’s pace. Such orders are not likely to speed up given the fiscal constraints local governments are experiencing due to the coronavirus-triggered shut down that has slashed tax collections.

OriginClear’s management team deserves some credit for perseverance and creativity. That said there may be a point at which shareholders might be better served with a divestiture of assets to a stronger player.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 6/22/20.

The post OriginClear Gambles on Marketing Program appeared first on Alternative Energy Stocks.

]]>The post Covanta Rebounds appeared first on Alternative Energy Stocks.

]]>by Debra Fiakas, CFA

Waste handler Covanta Holding Company (CVA: NYSE) reported financial results for the first three months of the year at the beginning of May 2020. True enough the net loss might have been wider than published estimates for the quarter, but the consensus target did not reflect a one-time, non-cash charge for asset impairment. Indeed, Covanta’s sales climbed year-over-year to $468 million, of which $61 million was converted to operating cash flow. Waste handling is considered an essential service so Covanta operations remained at full operations even as many of its customers were subject to work stoppages and stay-at-home policies to stop the spread of the coronavirus COVID-19.

The numbers must have triggered a widespread sigh of relief. In early April 2020, when Covanta leadership cut the company’s generous dividend payout, shareholders had apparently expected the worst. The bad news was accompanied by a withdrawal of guidance for 2020 earnings and a warning that policies to deal with the coronavirus could severely impact Covanta revenue. Furthermore employee health and safety would require additional spending, cutting into profits. They promptly took a cleaver to CVA shares, sending the price to historic lows.

In retrospect the dividend cut may seem a bit drastic given how well the company came through the first quarter. That said, the worst of the crisis came later in April and May 2020. To learn how Covanta handled conditions in those weeks shareholders will have to wait until early July 2020, when Covanta reports financial results for the quarter ending June.

Part of the company’s success in the first quarter 2020 was the result of clever negotiations with customers and forward-thinking contracts with price escalators. The company reported same-store average tip fee increases by 5% in the quarter. Much of the company’s tip fee revenue comes from processing residential waste on behalf of municipalities, for which volumes have remained strong.

There are reasons to be cautious in taking a position in CVA. The company is well leveraged with over $2.6 billion in debt on its balance sheet. That represents an exceptionally high debt-to-equity ratio of 843.9. Nonetheless, earnings often trump balance sheet circumstances. Based on cash earnings over the last twelve months Covanta’s interest coverage multiple was 2.4 times at the end of March 2020. This compares well to 2.5 times for the year 2019, but leaves little room for further slippage.

Having prepared for the worst in the first quarter report, shareholders will probably still brace themselves for Covanta’s second quarter results. The company will have been subjected to coronavirus pandemic conditions throughout the entire quarter. Management may have been able to apply lessons learned in the first quarter to help smooth out the worst bumps. Investors appear to believe they will be successful.

The stock has recovered by 37% over the all time low set in April, pushing back up through a line of volume-related price support/resistance at the $8.50 price level. Another good quarter report could move the stock back closer to the pre-crisis level near $15.00.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein. The author of this article holds a beneficial interest in CVA shares.

This article was first published on the Small Cap Strategist weblog on 6/4/20.

The post Covanta Rebounds appeared first on Alternative Energy Stocks.

]]>The post Budget Cut at Methanex appeared first on Alternative Energy Stocks.

]]>by Debra Fiakas, CFA

Initially investors were worried about a few delayed orders as a consequence of the coronavirus outbreak in China. The global supply chain, of which China is a critical link, would be temporarily interrupted by work stoppages in that country. As the virus jumped to other countries it became clear that businesses all over the world could experience business interruption and that could mean significant earnings erosion.

Investor alarm spiked as denial and dysfunctional appeared to be the main themes in the U.S. policy response to the situation. Panic ensued destroying billions in the U.S. capital base. Bank of America estimates the U.S. economy could shrink by 12% in the second quarter ending June and that for the full year 2020 the U.S. gross domestic product could shrink by 0.8%. As many as 3.5 million jobs will be eliminated.

Public spending has had to take the place of private capital to stabilize the economy by creating near-term liquidity. While that might help the unemployed for a period of time, it will not support capital spending in the long term. Caput will go the projects that investors might have been counting on to drive growth in the years to come.

Methanol producer Methanex (MEOH: Nasdaq) is among the first to announce a change in capital investment plans. Last week, Methanex announced the decision to delay a $500 million investment in a methanol plant planned for its Louisiana complex. The Geismer 3 project was to be built next to the existing Geismar 1 and Geismar 2 facilities. The third plant will be delayed at least a year and a half. Management cited unfavorable demand conditions as the reason for the delay.

As far as Methanex is concerned it is not a matter of not having access to capital. The company has $800 million in cash sitting in it bank accounts after drawing down on an existing credit facility. Like many operations that facing difficult market conditions, Methanex is tightening its corporate belt. Not only is the Geismar 3 project on hold, Methanex management trimmed $25 million from its regular capital spending budget as well.

With the brakes on growth investment, shareholders are left hanging to a shaky rung on the ladder. Is MEOH a hold or a sell? Expectations are for a loss in fiscal year ending June 2020. It is a lost year. The stock is trading at 13.0 times projected fiscal year 2021 earnings, a consensus figure of that has been dramatically reduced over the last two months. Even after the precipitous sell-off in recent weeks, MEOH is trading at a higher forward earnings multiple than historic levels.

When times are difficult it would seem prudent to remain with companies that have the financial strength to stay the course until recovery comes round. Methanex management appears to have just taken the steps that will do exactly that – reduce spending and fortify the bank account with a bundle of cash!

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 4/3/20.

The post Budget Cut at Methanex appeared first on Alternative Energy Stocks.

]]>The post Ocean Power Technologies: Alot Under the Water appeared first on Alternative Energy Stocks.

]]>by Debra Fiakas, CFA

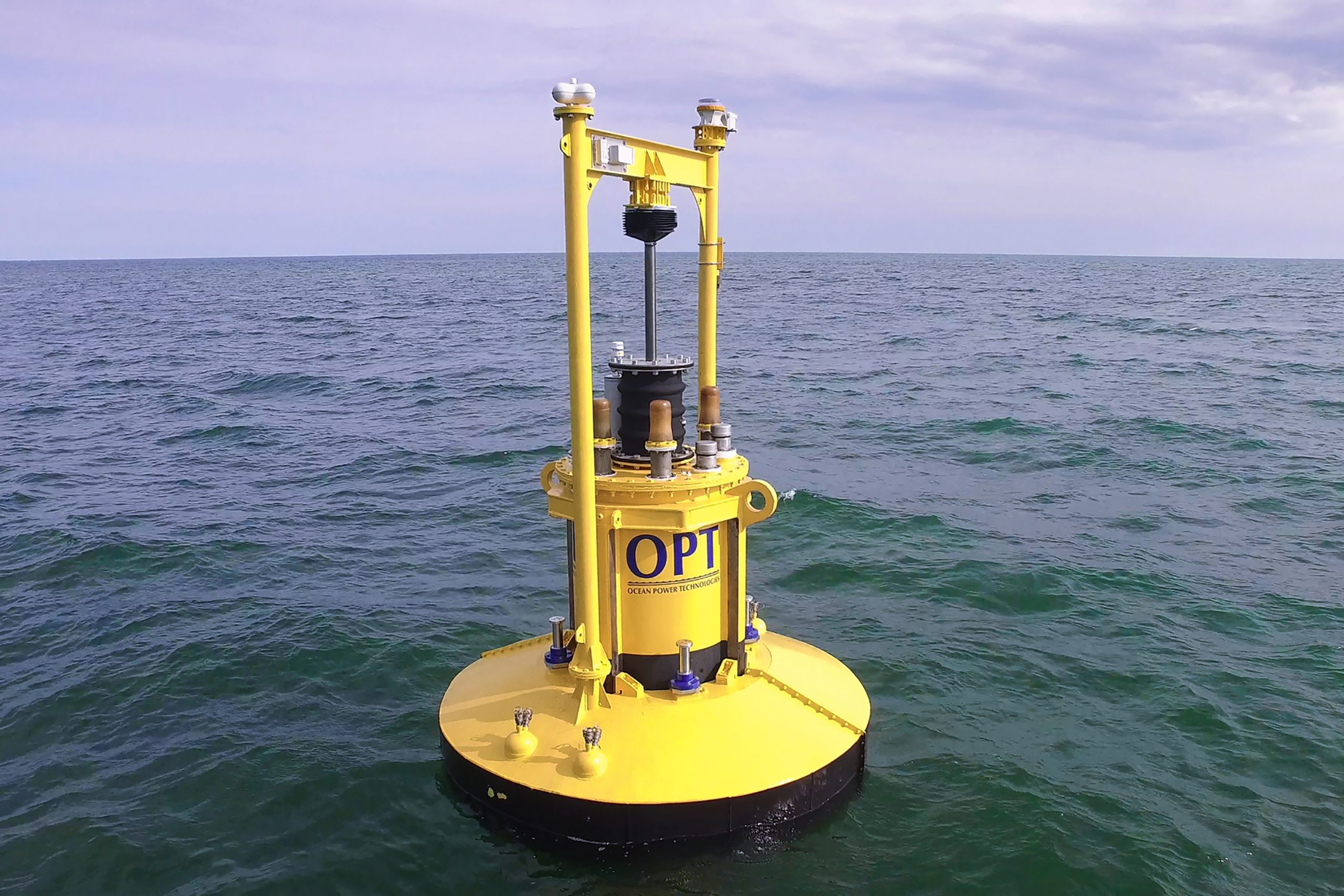

After years of promises Ocean Power Technologies (OPTT: Nasdaq) is finally realizing revenue from its ocean wave power innovations. Sales in the quarter ending January 2020, was $725,000 – more than double the same quarter in the previous fiscal year. Driving the top-line is the sale of one of the company’s signature PowerBuoy ocean wave power generation system to Enel Group (ENEL: BIT; ESOCF: OTC), Italy’s premier energy company.

Some investors might find Enel an unlikely customer for a renewable energy device like the PowerBuoy. Designed to convert the mechanical energy in ocean waves to electrical energy, the PowerBuoy has been years under development. Ocean Power has long touted the potential in the device to generate energy free of carbon emissions.

Yet the first commercial customer, Enel, is using the PowerBuoy power data gathering and communications for its offshore oil and gas operations. Maintaining communications with off-shore installations has often been frustrated by the expiration of power sources, leaving remove installations dark and no longer functional. Extracting power from the ocean itself is a major step forward in solving this problem for producers with off-shore oil and gas assets. Yet, it can hardly be considered a step toward a carbon free world if a renewable power source simply facilitates fossil fuel extraction.

Disappointment over the strategic direction of Ocean Power may have played a part in the dramatic decline in the stock from a high of $7.76 in April 2019, to its current level under a dollar. Of course, the stock price today reflects the stress and uncertainly in our economy due to work stoppages to combat the coronavirus health threat. It also reflects the company’s struggles to keeps it bills paid until cash begins to flow from operations.

The company has $9.9 million in cash on its balance sheet at the end of January 2020. That might seem like a tidy sum until investors consider that management has been using on average $2.9 million in cash each quarter to support operations. For the most part, expenditures are for sales and marketing activity as well as product development work.

The cash kitty was built up by sales of stock through an equity line of credit and an at-the-market stock sales agreement. The company sold 2.3 million shares under these two arrangements in the first nine months of fiscal year 2020. Shares outstanding have mushroomed from 5.4 million in April 2019 to 8.7 million at the end of January 2020. It is likely the dilutive effect of the stock sales has also been dragging down the OPTT stock price.

Ocean Power Technologies might be very much like the company’s flagship PowerBuoy devices – there is alot more under the water than you might think. That said, worries for one investor may be creating an opportunity for others. Those who expect Ocean Power to score additional sales opportunities of the PowerBuoy might find the hand wringing over dilution as overreaction. For those with a tolerance for risk at the top-line, the current stock price may be a compelling value.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 3/10/20.

The post Ocean Power Technologies: Alot Under the Water appeared first on Alternative Energy Stocks.

]]>The post Marrone Bio Innovations: Answers for Agricultural Angst appeared first on Alternative Energy Stocks.

]]>by Debra Fiakas, CFA

The world needs more food. At least more of the food produced in the world’s fields needs to end up in the mouths of humans and their animal friends. According to the United Nations, the world’s farmers produce enough food to feed everyone, yet over 800 million people routinely go hungry. This is due in part to the ancient and ongoing practice of selecting plants for high yield. The consequence is a selection of highly homogenous food crops. There are thousands of edible plants growing on Planet Earth, but only a dozen crops account for 75% of all human calories. Lack of genetic variability in those twelve crops means particular vulnerability to pests, disease and climate change.

Human efforts to control crop pests and diseases are as long-lived as crop selection. For centuries farmers manually picked insects from food crops, laid out smudge pots to ward off locusts or engulfed nearly ripened fruit trees in netting. It was not until the late 1800s that chemicals were applied to crops such as sulfur, nicotine and arsenic. By the mid-1900s the chemists appeared to have taken over agriculture, bringing all sorts of laboratory concoctions such as dichlorodipehnyltrichloreoethane to the field. Otherwise known as DDT, its inventor was awarded the Nobel Prize for its discovery. Enthusiasm has since waned as the potion began decimating bird populations and humans started having seizures and going infertile.

Fortunately, carcinogens are not the only way to boost crop success and food production. Marrone Bio Innovations (MBII: Nasdaq) offers bio-based solutions for pest and disease control. The company has developed a fairly wide product line, including insecticides and fungicides as well as seed and soil treatments. The company has developed proprietary technology to isolate important microorganisms that can be effective in pest management without collateral damage. Other microorganisms have been found that help promote plant health and productivity.

Fortunately, carcinogens are not the only way to boost crop success and food production. Marrone Bio Innovations (MBII: Nasdaq) offers bio-based solutions for pest and disease control. The company has developed a fairly wide product line, including insecticides and fungicides as well as seed and soil treatments. The company has developed proprietary technology to isolate important microorganisms that can be effective in pest management without collateral damage. Other microorganisms have been found that help promote plant health and productivity.

In the most recently reported twelve months ending September 2019, Marrone has claimed $28.4 million in total sales of its various crop elixirs. Despite a 54% gross margin, the company has still not delivered an operating profit. The company is still spending heavily on research and development. In the last twelve months 47 cents out of every sales dollar went toward new product development. Marrone is also spending heavily on marketing and sales. That investment is tucked away in the line of reported SG&A expenses, which represented a jaw-dropping 95% of revenue in the last year. In the last twelve months, Marrone reported its deepest operating loss to day at $25.1 million.

Fortunately, on a cash basis the news was not so alarming. In those same twelve months the company used $19.0 million in cash resources to support operations. Unless something is done to conserve cash, Marrone may need to raise capital. This is especially important if the company also uses cash for additional acquisitions, as it did in September 2019 with the $6.3 million cash purchase of Pro Farm and the Jet-Ag and Jet-Oxide product lines.

The company had $7.9 million in cash on its balance sheet at the end of September 2019, suggesting it could last about five months before it would need a capital infusion. However, in the capital markets that is not much time at all, given that it takes about four to six months to drum up support for a struggling operation.

A trip to the capital market is made even more difficult if a company gets into a legal dust up with its investment banker. In April 2019, Marrone was sued by investment banking firm Piper Jaffray for failure to pay a promised transaction fee related to a private placement. The dispute was resolved with a promise to pay half the requested fee. Nonetheless, in the future some bankers may think twice about signing on the help this company raise capital.

In the midst of the fee dispute with Piper Jaffray, Marrone adjusted its agreement with warrant holders. The company was then able to call in 10 million warrants, raising $10 million in new capital during the quarter ending September 2019. At that time there remained 26.6 million warrants outstanding under the warrant reorganization agreement.

In the past Marrone has used both debt and equity capital. Management has also factored various accounts receivable. Capitalization policy could be up in the air at this point, given that the company’s chief executive officer and founder resigned in December 2019. Since the company bears her name and she will continue to serve on the board of directors, Dr. Pamela Marrone will likely continue to have some influence over the company’s future.

Drama in the board room may be a distraction for some investors. Luckily there are fewer operational worries with a biologically-based product line. The company uses nominal fossil fuel, does not rely on highly toxic chemicals and emits negligent greenhouse gases. That means there are fewer unrecognized contingent liabilities in Marrone’s future, leaving investors with a straight forward play on an environmentally sound agriculture product line.

Editor’s Note: After the publication of this article, we received a communication from Marrone’s investor relations firm. The firm claims that Marrone has “established a $36.6 million financing facility through a right to call the exercise of certain outstanding warrants. Through this financing facility, the company is positioned very well from a cash perspective and will not require to raise capital in the near future.” The author is aware of this right to call, but in her analysis it may not be sufficiently strong.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 1/21/20.

The post Marrone Bio Innovations: Answers for Agricultural Angst appeared first on Alternative Energy Stocks.

]]>The post Water Stocks in the Americas appeared first on Alternative Energy Stocks.

]]>by Debra Fiakas, CFA

The post “Water: Invisible Crisis” introduced a new series on water supply in Latin America, describing the lack of access to quality water despite a bountiful supply of rainfall and snow melt. As the series has unfolded we have learned that water supply in Latin America is largely a local government undertaking. Investment opportunities are limited to water management companies that sign on to operate government-owned infrastructure or water treatment solution providers.

Water supply to the north has inched further into the commercial realm. A discussion of water investment would not be completed without a look at private water suppliers in the rest of the Americas.

The only one in the group to lay claim to market share in Latin America is Consolidated Water (CWCO: Nasdaq), which operates desalination plants in the Cayman Islands and Bahamas. In 2018, Consolidated began developing a seawater desalination plant in Rosarito, Baja California in Mexico. The company uses reverse osmosis technology in its plants. Reverse osmosis is notoriously energy hungry so Consolidated has deployed energy recovery devices from Energy Recovery (ERII: Nasdaq) to reduce energy costs at several of its plants.

Consolidated is a small company, reaching $69.2 million in total revenue in the most recently reported twelve months. However, it converted 21% of sales to operating cash flow. That helps support nearly debt-free balance sheet and an ample dividend. Consolidated shares trade at the lowest forward multiple in the selected group of water stocks listed in the tables below. At a forward PE of 24.0 and a forward dividend yield of 2.1% the stock has some appeal, despite the small size of the company.

If you are the sort of investor for whom size matters, American Water Works (AWK: NYSE) will be the best choice from among stocks in this group. American reported $3.6 billion in total sales in the twelve months ending September 2019, on which it collected $1.3 billion in operating cash flow. The company needs the cash to service its hefty debt load. Aside from Global Water Resources (GWRS: Nasdaq) and its unique situation, American Water Works is the most leveraged among the selected water stocks. The debt load has not dissuaded leadership from generous dividend payouts. At the current price level, the stock offers shareholders a forward yield of 1.7%.Service Ar

Global Water Resources reported $180.1 million in long-term debt at the end of September 2019, a hefty debt load given its business base. That said, management is aggressively executing on a growth strategy. In August 2019, Global Water announced agreements with the City of Coolidge, Arizona and Saint Holdings, LLC to provide water, wastewater and water recycling services. Coolidge is a bedroom community adjacent to Phoenix. Saint Holdings is privately owned land development company that recently sold land near Inland Port Arizona to Nikola Motor Company for a proposed mega-manufacturing plant. When fully approved and operational, the agreements will bring to fourteen the number of water, treatment and recycling utilities under Global Water Resources management.

| Company | Sym | Service Area | Revenue | CshFlw |

| American States Water | AWR | California | $471.9M | $112.7M |

| American Water Works | AWK | Northeastern U.S. and Canada | $3.6B | $1.3B |

| California Water Services | CWT | Calif, Wash St, NMex, Hawaii | $705.1M | $187.7M |

| Consolidated Water | CWCO | Cayman Islands, Bahamas | $69.2M | $14.2M |

| Global Water Resources | GWRS | Phoenix, AZ | $35.0M | $12.3M |

| Middlesex Water Co. | MSEX | New Jersey and Delaware | $135.1M | $36.4M |

| York Water | YORW | York & Adams County, PA | $50.6M | $17.5M |

| Company | Sym | Price | Mkt Cap | Yield | FPE | Debt |

| American States Water | AWR | $86.00 | $3.2B | 1.4% | 39.00 | 82.00 |

| American Water Works | AWK | $120.00 | $21.9B | 1.7% | 31.00 | 149.00 |

| California Water Services | CWT | $51.00 | $2.5B | 1.5% | 33.00 | 130.00 |

| Consolidated Water | CWCO | $16.00 | $244.7M | 2.1% | 24.01 | 3.00 |

| Global Water Resources | GWRS | $12.50 | $264.8M | 2.3% | 78.00 | 435.00 |

| Middlesex Water Co. | MSEX | $63.00 | $1.1B | 1.6% | 31.00 | 108.00 |

| York Water | YORW | $46.00 | $607.1M | 1.6% | 40.00 | 78.00 |

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 12/17/19.

The post Water Stocks in the Americas appeared first on Alternative Energy Stocks.

]]>The post Water Supply with a Latin Twist appeared first on Alternative Energy Stocks.

]]>by Debra Fiakas, CFA

Depending upon how you string the words together, it is possible to make Latin America sound like the world’s water fountain or the location of a putrid pond out of which hapless citizens ladle their drinking water.

Try these lofty words.

Four the world’s largest rivers and four of the world’s largest freshwater lakes can be found in the Latin America region with a run-off area encompassing 5,470 cubic miles. The rainwater and snowmelt running into these water bodies represents 20% of the world’s run-off. By itself Brazil is home to 20% of the water resources of the entire world.

Here is a more realistic string of words on water.

Desertification, pollution and poor infrastructure thwart access to a decent glass of water for most Latinos. One third of Latin American water is polluted due to lack of sewage treatment. Fresh, unspoiled water is not evenly available around the region. The United Nations reports that in 2017, nearly all Argentineans and Chileans were served by clean water systems, but only 43% of Mexicans have access to safe drinking water. In the Caribbean the numbers are even more stark. In the Dominican Republic only 24% of the rural population has access to taps with clean water. In DRC cities piped water access is near 95%, but Dominicans pay dearly for every drop. Virtually no one in Haiti is connected to a clean water system. The rest are reliant on rain water.

Much of the water supply in Latin America comes from municipal systems or specialized public utilities. As a consequence about 90% of urban water supply in Latin America is provided by publicly owned entities. Nonetheless, some of the largest commercial water companies in the world have taken an interest in Latin America. A stake in one would be a good hedge against either set of prose on Latin American water supply.

France’s Suez SA (SEV: PA, SZEVY: OTC/PK) is a global provider of water and wastewater management. Its portfolio of water management contracts in Latin America has grown to 7% of the company’s global revenue. A water distribution contract in Santo Domingo signed in 2018, brought Suez to Ecuador for the first time and extended the company’s Latin footprint to a total of ten countries. Suez signed on to reduce leaks in the Santo Domingo municipal water system and ensure 24/7 water availability. Suez is also serves commercial customers with water treatment and desalination systems. In the year 2018 alone the company signed nine new contracts for water optimization and conservation with commercial customers in the agri-food sector in Brazil, Mexico and Costa Rica.

In 2018, Suez realized Euro 335 million in net income on Euro 17 billion. For its efforts Suez shares are valued at 17.9 times trailing earnings. If that seems cheap, think again. The price-earnings to growth rate ratio is well above one at 1.41, leaving an investor paying dearly for Suez’s growth.

If Suez is not to an investors liking, there is her French sister, Veolia Environment, SA (VIE: Paris, VEOEF: OTC/PA). Veolia acquired Proactiva Medio Ambiente, which operates in eight locations in three Latin American countries. The water management company serves over 42 million customers with a mix of water distribution and waste management systems it operates for national and municipal agencies.

Veolia shares give an investor a stake in a significantly larger operation with diverse portfolio of water and waste water management contracts around the world. In the twelve months ending September 2019, Veolia reported Euro 27 billion, on which the company earned Euro 457 million in net income. Veolia shares trade at 31.8 times these earnings. The pricey multiple is a little easier to swallow with the company’s 4.0% forward annual dividend yield.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 12/13/19.

The post Water Supply with a Latin Twist appeared first on Alternative Energy Stocks.

]]>The post Water Treatment With a Latin Beat appeared first on Alternative Energy Stocks.

]]>by Debra Fiakas, CFA

The post “Water: Invisible Crisis” on December 6th highlighted the building problem of inadequate supplies of quality water in Latin America. The World Water Council’s Comision Nacional Del Agua reports that As much as one-third of the Latin America population lacks access to safe water. Unabated pollution and lack of water treatment have been identified as culprits. In South America, for example, 40% to 60% of water comes from aquifers that are subject to increasing pollution from untreated run-off from mining and agriculture operations.

Our survey of Latin America water sector in South America found an interesting mix of pollution abatement and water treatment suppliers and service providers in the region. European companies have set up shop in several of Latin America’s major cities and even a few U.S. and Canadian firms maintain at least a relationship with a local distributor. One might conclude that it is not lack of access to technology or expertise that is holding Latin American communities back from clean, safe water.

For the ambitious entrepreneur the shortfall in clean water is an opportunity for new business in Latin America. The astute investor could look for a strategy to participate. We look at several who provide immediate investment alternatives with publicly traded stocks.

Andritz Group SA (ANDR: VI, ADRZF: OTC) is primarily known for its equipment for hydropower stations and the pulp and paper industry. Make no mistake about it, this Austrian company knows water as well. Andritz has set up shop in Brazil with its Separation Segment that offers mechanical technologies for municipal water treatment, including filters, screens and separators. The company is well established in Brazil and could be a good partner for municipal operators. Andritz successfully set up the Santo Antonio hydropower plant in Brazil and regularly supplies Klabin’s pulp mill in Brazil.

In the most recently reported twelve months Andritz earned 3.6% operating profit on Euro 6.6 billion. The company converted 8.1% of those sales to operating cash flow. The cash flow is needed if Andritz intends to come down from its current leverage lever where the debt-to-equity ratio is 144.38. There is some competition for cash use. Andritz maintains a healthy dividend payout policy and the current forward dividend yield is 4.24%.

Japan’s Kurita Water Technologies Ltd. (6370: Tokyo, KTWIF: OTC/PK) provides water treatment solutions to various industries. Its specialty is treatment chemicals that can be used in boilers and cooling towers as well as industrial processes and wastewater treatment. Interestingly, the company has chemical products for use in biomass generation. Kurita can also set up turnkey water treatment facilities, including waste water reclamation systems.

Kurita has had boots on the ground in the state of Sao Paulo in Brazil since 1975. In 2011, the company opened a water treatment chemicals factory in Sao Paulo near Artur Nogueira.

Kurita’s shares are quoted on the OTC at a price that represents 20.8 times trailing earnings. That is not a particularly dear or cheap price, but investors might be swayed by the current dividend yield of 2.0%. The company earns about 10% return on equity and maintains a fairly modest leverage level with a 20.00 debt-to-equity ratio. Kurita has achieved top-line growth in each of the last five years and is habitually profitable. While cash flow from operations have varied year to year, over the last five years Kurita has converted 10% of sales to operating cash.

U.S. companies are not left out of the Latin America water treatment market. Unfortunately, few are publicly traded. Fluence Corporation (EMFGF: OTC, FLC: ASX) is a small company with big aspirations and interesting technology. Its engineers design and manufacture water and wastewater treatment systems for municipal, commercial and industrial applications. The company specializes in treatment of brackish water with its proprietary NIROBOX water desalination system. The EcoBox water reuse system offers strong cost/benefit for decentralized industrial water applications.

Fluence is headquartered in New York State and maintains a presence in Buenos Aires, Argentina. The company has been active in the Carribbean, recently installing a NIROBOX desalination system at a resort in Costa Rica. Fluence also implemented a wastewater treatment plant for the municipal government in Bordeaux, St. Thomas in the U.S. Virgin Islands. The treatment plant features Fluence’s proprietary MABR (membrane aerated biofilm reactor) modules that require as much as 90% less energy than the aeration methods used in competing sludge treatment solutions.

Fluence shares are widely listed on exchanges and quotation services around the world. Frankly speaking it needs all the friends it can find. The company has grown sales dramatically since inception in 2015, reaching the $100 million mark in just four years. Unfortunately, profits have not followed…as yet. The company has reported deep losses in all years. In the most recently reported quarter ending June 2019, Fluence had to draw $11.3 million out of its bank account to support operations. At the end of June the company had $16.5 million left on its balance sheet. The financial picture helps explain why Fluence shares are priced well below a buck and trade infrequently.

Foreign operations and unprofitable businesses mean risk. However, there is no doubt that each of these three companies provides solid value for their thirsty Latin American customers. They are worth consideration for the investor who wants to be part of the Latin America water solution.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 12/10/2019.

The post Water Treatment With a Latin Beat appeared first on Alternative Energy Stocks.

]]>The post Aviation Biofuel Overview appeared first on Alternative Energy Stocks.

]]>by Debra Fiakas, CFA

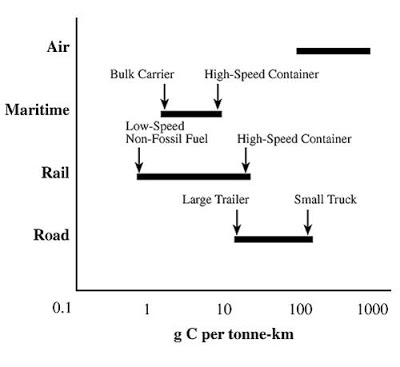

The aviation industry contributes about $2.7 trillion to the world’s gross domestic product. It may seem like a big number, but that is only 3.6% of the world’s wealth. Aviation may be a minor player in terms of creating wealth, it is a big culprit in climate change. Flying around the world accounts for as much as 9% of humankind’s climate change impact. Indeed, compared to other modes of transportation, flight has the greatest climate impact.

The negative impact of carbon emitted by aircraft is made even worse by the fact that the emissions point is mostly at cruising altitudes high in the atmosphere. High-altitude emissions are considered to be more harmful because the chemical reactions there create a greater net warming effect. The Intergovernmental Panel on Climate Change (IPCC) estimates that the climate impact of aircraft is as much as four times greater than the effect of the carbon emissions alone.

Several companies have attempted more environmentally friendly jet fuel. Honeywell (HON: NYSE) acquired Universal Oil Products (UOP) in 2005, and subsequently announcing in 2008, UOPs ‘ecorefining’ process for converting vegetable oils into diesel and jet fuel replacements. Since then Honeywell-UOP has announced several high profile customers for its jet fuel, including the U.S. Navy’s Green Hornet, United Airlines, Quantas Airlines and among others. Still Honeywell concedes its jet fuel will reduce greenhouse gas emissions by only 65% to 85% based on their own internal analysis.

Neste Oyj (NESTE: HE) has developed its own version of sustainable aviation fuel it calls MY Renewable Jet Fuel. Like Honeywell-UOP’s product, Neste’s jet fuel is compatible with existing jet engine technology and is considered a fuel that can be ‘dropped in’ to existing distribution and handling infrastructure. Neste uses a variety of feedstock for its bio-jet fuel, including used cooking oil, waste fish fat, animal fats and corn oil. The end result is a cleaner burning fuel that emits as much as 80% less greenhouse gas emissions than jet fuel made with petroleum.

Even small-fry Gevo, Inc. (GEVO: Nasdaq) is getting into the sustainable jet fuel business. In August 2019, Gevo announced an agreement to supply France’s Air TOTAL International SA with a jet fuel based on Gevo’s proprietary renewable isobutanol. Gevo fractionates grain and ferments the residual carbohydrate portion to produce bio-isobutanol that is then processed further into jet fuel. Given Air TOTAL’s position as a leading aviation fuel distributor, Gevo may be very well positioned beyond its historic share of the renewable fuel market.

Gevo has not yet achieved profitability so even its brilliant distribution relationship with Air TOTAL might not be enough to get risk adverse investors to take a position. The more mature Neste is trading at 24.2 times trailing earnings, which may seem a bit pricey until the stock’s 2.5% current dividend yield is taken into consideration. At 21.2 times its trailing earnings Honeywell’s stock is a bit cheaper. Its 2.0% current dividend yield is not hard to swallow either.

For those investors who cannot decide on the basis of valuation alone, a sustainability rating might help. Sustainanalytics puts Honeywell in the 59th percentile in terms of environmental sustainability. The rating was determined against a peer group of 29 companies. But the same rating scheme puts Neste in the 79th percentile among its peer group of 37 companies. Given its renewable fuel and chemicals focus, Gevo would probably like to be considered among the most environmentally friendly companies. However, Sustainanalytics gives it no rating at all.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 11/19/19 as “Flying High on Organics.”

The post Aviation Biofuel Overview appeared first on Alternative Energy Stocks.

]]>The post Battling Food Waste: Blue Sphere appeared first on Alternative Energy Stocks.

]]>If ‘food waste’ was a country it would be ranked as the third largest emitter of greenhouse gas emissions in the world behind only China and the United States. To reach this conclusion the World Resources Institute used food waste data in 2011, and considered agriculture inputs, food processing, land use, deforestation, food waste disposal, and landfill impacts.

The carbon footprint of wasted food is a big one with cereals contributing about 35% of the greenhouse gas emissions even though is only about 19% of food waste volume. Meat on the other hand is a small part of the food waste problem as it is not thrown away with as much frequency. However, producing food for meat animals, handling animal manure, and all those belching cows cause meat to contribute as much as 20% of food waste emissions.

It is a messy business, but many believe discarded food should be considered a valuable resource and not waste. The World Resources Institute reports that food waste in 2014 was estimated to hold a total of 2,142 petajoules of discarded energy, which is about 8% of the energy consumed annually around the globe. As the world frets over global warming and the harm caused by combusting fossil fuels, it seems like an 8% contribution to energy needs makes a great deal of sense.

Blue Sphere (BLSP: Nasdaq) operates waste-to-energy facilities in the U.S., Italy and The Netherlands. Blue Sphere scrounges the country side for what others consider waste, including food scraps, rejected produce, agriculture straw, livestock manure, and municipal waste. The company uses industrial scale digesters to convert the organic material to electricity that is sold to local utilities through power purchase agreements. Solid materials are converted to soil amendments and sold to local landscapers or farms.

Blue Sphere missed several deadlines in getting its North Carolina and Rhode Island operation up and running. Investors were justifiably disappointed with the pace of progress. However, Blue Sphere engineers finally got the digesters and generators for both projects going in late 2016. The North Carolina plant is rated at 5.2 megawatts and Rhode Island is 3.2 megawatts. The company is currently developing on yet another plant in The Netherlands that will produce biofuel and soil amendments. The acquisition of five small waste-to-energy plants in Italy helped jump start aggregate electricity output for the company.

Investors who want to put capital into a food waste solution may find Blue Sphere an unpalatable choice. The company stopped filing financial reports with the SEC in 2018 and its stock trades at sub-penny levels. Despite its operational struggles and lack of success as a public company, Blue Sphere has proven that food waste has a value in energy production and that it is possible to reduce the massive economic drain that is created by the ‘cult of perfection’ that leads to a loss of 40% of the value in the food supply chain.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This article was first published on the Small Cap Strategist weblog on 10/25/19 as “Electrifying Food Waste.” This is part of a three part series on battling food waste. The first two installments can be found here and here.

The post Battling Food Waste: Blue Sphere appeared first on Alternative Energy Stocks.

]]>