The post Ten Clean Energy Stocks for 2020: Navigating the Storm appeared first on Alternative Energy Stocks.

]]>by Tom Konrad, Ph.D., CFA

This monthly update for my Ten Clean Energy Stocks model portfolio is in two parts. I published my thoughts on the current market turmoil on March 2nd. You can find them here. I’m not even going to get into the Fed slashing interest rates like they were a furniture warehouse going out of business on March 3rd except to say that apparently they are more afraid of the effects of covid-19 on the economy than they are of appearing to panic.

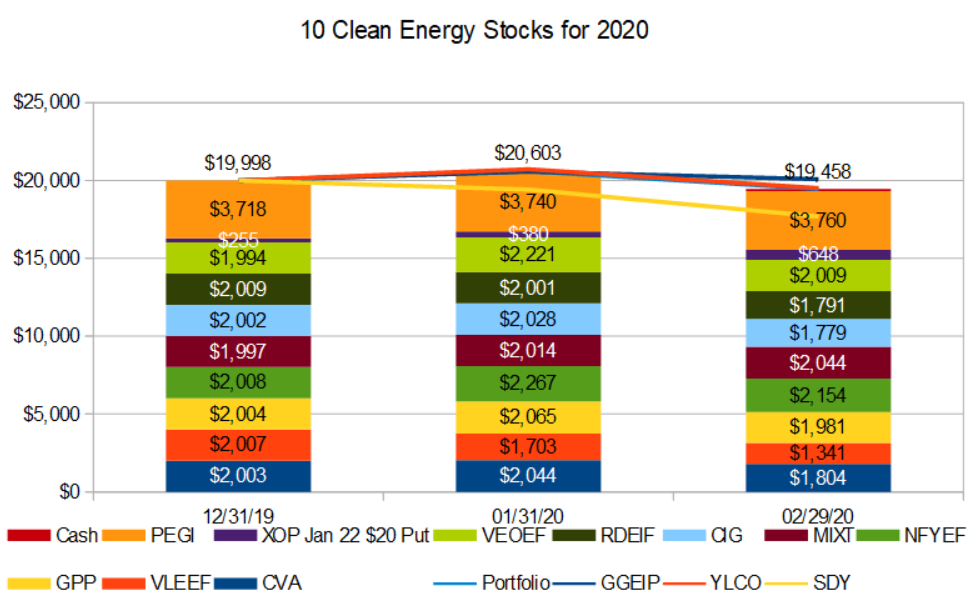

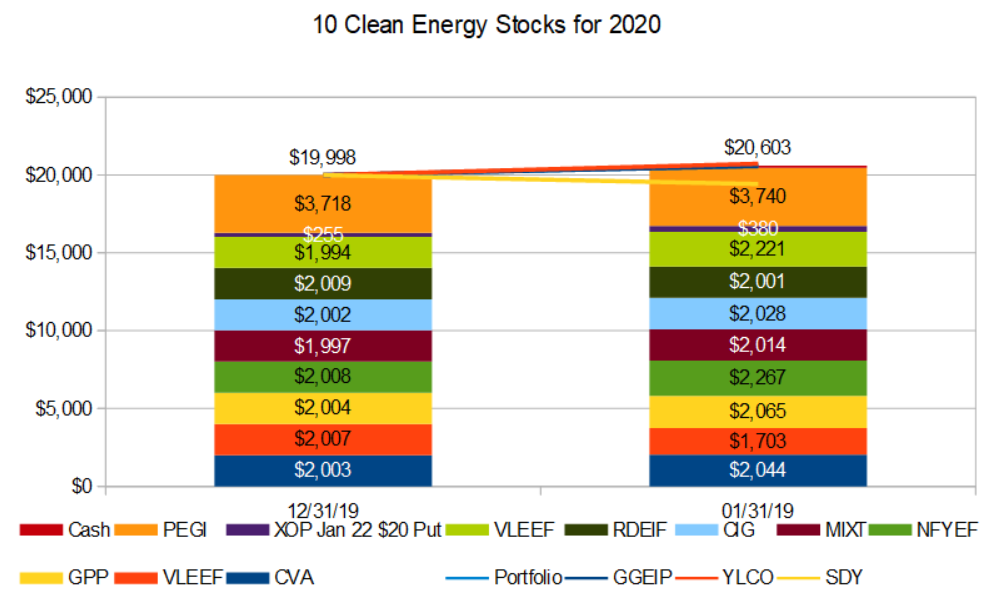

You can see overall performance for January and February in the following chart. Not that it means much any more after just a couple days of rebound.

Hedges

As planned in a down market, the two positions intended to hedge the portfolio have been performing well. The Put on SPDR S&P Oil & Gas Exploration & Production ETF (XOP) has risen in value along with the precipitous decline in XOP. Gains on this and Pattern managed to offset half of the declines of the other positions in the portfolio.

Pattern Energy Group (PEGI) shot up above $28 when hedge fund Water Island Capital called on shareholders to vote against the planned merger arguing that Pattern would be worth more as a stand-alone company. I delved into the details here, and told readers I thought it was a safer bet to just sell for $28 a share. The stock market implosion since has undermined Water Island’s case that investors should put their trust in the market rather than in the cash in hand offered by the Canada Pension Plan Investment Board. After selling on the way up, I bought back in on February 28th when Pattern briefly fell below $27, which once again made PEGI look like a good place to park some cash.

The current rebound in the market is an opportunity to reduce our market exposure. As I have been saying for the last year, I think it’s a good idea to take some profits in our winners and build up a large allocation to cash. If I am right about covid-19 being the catalyst which starts a new bear market, there will be nothing more valuable than cash to buy up newly cheap stocks at bargain prices after the bear runs its course.

Individual Stocks and Covid-19

I have not seen a lot of surprises in fourth quarter earnings so far, and the economic disruptions of the pandemic are likely to be much more significant in the short term. So rather than delve into earnings reports, I will instead take a look at how the individual companies are likely to be affected by the efforts to deal with covid-19.

Waste to Energy operator Covanta Holding (CVA) may see a boost to its revenues from the disposal of medical waste, but will probably continue to see headwinds from low prices for the scrap metal and energy it sells.

French autoparts maker Valeo SA (FR.PA, VLEEF, VLEEY) is seeing disruption of its supply chain in China, and will probably see further disruption as the virus effects the economy in Europe. The auto industry as a whole will probably have a bad year as people drive less and delay purchases of new vehicles. With all the bad news, the stock is down almost a third since the start of the year. I’m buying cautiously, and will buy more if it falls more.

Ethanol MLP Green Plains Partners (GPP) and its parent Green Plains (GPRE) are going to be hurt by the decline in gasoline consumption, which will also reduce the sale of ethanol. Pushing in the other direction is a court ruling that the EPA has improperly been granting waivers to the biofuel blending requirements of the Renewable Fuel Standard. The EPA has until March 9th to appeal this ruling. If the ruling holds or the EPA does not appeal, it will be applied nationwide.

So far, the Trump administration has consistently sided with the oil industry against the farm interests supporting the ethanol industry. The oil industry and a number of the Republican senators who serve its interests in Washington are asking the EPA to appeal the ruling. The Trump administration has to weigh the damage to farm states (whose support Trump needs for reelection in November) against the money it receives from the oil industry (which it also depends on for reelection.) If the Trump EPA sides with Trump’s voters over Trump’s paymasters, it will be good news for these companies. If it sides with the oil refiners, the decision will be appealed, and ethanol companies will continue to feel the pain until a higher court has a chance to rule or a Democrat sits in the White House and drops the appeal.

Both stocks are so cheap that I’m buying cautiously, but mostly GPP, which has both less downside risk and less potential upside.

Bus and motorcoach manufacturer NFI Group (NFI.TO, NFYEF) may see some supply chain disruptions, and bus ridership is almost certain to decline. The supply chain disruptions are probably more important, because transit agencies are unlikely to cancel long planned purchases over a temporary drop in ridership. Motorcoach customers (roughly a quarter of revenues) are more likely to reduce their buying, especially if a decline in ridership impacts their financial health.

Overall, I expect New Flyer’s business to be hurt, but not particularly badly.

MiX Telematics (MIXT) is exposed to disruption through its customers in the oil and gas and transportation industries. I expect the damage to be temporary, so keep an eye out for buying opportunities.

Brazilian electric and water utility Companhia Energetica de Minas Gerais aka Cemig (CIG) Spanish transmission utility Red Electrica Corporacion, S.A. (REE.MC, RDEIF, RDEIY), and French water, waste, and energy management conglomerate Veolia Environnement S.A. (VIE.PA, VEOEF, VEOEY) have limited exposure to the economic disruption of the pandemic, although they do have the potential to decline in a bear market if stock valuations in general were to decline.

Conclusion

Overall, the stocks in this list with the greatest economic exposure to the disruption caused by the covid-19 pandemic are Valeo, Green Plains Partners, and MiX Telematics. Green Plains has some potential short term upside if the Trump EPA does not appeal the recent court ruling.

For Valeo and MiX, the disruption is unlikely to damage their business in the long term, so readers should be ready to buy on any declines, but also maintain healthy cash balances for the future buying opportunities which will appear over the next year or two if I am right that the covid-19 pandemic will be the catalyst that starts a new bear market. If you have not already done so, take some profits in your winners; long time readers will have plenty of Yieldco positions showing large gains.

Disclosure: Long PEGI, CVA, GPP, GPRE, VLEEF, NFYEF, MIXT, CIG, RDEIY, VEOEF, Puts on XOP.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The post Ten Clean Energy Stocks for 2020: Navigating the Storm appeared first on Alternative Energy Stocks.

]]>The post Why is Terraform Power Trading at a Premium to the Brookfield Renewable Merger Value? appeared first on Alternative Energy Stocks.

]]>Tom Konrad, Ph.D., CFA

A reader asked:

Read your recent article on Pattern Energy (PEGI). Great summary and thoughts.

Would like to ask your view on TERP potential takeover by BEP (via shares swap) and whether you reckon the recent run-up on TERP is too excessive?

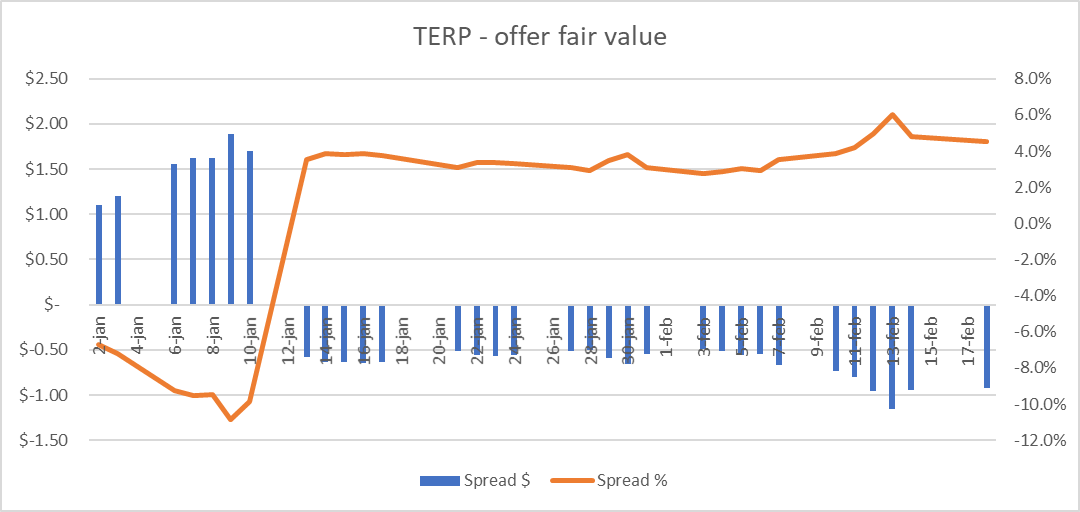

It’s a good question, and one that Robbert Manders on Seeking Alpha did a thorough analysis of here. For the details of the merger, I refer you to his work.

While his analysis is careful and complete, I disagree with his conclusion. TERP shares are not trading at a significant premium to the merger value. The reason is one that Manders touches on, but dismisses as immaterial. He says:

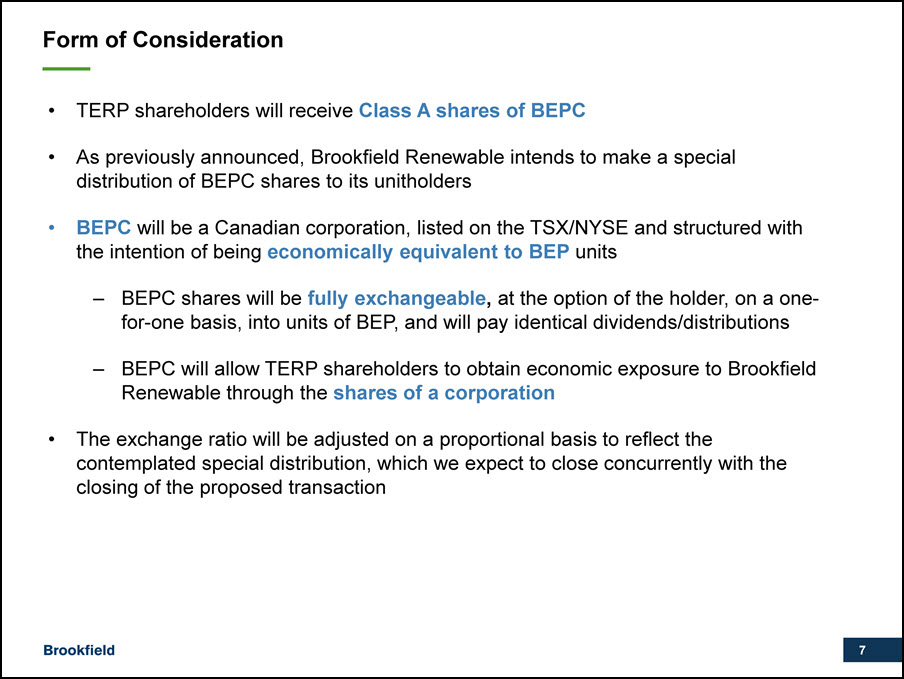

There is one more factor that can sow confusion which is that the shares to be issued to TERP shareholders will be BEPC, a new corporate share class. It is created to accommodate shareholders who want to own shares of a corporation instead of a partnership. The shares will have the same economic characteristics as BEP units and they will be convertible as well. I regard this as a minor detail to the thesis.

The difference between BEP and BEPC is not a minor detail. I discussed this new class of shares in December:

Brookfield Renewable Energy Partners announced a stock distribution and the creation of a new corporation, Brookfield Renewable Corporation (BEPC). This will allow investors who are not able to invest in limited partnerships like BEP to also invest in the stock, which is designed to have identical distributions to BEP and will be exchangeable for BEP units. The stock price of BEP has been climbing since the announcement in anticipation of the new demand for shares from this new potential class of buyers.

It is also important to note that while BEPC shares will be convertible into BEP partnership units, Brookfield has not said that the exchange can happen in reverse. The convertibility of BEPC shares into BEP will thus put a floor on the BEPC premium. Without the ability to convert partnership units into BEPC, there will be no upper limit to the premium at which BEPC shares will trade compared to BEP partnership units.

If Brookfield did not think that BEPC shares would trade at a premium, why would they have bothered to issue the new share class?

Without the ability to convert BEP units into BEPC shares, I predict BEPC will trade at a premium to BEP. We can see a similar effect with Clearway’s two share classes: CWEN trades at more than a two percent premium to CWEN-A based solely on better liquidity. The only economic difference between CWEN and CWEN-A is that CWEN-A shares have more voting rights than CWEN, but large investors value the additional liquidity so much that they pay more than 2% extra to give up most of their votes.

With BEPC, many large investors will be able to buy BEPC but not BEP, so the BEPC premium over BEP is likely to be higher than CWEN’s premium over CWEN-A. I expect it to be a little more than the 4% that has Robbert Manders trumpeting an arbitrage opportunity that will turn out to be illusory, and could easily lead to him losing money.

Disclosure: Long PEGI, TERP, BEP, CWEN-A. Short TERP Calls.

The post Why is Terraform Power Trading at a Premium to the Brookfield Renewable Merger Value? appeared first on Alternative Energy Stocks.

]]>The post Should Pattern Energy Shareholders Vote Against the Merger? appeared first on Alternative Energy Stocks.

]]>by Tom Konrad Ph.D., CFA

This morning, hedge fund Water Island Capital called on Pattern Energy (PEGI) Shareholders to vote against the merger with the Canada Pension Plan Investment Board (CPPIB).

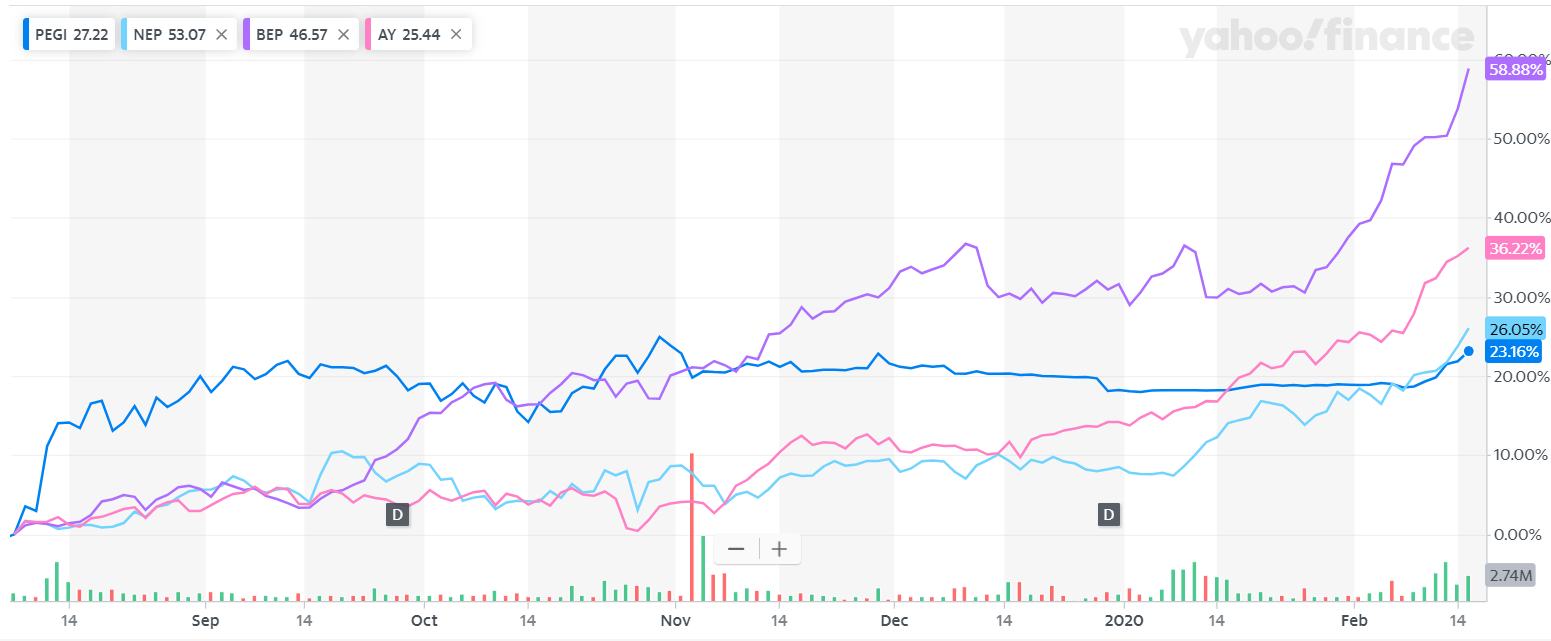

Water Island claims the merger is undervalued compared to the recently surging prices of other Yieldcos, and that PEGI would be trading at over $30 given current valuations. There are not a lot of other Yieldcos left, especially if we eliminate those with their own special circumstances. These are Terraform Power (TERP) which is subject to its own buyout agreement with Brookfield Renewable Energy (BEP), and Clearway (CWEN and CWEN/A) where the PG&E (PCG) bankruptcy is still causing a little lingering uncertainty.

Of the remaining Yieldcos, NextEra Energy Partners (NEP) is up 25% since the merger was announced, Atlantica Yield (AY) is up 33%, and Brookfield Renewable (BEP) is up 50%.

PEGI’s pre-merger price was approximately $23, meaning that if it had risen as much as its peers, it would currently be trading between $28.75 and $34.50, so Water Island’s valuation is credible.

Scenario Analysis

Let’s consider the options:

- A shareholder could sell the stock today for approximately $28.00 a share.

- A shareholder could hold the stock and vote against the merger:

- If the vote fails, the voting period will likely be extended. Subsequent extensions could last until November. CPPIB might raise the merger price to induce more shareholders to vote for the merger

- If the vote succeeds, shareholders will walk away with $26.75 plus one or two dividends of $0.422 each. $27.172 or $27.594 total.

Between 1 and 2b, selling now is clearly the better choice. In the case of 2a, we need to consider likely changes in Yieldco valuations between now and November. If they continue to increase, we will see an even higher valuation for PEGI, but we could have also invested the $28 we got by selling today in one of the other Yieldcos.

If Yieldco prices stay the same, we will have a return of between $1 and $7 compared to our $28/share in the next 9 months. That’s about 14%, which is good, and fairly large compared to the risk that the merger goes through.

I chose to take the money and run. $28 cash seems like a good deal in an uncertain market. The decision is more because I worry about Yeildco valuations overall than my concern about the small loss if the merger does go through. If Yeildco prices fall back to more reasonable levels, the potential gains of voting against the merger vanish.

Naturally, if PEGI’s price falls back down or rises more by the time you read this, the calculations will change. $0.50 either way can make a big difference in this risk-reward calculation. Expect the stock to remain volatile until we know the result of the vote on March 10th, and even longer if the first vote fails.

Disclosure: Long PEGI, short PEGI calls, long BEP, AY, CWEN/A, TERP, short NEP.

The post Should Pattern Energy Shareholders Vote Against the Merger? appeared first on Alternative Energy Stocks.

]]>The post Divestment v Coronavirus: Ten Clean Energy Stocks for 2020 January Update appeared first on Alternative Energy Stocks.

]]>by Tom Konrad, Ph.D., CFA

January 2020- where do I start? A year of market-shaking news in a month.

The Brink of War

The month started off with a literal bang when Trump decided that a good way to distract the public from his impeachment trial would be to try to start a war with Iran by assassinating one of Iran’s top military leaders, Qassem Suleimani. A week later, the world and markets heaved a collective sigh of relief when Iran decided that their honor had been satisfied with two missile strikes on US bases. While Trump reported no casualties, Iran’s Foreign Minister Javad Zarif said Tehran “concluded proportionate measures in self-defense and waged a propaganda campaign on state run and social media that spread rumors that casualties had been widespread.”

While we should be increasingly concerned about Iran’s (and many other actors’) ability to manipulate public opinion with social media, in this case, making the Iranian people believe that their counter-attacks had damaged more than property seems to have allowed the Iranians to avoid a cycle of escalation which would have likely led to war between the US and Iran.

Divestment

Soon after, I thought the theme of this month would be fossil fuel divestment entering the mainstream. Blackrock (BLK) CEO Larry Fink’s letter admitting that “Climate [c]hange become a defining factor in companies’ long-term prospects.” is a watershed moment for the investment management industry. There is no investment manager more mainstream than Blackrock, which tops the list of investment managers by assets under management.

While the steps that Blackrock plans to take (divesting from coal, engaging with companies on sustainability) are timid and incremental, the admission by this investment behemoth that climate change is key to companies’ long term prospects has fundamental implications far beyond the actions that Blackrock says it will take. This is because, as a fiduciary, Blackrock’s first responsibility is to look after its clients’ interests, something the mainstream investment industry equates with investment returns.

While short term investment returns are driven by multitudes of factors, a company’s long term prospects are the most important factor determining its long term investment returns. So Fink is saying that BlackRock has a fundamental duty to its clients to understand companies’ vulnerability and responses to climate change.

If Blackrock now invests client money in companies that later lose value due to climate change in its active portfolio, Fink’s letter will allow clients to show that it knew climate change was a “fundamental” risk. If Blackrock cannot then show that it diligently considered climate change when making that investment, it opens itself up to significant liability.

I personally feel that the steps Blackrock has promised are far from adequate, but I believe that this statement means that Blackrock analysts, no matter what their personal views, will start taking climate risk seriously in their analyses. I feel that way because it happened to me. I started taking climate change seriously as an investment risk in 2005, and it quickly became the guiding theme of my entire investment practice. I doubt that will happen to Blackrock, but I know that once you take a serious look at Climate risk, you never see the investment landscape in the same way again.

Climate change was also a focus of this year’s World Economic Forum in Davos. This opportunity of the world’s moneyed elites to rub shoulders is another indicator of what those elites are thinking about. Since thinking about climate change is much more common among European money managers than those in the US, it may also help to bring the Americans realize that this is not some fringe movement pushed solely by radical activists.

Now that big money seems to be beginning to take climate change seriously, it’s giving cover for smaller money managers to reverse long held positions against doing the same. New York State comptroller Tom DiNapoli seems to have dropped his long opposition to fossil fuel divestment when he announced that the New York State Common Retirement Fund is reviewing 27 thermal coal mining companies to determine whether they are taking steps to transition to a more sustainable business model in line with the growing low carbon economy.”

For smaller and more nimble investors, the changing investment climate is an opportunity. Rather than spending months “reviewing” the plans of fossil fuel companies, we can take the simple step of getting out while the getting is good. Small investors had the opportunity to get out of fossil fuel companies before their declines started in 2011 (for coal companies) and 2014 (for oil), but when large investors like Blackrock and pension funds see the climate writing on the wall and begin to sell in earnest, there will send fossil fuel stocks plummeting further.

The economy is transitioning away from fossil fuels. How long that takes is an open question, but as the transition happens it reduces these companies’ prospects of long term earnings. Yes, as long as current cash flows are good, these companies will be able to transition to more sustainable energy, but for me it has always seemed much simpler to transition my portfolio first, rather than waiting for the companies in it to eventually see the light and try (many unsuccessfully) to make that transition themselves.

While big money managers slowly come to that conclusion, small investors have the opportunity to move first, and sell any fossil fuel companies they still own while there are still investors willing to buy them.

Coronvirus

If coming to the brink of war and early signs that mainstream asset managers are waking up and smelling climate change in the air were not enough, investors spent the last two weeks coming to grips with the possibility of a pandemic. The novel Coronavirus originating in China’s Wuhan province is clearly both highly infectious and often deadly.

China’s economy and world trade are already being disrupted by the efforts to stop its spread. The longer it takes to bring the disease under control, and the farther it manages to spread before we do, the more significant the impact on world growth. Oil prices are already falling in response to the anticipated decline in travel worldwide, and if the pandemic spreads beyond the few cases reported here so far, it will likely disrupt the economy and could easily precipitate the end of the long bull market.

Stock Market Gyrations

All the bad news has had its effect on the stock market. My broad income stock benchmark, the SPDR S&P Dividend ETF (SDY) is down 2.9%. Clean energy income stocks bucked the trend, quite possibly due to the growing moves towards divestment. My clean energy income benchmark, YLCO gained 3.6% for the month, while the model portfolio is up 3.0% and the real money Green Global Equity Income Portfolio I manage is up 2.9%.

Individual Stocks

The two hedging positions in the portfolio performed well, with the January 2020 $20 Put on SPDR S&P Oil & Gas Exploration & Production ETF (XOP) rising from $2.55 to $3.80 as XOP dropped from $23.70 to $19.16. Pattern Energy Group’s (PEGI) buy out by the Canada Pension Plan Investment Board progressed with the company setting the date to vote on the merger for March 10th. This caused the stock to rise slightly despite being knocked back a little by the announcement of what looks to be like a nuisance class action lawsuit announced on January 28th.

The largest decliner in the portfolio was unsurprisingly Valeo SA (FR.PA, VLEEF, VLEEY), a French auto-parts maker which is very sensitive to changes in the global economic outlook. Despite the volatility of the auto parts market, this company has been making progress and taking market share while others contract. January’s price decline just makes it more attractive… at least as part of a portfolio which is otherwise positioned for a market downturn.

The biggest winners were NFI Group, Inc. (NFI.TO, NFYEF) (up 13%) and Veolia Environnement S.A. (VIE.PA, VEOEF, VEOEY), up 11%. New Flyer’s move seems to be more a valuation driven rebound from a long decline in 2019 than any news-driven event. Veolia’s move continues a rise that began from lows in late 2018, but also does not seem to be related to news. The company bought a hazardous waste business from Alcoa for $250 million at the start of the month, but a transaction that size is pocket change for a company like Veolia with $27 billion in annual revenue.

None of the other stocks in the portfolio made particularly big moves, with the exception of MiX Telematics (MIXT). The provider of vehicle tracking and telematics services rose for most of the month, until it reported its third fiscal quarter earnings on January 30th. One of MiX’s largest customer segments are international oil and gas companies, an industry which has been struggling to maintain profitability. This led to many customers temporarily reducing the number of their vehicles in active service to save on costs. One of these costs is MiX’s subscriptions. If and when the industry turns around, these subscriptions will likely be re-activated, but MiX cut its outlook for growth in 2020 and the stock gave back all the gains it had made earlier in the month.

This sensitivity to oil stocks is one of the reasons the oil and gas exploration ETF XOP is a good hedge for the portfolio as a whole. Other stocks in the portfolio like Green Plains Partners (GPP) also have some sensitivity to oil prices because the products they sell compete with oil products, as GPP’s ethanol displaces gasoline.

Conclusion

All in all, January was a very exciting month for stock market investors, and excitement in investing is not a good thing. With 2020 barely begun, we have had a year’s worth of market moving events, and doubtless more to come. Yet despite the wobbles of the broad market, the growing divestment trend seems to be keeping the clean energy relatively resilient, and this model portfolio was designed with the idea that a 2020 bear market was a distinct possibility.

It’s been a bumpy ride, but so far, so good.

Disclosure: Long PEGI, CVA, GPP. VLEEF, NFYEF, RAMPF, MIXT, CIG, RDEIY, VEOEF, Puts on XOP.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The post Divestment v Coronavirus: Ten Clean Energy Stocks for 2020 January Update appeared first on Alternative Energy Stocks.

]]>The post 2020 Hindsight: Ten Clean Energy Stocks For 2019 appeared first on Alternative Energy Stocks.

]]>by Tom Konrad Ph.D., CFA

Sometimes it’s good to be wrong.

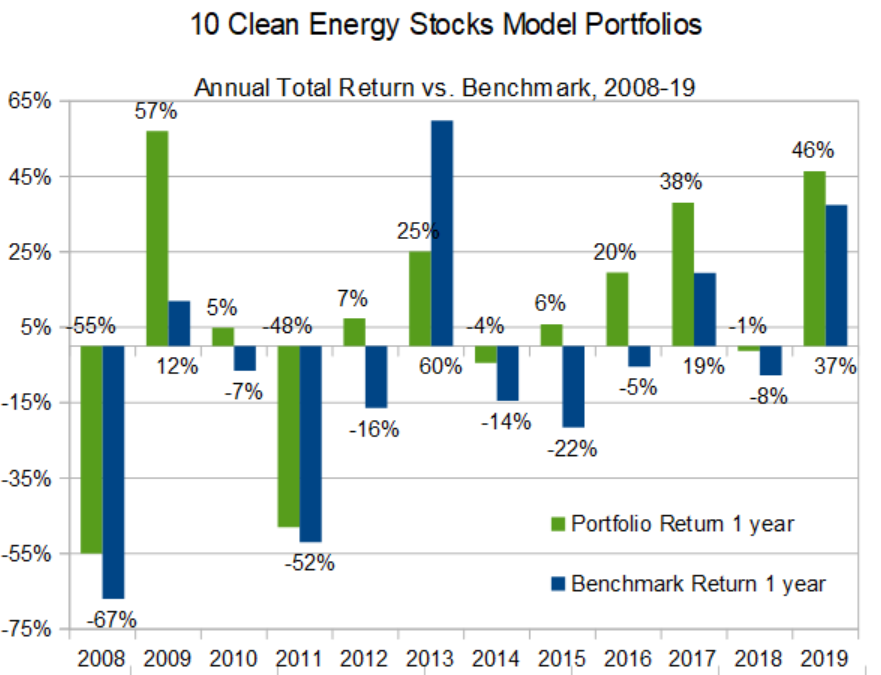

When I published the Ten Clean Energy Stocks For 2019 model portfolio on New Year’s Day 2019, I thought we were likely in the beginning of a bear market. With 20/20 hindsight, that was obviously wrong.

I made the following predictions and observations:

- “[T]he clean energy income stocks which are my focus should outperform riskier growth stocks.” [True]

- “[D]eep value investors will put a floor under the stock prices of these ten stocks.” [Irrelevant, and a little amusing.]

- “I could also be wrong about the future course of this market.” [So true!]

- “I have a history of underestimating the optimism of investors.” [True, and even more true today]

- “[If] the Dow [is] hitting new highs by the end of 2019 … I expect that this model portfolio will produce gains as well, although it will likely lag the gains seen by the broad market of less conservative picks.” [Wrong again]

- “As long as you are in the market, every now and then the stars will align, and you will make some great gains.” [True, but I did not think that alignment would come again in 2019 so soon after 2016 and 2017.]

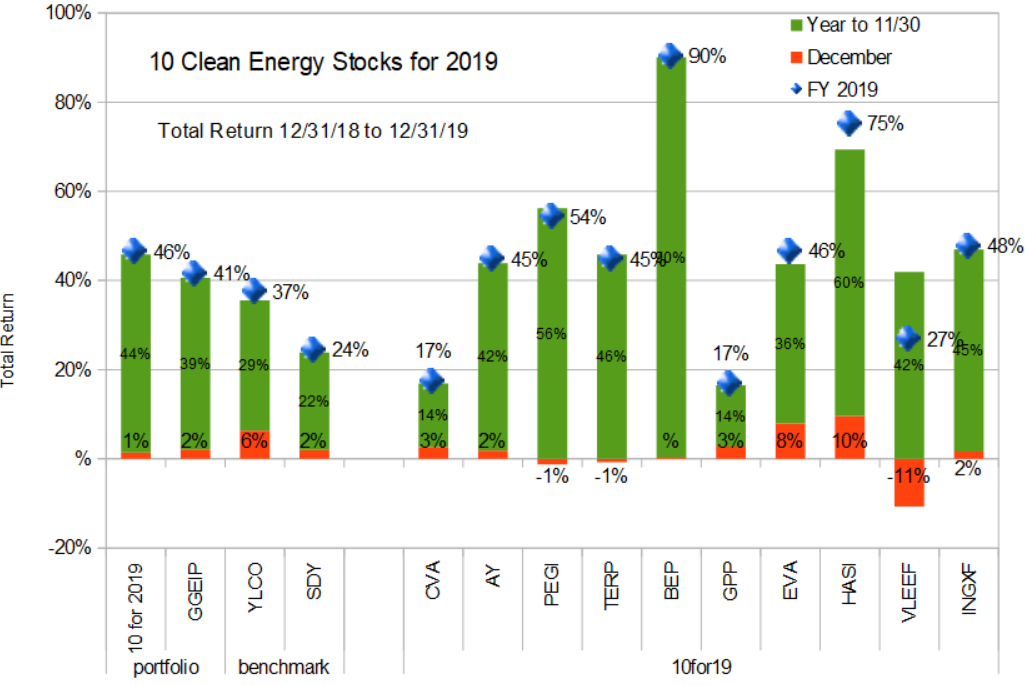

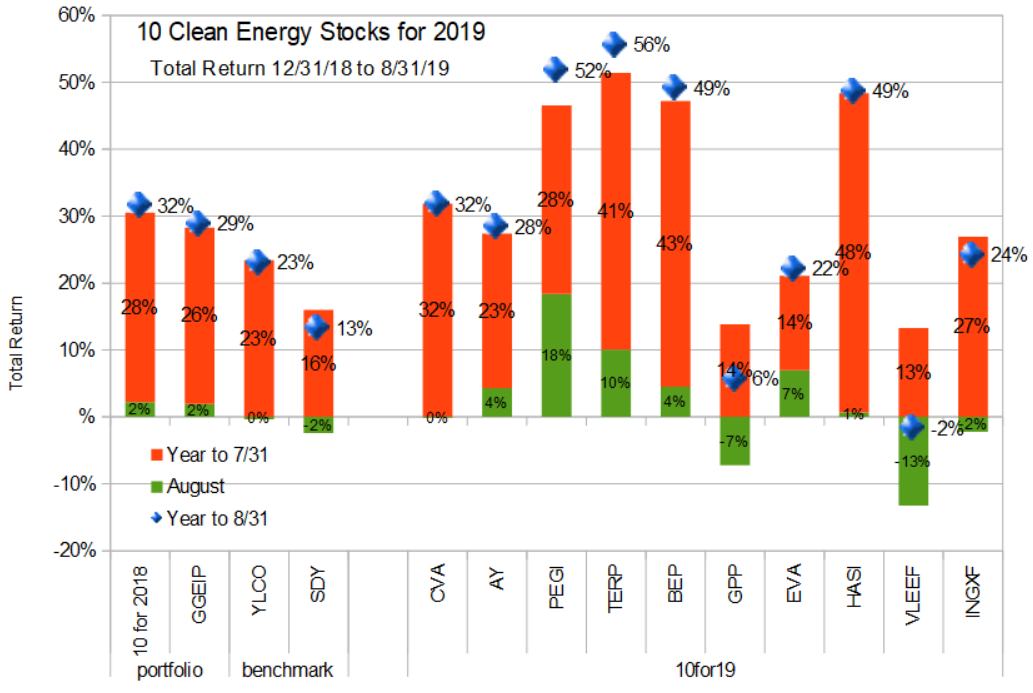

In the end, my conservative model portfolio ended the year with a total return of 46%. The real-money green income strategy I manage, GGEIP returned 41% despite a large cash allocation in the second half of the year. Both compare favorably to my clean energy income benchmark, YLCO, which was up 37%, and the broad market income benchmark SDY, which gained 24%.

In short, the stars aligned in 2019.

Because almost every stock in the model portfolio went up far more than its actual business improved, I dropped most of them from the 2020 clean energy stocks model portfolio. I still like all the companies, just not their prices.

I did not sell any of them completely in GGEIP, but I have been taking profits in and lowering my allocation to the ones with the greatest gains.

The new list is heavily international, and partly hedged. Despite being wrong in 2019, in 2020, I’m doubling down on the thesis that there is a good chance of a bear market in the United States this year.

When it comes to predicting bear markets, I sometimes feel like I’m a broken clock.

Eventually this broken clock will be right. Until then, I’ll console myself with the unexpected fruits of being wrong.

Disclosure: Long PEGI, CWEN/A, CVA, AY, TERP, BEP, EVA, GPP. INGXF, HASI, VLEEF.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The post 2020 Hindsight: Ten Clean Energy Stocks For 2019 appeared first on Alternative Energy Stocks.

]]>The post Ten Clean Energy Stocks for 2020 appeared first on Alternative Energy Stocks.

]]>by Tom Konrad, Ph.D., CFA

If it’s tough to follow a winner, 2020 is going to be an especially tough year for my Ten Clean Energy Stocks model portfolio.

I’ve been publishing lists of ten clean energy stocks that I think will do well in the year to come since 2008. With a 46 percent total return, the 2019 list has had its best year since 2009, when it managed a 57 percent return by catching the rebound off the 2008 crash. This year’s returns were also achieved in the context of full- to over-valuation of most of the clean energy income stocks I now specialize in.

Going International

With this as background, my main goal with the 2020 list is to find stocks which will be resilient in the event of a US bear market. Early 2019 saw bear market fears surface when the US yield curve inverted, only to fade again when the inversion vanished. The yield curve has inverted before every recession over the last 50 years, and there has only been one yield curve inversion which did not proceed a recession in that time. Will we get another recession in the two years following March 2019? It is clearly too early to say. Investor complacency is not a predictor of a recession, but it is an ingredient of bull market peaks.

I am not at all complacent about the prospects of the US stock market, European and emerging markets have not enjoyed the same bull run the US did in 2019, so they still have some relatively good values left. If you do not have much experience in trading foreign stocks, I’ve published some thoughts here. The short version is: Decide how much you want to pay for the stock, and use a good-til-cancelled limit order.

The article also has some notes in what the multiple ticker symbols mean. For the purposes of tracking performance, I will be using the stock price in the company’s home market translated into dollars at current exchange rates.

The List

Returning Stocks from 2019

Unsurprisingly, the stocks I’m keeping from last year’s list are those that that have not seen the biggest run-up.

Covanta Holding Corp. (CVA) and Valeo SA (FR.PA, VLEEF, VLEEY) have both been making progress implementing their business plans, but have not been fully rewarded by the market the way I would expect given the massive run-up in other stocks.

The thesis for retaining Green Plains Partners (GPP) remains the same as the one for including it last year: the ethanol MLP enjoys revenue guarantees from its parent, Green Plains, Inc (GPRE). Despite the continuing pain the ethanol market caused in large part by the Trump administration’s trade war and giveaways to friends in the petroleum refining industry, these guarantees should allow GPP to maintain its healthy $1.90 annual dividend. If Trump loses in November, I expect that the stock price to produce further gains as the market anticipates a return to business as usual and an end to the Trump EPA’s give-aways to refiners.

New Stocks for 2020

NFI Group, Inc. (NFI.TO, NFYEF) (formerly New Flyer Industries) is a leading manufacturer of transit buses and motor coaches. New Flyer was a great 10 Clean Energy Stocks success story; it appeared on the 2012 list at $5.65, gaining 54% that year. It returned in 2014 for a 22% total return, and in 2015 with an 80% return. I dropped it from the 2016 list because it was starting to look overvalued.

The stock did not peak until the start of 2018, but for the last two years it has since been struggling. When the stock was last in the list, it was simply the leading manufacturer of heavy duty transit buses in North America… now it is a leading global manufacturer of both transit buses and motor coaches. Its current problems do not seem permanent in nature. Some arose from the recent acquisition of Alexander Dennis and a build-up of work in progress as NFI experienced some hiccups internalizing much of its parts manufacturing.

Despite many people’s unpleasant experiences with diesel buses, bus transit is an inherently clean and low emission form of transport because it is an effective way to take numerous cars off the road. But buses are rapidly getting greener as they have some of the best economics for electrification.

Electric transit bus manufacturers like Proterra argue that an electric bus is best designed from the ground up as electric, in order to take advantage of the flexible layout possibilities that electric propulsion enables. In contrast, NFI takes a propulsion-agnostic approach, and uses third-party drivetrains including diesel hybrids, natural gas, battery-electric, and fuel cell electric to meet its customers needs. I see value in both approaches. I think many of the large transit agencies that are considering heavy duty electric transit buses from both Proterra and NFI will find comfort in the new technology when it is backed by a large, traditional supplier with a large parts and service arm that they have been dealing with for years, while others will prefer a bus designed from the ground up to be electric. From a competitive standpoint, I expect both strategies to flourish, at the expense of smaller competitors without the resources to deliver credible electrified and hybrid options. Proterra, however, is not a public company. NFI is, and it currently trades at an attractive price with a healthy dividend.

Like New Flyer, MiX Telematics (MIXT) is also a blast from the past. The company provides vehicle management systems and telematics systems to fleet owners. Their systems improve safety, reduce fuel use and theft, and help with regulatory compliance. The company’s software as a service (SaaS) platform enables it to leverage its technology platform for relatively rapid growth and high margins. MiX is a global company based in South Africa with operations on six continents. This global presence gives it an edge over its competitors in serving large, multinational clients, especially in transportation and resource industries.

MiX first entered the list in 2014 at $12.17. I was too optimistic about its valuation at the time, and it was the biggest loser of the year, falling 45%. There were nothing wrong with the company’s fundamentals, however, and I kept it in the list in 2015, when it fell another 32%. In 2016 I doubled down and it gained 51%, followed by a 110% gain in 2017, closing the year $12.76 plus a few dividends. I dropped it from the list in 2018 because I felt the valuation was reasonable, but not as attractive as many other opportunities that year. I sold most of my holdings in the mid teens (which I mentioned here) as the stock rose further in 2018. MIXT eventually made it as high as $20, before falling back to near where it was at the end of 2017 two years later. Overall, that would not have been that great a run except that when stocks I like fall, I tend to buy more.

Today. MIXT stands near where it was in late 2019, with the difference being that it has been growing its subscriber base at a little more than ten percent annually. Subscription revenue has been growing even faster as MiX adds more products and features to its offerings. There is plenty of room for this growth to continue as well; only 19% commercial vehicles have a telematics solution.

Brazilian utility Companhia Energetica de Minas Gerais, a.k.a Cemig (CIG) is a relatively conservative pick in a very volatile stock market. It is the third largest electricity generation utility and has the largest transmission and distribution utility in Brazil. In terms of sustainability, the company’s generation assets are almost all hydroelectric, with a few relatively new wind farms and one fossil plant. It also has a gas distribution utility in its home province of Minas Gerais.

From the perspective of risk, the biggest risk of investing in Cemig is investing in Brazil itself. The current (Bolsonaro) administration is business friendly… Cemig shares saw a sharp spike in late 2018 when the current president was elected. Bolsonaro is not environmentally friendly, however, and I generally avoid holding stocks which put my financial interests at odds with my ideals. In this case, I am hoping that Bolsonaro loses the next election in 2022, so I would not plan to hold Cemig more than a couple years.

Red Eléctrica Corporación, S.A. (REE.MC, RDEIF, RDEIY) is the electric transmission utility for Spain. It also owns some transmission assets in Portugal and Latin America, as well as some telecom assets. Long distance transmission and the integration of electric grids over large areas is an essential part of all plans to transition to high percentages of renewable electricity. Red Electrica sees sustainability and renewables integration as key parts of its mission, and has been making large investments in interconnections with France and Spain’s outlying islands.

As a regulated utility, the company is included in the portfolio as a relatively low risk pick that pays a healthy dividend.

Veolia Environnement S.A. (VIE.PA, VEOEF, VEOEY) is a France-based global company operating in the water, waste, and energy management. Although I generally prefer to invest in more focused companies, an investment in Veolia gives access to a number of interesting clean energy technologies which are not available as pure-plays. One of the most interesting to me is the production of biogas and other useful products from sewage.

Building energy management also has great potential to cost effectively reduce waste, energy use, and greenhouse gas emissions. The problem is that most companies do not have the in-house expertise to achieve its full potential. Veolia has the scale and expertise to solve this problem at practically any scale. They can also bring their expertise to bear to reduce energy use by understanding and influencing the behavior of building occupants through communication and education.

Hedging and Pseudo-cash

In line with my goal of protecting the model portfolio against a possible market downturn, I settled on using Puts on SPDR S&P Oil & Gas Exploration & Production ETF (XOP) as a hedge. In particular, my model $20,000 portfolio will include one XOP January 2022 $20 Put contract. That put gives us the right to sell 100 shares of XOP for $20 each at any time before January 21, 2022. As of the close of trading on December 31st, these puts were trading for $253. A single contract gives control of $2,000 worth of XOP, which should make this holding about as volatile as the other positions in the portfolio.

While I plan to use the January 2022 $20 Put for tracking purposes, really any put with a strike price between $20 and $25 expiring in January of 2021 or 2022 will do the trick. Puts that have higher strike prices will cost more but have a higher chance of paying off, which puts that expire in 2021 will cost less but not act as a hedge for as long. Shorting XOP and selling XOP calls are also valid hedging options, but keep in mind that both these strategies can potentially produce unlimited losses, far greater than the size of the initial investment. I generally avoid these strategies for this reason, but the losses can be manageable if the hedge is a very small portion of your portfolio. I currently have sold naked calls on Nextera Energy Partners (NEP) as a hedge against my many large Yieldco holdings. I am currently losing money on this hedge because all Yieldcos have been going up for the past few months, but my gains on other Yieldcos far outweigh the losses on NEP calls because the hedge is tiny compared to the other Yieldco holdings.

The oil and gas E&P sector has had several bad years, and I was a little hesitant to choose an effective short position in a sector which has had such a bad run. However, stocks in declining industries don’t necessarily have a bottom. A quick look at the long term chart for the VanEck Vectors Coal ETF (KOL) will show you that. I would have considered KOL for this hedge if not for the fact that KOL only has options contracts going out 6 months, and so using KOL should have required options trading in the middle of the year.

The reasons I think XOP might continue to go down are

- Stranded asset risk

- Political risk

- Divestment risk

- Legal liability from past deception about climate change

Stranded asset risk is the risk that past investments to develop fossil fuel reserves will never see a payoff. The world simply cannot burn all the oil and gas that companies count among their “proven” reserves, and avoid catastrophic global warming. I’m not confident that we will avoid that, but I do know that the more fossil fuels we use, the more catastrophic the outcome will be. Since climate-change fueled natural disasters are becoming a commonplace occurrence, I see governments and individuals around the world starting to take swifter action to deal with the problem. This takes the form of political risk when governments decide to regulate emissions, increase fuel economy standards, regulate oil drilling, and remove existing subsidies. But it can also arise when individuals worried about climate change take steps like driving less by taking actions like combining trips, using mass transit, and walking and biking more, and ridesharing. As well as by shifting to electric vehicles.

Divestment risk is simply the risk that as more individuals and institutions adopt policies of not investing in fossil fuel companies, the stock prices will fall simply because of a lack of buyers. As I wrote in September 2014, in divesting, the last one out loses. Anyone who read that article back then could have sold XOP for over $70 a share, as opposed to $23 today. But there are still more people who can sell.

Legal liability arises from big oil companies long term deception about climate change. Right now there are a large number of state lawsuits alleging that big oil companies knew about the risks of climate change but deceived the public and investors about the risks. None of these lawsuits has a giant chance of succeeding, but it only takes one. If a single such lawsuit succeeds, it will open the floodgates to every state and municipality which has seen some negative effect of climate change to file additional lawsuits. I don’t know when (or even if) it will happen, but Big Oil could be on the verge of its “Big Tobacco” moment.

The reason I chose to use puts is because shorting is always risky. Even with all the risks above, there could still be a short term oil price spike in 2020 which sends all oil stocks gushing upward. Buy buying a single put, we are limiting the risk to the option premium.

Yieldco Pattern Energy Group (PEGI) is currently in the process of being bought out by the Canada Pension Plan Investment Board for $26.75 per share. The transaction is expected to close before June 30, 2020, and the company will continue to pay its quarterly dividend of $0.422 per share until it closes. I’m including Pattern in this list mainly because I think of it as a good place to park cash for 4-6 months as insurance against a market downturn.

Compared to a bank CD, there is a small risk that the transaction will not go through, in which case the stock might fall 10% or so in the short term. The upside is that readers who buy at or below the $26.75 will collect a $0.422 (1.57%) dividend for holding the stock for 4-6 months, approximately double the return available from comparable CDs. There is further upside from the chance that the buyout is delayed until after June 30 and holders collect a second $0.422 dividend. This is also unlikely, but considerably more probable than the merger falling through.

I suggest readers who do not still own Pattern from 2019 and previous years buy PEGI using limit orders at the buyout price ($26.75) or better. If the price rises and your trade does not execute, just keep the money in cash. I will have a new stock pick to replace PEGI after the deal is complete.

For the purposes of tracking the portfolio, I will be considering the $2000 which I would have allocated to PEGI to be held as cash unless or until the stock trades at $26.75 or below in 2020. Excess cash from the $2000 position allocated to XOP will also be allocated to PEGI if it trades at or below $26.75 in 2020. All of this money will be allocated to one or two new or existing positions chosen after the PEGI sale completes.

Bonus Pick

Polaris Infrastructure Inc. (PIF.TO, RAMPF) is a tiny geothermal and run-of-river hydropower Yieldco build around the assets of Ram Power. Long time readers may recall Ram Power as a bonus “speculative” pick from the 2014 list. Like most speculations, that particular gamble did not pay off, and the company went into bankruptcy after repeated drilling failed to stabilize electricity production at its main geothermal asset, San Jacinto-Tizate in Nicaragua even after extensive additional drilling. Unable to meet its debt obligations with the lower-than-expected electricity revenues, the bondholders ended up owning the company, and they re-listed it without its former heavy debt burden and a healthy dividend in 2015.

In early December, I had hoped to include Polaris in the list, but the stock price ran up over 10% in the last two weeks of the year. While its yield is very attractive compared to other Yieldcos, its small size and continued need for additional drilling at San Jacinto-Tizate to offset natural production declines make me cautious about buying this company at anything but rock-bottom prices. Nevertheless, it is one to watch, and if the price falls back in 2020, it’s a leading candidate to replace PEGI when the buyout is complete.

Portfolio

For the first time this year, I plan to track the model portfolio based on an initial $20,000 investment, using actual share numbers and cash. In the past, I have assumed that dividends would be re-invested in each position; this year I will track them as cash and only re-invest if I see an attractive opportunity.

I will track foreign stocks using their stock prices in their home markets with values translated into US dollars at current exchange rates using the five letter foreign stock ticker. Readers should note that stock price quotes for these tickers are often stale, and so they will likely vary slightly from my calculated prices. Readers who are using ADRs rather than foreign stocks in their own portfolios should use 2 shares of VLEEY and RDEIY in place of one share of VLEEF or RDEIF because of the ADR multipliers. In contrast shares of VEOEY and VEOEF have equal value. See my recent article on trading foreign stocks and options for more details.

I will track the price of the XOP Put option using the midpoint of the bid and the ask at market close rather than the most trade, which could be hours or even days old and so may not reflect recent price movements in the underlying ETF, XOP.

As I have for the last few years, I will continue to use Global X YieldCo & Renewable Energy Income ETF (YLCO) as a clean energy benchmark and SPDR S&P Dividend ETF (SDY) as a broad market benchmark.

| Ticker | Shares | 12/31/19 | Price |

| CVA | 135 | $2,003.40 | $14.84 |

| VLEEF | 57* | $2,007.36* | $35.22* |

| GPP | 145 | $2,003.90 | $13.82 |

| NFYEF | 98* | $2,008.14* | $26.65* |

| MIXT | 154* | $1,997.38* | $12.97 |

| CIG | 587 | $2,001.67 | $3.41 |

| RDEIF | 100* | $2,009.19* | $17.92* |

| VEOEF | 75* | $1,993.77* | $23.71* |

| XOP Jan ’22 $20 Put | 1 | $255.00 | $2.55 |

| PEGI | 139 | $3,718.25 | $26.75 |

| Cash | $0.00 | ||

| Portfolio | $19,998.06* | ||

| YLCO (Benchmark) | 1344 | $19,998.06* | $14.88 |

| SDY (Benchmark) | 186 | $19,998.06* | $107.57 |

| *Note: Updated from an earlier version of this table which did not account for currency exchange rates. | |||

Conclusion

Looking forward to 2020, the only thing I am sure of is that I have no idea what is going to happen to the stock market. I have been preparing for a large market correction for more than half of 2019, and the US stock market has continued to advance unstoppably. Valuations seem extremely stretched, the political climate could not be more volatile, and the Federal Reserve has indicated that they do not intend to keep lowering interest rates. With this backdrop, it should not take much to send the stock market into a tailspin.

On the other hand, my friend Jan Schalkwijk, CFA of JPS Global Investments (an advertiser on this website) recently reminded me that most bull markets end in euphoria, when there is no one left to get excited about the stock market. That is hardly the situation today and I am hardly the only voice of caution among stock market pundits.

I also have a track record of being too early… I often get out of bull markets long before they peak and start buying declining stocks long before they bottom. So I’m far from confident that the bear I expect will appear soon, or even in 2020. But when it comes to bear markets, it’s better to get out too soon than too late.

Ten Clean Energy Stocks for 2020 is probably the most diversified and defensive model portfolio in the series since I started it in 2008. Yet with my worries about the coming year, I will not be surprised if the portfolio ends 2020 lower than it begins the year. Let’s hope that does not happen, but if it does, the model portfolio should decline much less than its benchmarks, especially the ever-volatile YLCO.

Disclosure: Long PEGI, CVA, GPP. VLEEF, NFYEF, RAMPF, MIXT, CIG, RDEIY, RAMPF, VEOEF, Puts on XOP, short NEP.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The post Ten Clean Energy Stocks for 2020 appeared first on Alternative Energy Stocks.

]]>The post Ten Clean Energy Stocks For 2019: Still Party Time appeared first on Alternative Energy Stocks.

]]>by Tom Konrad Ph.D., CFA

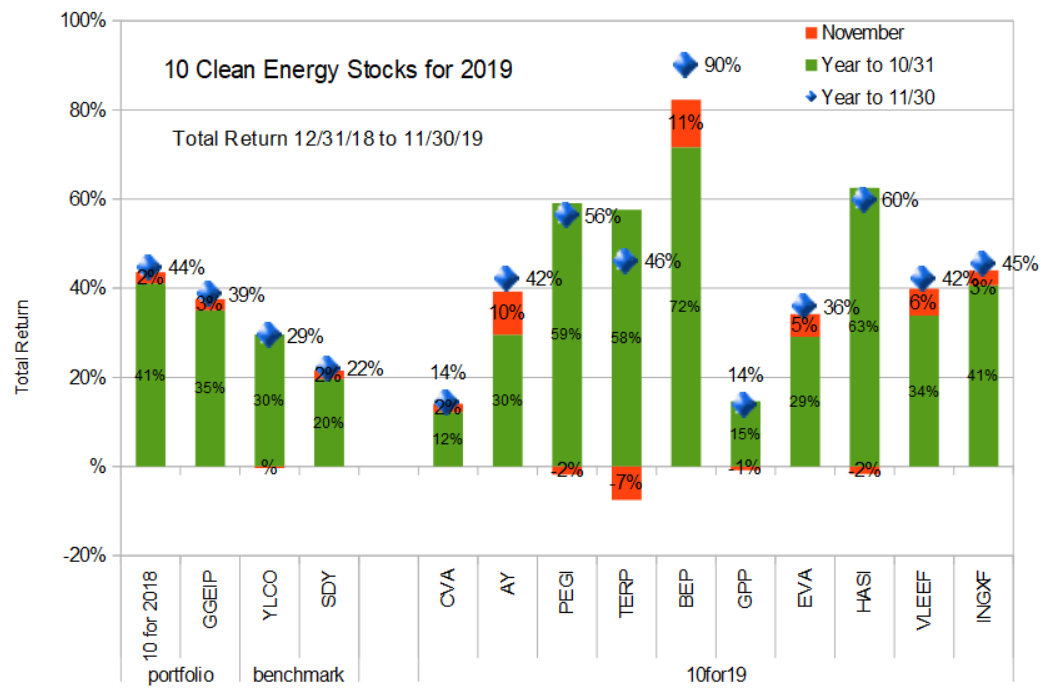

2019 has become another blockbuster year for the Ten Clean Energy Stocks model portfolio and, to a lesser extent clean energy stocks and the broad stock market as well. I’m frankly surprised to see the party continuing. The continued spiking of the metaphorical punch bowl by the Federal Reserve with interest rate cuts certainly has a lot to do with it. I had expected those cuts to be both fewer and less effective.

Which all goes to show that it’s always a good idea to hedge one’s bets in the stock market. At least in part because of this hedging, my real money Global Green Equity Income Portfolio GGEIP has somewhat underperformed the 10 Clean Energy Stocks model portfolio, up 38.5% and 44.5% for the year, respectively. Both remain well ahead of their benchmarks, however, with the clean energy income stock benchmark YLCO up 29.3% and the broad income stock benchmark SDY up a still respectable 21.9%.

Will the party continue with a blowout Santa Claus rally? Only Santa knows, but I’m going to continue with caution in case he decides to show up with a lump of coal (have you seen coal stocks recently?) instead of nicer gifts.

Individual Stocks

Last month I warned,

Hannon Armstrong HASI, Terraform Power (TERP), and Brookfield Renewable Energy Partners (BEP) are all stocks in which readers should be considering taking some profits, if they have not already. I continue to think these three stocks are all ripe for price corrections.

Terraform saw that price correction, down 10% on a secondary offering of 14.9 million shares of stock at approximately $16.84 a share. This is business as usual for Yieldcos, which sell shares when prices are high to finance the purchase of income producing clean energy investments. As long as such investments can be had at prices which expand per share cash available for distribution, such secondary offerings are good for long term shareholders. I generally consider the one or two months following a secondary offering as the best time to invest in Yieldco stocks, although Terraform’s valuation even after the recent dip is not making me rush in with any buy orders. But it’s certainly less overvalued than last month.

Brookfield Renewable Energy Partners announced a stock distribution and the creation of a new corporation, Brookfield Renewable Corporation (BEPC). This will allow investors who are not able to invest in limited partnerships like BEP to also invest in the stock, which is designed to have identical distributions to BEP and will be exchangeable for BEP units. The stock price of BEP has been climbing since the announcement in anticipation of the new demand for shares from this new potential class of buyers. After the split, investors should not be surprised if BEP takes advantage of its new, lofty stock price to raise cash in its own secondary offering, bringing the stock price back down from its temporarily lofty level.

Although I think the formation of BEPC will be good for existing investors, I continue to trim my holdings of BEP in anticipation for such a decline.

French autoparts maker Valeo SA (FR.PA, VLEEF) reported strong 3rd quarter sales at the end of October, and the stock has been rising since. Sales were up 8% despite an ongoing contraction in auto sales overall. The company’s excellent performance is largely due to the start of production on projects including vehicle electrification, cameras, and lighting. All-in-all, the company’s plan to leverage its R&D efforts to get its products into more new vehicle models seems to be paying off. Barring a broad market sell-off, I would expect the stock to continue to advance. Given the large increases in most of the stocks in this year’s list, I am going to be searching for a large number of new stocks to add to the 2020 list as I drop the ones that have climbed the most since they are no longer offer compelling valuations. Unless it advances significantly more in December, Valeo seems likely to stay.

Another big winner was Atlantica Yield (AY). Investors generally liked the 3rd quarter earnings report and 1 cent increase in its quarterly dividend to $0.41 at the start of November. Revenue and Cash Available For Distribution (CAFD) continue to advance at a 6-7% rate through the company’s investment in new projects, such as the ATN Expansion 2 transmission project which it closed on during the quarter.

One thing I like about Atlantica compared to other Yieldcos is its diversification into electricity transmission and water. Owning both of these asset classes is rare in the industry, but transmission in particular is essential to the clean energy transition, and having expertise in different asset classes means that Atlantica can look at different types of investment opportunities when traditional Yieldco assets like solar and wind are relatively expensive. Because of its Spanish roots, Atlantica also has a more diverse geographic profile than other Yieldcos.

Conclusion

The year isn’t over, but I can confidently say that, at least as far as my stock picks go, it far exceeded my expectations. With all the price rises, I’m going to have trouble finding ten clean energy stocks that I think are good investments at the end of December. I’m seriously considering including one or two short positions in the portfolio, something I have done only once before, in 2008 when I include a short of First Solar (FSLR). It was a timely choice, since First Solar fell 50% that year, helped along by the financial crisis. Alternatively, given the new accessibility of option strategies for the small investor, perhaps I should include option hedging or positions in the portfolio.

What do readers think? Would a short, option hedging, or just sticking to long-only (with the continued caveat that readers should have a large allocation to cash or a hedging strategy) be the most useful to you in the Ten Clean Energy Stocks for 2020 model portfolio? Let me know in the comments.

Disclosure: Long PEGI, CVA, AY, TERP, BEP, EVA, GPP. INGXF, HASI, FR.PA/VLEEF, CWEN-A.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The post Ten Clean Energy Stocks For 2019: Still Party Time appeared first on Alternative Energy Stocks.

]]>The post Ten Clean Energy Stocks For 2019: Pattern Buyout, Analyst Downgrades appeared first on Alternative Energy Stocks.

]]>by Tom Konrad Ph.D., CFA

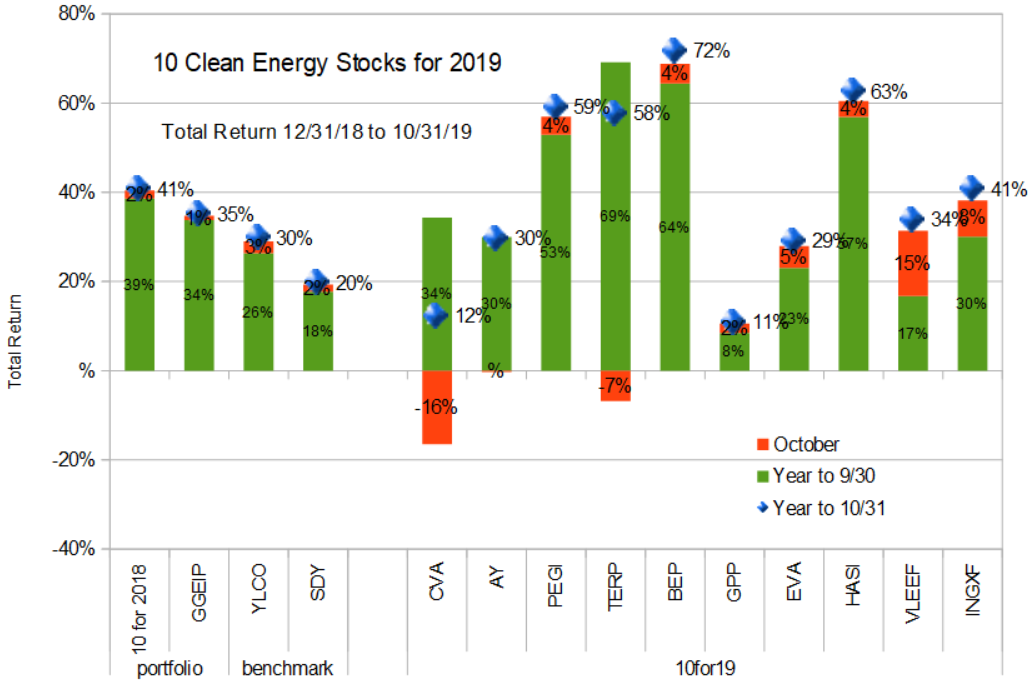

Although valuations and political uncertainty have me spooked, October was another strong month for the stock market in general and clean energy income stocks in particular.

While my broad income stock benchmark SDY added 1.6% for a year to date total gain of 19.6%. My clean energy income stock benchmark YLCO did even better, 2.7% for October and 29.7% year to date. The 10 Clean Energy Stocks model portfolio fell somewhere in between for the month (up 1.8%) but remains unchallenged for the year to date (40.7%). My real-money managed strategy, GGEIP, lagged as I reduce market exposure in what I consider an increasingly risky market (as discussed last month). GGEIP was up 1.0% for the month, and 35.0% year to date.

Individual Stocks

Analyst Downgrades, Sudden Stock Moves

The most notable stock move of the month was Covanta Holding Corp’s (NYSE:CVA) 16% decline. This started on October 22nd, when Raymond James warned that the company’s earnings would be impacted by the weak commodity market. The analysts like the company’s long term prospects, but reduced their rating from “Strong Buy” to “Market Perform” based on expected near term weakness. Sure enough, the company reported weakness in commodity prices in its third quarter earnings. After earnings, BMO cut its price target from $19 to $18, and UBS cut its from $17 to $15.50.

With the stock trading below $15, I see this as one of the few buying opportunities in the stock market today, and added to my exposure by selling cash covered puts with strike prices of $12.50 and $15. I think the large sell-off is symptomatic of increasing investor nervousness. We also saw a similar sell-off in Yieldco Clearway (CWEN, CWEN-A) based on analyst downgrades.

It feels to me that investors are looking for an excuse to sell, causing the market to overreact to analyst downgrades. Regular followers of this blog, in contrast, will likely have already trimmed their holdings as the stocks rose, and so should remain unphazed by these sudden swings in sentiment. If you have not been trimming your holdings in your biggest winners, you probably should be. Hannon Armstrong HASI, Terraform Power (TERP), and Brookfield Renewable Energy Partners (BEP) are all stocks in which readers should be considering taking some profits, if they have not already. I continue to think these three stocks are all ripe for price corrections.

Buyout

One stock with significant gains where I am not currently taking profits is Pattern Energy Group (PEGI) because a cash buyout announced on November 4th for $26.75 removes most of the market risk from this stock. Two months ago, I dismissed the rumors that Terraform Power would be the buyer, but the rumors that the company was in talks for a buyout were well-founded. The buyers ended up being the Canada Pension Plan Investment Board (CPPIB), which is also negotiating to purchase Pattern Development.

The price of the buyout was below the stock market price at the time of the announcement, but approximately 15% above the price PEGI had been trading at prior to the buyout rumors, which began to circulate in early August. Because the buyout price was below the market price at the time of announcement, a number of shareholder class action lawsuits were immediately filed. Investors should not be alarmed at the number of suits; class action lawyers are simply jockeying to be first, because typically most such class actions will be consolidated into one and the lawyers who were first to file generally get to take the lead and collect the lion’s share of the fees.

PEGI and CPPIB need to convince both the judge and shareholders that the buyout price was justified. They need shareholders in order to win shareholder approval for the merger. In order to make this case, it is not out of the question CPPIB may increase the buyout price slightly in order to bolster their argument. But I don’t think that readers should expect this. As I wrote in August, “At $27, I’d call PEGI fairly valued, so investors should be cautious about banking on a merger going forward.”

Even without a price increase, the merger dramatically lowers the market risk of PEGI stock. With two expected dividends of $0.4222 before the expected close of the deal, shareholders can expect to receive a total of $27.59 over the next six to eight months. As I write, the share price is $27.33, which would amount to a 1% gain over that time. This is not a great interest rate, but it is better than cash, and holders do get the chance of an upward revision to the buyout price.

Conclusion

I continue to remain cautious. Readers should take some gains in their biggest winners and be prepared for more of their stocks to fall suddenly and dramatically in response to even mild analyst downgrades and short term bad news. A sharp market correction or bear market could start at any time… or the bull may continue to limp along. I continue to believe the downside risks outweigh the possible gains of betting that the bull still has much life left in him.

Disclosure: Long PEGI, CVA, AY, TERP, BEP, EVA, GPP. INGXF, HASI, FR.PA/VLEEF, CWEN-A.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The post Ten Clean Energy Stocks For 2019: Pattern Buyout, Analyst Downgrades appeared first on Alternative Energy Stocks.

]]>The post Ten Clean Energy Stocks For 2019: What Caution Looks Like appeared first on Alternative Energy Stocks.

]]>by Tom Konrad Ph.D., CFA

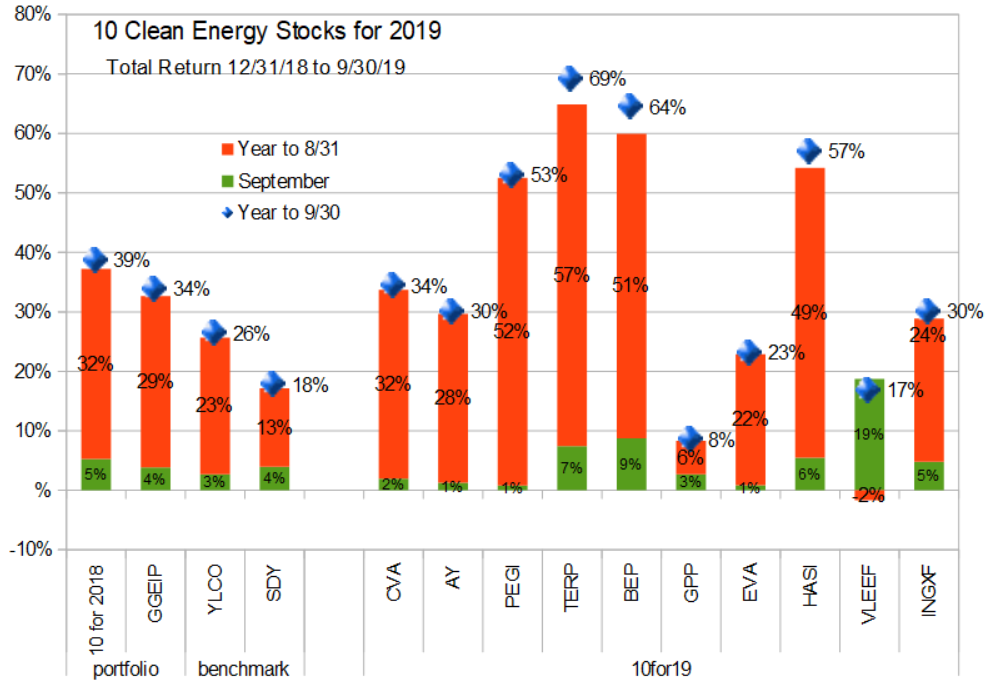

So far, my worries about stock market valuation and political turmoil have not turned into the stock market downturn I’ve been warning readers to prepare for. In fact, September has been a particularly sunny month for both clean energy stocks and the stock market in general. My broad income stock benchmark SDY was up 3.9% and the energy income stock benchmark YLCO rose 2.7% for the month, more than reversing August’s declines. My 10 Clean Energy Stocks model portfolio accelerated upward by 5.3%, as did my real-money managed strategy, the Green Global Equity Income Portfolio(GGEIP), which added 3.8% to August gains.

My broad income stock benchmark SDY was up 3.9% and the energy income stock benchmark YLCO rose 2.7% for the month, more than reversing August’s declines. My 10 Clean Energy Stocks model portfolio accelerated upward by 5.3%, as did my real-money managed strategy, the Green Global Equity Income Portfolio(GGEIP), which added 3.8% to August gains.

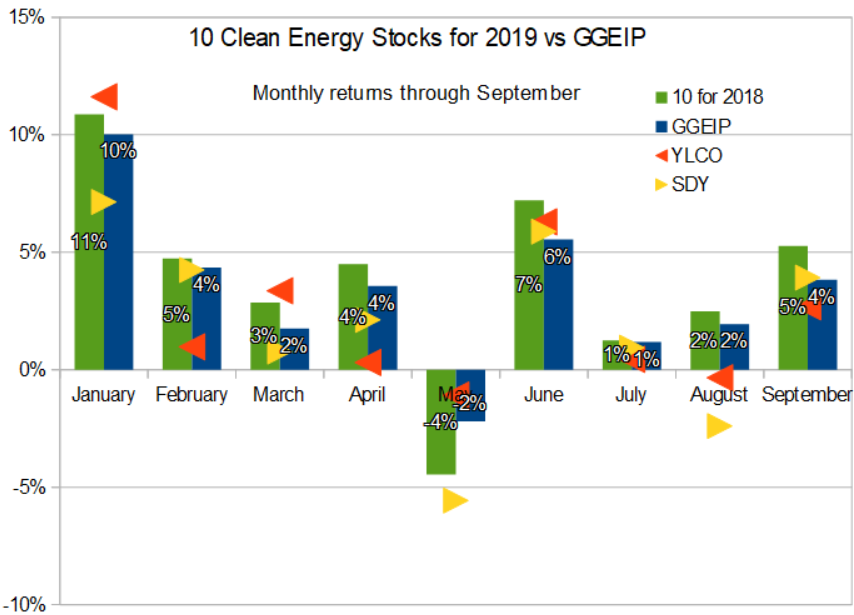

I’ve been cautioning readers to take a more defensive stance towards the market all year. As I said last month, and as this month proves, that does not mean that the stock market’s rise is over. It means that I believe the risks of a stock market decline outweigh the potential gains of staying fully invested.

To show readers what that looks like, consider the following graph comparing the monthly returns of my real-money strategy, GGEIP, with the returns of the full-invested 10 Clean Energy Stocks Model Portfolio.

As you can see, GGEIP has lagged the 10 for 2019 model portfolio every month so far this year except one: May- the only down month. In the up months, GGEIP was gaining about nine-tenths as much as the model portfolio early in they year, while it has been gaining about three-quarters as much as the model portfolio in recent months. This is because I have been following my own advice, and lowering GGEIP’s overall market exposure as the year progresses. The benefit can be seen in May: GGEIP lost only half as much as the model portfolio.

In short, GGEIP has roughly half the exposure to a market decline as the fully-invested model portfolio, but has still participated in 87% (33.7% vs 38.6%) of the total gains this year. I have achieved this asymmetric risk/reward exposure through a combination techniques:

- By selling more of my biggest winners, which have the less potential upside left and re-allocating to cash and stocks that have risen less.

- Increasing my overall cash allocation.

- Selling covered calls.

- Reducing my sales of cash-covered puts as I allow older positions to expire.

While many readers may be uncomfortable with option strategies, reducing exposure to stocks that have risen sharply and allocating the proceeds to cash and better-valued stocks is a strategy that is accessible to any investor. Each outsized monthly gain (like the 3-4% market return we saw in September) increases valuations and makes the potential decline in a bear market that much greater.

Stock market overvaluation is a lot like the continued crimes in the Trump White House. It can go on longer than any rational observer could possibly expect, but when the reckoning comes, it will likely be both swift and severe. Investors would be wise not to use taxpayer funds to pressure foreign governments into doing any political favors or otherwise using the powers of government for personal gain. Metaphorically speaking, of course.

-

Individual Stocks

The biggest mover in September was French auto parts supplier Valeo (FR.PA). The increase was likely mostly due to a general rebound in automotive stocks and the fact that Valeo is generally very sensitive to overall market movements. Although I think Valeo is one of the few relative bargains I’m aware of in the stock market today, I’ve been keeping a relatively low allocation to it in GGEIP because of its strong sensitivity to stock market moves.

Other notable movers were Terraform Power (TERP) and Brookfield Renewable Energy Partners (BEP). Both of these Brookfield Asset Management (BAM) sponsored Yieldcos are starting to look expensive to me, especially Terraform. Terraform management seems to agree, and took the opportunity to raise $251 million in a secondary offering of common stock at $16.84 a share on October 4th. The fact that Terraform can once again raise stock market capital at an attractive price is good news for its future growth in earnings per share, but the new stock will depress its price, at least temporarily.

There has been no news regarding the rumors discussed last month that Pattern Energy Group (PEGI) might be bought by BAM an merged with Terraform, but if Terraform were preparing for such a merger, the company would have probably delayed its secondary offering in order to keep its stock price up and consummate the merger at a more attractive valuation. For this reason, I think it is unlikely that the rumors are going to amount to anything.

More details have been emerging about the deal Donald Trump has been promising corn and ethanol interests to fix the damage that his EPA has caused with the “hardship” exemptions it has been passing out to oil refiners like rolls of paper towels thrown to hurricane survivors. I was skeptical of his promises last month, and while the announced goal of selling 15 billion gallons of corn ethanol and soy biodiesel is a step in the right direction, this goal would only stop doing more damage to the ethanol market, and not do anything about the damage already done. It’s also not specific about when the 15 million gallon target is likely to be achieved, and will only happen after an initial public comment period.

In short, the EPA’s actions are continuing to favor oil refiners over ethanol producers and farmers today, while Trump making promises it will stop doing harm at some unspecified future date. That date is looking increasingly likely to be after Trump is either impeached or voted out of office.

Mike Carr, Executive Director of New Energy America summed it up by saying “We’re in this situation because the President broke his promise to heartland voters, and we’ve seen the EPA break his promise each of the 31 times they’ve given away waivers to the oil industry. This Administration has proved again and again that their reflexive support for Big Oil donors and opposition to anything that would move us closer to a clean energy economy wins out over even his strongest supporters in rural America.”

The response of ethanol stocks like MLP Green Plains Partners (GPP) has been positive, but only mildly so. I continue to see Green Plains Partners as the best value (after accounting for risk) in the list of ten, but I expect the potential gains in that stock will come from the prospect of the end of the Trump presidency rather than a more favorable stance towards the biofuel industry at the expense of oil refiner’s from Trump’s EPA.

-

Conclusion

September was another great month for the model portfolio, but now is not a time to be chasing returns. Valuations are high, and political risks abound. When this market turns around, I expect it to do so surprisingly quickly and dramatically.

Disclosure: Long PEGI, CVA, AY, TERP, BEP, EVA, GPP. INGXF, HASI, FR/PA/VLEEF.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

The post Ten Clean Energy Stocks For 2019: What Caution Looks Like appeared first on Alternative Energy Stocks.

]]>The post Ten Clean Energy Stocks For 2019: Will Pattern Merge With Terraform? appeared first on Alternative Energy Stocks.

]]>by Tom Konrad Ph.D., CFA

August 2019 saw economic warning signs flashing and a worsening trade war with China. Unsurprisingly, this led to weakness in most stock market indexes.

My broad income stock benchmark SDY was down 2.4% and the energy income stock benchmark YLCO fell 0.3% for the month. Most of the stocks in my 10 Clean Energy Stocks model portfolio continued to buck the trend, with the portfolio as a whole gaining 2.2% for the month. My real-money managed strategy, GGEIP, also turned in a solid 1.9% gain.

The strong performance of my portfolios probably rises from the falling interest rate environment we are in. As central banks begin to cut rates in an attempt to avert recession, investors are bidding up the prices of higher yielding securities. The small capitalization but high-yield clean energy stocks I favor are particular beneficiaries as investors find that larger capitalization, more mainstream companies and bonds no longer are producing enough income for their requirements.

While the search for yield seems to be allowing my stocks to ignore the weakening market trend, this feels like very late-cycle market action. I continue to see this as a good time to take profits, sell covered calls, and generally reduce overall market exposure.

Valuations of many of these stocks are feeling stretched, and if or when a bear market begins in earnest, it will be felt in all corners of the market. It’s been my experience during bear markets that even stocks which were relatively uncorrelated with the broad market when it was heading up tend to head down at the same time as everything else.

I’ve never been good at predicting the timing of bear markets; I’ve been far too early every time. But being too early is far better than too late. It may still be early, but taking profits, selling covered calls, and shifting to lower risk stocks are all actions that are much better to take too early than too late.

Buyout Rumors

The biggest mover in August was Pattern Energy Group (PEGI). There were news reports of rumors that the company might be bought out. One rumored buyer is Brookfield Asset Management (BAM) which is said to have proposed merging PEGI with it’s 65% owned Yieldco Terraform Power (TERP).

BAM is currently the sponsor for both TERP and Brookfield Renewable Energy Partners (BEP). I included these two Yieldcos in my 10 Clean Energy Stocks model portfolio this year because I felt they were both slightly undervalued and I consider BAM to be an excellent sponsor in that it has nearly unparalleled access to capital markets, and its values its reputation as a reliable manager of infrastructure assets. That reputation is key, because the often opaque accounting and complex corporate structures of Yieldcos allow unscrupulous Yieldco sponsors plenty of opportunities to present an overly rosy picture of a Yieldco’s cash flow and growth prospects. If BAM were to attempt to mislead investors about the prospects of its Yieldcos, the damage to its reputation when it was eventually found out would far outweigh the short term gains from temporarily inflated Yieldco stock prices.

While I have no reason to distrust PEGI’s private sponsor, Pattern Development Group, it has nothing like Brookfield Asset Management’s sterling reputation or access to capital. This is one reason PEGI has been trading at a discount to other Yieldcos, and I included it in the 10 Clean Energy Stocks model portfolio because it was the most undervalued Yieldco. Although both PEGI and TERP have returned over 50% since the start of the year, TERP still trades at a premium to PEGI, and we could expect PEGI shares to gain another 10% to 15% in such a merger.

The benefit for TERP would be increased scale, which could potentially lower its cost of capital. There could also be some synergies from reducing redundant management. I’m not sure if these benefits are compelling enough to tempt BAM to go through with such a deal. In my experience, Brookfield prefers to buy companies in distress, at a significant discount to their net asset value. At $27, I’d call PEGI fairly valued, so investors should be cautious about banking on a merger going forward. Terraform Power was a much smaller and more troubled company when Brookfield bought it in 2017, but it pays to remember that that purchase took place at about $13 a share.

Ethanol Shenanigans

Donald Trump likes pleasing his oil industry donors. Sometimes that is at odds with pleasing his farm state supporters. The Trump EPA’s actions with “hardship” refinery waivers which are delivering profits to selected oil refinery owners at the cost of undercutting the ethanol market (and hence the market for corn) are sending a clear signal that his first loyalty is to his donors. His trade war with China isn’t helping his farm state voters, either.

Trump is still promising an announcement of some action that will greatly help the biofuel industry. But previous promises have amounted to nothing. With farm state voters getting restless, perhaps this time will be different. But until there is decisive action from the Trump administration or a new president in the White House, the ethanol industry is likely to remain a very difficult place to do business. Hoping for decisive action from the Trump administration does not strike me as a wise investment strategy.

Ethanol production and transportation MLP Green Plains Partners (GPP) has not escaped unscathed. It has agreements with its sponsor, Green Plains (GPRE) that guarantee minimum income, but ethanol industry conditions are also hurting GPRE, which has reacted to weak ethanol markets by diversifying away from the ethanol business.

The question GPP investors need to ask themselves is, “Will GPRE continue to honor its commitments to GPP?” I believe the answer will be “yes.” If I am right, then the current 14% yield from GPP is quite attractive, and if/when GPRE regains a more stable financial footing from a recovered ethanol market or by successful diversification, GPP investors will see significant capital gains as the partnership’s valuation returns to non-distressed levels.

Conclusion

Late 2019 remains a time for stock market investors to be cautious. Investors in the 10 Clean Energy Stocks Model Portfolio should be taking some of their handsome gains and holding them in cash as they wait for better valuations.

Of the stocks in the list, only Green Plains Partners seems attractive at this point. GPP is already cheap because of troubles in the ethanol market. Since these troubles are political in nature, a worsening overall economy could as easily help (if it spurs political action) as it could hurt. Cash also seems quite attractive right now.

Disclosure: Long PEGI, CVA, AY, TERP, BEP, EVA, GPP. INGXF, HASI, FR/PA/VLEEF.